***I have posted this question now six times. Each time I am told I need more information, I add something and no one returns to answer. Yesterday I posted everything and no one has responded; which is why I didn't post all the data at first because I thought it would be too much. Can someone PLEASEEE, help me? My project is due tomorrow. If I need more information can you tell me what specifically you need and please come back to answer it? I have provided everything from round four. And it doesn't have to be long it can be the same amt the example is***

I am a part of Team Chester. With the data, I will attach and the example (which we can't use) we were given can someone please help me analyze round four for my report, which should include the data as the example did below?

We were given this example,

"Round 4 Analysis.

Unit sold in this round for Daze was 1.603 million with an inventory of only 1,000. For Dot, units sold were 749,000 with 0 inventory on hand. Unit sold for Donut was 488,000 with inventory on hand of 156,000. Donut was a success, pulling in a net $3 million profit (having a payback period of less than a year). Due to 3 successful products, we have become overall leader in market share. We issued common stock worth $14.07 million and borrowed long term debt of $16.28 million. The reason for borrowing high amount was due to product refreshment (automation, capacity increase for prior product lines), and introducing a brand-new product in the high-end market called Dragon. Our rational for introducing Dragon was that we were going to let our previous product's specification stay where they are (implementing only minor changes to refresh the product in future rounds) as the perceptual map keeps moving.Just as previous round, we invested only in some category in TQM totaling $2.75 million. The statistic from this round shows that our market share rose to 24.39%, contribution margin was at 46.6%, sales was approximately $108.3 million (highest among the competitors). The stock price closed at $43.48 (increase of $15.74), the market cap was $132 million in this round."

