Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have provided all the information needed. Please advise if no one is able to answer. I paid for this service Galamoyo Limited is a

I have provided all the information needed. Please advise if no one is able to answer. I paid for this service

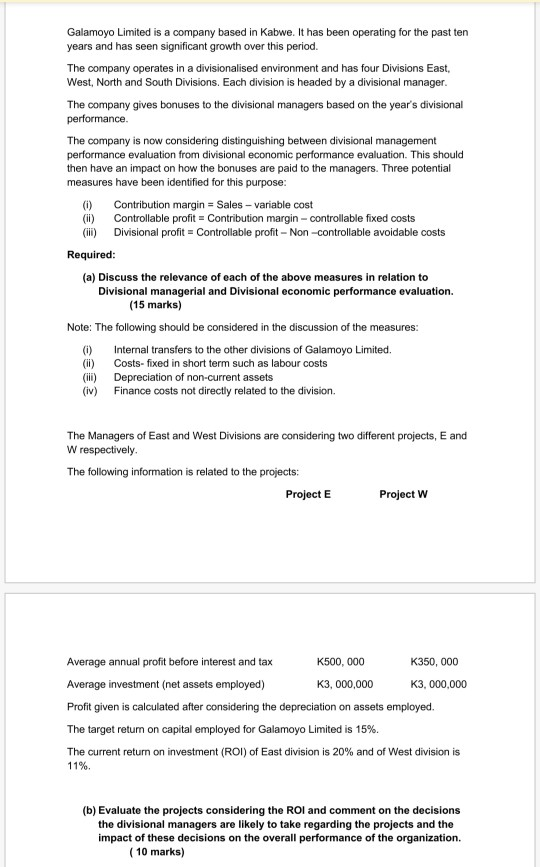

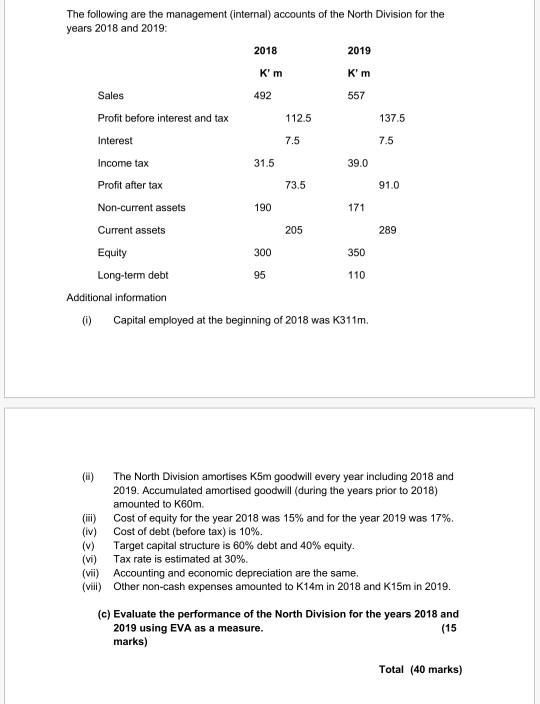

Galamoyo Limited is a company based in Kabwe. It has been operating for the past ten years and has seen significant growth over this period. The company operates in a divisionalised environment and has four Divisions East, West, North and South Divisions. Each division is headed by a divisional manager. The company gives bonuses to the divisional managers based on the year's divisional performance. The company is now considering distinguishing between divisional management performance evaluation from divisional economic performance evaluation. This should then have an impact on how the bonuses are paid to the managers. Three potential measures have been identified for this purpose: (0) Contribution margin = Sales - variable cost (1) Controllable profit = Contribution margin-controllable fixed costs (II) Divisional profit = Controllable profit - Non-controllable avoidable costs Required: (a) Discuss the relevance of each of the above measures in relation to Divisional managerial and Divisional economic performance evaluation. (15 marks) Note: The following should be considered in the discussion of the measures: 0 Internal transfers to the other divisions of Galamoyo Limited. C) Costs-fixed in short term such as labour costs C) Depreciation of non-current assets (iv) Finance costs not directly related to the division. The Managers of East and West Divisions are considering two different projects, E and W respectively. The following information is related to the projects: Project E Project W Average annual profit before interest and tax K500,000 K350,000 Average investment (net assets employed) K3,000,000 K3,000,000 Profit given is calculated after considering the depreciation on assets employed. The target return on capital employed for Galamoyo Limited is 15%. The current return on investment (ROI) of East division is 20% and of West division is 11% (b) Evaluate the projects considering the ROI and comment on the decisions the divisional managers are likely to take regarding the projects and the impact of these decisions on the overall performance of the organization. (10 marks) The following are the management (internal) accounts of the North Division for the years 2018 and 2019 2018 2019 Kim Km Sales 492 557 137.5 7.5 91.0 Profit before interest and tax 112.5 Interest 7.5 Income tax 31.5 39.0 Profit after tax 73.5 Non-current assets 190 171 Current assets 205 Equity 300 350 Long-term debt 95 110 Additional information (0) Capital employed at the beginning of 2018 was K311m. 289 (in) The North Division amortises K5m goodwill every year including 2018 and 2019. Accumulated amortised goodwill (during the years prior to 2018) amounted to K60m. () Cost of equity for the year 2018 was 15% and for the year 2019 was 17%. (iv) Cost of debt (before tax) is 10%. (v) Target capital structure is 60% debt and 40% equity. (vi) Tax rate is estimated at 30% (vii) Accounting and economic depreciation are the same. (vii) Other non-cash expenses amounted