Question

I have only 20 minutes to answer these. Please do them fast and do not put details, just answer as A, B, C as i

I have only 20 minutes to answer these. Please do them fast and do not put details, just answer as A, B, C as i do not have time

Micheal company received its monthly bank statement, which showed an ending balance of $4500. Adjustments on Micheal's monthly bank reconcilation included a deposit in transist $600, outstanding check $900, an "NSF check of $150, a bank service charge of $9, proceeds of a customer's note collected by the bank of $1200. What was corrected cash balance shown on the balance sheet at the end of month?

Micheal company received its monthly bank statement, which showed an ending balance of $4500. Adjustments on Micheal's monthly bank reconcilation included a deposit in transist $600, outstanding check $900, an "NSF check of $150, a bank service charge of $9, proceeds of a customer's note collected by the bank of $1200. What was corrected cash balance shown on the balance sheet at the end of month?

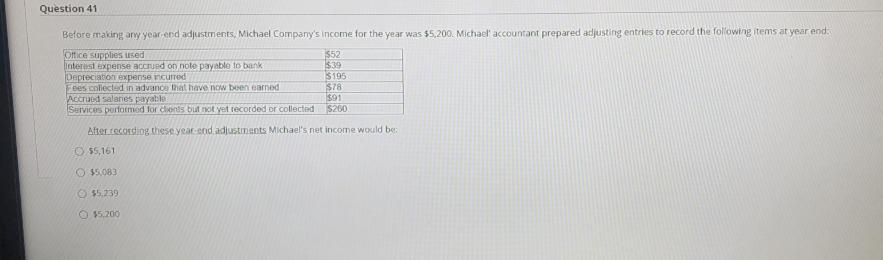

Question 41 Before making any year-end adjustments, Michael Company s income for the year was $5,200. Michael accountant prepared adjusting entries to record the following items at year end Office supplies used Interest expense accrued on note payable to bank Depreciation expense incurred ees collected in advance that have now been earned Accrued salaries payable Services performed for clients but not yet recorded or collected $52 $39 $195 $78 $91 $260 After recording these year-end adjustments Michael s net income would be: O $5,161 O $5,083 $5,239 $5,200 Question 42 Michael Company received its monthly bank statement, which showed an ending balance of $4,500. Adjustments on Michael s monthly bank reconciliation included a deposit in transit $600; out NSF check for $150; a bank service charge of $9; proceeds of a customer s note collected by the bank of $1,200. What was the corrected cash balance shown on the balance sheet at the end of $5,241 $4,200 O $4,050 $4,041

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Anonymous answered this 13853 answers 1 The correct option is 516...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started