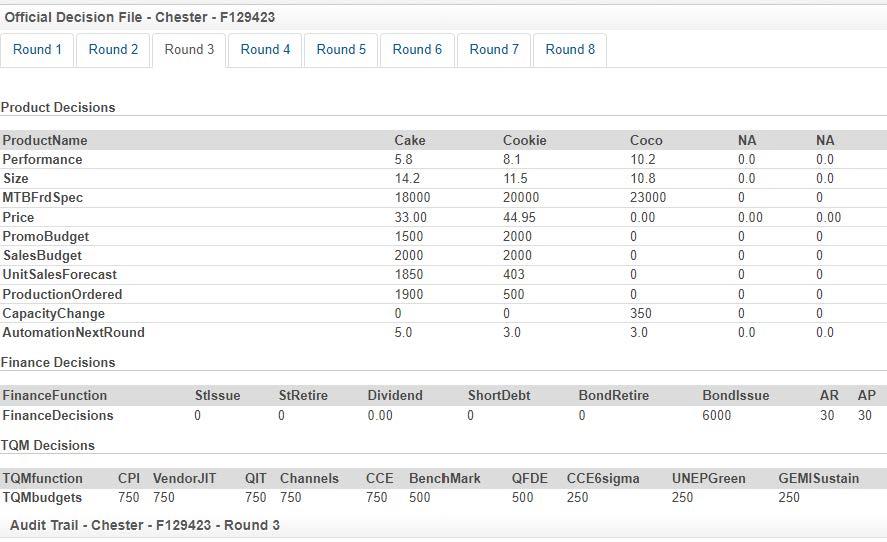

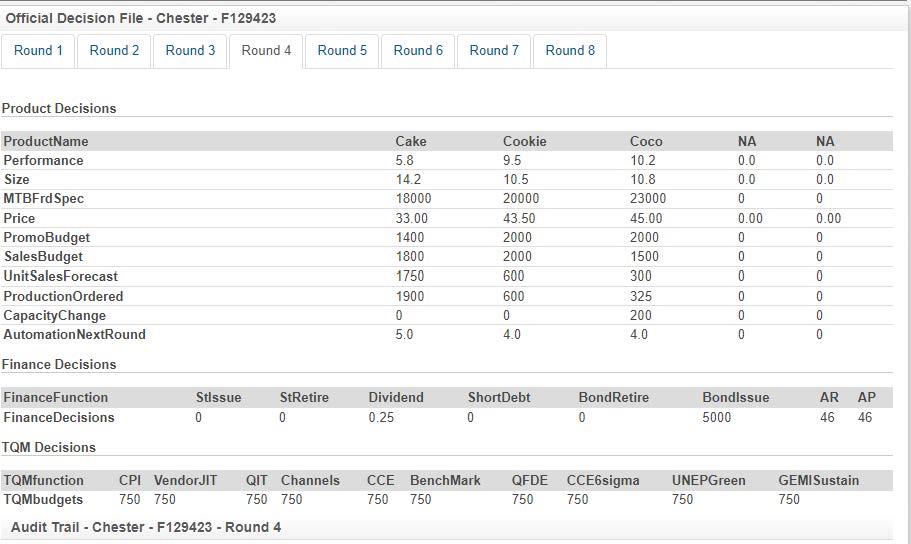

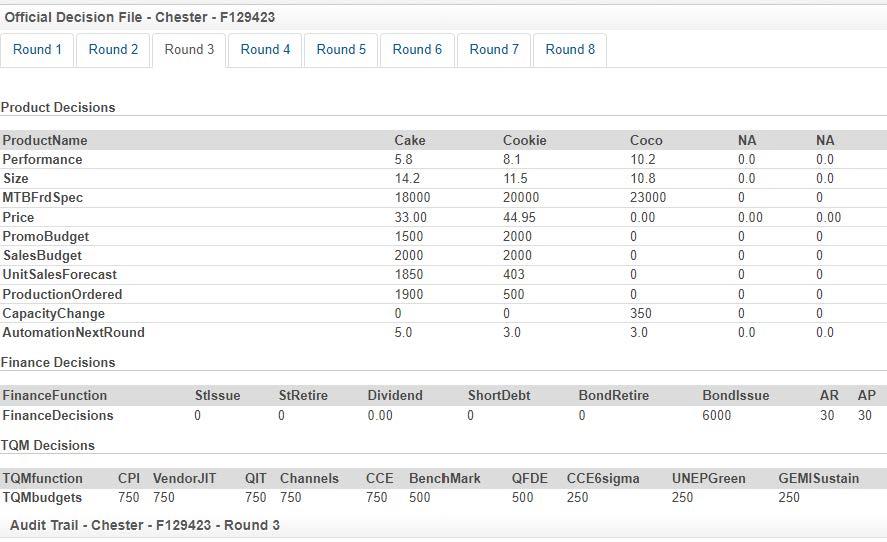

This is the official decision file data for rounds three and four

This is the data from round 4

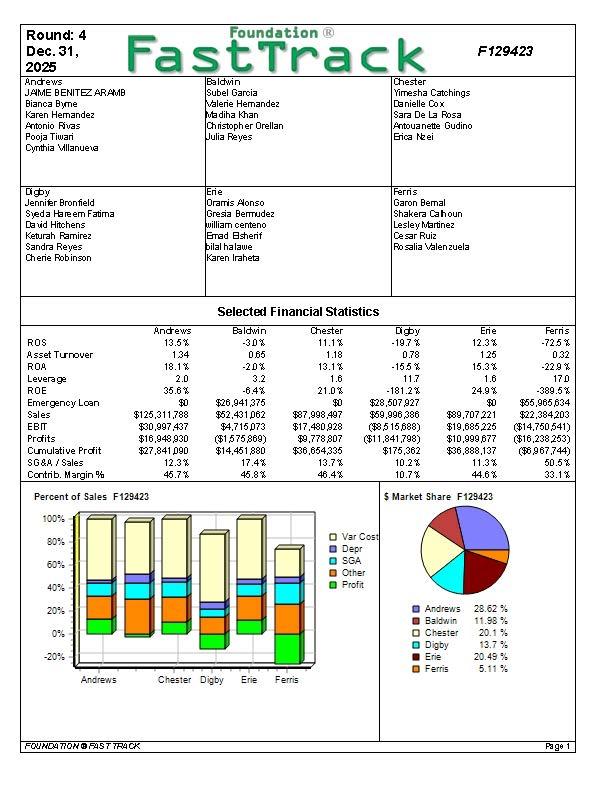

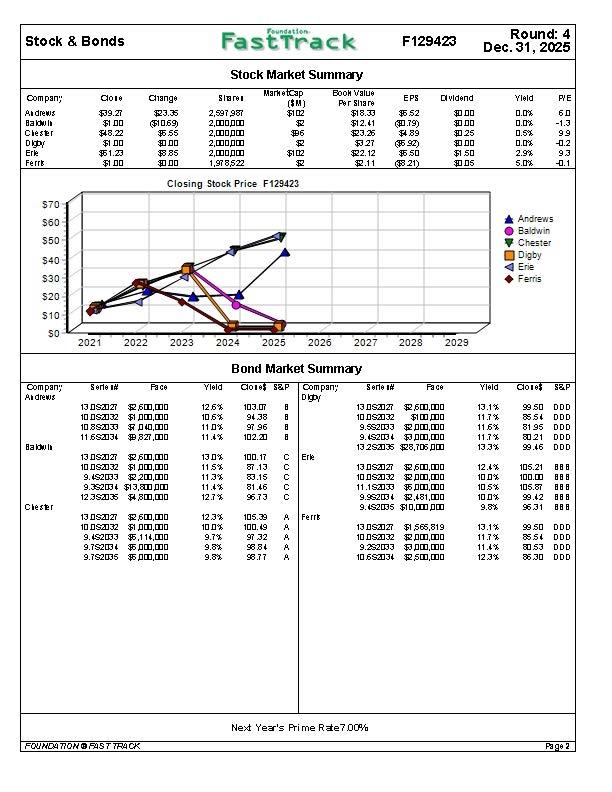

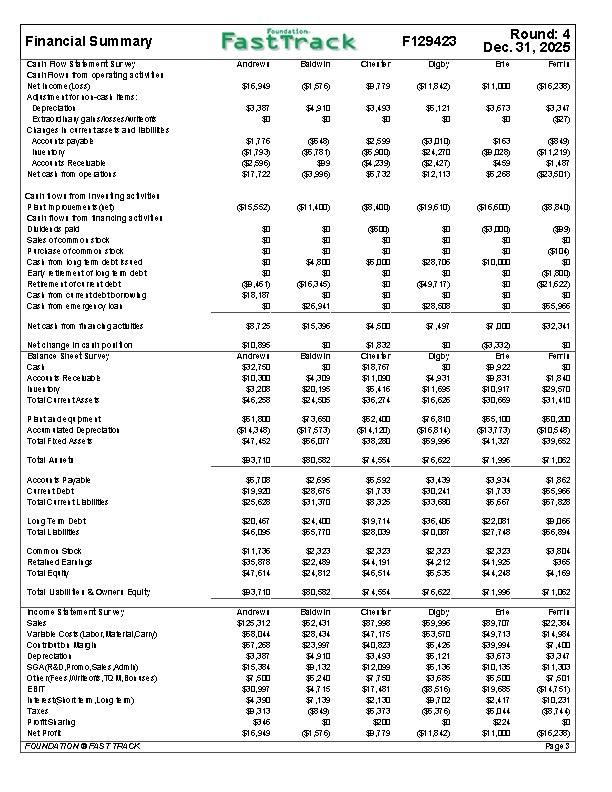

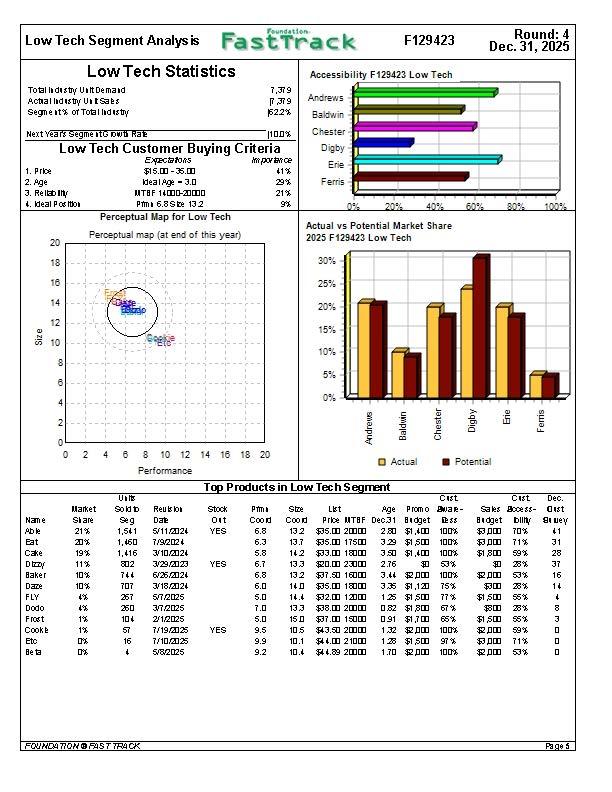

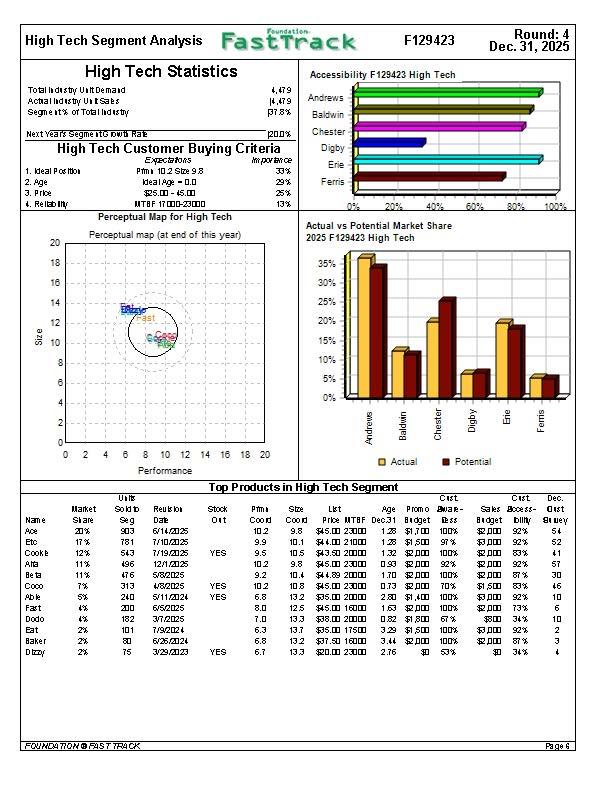

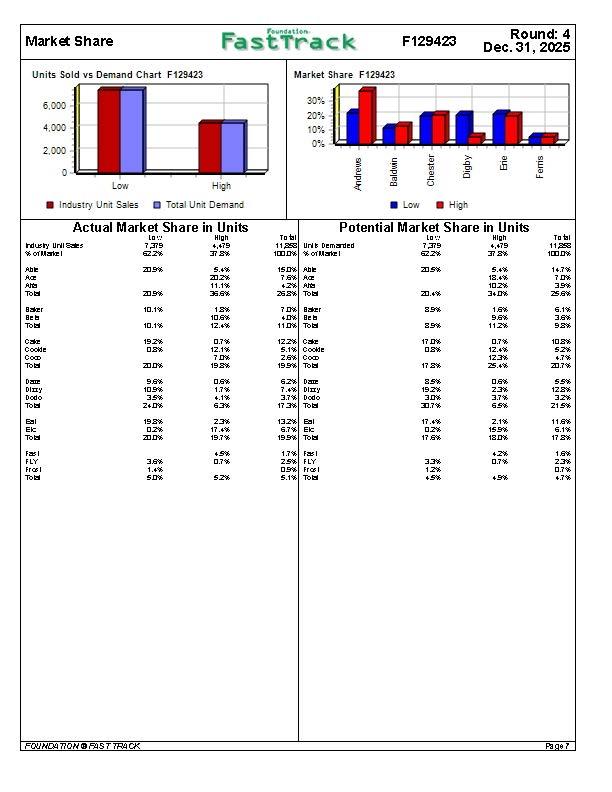

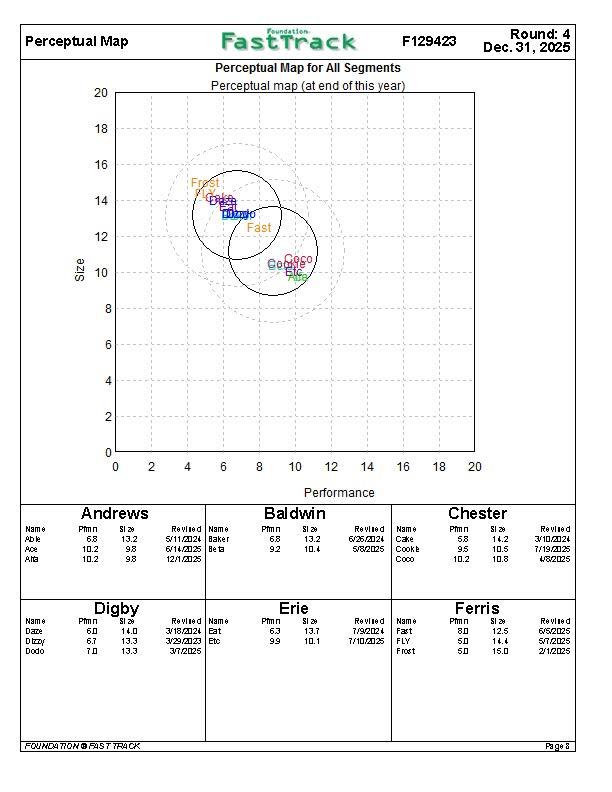

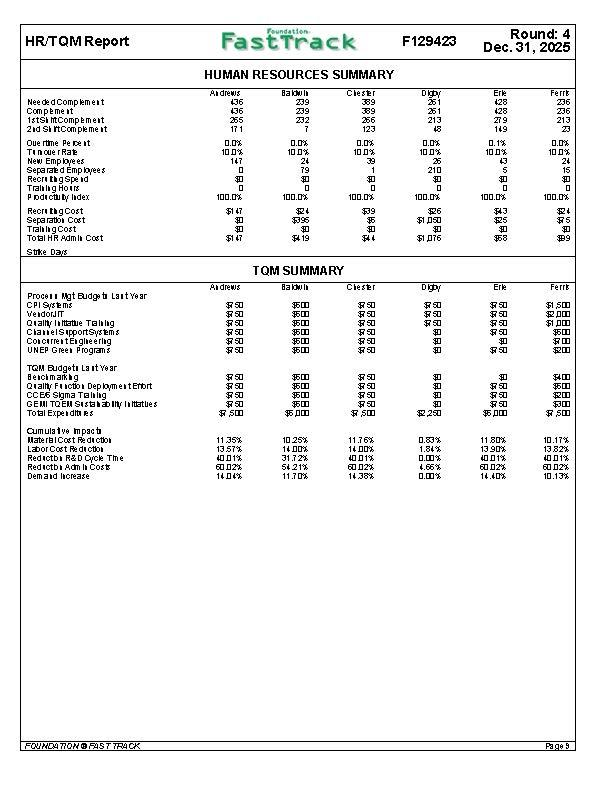

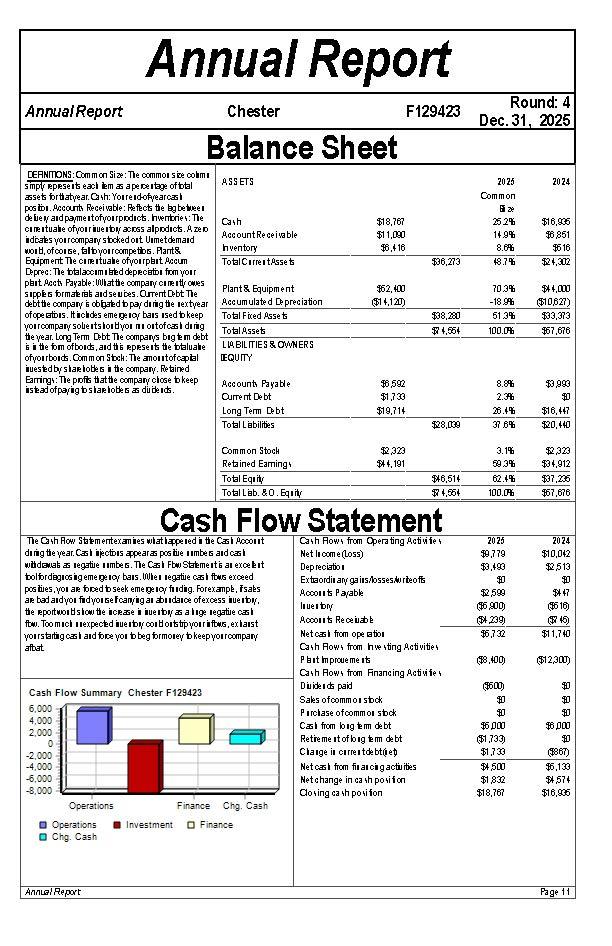

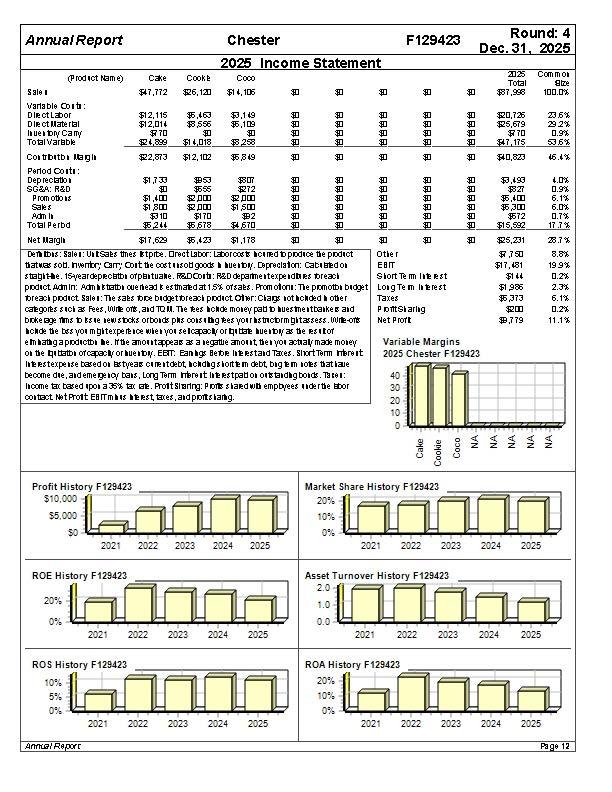

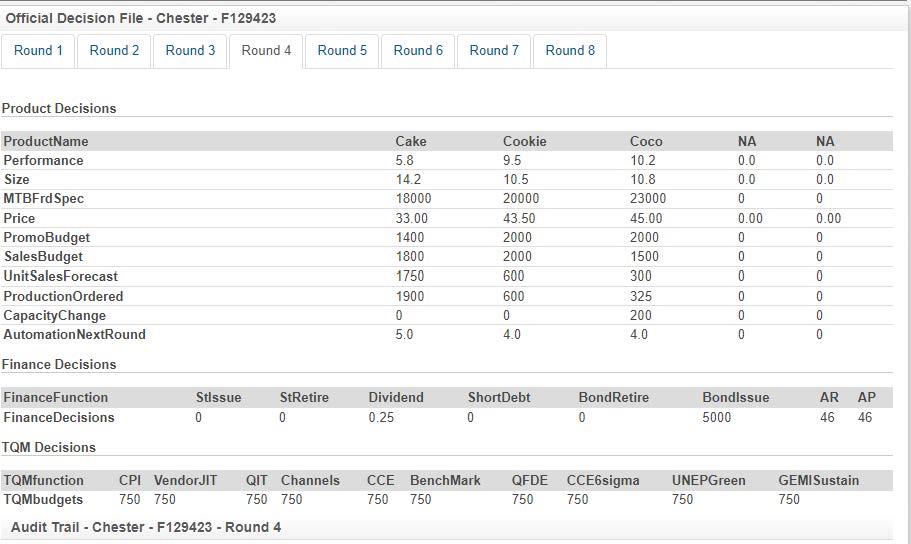

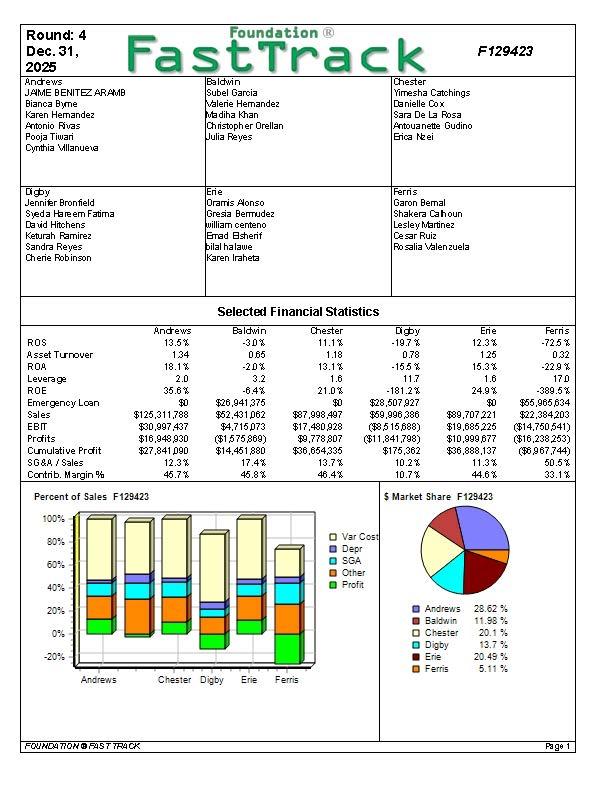

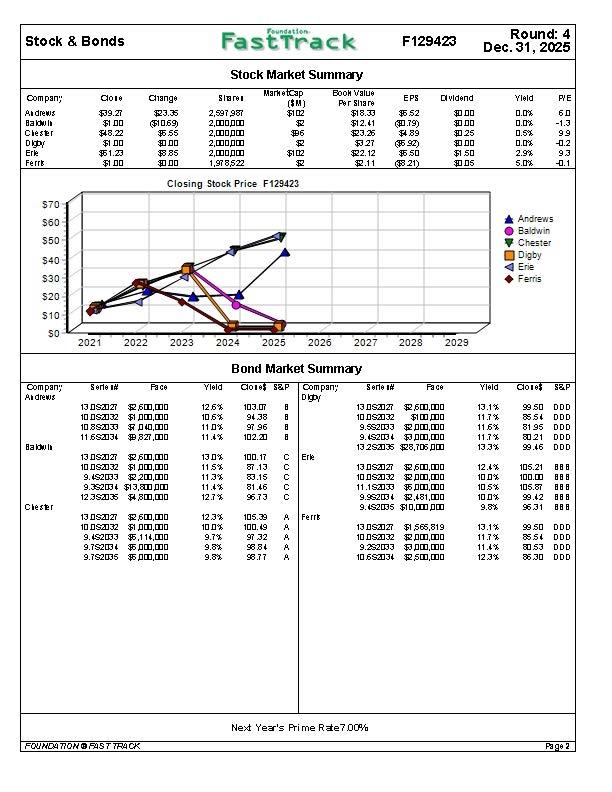

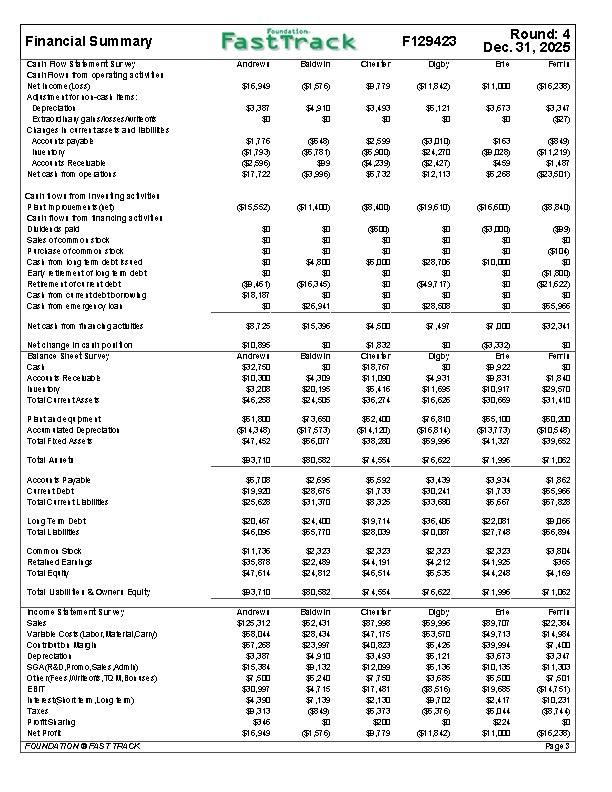

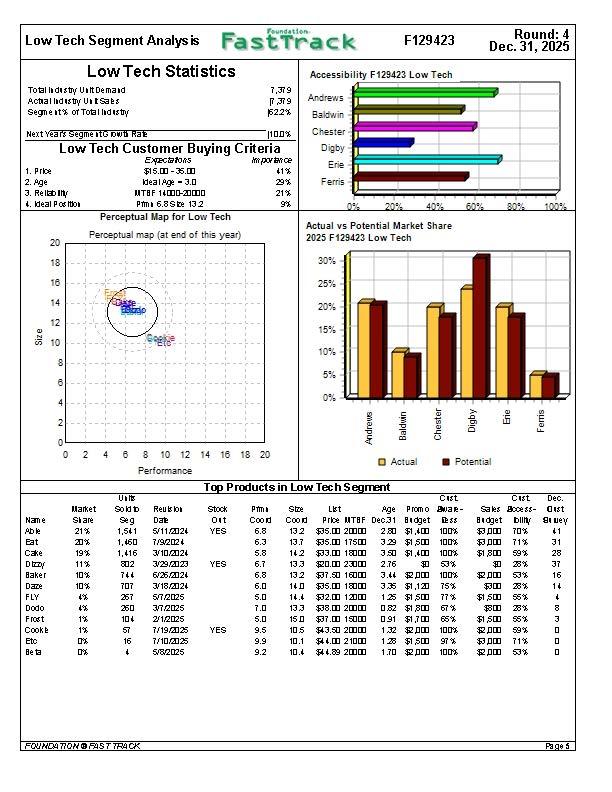

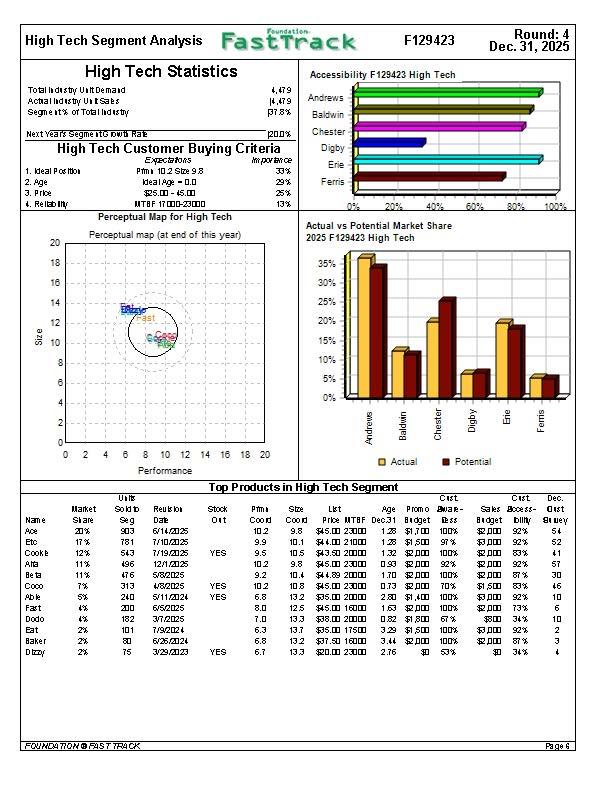

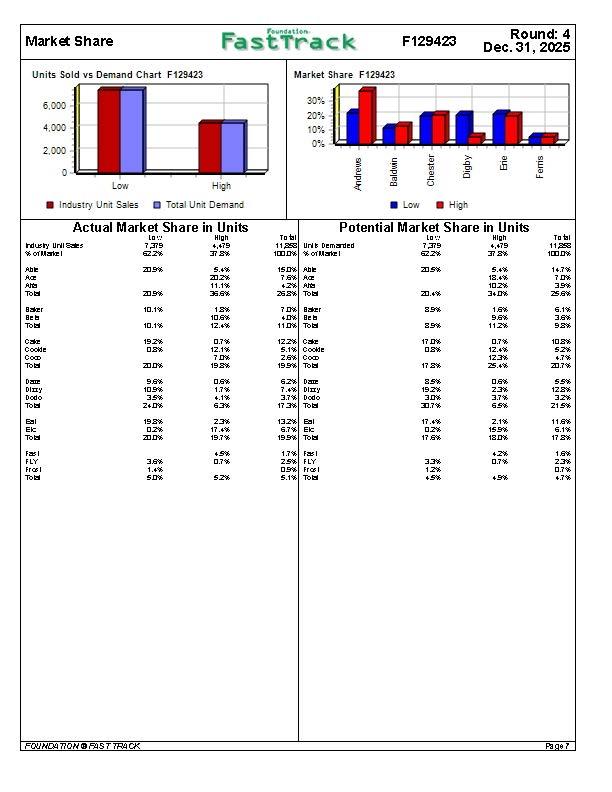

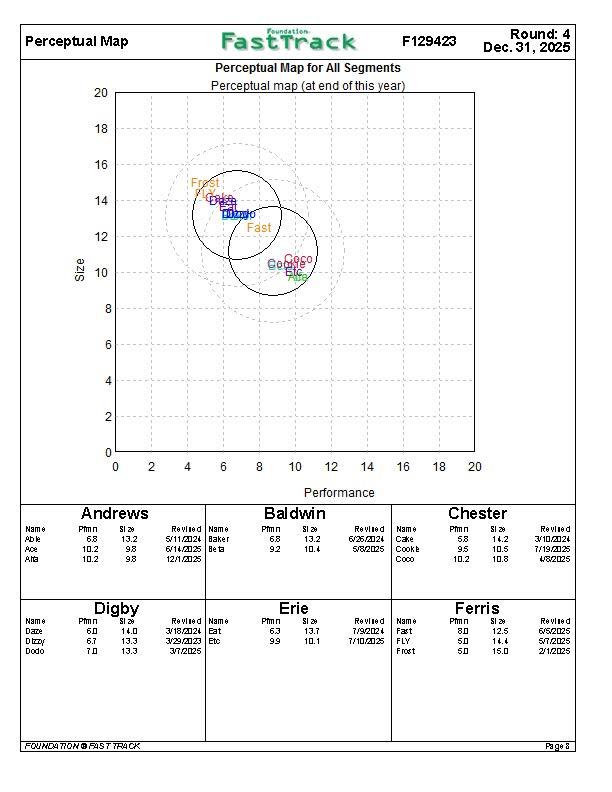

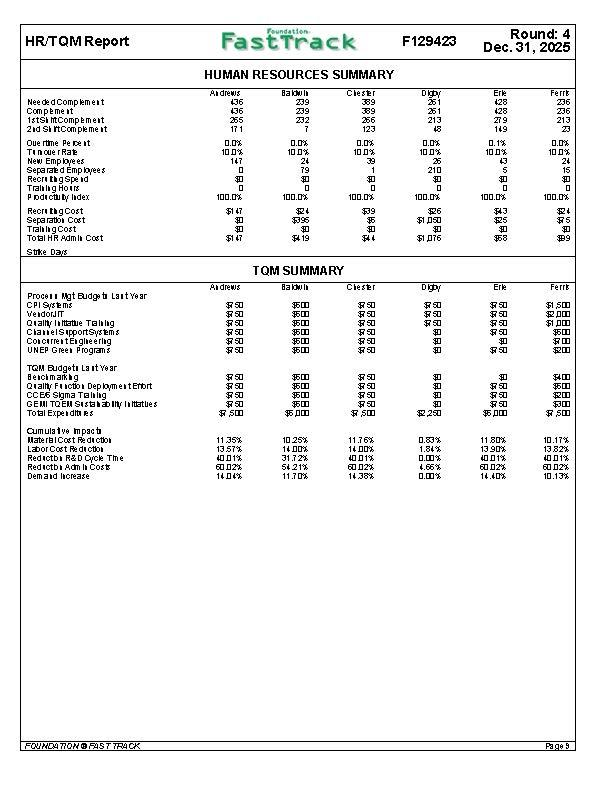

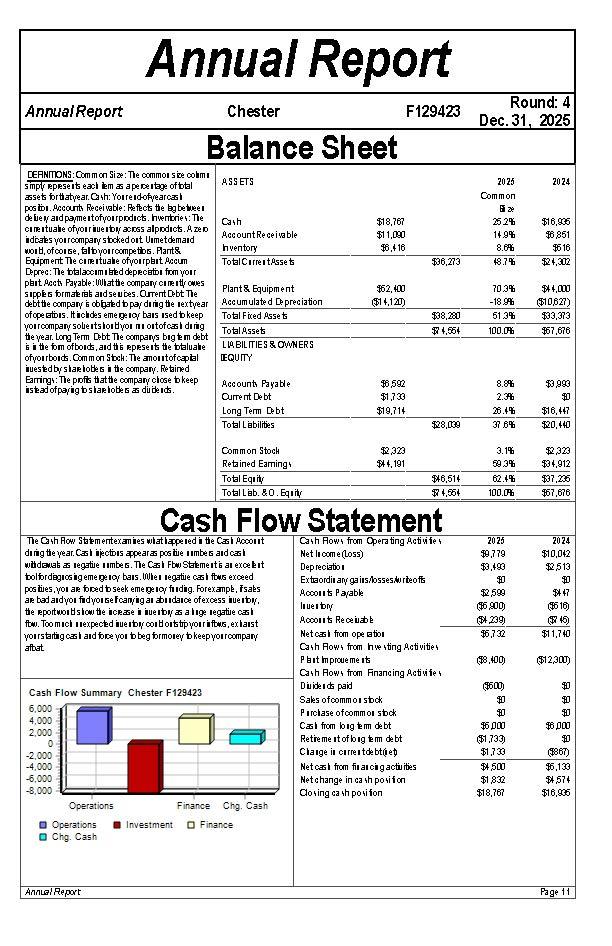

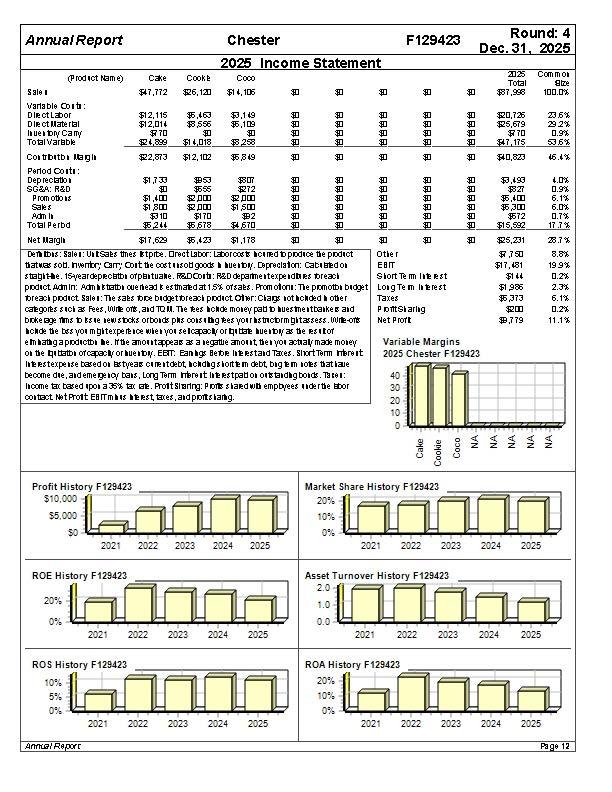

Official Decision File - Chester - F129423 Round 1 Round 2 Round 3 Round 4 Round 5 Round 6 Round 7 Round 8 Product Decisions NA ProductName Performance Size MTBFrd Spec Price PromoBudget Sales Budget Unit SalesForecast Production Ordered CapacityChange Automation NextRound Finance Decisions Cake 5.8 14.2 18000 33.00 1500 2000 1850 1900 0 5.0 Cookie 8.1 11.5 20000 44.95 2000 2000 403 500 0 3.0 Coco 10.2 10.8 23000 0.00 0 0 0 0 350 3.0 0.0 0.0 0 0.00 0 0 0 0 0 0.0 NA 0.0 0.0 0 0.00 0 0 0 0 0 0.0 Finance Function Finance Decisions Stissue 0 StRetire 0 Dividend 0.00 ShortDebt 0 BondRetire 0 Bondissue 6000 AR 30 AP 30 0 TQM Decisions TQMfunction CPI Vendor JIT QIT Channels TQMbudgets 750 750 750 750 Audit Trail - Chester - F129423 - Round 3 CCE Bench Mark 750 500 QFDE 500 CCE6sigma 250 UNEPGreen 250 GEMISustain 250 Official Decision File - Chester - F129423 Round 1 Round 2 Round 3 Round 4 Round 5 Round 6 Round 7 Round 8 NA 0.0 Product Decisions ProductName Performance Size MTBFrd Spec Price PromoBudget SalesBudget UnitSalesForecast Production Ordered CapacityChange Automation NextRound Finance Decisions Cake 5.8 14.2 18000 33.00 1400 1800 1750 1900 0 5.0 Cookie 9.5 10.5 20000 43.50 2000 2000 600 600 0 4.0 Coco 10.2 10.8 23000 45.00 2000 1500 300 0.0 0 0.00 0 0 0 NA 0.0 0.0 0 0.00 0 0 0 0 0 0 0 325 200 4.0 0 0 Finance Function Finance Decisions TQM Decisions Stissue 0 StRetire 0 Dividend 0.25 ShortDebt 0 BondRetire 0 Bondissue 5000 AR 46 AP 46 TQMfunction CPL VendorJIT QIT Channels TQMbudgets 750 750 750 750 Audit Trail - Chester - F129423 - Round 4 CCE Bench Mark 750 750 QFDE CCE6sigma 750 750 UNEPGreen 750 GEMISustain 750 Foundation FastTrack F129423 Round: 4 Dec. 31, 2025 Andrews JAME BENITEZ ARAMB Bianca Byme Karen Hemandez Antonio Rvas Pooja Tiwari Cynthia Villanueva Baldwin Subel Garcia Malerie Hemandez Mta diha Khan Christopher Orellan Julia Reyes Chester Yimesha Catchings Danielle Cox Sara De La Rosa Antouanette Gudino Erica Ne ei Digby Jennifer Bronfield Syeda Hare em Fatima David Hitchens Keturah Ramirez Sandra Reyes Cherie Robinson Erie Oramis Alonso Gresia Bermudez william centeno Emrad Bsterit bilal halawe Karen Iraheta Ferris Garon Bemal Shakera Cahoun Lesley Martinez Cesar Ruiz Rosalia Valenzuela Andrews 13.5% Ferris -725% Erie 12.3% 126 15.3% 134 0.78 032 117 1.6 ROS Asset Turnover ROA Leverage ROE Emergency Loan Sales EBIT Profits Cumulative Profit SG&A / Sales Contrib. Margin % 18.1% 2.0 35.6% $0 $125,311,788 $30,997,437 $16,948 930 $27,841 090 12.3% 45.7% Selected Financial Statistics Baldwin Chester Digby -30% 11.1% -19.7% 065 1.18 -20% 13.1% -15,5% 3.2 1.6 -6.4% 21.0% -181.2% $26.941 375 40 $28,507 927 $62,431 062 $87,998,497 $69,996,386 $4,715 073 $17.480928 (18515688) ($1,575869) $9,778807 $11,841,798) $14,461 880 $36,654,336 $175,362 17.4% 13.7% 10.2% 45.8% 46.4% 10.7% 24.9% 90 $89,707 221 $19,685.225 $10.999 677 $36.888,137 11.3% 44.6% -229% 170 -389.5% $65,965634 $22,384203 ($14,750 541) ($16,238 253) (98 967.744) 50.5% 33.1% Percent of Sales F129423 $ Market Share F129423 100% 80% 60%. O Var Cost Depr O SGA 0 Other Profit 40% 20%. 0% Andrews Baldwin O Chester Digby Erie O Ferris 28.62 % 11.98 % 20.1% 13.7% 20.49 % 5.11 % -20% Andrews Chester Digby Erie Ferris FOVMD4 770N FAST TRACK Page 1 Foundation Stock & Bonds Fast Track F129423 Round: 4 Dec. 31, 2025 Clone EPS Yleld Company Andrews Baldwin Chester Dig Erle Ferrt $39.21 $1 DD 548.22 i Du $61.23 $1 DO Chiang 23.35 $10.69) $5.55 000 $885 000 Stock Market Summary MarketCap Sanel BOOK Value ($M) Per Sare 2,597 98T $102 $18.30 2.00.00 2 $12.41 2,000,000 6 $23.26 2,000.00 $ 27 2,000m $102 22.12 1,978,522 $2.11 $6.52 0.79) $489 $592) $6.50 821) Dividend DO DO 25 DO $1.50 DS 0.0% 0.0% 0.5% 0.0% 2.9% 5.0% PVE 60 -1.3 99 -0.2 93 -0.1 Closing Stock Price F129423 $70 $60 $50 Andrews Baldwin Chester Digby Erie Ferris $40 $30 $20 $10 SO 2021 2022 2023 2024 2025 2026 2027 2028 2029 Serie 1 Pace Yleid Yleld Clone S&P Oompany Andrews 13 OSZOZ 260,00 10 DS232 $1 pm 00 10 852033 40,00 11682034 827,00 12.6% 10.6% 110% 11.4% 13.1% 11.7% 11.6% 11.7% 13.3% 99.50 DDD 885 DDD 81 95 DDD 80 21 DDD 99.46 DDD Baldwin 13 OSZOZ $260,000 10 OS232 $100,00 9.482033 20,00 9.382034 $13,80 m 123S2036 480,ma 130% 11.5% 11.3% 11.4% 12.7% Bond Market Summary Clone S&P Oompany Serie 1# Pace Dig 103.07 8 13 DSZO21 $ 600,00 9438 B 10 DS232 $10 10 97 96 8 9.582033 00,000 102.21 8 9. (S2034 900,00 132S2036 $28,705 pm 100.17 Erle 8.13 13 OSZDZI $260.00 83.15 10 DS2132 m.00 81.46 11.152033 6pm, 10 96.73 9.982034 $2,481,00 9. IS2035 $10,000 pm 105.39 A Ferrt 100.19 A 13 OSZZ $1 565,819 97 32 10 DS232 pm,n0 8884 A 9.282033 $300,00 98.77 A 10652034 50,00 12.4% 100% 10.5% 100% 9.8% 105.21 100.00 105.87 99.12 9631 BBB BBB 888 BBB BBB Chester 13 OSZOZ 260,00 10 OS232 $100,00 9.