to K14m in 2018 and 15m in 2019. (c) Evaluate the performance of the North Division for the years 2018 and 2019 using EVA as a measure. marks) (15 Total (40 marks) Galamoyo Limited is a company based in Kabwe. It has been operating for the past ten years and has seen significant growth over this period. The company operates in a divisionalised environment and has four Divisions East, West, North and South Divisions. Each division is headed by a divisional manager. The company gives bonuses to the divisional managers based on the year's divisional performance. The company is now considering distinguishing between divisional management performance evaluation from divisional economic performance evaluation. This should then have an impact on how the bonuses are paid to the managers. Three potential measures have been identified for this purpose: (0) Contribution margin = Sales - variable cost (1) Controllable profit = Contribution margin-controllable fixed costs (II) Divisional profit = Controllable profit - Non-controllable avoidable costs Required: (a) Discuss the relevance of each of the above measures in relation to Divisional managerial and Divisional economic performance evaluation. (15 marks) Note: The following should be considered in the discussion of the measures: 0 Internal transfers to the other divisions of Galamoyo Limited. C) Costs-fixed in short term such as labour costs C) Depreciation of non-current assets (iv) Finance costs not directly related to the division. The Managers of East and West Divisions are considering two different projects, E and W respectively. The following information is related to the projects: Project E Project W Average annual profit before interest and tax K500,000 K350,000 Average investment (net assets employed) K3,000,000 K3,000,000 Profit given is calculated after considering the depreciation on assets employed. The target return on capital employed for Galamoyo Limited is 15%. The current return on investment (ROI) of East division is 20% and of West division is 11% (b) Evaluate the projects considering the ROI and comment on the decisions the divisional managers are likely to take regarding the projects and the impact of these decisions on the overall performance of the organization. (10 marks) The following are the management (internal) accounts of the North Division for the years 2018 and 2019 2018 2019 Kim Km Sales 492 557 137.5 7.5 91.0 Profit before interest and tax 112.5 Interest 7.5 Income tax 31.5 39.0 Profit after tax 73.5 Non-current assets 190 171 Current assets 205 Equity 300 350 Long-term debt 95 110 Additional information (0) Capital employed at the beginning of 2018 was K311m. 289 (in) The North Division amortises K5m goodwill every year including 2018 and 2019. Accumulated amortised goodwill (during the years prior to 2018) amounted to K60m. () Cost of equity for the year 2018 was 15% and for the year 2019 was 17%. (iv) Cost of debt (before tax) is 10%. (v) Target capital structure is 60% debt and 40% equity. (vi) Tax rate is estimated at 30% (vii) Accounting and economic depreciation are the same. (vii) Other non-cash expenses amounted to K14m in 2018 and 15m in 2019. (c) Evaluate the performance of the North Division for the years 2018 and 2019 using EVA as a measure. marks) (15 Total (40 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started