Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have only 30%, can you solve this question in excel I need same solution like it is solved 3.) A doohickey making machine is

I have only 30%, can you solve this question in excel I need same solution like it is solved

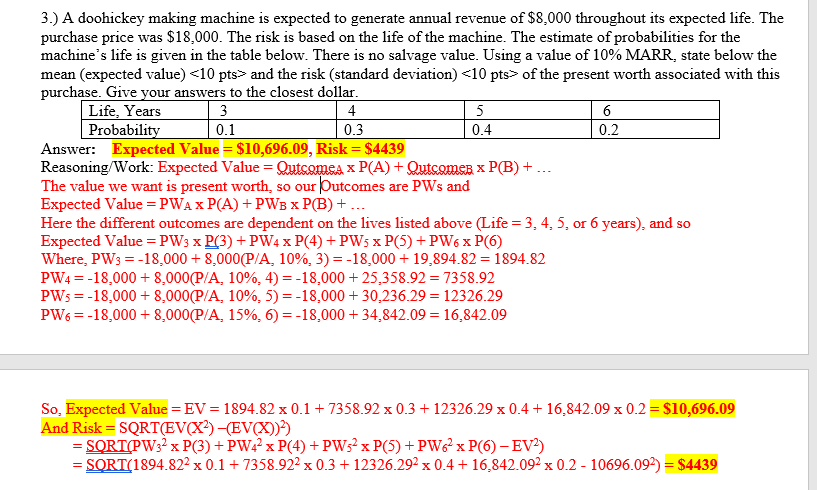

3.) A doohickey making machine is expected to generate annual revenue of $8,000 throughout its expected life. The purchase price was $18,000. The risk is based on the life of the machine. The estimate of probabilities for the machine's life is given in the table below. There is no salvage value. Using a value of 10% MARR, state below the mean (expected value) and the risk (standard deviation) of the present worth associated with this purchase. Give your answers to the closest dollar. Life, Years 3 4 5 6 Probability 0.1 0.3 0.4 0.2 Answer: Expected Value = $10,696.09, Risk = $4439 Reasoning/Work: Expected Value = Qutsomsa x P(A) + Qutcomes x P(B) + ... The value we want is present worth, so our butcomes are PWs and Expected Value = PWAX P(A) + PWB x PB)+... Here the different outcomes are dependent on the lives listed above (Life = 3,4,5. or 6 years), and so Expected Value = PW3 x P(3) + PW4 x P(4) + PW5 x P(5) +PW6XPO) Where, PW3 = -18,000 + 8,000(P/A, 10%, 3) = -18,000 + 19,894.82 = 1894.82 PW4 = -18,000 + 8,000(P/A, 10%, 4)=-18,000 + 25,358.92 = 7358.92 PW5=-18,000 + 8,000 P/A 10%, 5) =-18,000 + 30,236.29 = 12326.29 PW6=-18,000 + 8,000(P/A, 15%,6)=-18,000+ 34,842.09 = 16,842.09 = So, Expected Value = EV = 1894.82 x 0.1 + 7358.92 x 0.3+ 12326.29 x 0.4+ 16.842.09 x 0.2 = $10,696.09 And Risk = SQRT(EVX)-(EVX))) = SQRTCPW32 x P(3) + PW42 x P(4) + PW32 x P(5) +PW62 x PO- EV2) = SORT(1894.822 x 0.1 + 7358.922 x 0.3 + 12326.292 x 0.4 + 16,842.092 x 0.2 - 10696.092) = $4439

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started