(S2033 $5,114,000 9.782034 pm,n0 9.782035 $500,00 12.3% 100% 9.7% 9.8% 9.8% 13.1% 11.7% 11.4% 123% 99 50 88.54 20.53 88.30 DDD DDD DDD DDD Next Year's Prime Rae700% FOUND4 770N FAST TRACK Page 2 Foundation Financial Summary Fast Track F1294 Round: 4 Dec.31, 2025 Ferrin Andrews Baldwin Clienbr Digby $16.919 $11812) 1. $16,236) 3 $3,193 $5,121 Caili Row statment sur way CalliAowi tom operating actinten Net Income (Loss) d/meitor 10-m: Deprecator Extrao daw galis/osses/write on Changes in cirretaret ad lubilith Accounts payab Inue ID 40001 ts Recewable Net cash from ope atons 34 $1.776 1,790 $17,722 0 39 010 1,70 ,425 $12,113 $163 $.268 9 12 , 23,501) ($15552) 1,4D , 950 66 DD 9 Caili town from Invening actvitter Pent pouement (et) Cailfowi tom Inancing activitei Dulded paid Sales otcommoistok Purchase ofcommon stok Cash from big tem debt isted Earty e theme torbigtem debt Retreme it ofcure it debt Cach Tom cl me atdebtbordwig C Cash from eme ge 1 oy ban 0$ D :D 10 90 1522) $18,18T $16,315) $19,7 17) 6,941 ,AB $65.966 $8,725 $15,396 ,197 DD $32,341 Baldwin Digby Fertii Net cash from thachgacties Net change In ca ili poilton Balance 5119 et Survey Cact Account Receu Iuel DIY TotalCarretasset $10.885 d $32,760 , 2B $46,283 $1832 Climler 8, $11,020 $6.416 $36,274 4 831 10,917 $30,669 911 $11.696 $16.626 3DS , 4 9.STO $31,410 Partaide me at Accum Ilated Depreciation Total Fbced Asset Total Annet 1, $14315) , R 3 $750 6.TT $80,82 2, 4D $14,121) $38,200 6.80 16.145 $69,996 , $65,100 37 #1 $0,20 105 $39,662 P3,710 4.4 1.9% $ 1,DER Acoout Payable Current Debt TotalCurrent abilities B $19.920 568 $ 5 1.TO $592 $8,325 $3,439 $30,241 $33.600 $3.934 $1,735 88 $65.966 $57,878 Long Tem Debt Total Labilities , $46,036 4, HD 5,770 $19,714 S, US $36,405 , 2,B1 , 6 $66,894 Common Sock Retailed Earlig Total Eqiny Total Uabiliter & Owneri Equit; $11,736 $35,878 7,614 3 2,499 4,812 4, 191 $46,514 3 22 $5.538 3 $1,925 4,28 804 8 , 18 P3,710 $0,582 1,84 $6, 198 1.DB2 ncome statement sur %, Sales Varable Cost (Labor Alateral Carry Contbatbu lagi Deprecato ) SEAR&D,P Domaged edm Otie Fees Write oft, 10 M, Bon se :) EBIT Intestsortem.Long tm) Taxes Portsiaring Net Prort FOU044 770WF497 TRACK Andrew $125,312 $68,044 $67.238 $15,354 $30.997 30 313 $16,919 Baldwin $62,431 , 1 23,997 132 20 :15 1 C116 Thr $67,996 $47.175 , ,49 $12,029 $17,481 :10 373 Digby $69,996 30 $6.426 $6.121 $6.136 6 1 7 le 9, $19,713 $39,994 $10,135 $5.50 $19,675 .4 17 44 24 1. Ferrin W22,384 14,984 ,4D 347 $11,300 501 $ 4,515 $10,231 ! 45 $11312) (916235) 993 Round: 4 Dec. 31, 2025 Foundation Low Tech Segment Analysis Fast Track F129423 Low Tech Statistics Accessibility F129423 Low Tech Totallidesty Unit Demaid 7,379 Actualldsty Uit Saes 39 Andrews Segment% of Total Industy 152.2% Baldwin Next Years Segment Dwi Rat 100% Chester Low Tech Customer Buying Criteria Digby Exactions Nie povince Erie 1. Price $15.0-36.0 41% 2. Age Ideal Age - 3.0 29% Ferris 3. Rellabiny UITBF 1400-2000 21% 4. Ideal posto Pm 6.3 Ste 132 9% 2014 4094 Perceptual Map for Low Tech Actual vs Potential Market Share Perceptual map (at end of this year) 20 2025 F129423 Low Tech 60 908 100% 18 30% 16 25% 14 20%. 12 15%. Size wah 10 10% 5%. 0% 8 8 4 2 0 Andrews Baldwin Chester 2 4 Dat Name able Eat Cake 6 8 10 12 14 16 18 20 O Actual Potential Performance Top Products in Low Tech Segment UIT Cust Cust Sold Reullon Stock mm Stre Let Age Promo wae- Sales 2002 - Seg Oit Coord Coord Price HITF Dec.31 Budget 2288 Bidget bliny 1,541 5/11.2024 YES 6.8 132 $35.0 2000 280 $1,400 100% D 70% 1,460 7/92024 6.3 13.7 $35.0 1750 329 $150 100% DD 71% 1,416 710.2024 5.8 142 $33. 10m 350 $1,40 100% $180 99% 802 3/29/2012 YES 6.7 133 20.m 2300 2.76 0 28% 744 6/26/2024 6.8 132 $37.50 1600 3.44 82 T 100% DD 53% 707 318/2024 6.0 140 $35.00 18000 3.35 $1,120 75% $300 28% 267 ST.2025 5.0 14.4 $32.0 1200 125 $150 77% $1.500 55% 250 372026 7.0 133 $38.0 20m 0.82 $180 67% $80 28% 104 2/12025 5.0 150 $37.00 15000 091 $1,70 65% $1.5m 55% 51 7/19/2025 YES 9.5 10.5 $43.90 2000 1.32 $ por 100% DD 59% 16 7/10/2025 9.9 10.1 4.00 21001 128 $1.50 97% $300 71% 5/&2025 9.2 10.4 1.89 200 1.70 XD 100% pm 53% Dec. dist Si uey 41 31 28 37 16 14 Market Share 21% 20% 19% 11% 10% 10% 4% 1% 1% 1% 0% 0% Dizar Baker Dare FLY Dodo Frost Cooke Etc Beta 8 3 0 0 0 * FOUNDATION 2017 TTCX Page 5 Round: 4 Dec. 31, 2025 7.8% Foundation High Tech Segment Analysis Fast Track F129423 High Tech Statistics Accessibility F129423 High Tech Total Industry Unit Demand 4,479 Actualldsty Uit Saes 14.479 Andrews Segment% of Total Industy Baldwin Next Years Segment Dwi Rat 200% Chester High Tech Customer Buying Criteria Digby Expections Nie povince Erie 1. Ideal Poc on Ptm 10 2 Size 98 30% 2. Age Ideal Age - 0.0 29% Ferris 3. Price 25. - 15.0 25% 4. Rellabiny MTBF 17 100-2300 13% 0% 2014 Perceptual Map for High Tech Actual vs Potential Market Share Perceptual map (at end of this year) 20 2025 F129423 High Tech 60% 908 100% 18 35% 18 30% 25% 14 12 20% Size ... 10 15% 10% 8 8 4 5% 0% Andrews Baldwin Chester 0 2 4 Dar Name Ace Etc Cooke Market Share 20% 17% 12% 6 8 10 12 14 16 18 20 O Actual Potential Performance Top Products in High Tech Segment UIT Cust Cust Sold Reullon Stock mm Stre Let Age Promo wae- Sales 8000 88- Seg Oit Coord Coord Price HITF Dec.31 Budget 2288 Budget billy 903 6/142025 102 9.8 $45.00 23001 128 $1.7 100% DD 92% 781 7/10/2025 9.9 10.1 4.0 2100 1.28 $150 97% DD 92% 543 7/19/2025 YES 9.5 10.5 $43.50 200 1.322 100% D 83% 196 12/1/2025 102 9.8 $45.0 23001 093 92% D 92% 476 S/&2025 9.2 10.4 1.89 2000 1.70 rpm 100% om 87% 313 182025 YES 102 108 $45.00 2300 0.73 ROOT 70% $1.50 83 % 240 5/11/2024 YES 6.8 132 $35.0 200m 220 $1,400 100% D 92% 200 6/52025 8.0 125 5.0 1600 163 mm 100% 73% 182 372025 7.0 133 $38.0 200 0.82 $180 67% $80 31% 101 7/92024 6.3 13.7 $35.00 17500 329 $150 100% 92% ad 6/25,2024 6.8 13 2 $37.50 100m 3.44 DD 100% D 87% 75 329/2023 YES 6.7 133 220.00 23001 2.76 53% 31% Alta 11% Dec. dist Si uey 54 S2 41 57 30 46 10 6 10 2 3 Beta Cooo Able Fart Dodo Eat Baker Drzy 11% 7% 5% 4% 1% 24 2% 2% FOUNDATION 2017 TTCX Page 6 Foundation Market Share Fast Track F129423 Round: 4 Dec. 31, 2025 Units Sold vs Demand Chart F129423 Market Share F129423 6.000 30%. 