Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i have provided all information do not use my question as a way to make a side buisness [The following information applies to the questions

i have provided all information do not use my question as a way to make a side buisness

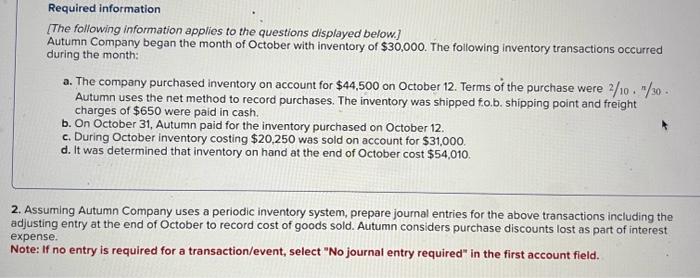

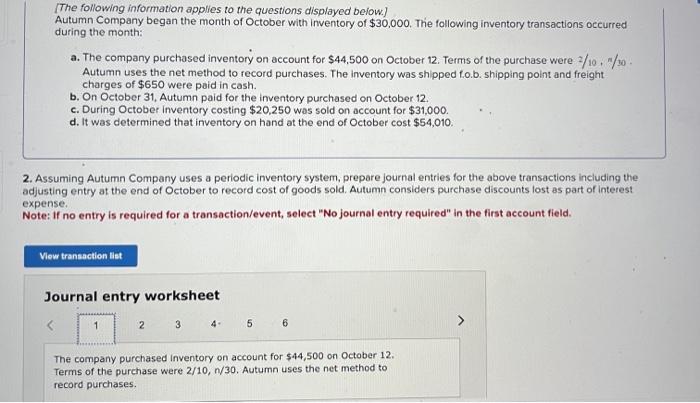

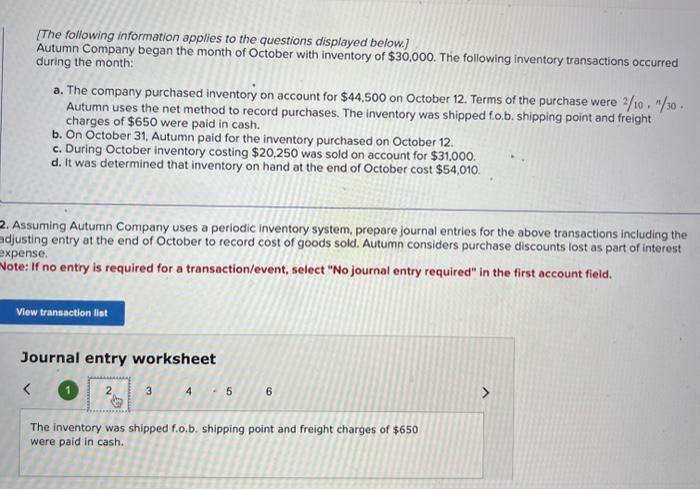

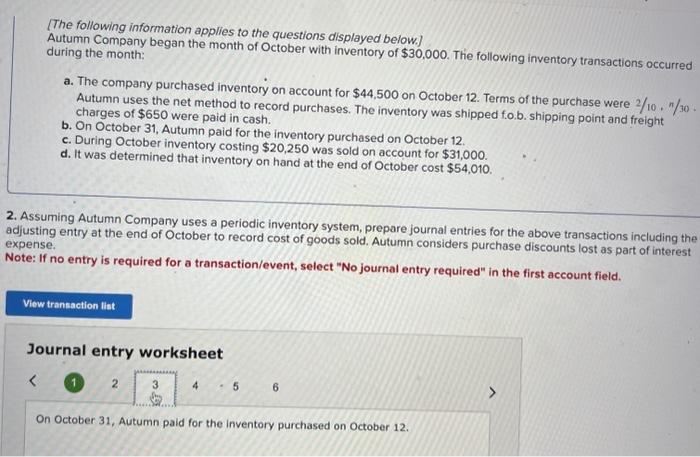

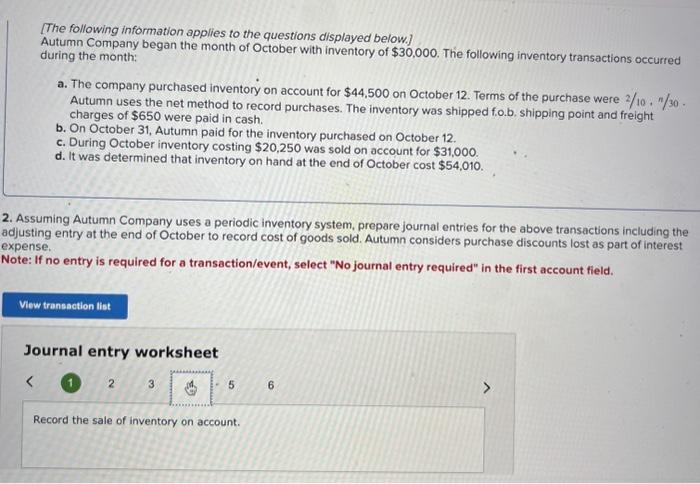

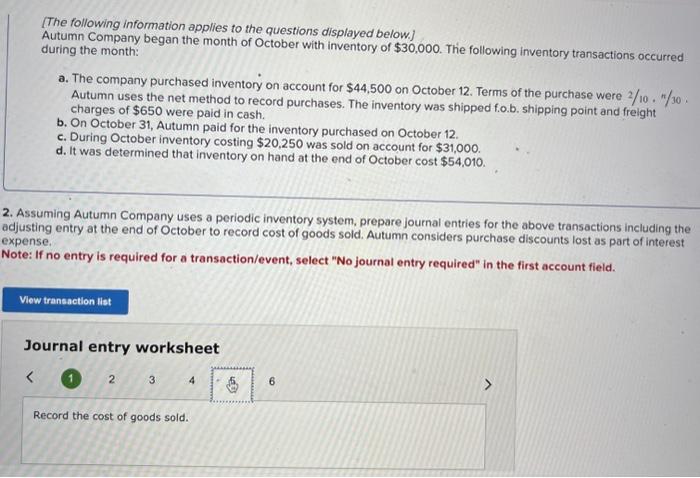

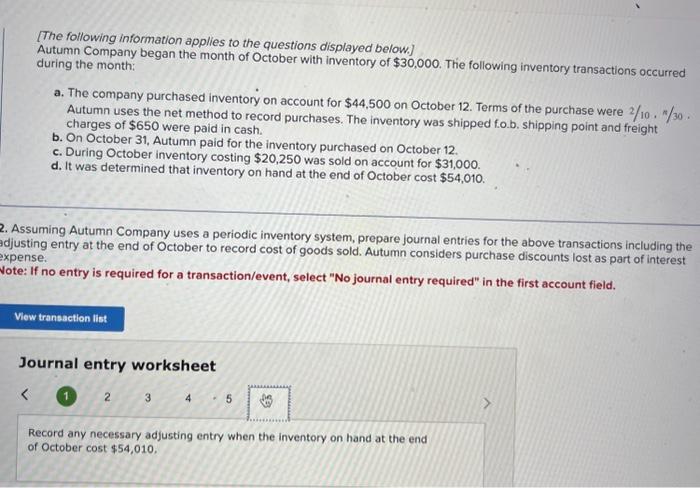

[The following information applies to the questions displayed below.] Autumn Company began the month of October with inventory of $30,000. The following inventory transactions occurred during the month: a. The company purchased inventory on account for $44,500 on October 12 . Terms of the purchase were 2/10,n/30. Autumn uses the net method to record purchases. The inventory was shipped f.o.b. shipping point and freight charges of $650 were paid in cash. b. On October 31, Autumn paid for the inventory purchased on October 12. c. During October inventory costing $20,250 was sold on occount for $31,000. d. It was determined that inventory on hand at the end of October cost $54,010. Assuming Autumn Company uses a periodic inventory system, prepare journal entries for the above transactions including the djusting entry at the end of October to record cost of goods sold. Autumn considers purchase discounts lost as part of interest xpense. lote: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. [The following information applies to the questions displayed below] Autumn Company began the month of October with Inventory of $30,000. The following inventory transactions occurred during the month: a. The company purchased inventory on account for $44,500 on October 12 . Terms of the purchase were 2/10,7/10. Autumn uses the net method to record purchases. The inventory was shipped fo.b. shipping point and freight charges of $650 were paid in cash. b. On October 31, Autumn paid for the inventory purchased on October 12. c. During October inventory costing $20,250 was sold on account for $31,000. d. It was determined that inventory on hand at the end of October cost $54,010. 2. Assuming Autumn Company uses a periodic inventory system, prepare journal entries for the above transactions including the idjusting entry at the end of October to record cost of goods sold. Autumn considers purchase discounts lost as part of interest xpense. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 4. 