Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i have short time to be answered Today, you have $40,000 to Invest. Two investment alternatives are available to you one would require you to

i have short time to be answered

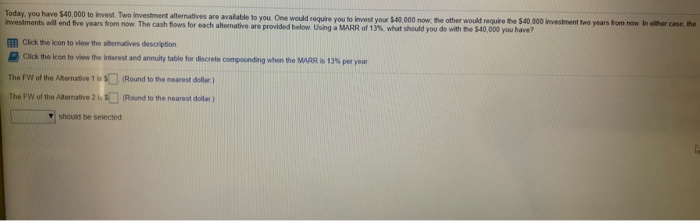

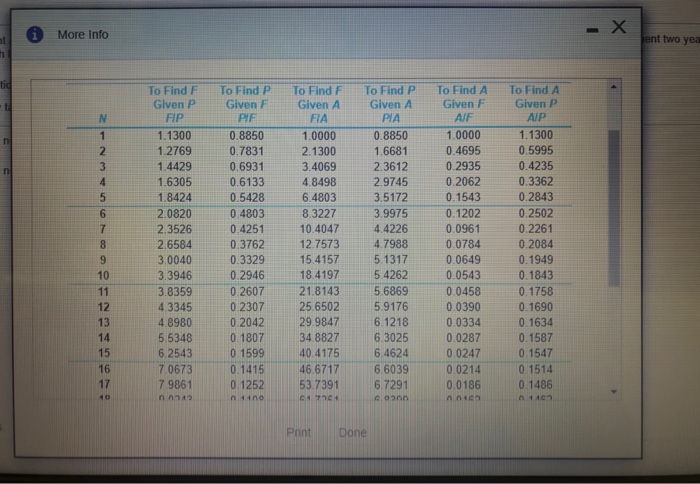

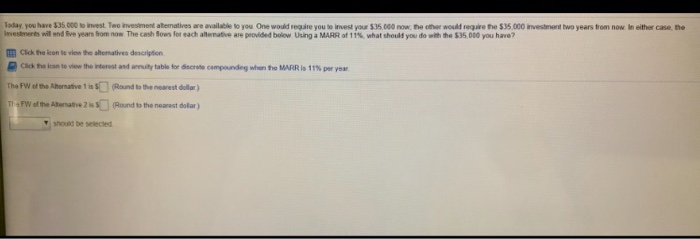

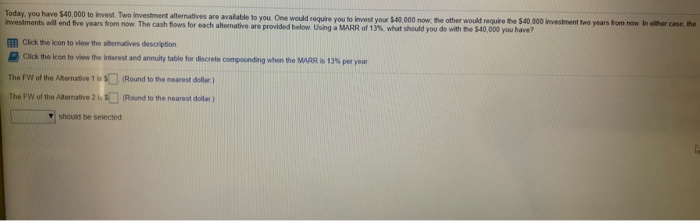

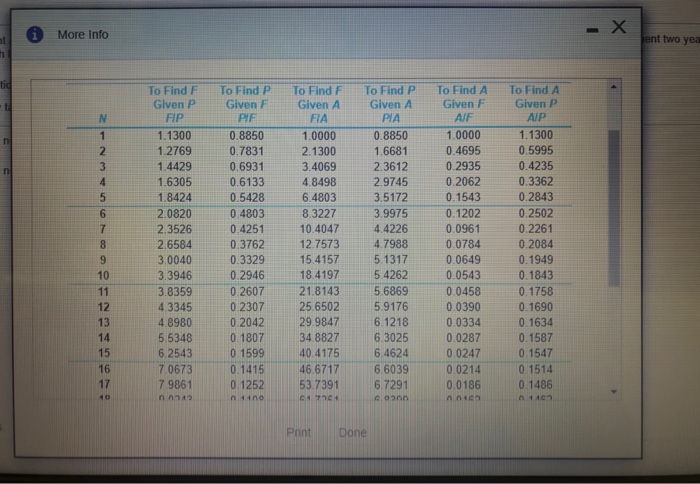

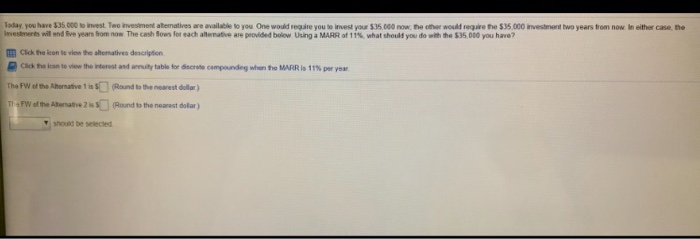

i have short time to be answered  Today, you have $40,000 to Invest. Two investment alternatives are available to you one would require you to invest your 540.000 now, the other would require the $40.000 investment two years from now. In elher case, the investments will end five years from now. The cash flows for each alternative are provided below Using a MARR of 13% what should you do with the $40,000 you have? Click the icon to view the alteratives description Click the icon to view the Interest and annuity table for discrete compounding when the MARR IS 13% per year The FW of the Alternative 1 (Round to the nearest dollar) The FW of the Alternative 25 (Round to the nearest dollar) should be selected - More Info ent two yea at th tid . N 2 3 n 5 6 7 8 9 10 11 12 13 14 15 16 17 To Find Glven P FIP 1.1300 1.2769 1.4429 1.6305 1.8424 2.0820 2.3526 2.6584 3.0040 3.3946 3.8359 4 3345 4.8980 5.5348 6.2543 7.0673 7 9861 n2 To Find P Given F PIF 0.8850 0.7831 0.6931 0.6133 0.5428 0.4803 0.4251 0.3762 0.3329 0.2946 0.2607 0.2307 0.2042 0.1807 0.1599 0.1415 0.1252 no To Find F Given A FIA 1.0000 2.1300 3.4069 4.8498 6.4803 8.3227 10.4047 12.7573 15.4157 18.4197 21.8143 25.6502 29.9847 34.8827 40.4175 46.6717 53.7391 C17 To Find P Given A PIA 0.8850 1.6681 2.3612 2.9745 3.5172 3.9975 4.4226 4.7988 5.1317 5.4262 5.6869 5.9176 6.1218 6.3025 6.4624 6.6039 6.7291 con To Find A Given F AIF 1.0000 0.4695 0.2935 0.2062 0.1543 0.1202 0.0961 0.0784 0.0649 0.0543 0.0458 0.0390 0.0334 0.0287 0.0247 0.0214 0.0186 To Find A Given P 1.1300 0.5995 0.4235 0.3362 0.2843 0.2502 0.2261 