4,000 10% 0% 2.000 Andrews Baldwin Chester Digby Low High Low High Industry Unit Sales Total Unit Demand Actual Market Share in Units Low High Industry Unilates 725 4,479 * of Marke 622 Potential Market Share in Units Total Low High 11898 Unis Demanded 4,479 100 % of Market ZZX 12% Total 11 1000W 205 5.4% 20.5 Abt ACE Art 20.2% 11.1% 16.96 15.0Able 7.6%ACE +24 AM 258% TOLI 5.4* 18.4* 10.2% 340W 14.7 70% 39% 25.6% 2090 20.4% 10.16 89* BE Beba 12% 10.6% 12.6% 70% Baker +0% Beba 11.0% To 1.6% 9.6% 11 2 6.1% 3.6% 92% 10.16 89* 192 0.8% 0.7% 12.18 17 D* 02% 10.8% 5.2% 70% 1993 12.2 CSE 5.16 Coolde 2.6% COD 1994 To 0.7% 12.4% 123 25.4% 47% 200 17 2* 20.7% Car Coolde Coco DALLE DIETY Dodo 9.6% 1098 35% Z+D 0.6% 1.7% 4.1% 63% 6.7% Date 7.4* DIELY 3.7% Dodo 173 Total &5 1978 30% 1.7% 0.6% 23 3.7% 65% 55% 1284 3.28 219% 23 ESI El 1986 02W ID 17.4% 13.28 Tai 6.7% El 199* TOS 17.5 0.2% 17.6% 2.1% 155 11.6% 6.1% 17 23 19.74 +9* 0.7% +28 0.7% Fst FLY Fras! 3.6% 1.4 50% 1.7% Fasi ZSW FLY 09% Fres! 5.1% TOST 33% 12% +5% 1.6% 23* 0.7% 4.76 5.2% +9* FOUNDATION 2017 TTCX Page 7 Foundation Perceptual Map Round: 4 Dec. 31, 2025 Fast Track F129423 Perceptual Map for All Segments Perceptual map (at end of this year) 20 18 16 14 TOZENO Fast 12 Size Co@.98 , 10 Etc 8 6 2 0 0 2 4 6 8 10 12 14 16 18 20 Andrews Performance Baldwin Pfm SI 29 Revised 6.8 13.2 6/25/2024 92 10.4 S1&2025 Chester Name able Hoe Alt Pimn 68 10.2 10.2 SI 28 13.2 98 98 Revised Name 5/11.2024 Baker 6/11/2025 Beta 12/1/2025 Name Cake Cooke C000 Pfm 58 9.5 10.2 SI 28 14.2 10.5 10.8 Revised 310.2024 7/19/2025 W&2025 Digby Erie Ferris Name Dare Dizzy Dodo Pfm 60 6.7 70 SI 2 14.0 13.3 13.3 Revised Namo 318.2024 Bat 3/29/2023 Etc 317.2026 Pfm 6.3 99 SI 29 13.7 10.1 Revised 7/92024 7/10/2025 Name Fast FLY Frost Pfm 80 50 50 SI 28 12.5 14.4 15.0 Revised 6/5/2025 SIT 2025 2/12026 FOUND4 770N FAST TRACK Pa 903 Foundation HR/TQM Report Fast Track F129423 Round: 4 Dec. 31, 2025 HUMAN RESOURCES SUMMARY Andrews 436 136 256 171 Ferrt 236 236 213 23 Erle 128 128 T9 149 0.1% 13 5 Baldwin 239 239 232 7 0. 24 79 100.0% Needed Complement Compement 1stsi Compement 2id Si Compleme it Ouertime Pe Dent Tinquer Rate New Employees Separate d Employees Recruthg speid Trallig Hours Podictu by Index Recri tag Cost Separation Cost Trallg Cost Total HR Admin Cot Stke Das Chester 389 389 256 123 0.0% 39 1 100.0% $39 251 261 213 18 0.0% 26 210 00.0% D. 24 15 00% 147 $! 0 D. A 0 100.0% 0 100.0% 4 5 9 $44 $8 TOM SUMMARY Andrews Baldwin Chester Erle Ferrt SED D D SD DD D Proceli Mgt Budget Lait Year CPI Systems Verdorit Qualny laittathe Tenning Channel Support Systems Concurrent Engheering UNEP Green Programs TQM Budgeti Laut Year Benchmarkg Qualny Fucto Deployment Etort CCE6 Sigma Tanning GEMITO EM SIStally little Total Expedities Cumulatye mpacto MaterblCost Pedicto Labor Cost Reduction Redicto R&D Orcle The Redict Adm in Cost Demaid lncrease BD SED D D SD AD D D 11.35% 13.57% D0% 60 02% 141 10.25% 1400% 31.72% 54 21% | 11.7% 11.76% 1400% 1 1438% 0.8% 1.84% 0.0% 4.66% 11 80% 13 90% 11.4T, 10.17% 13 82% 1 028 10.13% | FOUNDATION 2017 TTCX 8905 Foundation Ethics Report Fast Track F129423 Round: 4 Dec. 31, 2025 Other (Fees, W nie onts, etc.) Demand Factor Mateital Cost Impact Admin Cost Impact Productony Impact Awarhess Impact A002 38 bilby Impact ETHICS SUMMARY The actualdollar Impact Example, $121 means Other liceated by $121. The % Tiomal. 98% meais demaid tell2%. The % of iomal. 101% means mate Glost ose 1%. The Xotiomal. 103% means adm costs roce 3%. The Xotiomal. 104% means productory creased by 1%. The % of iomal. 105% means to malawareness was miltplied by 105. The Xotiomal.98% means romalacoess bly was me plled by098. Nomalmeans the valle tatwould lave been podiced I the poblem bad totbeepesented. No Impact Andrews Baldwin Chester Didy Erle Ferk Total Other (Fees, wie onts, etc) Demaid Facbr Mateital cost impact Admin Cost Impact Productuhy mpact Awareness impact Access bilbympact 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 0 100% 100% 100% 100% 100% 100% 0 100% 100% 100% 100% 100% 100% 0 100% 100% 100% 100% 100% 100% FOUND4 770N FAST TRACK Page 10 Annual Report Annual Report Chester F129423 Round: 4 Dec. 31, 2025 Balance Sheet ASSETS 2024 2025 Common Cash Account Receivable hventory TotalCurrent Assets $18,767 $11,000 $8.416 25 24 1494 8.6% 18.74 $16.836 $6851 $616 24,302 $36,273 DERNIONS:Common Size: The common see olim smpy epesent each tema apetitage of btal aset for thatyear. Osh: Youre dorearcal posti. Accounts Receivable: Reflects the bg beweer de uew and paymentofyourpodict. Inventories: The cineituale ofyourbuerby across alpodict. A zen indicates your company sboked out Uimetdemaid word, of conge, talbyourcompetiba. Mant& Equipment The cineituale ofyourpart Accum Deprec: The balaccim i breddeprout fom your pant acts Payable: What the company cure it owes Sipples formaterial and seu des. Ourrent Debt The debt the company s obhated bpay dung the textyear ofopeators. It ichdes eme Decoy bans ised keep yourcompany soleitstorbyon ni ortofcal dung the year. Long Term Debt The companys bigtem debt si the fom ofbords, and the present the bteluale ofyourboids. Common Stch: The amoutofcaptal quested by sharobe s i the company. Retained Earring: The ports that the company close bkeep istadofparig bslalobes & dudents. $62,400 $14,120) Plant & Equipment Accumulated Depreciation Total Ficed Asset Total Asset LABILITIES & OWNERS EQUITY 7034 -1894 51 34 100.0% $44,000 $10627) $33,373 $67,676 $38,220 $ 4,364 Accounts Payable Ourrent Debt Long Term Debt Total Liabilities $8.592 $1,730 $19,714 8.8% 2.34 28.14 37 84 $3.990 40 $16,447 $20,440 98,630 $2 323 \2323 $44, 191 Common Stoch Retained Eaming Total Equity Total Lab. &0. Equity 3.14 59.34 62.44 100.0% $46,514 $74,564 $34,012 $37,236 $67,676 Cash Flow Statement 2024 $10,012 $2,513 90 The Oath Row Statementexamines what happened in the Cash Accout ding the year. Cal