i have number 1 correct :) just missing the others

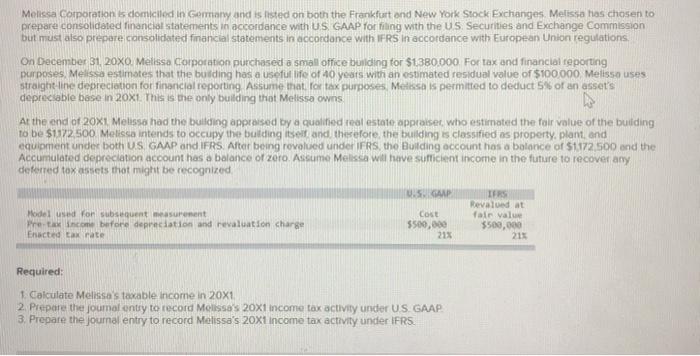

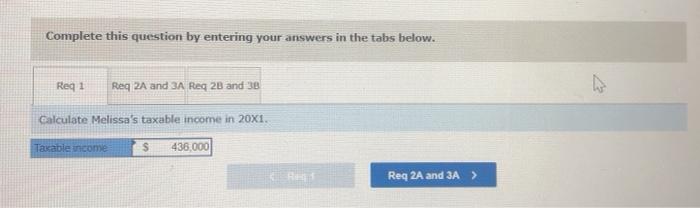

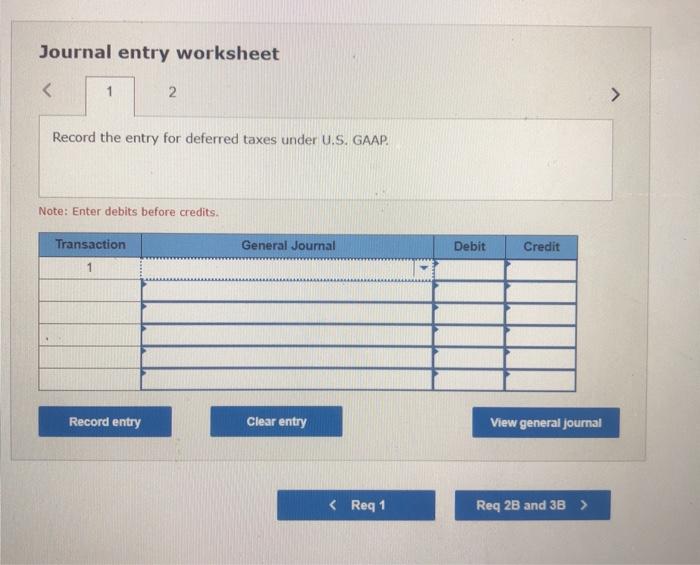

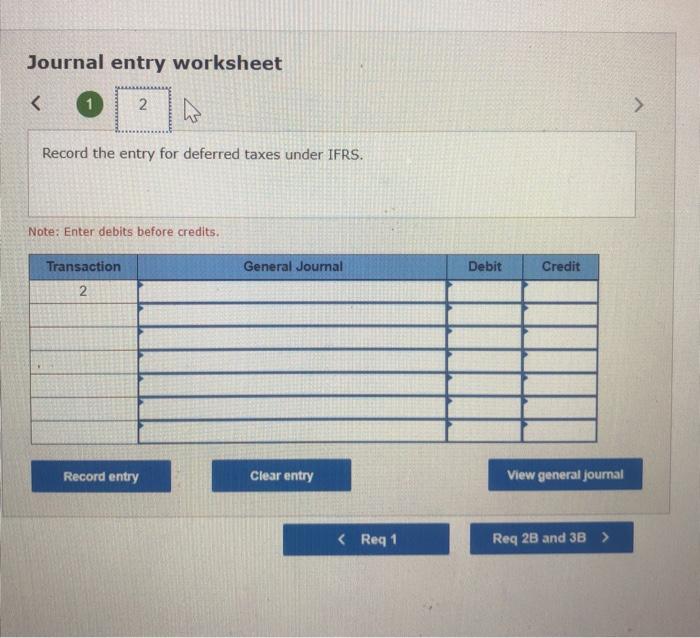

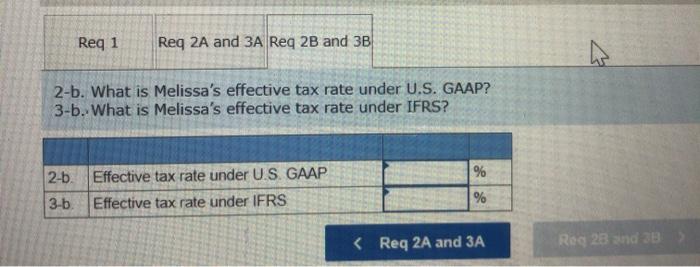

Melissa Corporations domiciled in Germany and is listed on both the Frankfurt and New York Stock Exchanges. Melissa las chosen to prepare consolidated financial statements in accordance with US GAAP for filing with the US Securities and Exchange Commission but must also prepare consolidated financial statements in accordance with IFRS in accordance with European Union regulations. On December 31, 20x0 Melissa Corporation purchased a small office building for $1380 000 for tax and financial reporting purposes Melissa estimates that the building has a useful life of 40 years with an estimated residual value of $100,000 Melissa uses straight-line depreciation for financial reporting Assume that for tax purposes Melissa is permitted to deduct 5% of an asset's depreciable base in 20X1. This is the only building that Melissa owns At the end of 20X1 . Melissa had the building appraised by a qualified real estate appraiser, who estimated the folr value of the building to be $1172 500 Melissa intends to occupy the building itself and therefore the building is classified as property, plant, and equipment under both US GAAP and IFRS. After being revolued under IFRS, the Building account has a balance of $1172 500 and the Accumulated depreciation account has a balance of zero. Assume Melissa will have sufficient income in the future to recover any deferred to assets that might be recognized U.S. GAP Model used for subsequent measurement Pret income before depreciation and revaluation charge Enacted tax rate COLE $500,000 IFRS Revalued at fair value $500,000 213 Required: 1. Calculate Melissa's taxable income in 20X1 2. Prepare the journal entry to record Melissa 20X1 income tax activity under US GAAP 3. Prepare the journal entry to record Melissa's 20x1income tax activity under IFRS. Complete this question by entering your answers in the tabs below. Reg 1 Req 2 and 3A Reg 2B and 38 Calculate Melissa's taxable income in 20X1. Taxable income S 436,000 Req 2A and 3A > Journal entry worksheet 1 2 > Record the entry for deferred taxes under U.S. GAAP. Note: Enter debits before credits Transaction General Journal Debit Credit 1 Record entry Clear entry View general journal Journal entry worksheet Req 1 Req 2A and 3A Req 2B and 3B 2-b. What is Melissa's effective tax rate under U.S. GAAP? 3-b. What is Melissa's effective tax rate under IFRS? 2-b. % Effective tax rate under US GAAP Effective tax rate under IFRS 3-b. %