56 The company purchased inventory on account for $44,500 on October 12 . Terms of the purchase were 2/10,n/30. Autumn uses the net method to record purchases. [The following information applies to the questions displayed below.] Autumn Company began the month of October with inventory of $30,000. The following inventory transactions occurred during the month: a. The company purchased inventory on account for $44,500 on October 12 . Terms of the purchase were 2/10,n/30. Autumn uses the net method to record purchases. The inventory was shipped fo.b. shipping point and freight charges of $650 were paid in cash. b. On October 31, Autumn paid for the inventory purchased on October 12. c. During October inventory costing $20,250 was sold on account for $31,000. d. It was determined that inventory on hand at the end of October cost $54,010. Assuming Autumn Company uses a periodic inventory system, prepare journal entries for the above transactions including the djusting entry at the end of October to record cost of goods sold. Autumn considers purchase discounts lost as part of interest xpense. ote: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet (1) 2345 Record any necessary adjusting entry when the inventory on hand at the end of October cost $54,010. [The following information applies to the questions displayed below.] Autumn Company began the month of October with inventory of $30,000. The following inventory transactions occurred during the month: a. The company purchased inventory on account for $44,500 on October 12 . Terms of the purchase were 2/10,n/30. Autumn uses the net method to record purchases. The inventory was shipped f.o.b. shipping point and freight charges of $650 were paid in cash. b. On October 31, Autumn paid for the inventory purchased on October 12. c. During October inventory costing $20,250 was sold on account for $31,000. d. It was determined that inventory on hand at the end of October cost $54,010. 2. Assuming Autumn Company uses a periodic inventory system, prepare journal entries for the above transactions including the djusting entry at the end of October to record cost of goods sold. Autumn considers purchase discounts lost as part of interest xpense. lote: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Required information [The following information applies to the questions displayed below] Autumn Company began the month of October with inventory of $30,000. The following inventory transactions occurred during the month: a. The company purchased inventory on account for $44,500 on October 12 . Terms of the purchase were 2/10,n/30. Autumn uses the net method to record purchases. The inventory was shipped fo.b. shipping point and freight charges of $650 were paid in cash. b. On October 31, Autumn paid for the inventory purchased on October 12. c. During October inventory costing $20,250 was sold on account for $31,000. d. It was determined that inventory on hand at the end of October cost $54,010. 