injections appear a positie imbes and cal wdenat a legative iimbes. The Cal Fbw Statements an excit bolfordegros igeme pero bars. When negative cash ftus exceed posties, you are fred b seek emeg: 1 fudig. Forexample, Isabs ar bad andyou fidyou gefcanyiga budaice ofexcess huendy. the sportmonoshow the iceze i jedy zalige negatie cash ftw. Too much nexpected huerby colborstp yorriftws, exhaust yourstarting cal ad fpe you beg formorey bkeepyourcompany aftat 2025 $9,779 $3,493 $0 $2.599 $6900 $4,239 $6,732 $447 $510) $16) $11,740 $8.400 Cash Row from Operating Activites Net Income (Loss) Depreciation Ex teordinary ga ins/osses.urteofs Accounts Payable Inuen DIY 4000nt Recewable Netcal from ope atio Cath Rows from investing Activities Pent improve me it Cash Row from Financing Activite Duided paid Sales ofcommonsbok Purchase ofcommoistok Cal from bigtem debt Retre me it of big tem debt Chaige is currentdebtret Netcal from financig activities Netchange in cash position Closing cash positon $12300) mm Cash Flow Summary Chester F129423 6,000 4,000 2,000 0 -2.000 -4.000 -6,000 -8.000 Operations Finance Chg. Cash Operations Investment Finance Chg. Cash $500) 90 $0 $6000 $1.733) $1,733 $4,500 $1 832 $18,767 $6 pou 40 $867) $5,130 $4,574 $16,836 Annual Report Page 11 m mmmm $ $ $50 Annual Report Chester F12943 Round: 4 Dec. 31, 2025 2025 Income Statement Cake Product Name) Cooke 2025 C000 Common Total Fe Sale! $47,772 4.65 $87.986 100.0% Variable Coito Dlect Labor $12,115 ,16.1 :19 D7% 236% Dlect Material $12,014 $ 556 , 5.79 292% Iue Dry Cany 7 0.9% Total Varable 4 14.08 8 29 47.13 Contrbitblagi 23 $12, 102 9 46.4% Perlod Ooit : Deprecato $1.730 $3,495 4.0% SG&A: R&D $655 0.9% Promotions $1,400 DD DD ,D 6.1% D 50 $300 6.0% 2 $672 0.7% Total Perbd 35211 58 450 $15,592 17.7% Net Margh $17.629 5.31 28.7% Dentis: Salen: Unt Saes thes Etprte. Orect Labor: Latorcat bined Dopodice the podict Other 8.8% thatnes s06. huentr; Garr; cout the costusoo goods buelty. Depreciaton: Catiedon EBIT $17,181 199% stagithe. 15eardepecebi otpantuahe. R&DCont: R&D deparmentexpedbes breach Short Tem lit est 44 0.2% podict Admin: Admittat que neades thated at 15% otsaes. Promotori: The promote budget Long Tem Interest $1906 2.3% breach product Saler: The sats te bidget treach podict Ofwr:Clags hot holded other Taxes 33 6.1% categores such as fees, Wite onts, and To M. The tes lche money pati dhuesmentbankes and Portsiarlig D 0.2% broke Bye ms D Isle newsboks orboid phs consibgtes your strcbrmgltassess. Wite-ott Net Prort 779 11.1% Ichde the bes you mgltexpertence when you selcapacy or guttate huendy as the esitor embang apodicto le. If the amontpear as a negatire amont, then you actually made money Variable Margins or the Gattat ofcapacy or buelty, EET: Eang dede lit estard Taces. Short Term more it 2025 Chester F129423 Inte estexpense besedo styeas cuentdebt, hchdhg shortem debt bugem notes that are become die andeme geror tans, Long Term here it intestation ont tadhg bords. Tater: 40 Income tax based upon a 35% tarat. Prottslering: Ports shardwb empbrees under the sbor 30 contact Nat Prott Eartmhus test, taces, and protstang, 20 10 $0 mm $1,178 Tim Cake Cookie Coco Profit History F129423 $10,000 $5,000 Lon Market Share History F129423 20% 10% $0 2021 2022 2023 2024 2025 2021 2022 2023 2024 2025 ROE History F129423 Asset Turnover History F129423 2.0 1.0 20% C: 0.0 2021 2022 2023 2024 2025 2021 2022 2023 2024 2025 ROS History F129423 10% 5%. ROA History F129423 20% 10%. 17: 2021 2022 2021 2022 2023 2024 2025 2023 2024 2025 ANRI Report ge 12 Official Decision File - Chester - F129423 Round 1 Round 2 Round 3 Round 4 Round 5 Round 6 Round 7 Round 8 Product Decisions NA ProductName Performance Size MTBFrd Spec Price PromoBudget Sales Budget Unit SalesForecast Production Ordered CapacityChange Automation NextRound Finance Decisions Cake 5.8 14.2 18000 33.00 1500 2000 1850 1900 0 5.0 Cookie 8.1 11.5 20000 44.95 2000 2000 403 500 0 3.0 Coco 10.2 10.8 23000 0.00 0 0 0 0 350 3.0 0.0 0.0 0 0.00 0 0 0 0 0 0.0 NA 0.0 0.0 0 0.00 0 0 0 0 0 0.0 Finance Function Finance Decisions Stissue 0 StRetire 0 Dividend 0.00 ShortDebt 0 BondRetire 0 Bondissue 6000 AR 30 AP 30 0 TQM Decisions TQMfunction CPI Vendor JIT QIT Channels TQMbudgets 750 750 750 750 Audit Trail - Chester - F129423 - Round 3 CCE Bench Mark 750 500 QFDE 500 CCE6sigma 250 UNEPGreen 250 GEMISustain 250 Official Decision File - Chester - F129423 Round 1 Round 2 Round 3 Round 4 Round 5 Round 6 Round 7 Round 8 NA 0.0 Product Decisions ProductName Performance Size MTBFrd Spec Price PromoBudget SalesBudget UnitSalesForecast Production Ordered CapacityChange Automation NextRound Finance Decisions Cake 5.8 14.2 18000 33.00 1400 1800 1750 1900 0 5.0 Cookie 9.5 10.5 20000 43.50 2000 2000 600 600 0 4.0 Coco 10.2 10.8 23000 45.00 2000 1500 300 0.0 0 0.00 0 0 0 NA 0.0 0.0 0 0.00 0 0 0 0 0 0 0 325 200 4.0 0 0 Finance Function Finance Decisions TQM Decisions Stissue 0 StRetire 0 Dividend 0.25 ShortDebt 0 BondRetire 0 Bondissue 5000 AR 46 AP 46 TQMfunction CPL VendorJIT QIT Channels TQMbudgets 750 750 750 750 Audit Trail - Chester - F129423 - Round 4 CCE Bench Mark 750 750 QFDE CCE6sigma 750 750 UNEPGreen 750 GEMISustain 750 Foundation FastTrack F129423 Round: 4 Dec. 31, 2025 Andrews JAME BENITEZ ARAMB Bianca Byme Karen Hemandez Antonio Rvas Pooja Tiwari Cynthia Villanueva Baldwin Subel Garcia Malerie Hemandez Mta diha Khan Christopher Orellan Julia Reyes Chester Yimesha Catchings Danielle Cox Sara De La Rosa Antouanette Gudino Erica Ne ei Digby Jennifer Bronfield Syeda Hare em Fatima David Hitchens Keturah Ramirez Sandra Reyes Cherie Robinson Erie Oramis Alonso Gresia Bermudez william centeno Emrad Bsterit bilal halawe Karen Iraheta Ferris Garon Bemal Shakera Cahoun Lesley Martinez Cesar Ruiz Rosalia Valenzuela Andrews 13.5% Ferris -725% Erie 12.3% 126 15.3% 134 0.78 032 117 1.6 ROS Asset Turnover ROA Leverage ROE Emergency Loan Sales EBIT Profits Cumulative Profit SG&A / Sales Contrib. Margin % 18.1% 2.0 35.6% $0 $125,311,788 $30,997,437 $16,948 930 $27,841 090 12.3% 45.7% Selected Financial Statistics Baldwin Chester Digby -30% 11.1% -19.7% 065 1.18 -20% 13.1% -15,5% 3.2 1.6 -6.4% 21.0% -181.2% $26.941 375 40 $28,507 927 $62,431 062 $87,998,497 $69,996,386 $4,715 073 $17.480928 (18515688) ($1,575869) $9,778807 $11,841,798) $14,461 880 $36,654,336 $175,362 17.4% 13.7% 10.2% 45.8% 46.4% 10.7% 24.9% 90 $89,707 221 $19,685.225 $10.999 677 $36.888,137 11.3% 44.6% -229% 170 -389.5% $65,965634 $22,384203 ($14,750 541) ($16,238 253) (98 967.744) 50.5% 33.1% Percent of Sales F129423 $ Market Share F129423 100% 80% 60%. O Var Cost Depr O SGA 0 Other Profit 40% 20%. 0% Andrews Baldwin O Chester Digby Erie O Ferris 28.62 % 11.98 % 20.1% 13.7% 20.49 % 5.11 % -20% Andrews Chester Digby Erie Ferris FOVMD4 770N FAST TRACK Page 1 Foundation Stock & Bonds Fast Track F129423 Round: 4 Dec. 31, 2025 Clone EPS Yleld Company Andrews Baldwin Chester Dig Erle Ferrt $39.21 $1 DD 548.22 i Du $61.23 $1 DO Chiang 23.35 $10.69) $5.55 000 $885 000 Stock Market Summary MarketCap Sanel BOOK Value ($M) Per Sare 2,597 98T $102 $18.30 2.00.00 2 $12.41 2,000,000 6 $23.26 2,000.00 $ 27 2,000m $102 22.12 1,978,522 $2.11 $6.52 0.79) $489 $592) $6.50 821) Dividend DO DO 25 DO $1.50 DS 0.0% 0.0% 0.5% 0.0% 2.9% 5.0% PVE 60 -1.3 99 -0.2 93 -0.1 Closing Stock Price F129423 $70 $60 $50 Andrews Baldwin Chester Digby Erie Ferris $40 $30 $20 $10 SO 2021 2022 2023 2024 2025 2026 2027 2028 2029 Serie 1 Pace Yleid Yleld Clone S&P Oompany Andrews 13 OSZOZ 260,00 10 DS232 $1 pm 00 10 852033 40,00 11682034 827,00 12.6% 10.6% 110% 11.4% 13.1% 11.7% 11.6% 11.7% 13.3% 99.50 DDD 885 DDD 81 95 DDD 80 21 DDD 99.46 DDD Baldwin 13 OSZOZ $260,000 10 OS232 $100,00 9.482033 20,00 9.382034 $13,80 m 123S2036 480,ma 130% 11.5% 11.3% 11.4% 12.7% Bond Market Summary Clone S&P Oompany Serie 1# Pace Dig 103.07 8 13 DSZO21 $ 600,00 9438 B 10 DS232 $10 10 97 96 8 9.582033 00,000 102.21 8 9. (S2034 900,00 132S2036 $28,705 pm 100.17 Erle 8.13 13 OSZDZI $260.00 83.15 10 DS2132 m.00 81.46 11.152033 6pm, 10 96.73 9.982034 $2,481,00 9. IS2035 $10,000 pm 105.39 A Ferrt 100.19 A 13 OSZZ $1 565,819 97 32 10 DS232 pm,n0 8884 A 9.282033 $300,00 98.77 A 10652034 50,00 12.4% 100% 10.5% 100% 9.8% 105.21 100.00 105.87 99.12 9631 BBB BBB 888 BBB BBB Chester 13 OSZOZ 260,00 10 OS232 $100,00 9.(S2033 $5,114,000 9.782034 pm,n0 9.782035 $500,00 12.3% 100% 9.7% 9.8% 9.8% 13.1% 11.7% 11.4% 123% 99 50 88.54 20.53 88.30 DDD DDD DDD DDD Next Year's Prime Rae700% FOUND4 770N FAST TRACK Page 2 Foundation Financial Summary Fast Track F1294 Round: 4 Dec.31, 2025 Ferrin Andrews Baldwin Clienbr Digby $16.919 $11812) 1. $16,236) 3 $3,193 $5,121 Caili Row statment sur way CalliAowi tom operating actinten Net Income (Loss) d/meitor 10-m: Deprecator Extrao daw galis/osses/write on Changes in cirretaret ad lubilith Accounts payab Inue ID 40001 ts Recewable Net cash from ope atons 34 $1.776 1,790 $17,722 0 39 010 1,70 ,425 $12,113 $163 $.268 9 12 , 23,501) ($15552) 1,4D , 950 66 DD 9 Caili town from Invening actvitter Pent pouement (et) Cailfowi tom Inancing activitei Dulded paid Sales otcommoistok Purchase ofcommon stok Cash from big tem debt isted Earty e theme torbigtem debt Retreme it ofcure it debt Cach Tom cl me atdebtbordwig C Cash from eme ge 1 oy ban 0$ D :D 10 90 1522) $18,18T $16,315) $19,7 17) 6,941 ,AB $65.966 $8,725 $15,396 ,197 DD $32,341 Baldwin Digby Fertii Net cash from thachgacties Net change In ca ili poilton Balance 5119 et Survey Cact Account Receu Iuel DIY TotalCarretasset $10.885 d $32,760 , 2B $46,283 $1832 Climler 8, $11,020 $6.416 $36,274 4 831 10,917 $30,669 911 $11.696 $16.626 3DS , 4 9.STO $31,410 Partaide me at Accum Ilated Depreciation Total Fbced Asset Total Annet 1, $14315) , R 3 $750 6.TT $80,82 2, 4D $14,121) $38,200 6.80 16.145 $69,996 , $65,100 37 #1 $0,20 105 $39,662 P3,710 4.4 1.9% $ 1,DER Acoout Payable Current Debt TotalCurrent abilities B $19.920 568 $ 5 1.TO $592 $8,325 $3,439 $30,241 $33.600 $3.934 $1,735 88 $65.966 $57,878 Long Tem Debt Total Labilities , $46,036 4, HD 5,770 $19,714 S, US $36,405 , 2,B1 , 6 $66,894 Common Sock Retailed Earlig Total Eqiny Total Uabiliter & Owneri Equit; $11,736 $35,878 7,614 3 2,499 4,812 4, 191 $46,514 3 22 $5.538 3 $1,925 4,28 804 8 , 18 P3,710 $0,582 1,84 $6, 198 1.DB2 ncome statement sur %, Sales Varable Cost (Labor Alateral Carry Contbatbu lagi Deprecato ) SEAR&D,P Domaged edm Otie Fees Write oft, 10 M, Bon se :) EBIT Intestsortem.Long tm) Taxes Portsiaring Net Prort FOU044 770WF497 TRACK Andrew $125,312 $68,044 $67.238 $15,354 $30.997 30 313 $16,919 Baldwin $62,431 , 1 23,997 132 20 :15 1 C116 Thr $67,996 $47.175 , ,49 $12,029 $17,481 :10 373 Digby $69,996 30 $6.426 $6.121 $6.136 6 1 7 le 9, $19,713 $39,994 $10,135 $5.50 $19,675 .4 17 44 24 1. Ferrin W22,384 14,984 ,4D 347 $11,300 501 $ 4,515 $10,231 ! 45 $11312) (916235) 993 Round: 4 Dec. 31, 2025 Foundation Low Tech Segment Analysis Fast Track F129423 Low Tech Statistics Accessibility F129423 Low Tech Totallidesty Unit Demaid 7,379 Actualldsty Uit Saes 39 Andrews Segment% of Total Industy 152.2% Baldwin Next Years Segment Dwi Rat 100% Chester Low Tech Customer Buying Criteria Digby Exactions Nie povince Erie 1. Price $15.0-36.0 41% 2. Age Ideal Age - 3.0 29% Ferris 3. Rellabiny UITBF 1400-2000 21% 4. Ideal posto Pm 6.3 Ste 132 9% 2014 4094 Perceptual Map for Low Tech Actual vs Potential Market Share Perceptual map (at end of this year) 20 2025 F129423 Low Tech 60 908 100% 18 30% 16 25% 14 20%. 12 15%. Size wah 10 10% 5%. 0% 8 8 4 2 0 Andrews Baldwin Chester 2 4 Dat Name able Eat Cake 6 8 10 12 14 16 18 20 O Actual Potential Performance Top Products in Low Tech Segment UIT Cust Cust Sold Reullon Stock mm Stre Let Age Promo wae- Sales 2002 - Seg Oit Coord Coord Price HITF Dec.31 Budget 2288 Bidget bliny 1,541 5/11.2024 YES 6.8 132 $35.0 2000 280 $1,400 100% D 70% 1,460 7/92024 6.3 13.7 $35.0 1750 329 $150 100% DD 71% 1,416 710.2024 5.8 142 $33. 