2. Assuming Autumn Company uses a periodic inventory system, prepare journal entries for the above transactions including the adjusting entry at the end of October to record cost of goods sold. Autumn considers purchase discounts lost as part of interest expense. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. [The following information applies to the questions displayed below] Autumn Company began the month of October with inventory of $30,000. The following inventory transactions occurred during the month: a. The company purchased inventory on account for $44,500 on October 12 . Terms of the purchase were 2/10,n/30. Autumn uses the net method to record purchases. The inventory was shipped fo.b. shipping point and freight charges of $650 were paid in cash. b. On October 31 , Autumn paid for the inventory purchased on October 12. c. During October inventory costing $20,250 was sold on account for $31,000. d. It was determined that inventory on hand at the end oftober cost $54,010. 2. Assuming Autumn Company uses a periodic inventory system, prepare journal entries for the above transactions including the adjusting entry at the end of October to record cost of goods sold. Autumn considers purchase discounts lost as part of interest xpense. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. [The following information applies to the questions displayed below.] Autumn Company began the month of October with inventory of $30,000. The following inventory transactions occurred during the month: a. The company purchased inventory on account for $44,500 on October 12 . Terms of the purchase were 2/10,n/30. Autumn uses the net method to record purchases. The inventory was shipped fo.b. shipping point and freight charges of $650 were paid in cash. b. On October 31, Autumn paid for the inventory purchased on October 12. c. During October inventory costing $20,250 was sold on account for $31,000. d. It was determined that inventory on hand at the end of October cost $54,010. Assuming Autumn Company uses a periodic inventory system, prepare journal entries for the above transactions including the djusting entry at the end of October to record cost of goods sold. Autumn considers purchase discounts lost as part of interest xpense. ote: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 456 The inventory was shipped f.o.b. shipping point and freight charges of $650 were paid in cash Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started