10m 350 $1,40 100% $180 99% 802 3/29/2012 YES 6.7 133 20.m 2300 2.76 0 28% 744 6/26/2024 6.8 132 $37.50 1600 3.44 82 T 100% DD 53% 707 318/2024 6.0 140 $35.00 18000 3.35 $1,120 75% $300 28% 267 ST.2025 5.0 14.4 $32.0 1200 125 $150 77% $1.500 55% 250 372026 7.0 133 $38.0 20m 0.82 $180 67% $80 28% 104 2/12025 5.0 150 $37.00 15000 091 $1,70 65% $1.5m 55% 51 7/19/2025 YES 9.5 10.5 $43.90 2000 1.32 $ por 100% DD 59% 16 7/10/2025 9.9 10.1 4.00 21001 128 $1.50 97% $300 71% 5/&2025 9.2 10.4 1.89 200 1.70 XD 100% pm 53% Dec. dist Si uey 41 31 28 37 16 14 Market Share 21% 20% 19% 11% 10% 10% 4% 1% 1% 1% 0% 0% Dizar Baker Dare FLY Dodo Frost Cooke Etc Beta 8 3 0 0 0 * FOUNDATION 2017 TTCX Page 5 Round: 4 Dec. 31, 2025 7.8% Foundation High Tech Segment Analysis Fast Track F129423 High Tech Statistics Accessibility F129423 High Tech Total Industry Unit Demand 4,479 Actualldsty Uit Saes 14.479 Andrews Segment% of Total Industy Baldwin Next Years Segment Dwi Rat 200% Chester High Tech Customer Buying Criteria Digby Expections Nie povince Erie 1. Ideal Poc on Ptm 10 2 Size 98 30% 2. Age Ideal Age - 0.0 29% Ferris 3. Price 25. - 15.0 25% 4. Rellabiny MTBF 17 100-2300 13% 0% 2014 Perceptual Map for High Tech Actual vs Potential Market Share Perceptual map (at end of this year) 20 2025 F129423 High Tech 60% 908 100% 18 35% 18 30% 25% 14 12 20% Size ... 10 15% 10% 8 8 4 5% 0% Andrews Baldwin Chester 0 2 4 Dar Name Ace Etc Cooke Market Share 20% 17% 12% 6 8 10 12 14 16 18 20 O Actual Potential Performance Top Products in High Tech Segment UIT Cust Cust Sold Reullon Stock mm Stre Let Age Promo wae- Sales 8000 88- Seg Oit Coord Coord Price HITF Dec.31 Budget 2288 Budget billy 903 6/142025 102 9.8 $45.00 23001 128 $1.7 100% DD 92% 781 7/10/2025 9.9 10.1 4.0 2100 1.28 $150 97% DD 92% 543 7/19/2025 YES 9.5 10.5 $43.50 200 1.322 100% D 83% 196 12/1/2025 102 9.8 $45.0 23001 093 92% D 92% 476 S/&2025 9.2 10.4 1.89 2000 1.70 rpm 100% om 87% 313 182025 YES 102 108 $45.00 2300 0.73 ROOT 70% $1.50 83 % 240 5/11/2024 YES 6.8 132 $35.0 200m 220 $1,400 100% D 92% 200 6/52025 8.0 125 5.0 1600 163 mm 100% 73% 182 372025 7.0 133 $38.0 200 0.82 $180 67% $80 31% 101 7/92024 6.3 13.7 $35.00 17500 329 $150 100% 92% ad 6/25,2024 6.8 13 2 $37.50 100m 3.44 DD 100% D 87% 75 329/2023 YES 6.7 133 220.00 23001 2.76 53% 31% Alta 11% Dec. dist Si uey 54 S2 41 57 30 46 10 6 10 2 3 Beta Cooo Able Fart Dodo Eat Baker Drzy 11% 7% 5% 4% 1% 24 2% 2% FOUNDATION 2017 TTCX Page 6 Foundation Market Share Fast Track F129423 Round: 4 Dec. 31, 2025 Units Sold vs Demand Chart F129423 Market Share F129423 6.000 30%. 4,000 10% 0% 2.000 Andrews Baldwin Chester Digby Low High Low High Industry Unit Sales Total Unit Demand Actual Market Share in Units Low High Industry Unilates 725 4,479 * of Marke 622 Potential Market Share in Units Total Low High 11898 Unis Demanded 4,479 100 % of Market ZZX 12% Total 11 1000W 205 5.4% 20.5 Abt ACE Art 20.2% 11.1% 16.96 15.0Able 7.6%ACE +24 AM 258% TOLI 5.4* 18.4* 10.2% 340W 14.7 70% 39% 25.6% 2090 20.4% 10.16 89* BE Beba 12% 10.6% 12.6% 70% Baker +0% Beba 11.0% To 1.6% 9.6% 11 2 6.1% 3.6% 92% 10.16 89* 192 0.8% 0.7% 12.18 17 D* 02% 10.8% 5.2% 70% 1993 12.2 CSE 5.16 Coolde 2.6% COD 1994 To 0.7% 12.4% 123 25.4% 47% 200 17 2* 20.7% Car Coolde Coco DALLE DIETY Dodo 9.6% 1098 35% Z+D 0.6% 1.7% 4.1% 63% 6.7% Date 7.4* DIELY 3.7% Dodo 173 Total &5 1978 30% 1.7% 0.6% 23 3.7% 65% 55% 1284 3.28 219% 23 ESI El 1986 02W ID 17.4% 13.28 Tai 6.7% El 199* TOS 17.5 0.2% 17.6% 2.1% 155 11.6% 6.1% 17 23 19.74 +9* 0.7% +28 0.7% Fst FLY Fras! 3.6% 1.4 50% 1.7% Fasi ZSW FLY 09% Fres! 5.1% TOST 33% 12% +5% 1.6% 23* 0.7% 4.76 5.2% +9* FOUNDATION 2017 TTCX Page 7 Foundation Perceptual Map Round: 4 Dec. 31, 2025 Fast Track F129423 Perceptual Map for All Segments Perceptual map (at end of this year) 20 18 16 14 TOZENO Fast 12 Size Co@.98 , 10 Etc 8 6 2 0 0 2 4 6 8 10 12 14 16 18 20 Andrews Performance Baldwin Pfm SI 29 Revised 6.8 13.2 6/25/2024 92 10.4 S1&2025 Chester Name able Hoe Alt Pimn 68 10.2 10.2 SI 28 13.2 98 98 Revised Name 5/11.2024 Baker 6/11/2025 Beta 12/1/2025 Name Cake Cooke C000 Pfm 58 9.5 10.2 SI 28 14.2 10.5 10.8 Revised 310.2024 7/19/2025 W&2025 Digby Erie Ferris Name Dare Dizzy Dodo Pfm 60 6.7 70 SI 2 14.0 13.3 13.3 Revised Namo 318.2024 Bat 3/29/2023 Etc 317.2026 Pfm 6.3 99 SI 29 13.7 10.1 Revised 7/92024 7/10/2025 Name Fast FLY Frost Pfm 80 50 50 SI 28 12.5 14.4 15.0 Revised 6/5/2025 SIT 2025 2/12026 FOUND4 770N FAST TRACK Pa 903 Foundation HR/TQM Report Fast Track F129423 Round: 4 Dec. 31, 2025 HUMAN RESOURCES SUMMARY Andrews 436 136 256 171 Ferrt 236 236 213 23 Erle 128 128 T9 149 0.1% 13 5 Baldwin 239 239 232 7 0. 24 79 100.0% Needed Complement Compement 1stsi Compement 2id Si Compleme it Ouertime Pe Dent Tinquer Rate New Employees Separate d Employees Recruthg speid Trallig Hours Podictu by Index Recri tag Cost Separation Cost Trallg Cost Total HR Admin Cot Stke Das Chester 389 389 256 123 0.0% 39 1 100.0% $39 251 261 213 18 0.0% 26 210 00.0% D. 24 15 00% 147 $! 0 D. A 0 100.0% 0 100.0% 4 5 9 $44 $8 TOM SUMMARY Andrews Baldwin Chester Erle Ferrt SED D D SD DD D Proceli Mgt Budget Lait Year CPI Systems Verdorit Qualny laittathe Tenning Channel Support Systems Concurrent Engheering UNEP Green Programs TQM Budgeti Laut Year Benchmarkg Qualny Fucto Deployment Etort CCE6 Sigma Tanning GEMITO EM SIStally little Total Expedities Cumulatye mpacto MaterblCost Pedicto Labor Cost Reduction Redicto R&D Orcle The Redict Adm in Cost Demaid lncrease BD SED D D SD AD D D 11.35% 13.57% D0% 60 02% 141 10.25% 1400% 31.72% 54 21% | 11.7% 11.76% 1400% 1 1438% 0.8% 1.84% 0.0% 4.66% 11 80% 13 90% 11.4T, 10.17% 13 82% 1 028 10.13% | FOUNDATION 2017 TTCX 8905 Foundation Ethics Report Fast Track F129423 Round: 4 Dec. 31, 2025 Other (Fees, W nie onts, etc.) Demand Factor Mateital Cost Impact Admin Cost Impact Productony Impact Awarhess Impact A002 38 bilby Impact ETHICS SUMMARY The actualdollar Impact Example, $121 means Other liceated by $121. The % Tiomal. 98% meais demaid tell2%. The % of iomal. 101% means mate Glost ose 1%. The Xotiomal. 103% means adm costs roce 3%. The Xotiomal. 104% means productory creased by 1%. The % of iomal. 105% means to malawareness was miltplied by 105. The Xotiomal.98% means romalacoess bly was me plled by098. Nomalmeans the valle tatwould lave been podiced I the poblem bad totbeepesented. No Impact Andrews Baldwin Chester Didy Erle Ferk Total Other (Fees, wie onts, etc) Demaid Facbr Mateital cost impact Admin Cost Impact Productuhy mpact Awareness impact Access bilbympact 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 0 100% 100% 100% 100% 100% 100% 0 100% 100% 100% 100% 100% 100% 0 100% 100% 100% 100% 100% 100% FOUND4 770N FAST TRACK Page 10 Annual Report Annual Report Chester F129423 Round: 4 Dec. 31, 2025 Balance Sheet ASSETS 2024 2025 Common Cash Account Receivable hventory TotalCurrent Assets $18,767 $11,000 $8.416 25 24 1494 8.6% 18.74 $16.836 $6851 $616 24,302 $36,273 DERNIONS:Common Size: The common see olim smpy epesent each tema apetitage of btal aset for thatyear. Osh: Youre dorearcal posti. Accounts Receivable: Reflects the bg beweer de uew and paymentofyourpodict. Inventories: The cineituale ofyourbuerby across alpodict. A zen indicates your company sboked out Uimetdemaid word, of conge, talbyourcompetiba. Mant& Equipment The cineituale ofyourpart Accum Deprec: The balaccim i breddeprout fom your pant acts Payable: What the company cure it owes Sipples formaterial and seu des. Ourrent Debt The debt the company s obhated bpay dung the textyear ofopeators. It ichdes eme Decoy bans ised keep yourcompany soleitstorbyon ni ortofcal dung the year. Long Term Debt The companys bigtem debt si the fom ofbords, and the present the bteluale ofyourboids. Common Stch: The amoutofcaptal quested by sharobe s i the company. Retained Earring: The ports that the company close bkeep istadofparig bslalobes & dudents. $62,400 $14,120) Plant & Equipment Accumulated Depreciation Total Ficed Asset Total Asset LABILITIES & OWNERS EQUITY 7034 -1894 51 34 100.0% $44,000 $10627) $33,373 $67,676 $38,220 $ 4,364 Accounts Payable Ourrent Debt Long Term Debt Total Liabilities $8.592 $1,730 $19,714 8.8% 2.34 28.14 37 84 $3.990 40 $16,447 $20,440 98,630 $2 323 \2323 $44, 191 Common Stoch Retained Eaming Total Equity Total Lab. &0. Equity 3.14 59.34 62.44 100.0% $46,514 $74,564 $34,012 $37,236 $67,676 Cash Flow Statement 2024 $10,012 $2,513 90 The Oath Row Statementexamines what happened in the Cash Accout ding the year. Cal injections appear a positie imbes and cal wdenat a legative iimbes. The Cal Fbw Statements an excit bolfordegros igeme pero bars. When negative cash ftus exceed posties, you are fred b seek emeg: 1 fudig. Forexample, Isabs ar bad andyou fidyou gefcanyiga budaice ofexcess huendy. the sportmonoshow the iceze i jedy zalige negatie cash ftw. Too much nexpected huerby colborstp yorriftws, exhaust yourstarting cal ad fpe you beg formorey bkeepyourcompany aftat 2025 $9,779 $3,493 $0 $2.599 $6900 $4,239 $6,732 $447 $510) $16) $11,740 $8.400 Cash Row from Operating Activites Net Income (Loss) Depreciation Ex teordinary ga ins/osses.urteofs Accounts Payable Inuen DIY 4000nt Recewable Netcal from ope atio Cath Rows from investing Activities Pent improve me it Cash Row from Financing Activite Duided paid Sales ofcommonsbok Purchase ofcommoistok Cal from bigtem debt Retre me it of big tem debt Chaige is currentdebtret Netcal from financig activities Netchange in cash position Closing cash positon $12300) mm Cash Flow Summary Chester F129423 6,000 4,000 2,000 0 -2.000 -4.000 -6,000 -8.000 Operations Finance Chg. Cash Operations Investment Finance Chg. Cash $500) 90 $0 $6000 $1.733) $1,733 $4,500 $1 832 $18,767 $6 pou 40 $867) $5,130 $4,574 $16,836 Annual Report Page 11 m mmmm $ $ $50 Annual Report Chester F12943 Round: 4 Dec. 31, 2025 2025 Income Statement Cake Product Name) Cooke 2025 C000 Common Total Fe Sale! $47,772 4.65 $87.986 100.0% Variable Coito Dlect Labor $12,115 ,16.1 :19 D7% 236% Dlect Material $12,014 $ 556 , 5.79 292% Iue Dry Cany 7 0.9% Total Varable 4 14.08 8 29 47.13 Contrbitblagi 23 $12, 102 9 46.4% Perlod Ooit : Deprecato $1.730 $3,495 4.0% SG&A: R&D $655 0.9% Promotions $1,400 DD DD ,D 6.1% D 50 $300 6.0% 2 $672 0.7% Total Perbd 35211 58 450 $15,592 17.7% Net Margh $17.629 5.31 28.7% Dentis: Salen: Unt Saes thes Etprte. Orect Labor: Latorcat bined Dopodice the podict Other 8.8% thatnes s06. huentr; Garr; cout the costusoo goods buelty. Depreciaton: Catiedon EBIT $17,181 199% stagithe. 15eardepecebi otpantuahe. R&DCont: R&D deparmentexpedbes breach Short Tem lit est 44 0.2% podict Admin: Admittat que neades thated at 15% otsaes. Promotori: The promote budget Long Tem Interest $1906 2.3% breach product Saler: The sats te bidget treach podict Ofwr:Clags hot holded other Taxes 33 6.1% categores such as fees, Wite onts, and To M. The tes lche money pati dhuesmentbankes and Portsiarlig D 0.2% broke Bye ms D Isle newsboks orboid phs consibgtes your strcbrmgltassess. Wite-ott Net Prort 779 11.1% Ichde the bes you mgltexpertence when you selcapacy or guttate huendy as the esitor embang apodicto le. If the amontpear as a negatire amont, then you actually made money Variable Margins or the Gattat ofcapacy or buelty, EET: Eang dede lit estard Taces. Short Term more it 2025 Chester F129423 Inte estexpense besedo styeas cuentdebt, hchdhg shortem debt bugem notes that are become die andeme geror tans, Long Term here it intestation ont tadhg bords. Tater: 40 Income tax based upon a 35% tarat. Prottslering: Ports shardwb empbrees under the sbor 30 contact Nat Prott Eartmhus test, taces, and protstang, 20 10 $0 mm $1,178 Tim Cake Cookie Coco Profit History F129423 $10,000 $5,000 Lon Market Share History F129423 20% 10% $0 2021 2022 2023 2024 2025 2021 2022 2023 2024 2025 ROE History F129423 Asset Turnover History F129423 2.0 1.0 20% C: 0.0 2021 2022 2023 2024 2025 2021 2022 2023 2024 2025 ROS History F129423 10% 5%. ROA History F129423 20% 10%. 17: 2021 2022 2021 2022 2023 2024 2025 2023 2024 2025 ANRI Report ge 12