0.2084 0.1949 0.1843 0.1758 0.1690 0.1634 0.1587 0.1547 0.1514 0.1486 +40 10 Point Done Today, you have $35.000 to invest Two Investment alternatives are available to you one would require you to invest your $35.000 now, the other would require the $35.000 investment two years from now In either case, the investments will end five years from now. The cash fous for each alternative are provided below. Using a MARR of 11%, what should you do with the 535,000 you have? Click the icon to view the alternatives description Check the len to view the trust and arnuty table for discrete compounds when the MARR IS 11% per year. The FW of the hernatives (Round to the nearest dollar) FW of the hartie 25 Round to the nearest dolar) shoudbe seed Today, you have $40,000 to Invest. Two investment alternatives are available to you one would require you to invest your 540.000 now, the other would require the $40.000 investment two years from now. In elher case, the investments will end five years from now. The cash flows for each alternative are provided below Using a MARR of 13% what should you do with the $40,000 you have? Click the icon to view the alteratives description Click the icon to view the Interest and annuity table for discrete compounding when the MARR IS 13% per year The FW of the Alternative 1 (Round to the nearest dollar) The FW of the Alternative 25 (Round to the nearest dollar) should be selected - More Info ent two yea at th tid . N 2 3 n 5 6 7 8 9 10 11 12 13 14 15 16 17 To Find Glven P FIP 1.1300 1.2769 1.4429 1.6305 1.8424 2.0820 2.3526 2.6584 3.0040 3.3946 3.8359 4 3345 4.8980 5.5348 6.2543 7.0673 7 9861 n2 To Find P Given F PIF 0.8850 0.7831 0.6931 0.6133 0.5428 0.4803 0.4251 0.3762 0.3329 0.2946 0.2607 0.2307 0.2042 0.1807 0.1599 0.1415 0.1252 no To Find F Given A FIA 1.0000 2.1300 3.4069 4.8498 6.4803 8.3227 10.4047 12.7573 15.4157 18.4197 21.8143 25.6502 29.9847 34.8827 40.4175 46.6717 53.7391 C17 To Find P Given A PIA 0.8850 1.6681 2.3612 2.9745 3.5172 3.9975 4.4226 4.7988 5.1317 5.4262 5.6869 5.9176 6.1218 6.3025 6.4624 6.6039 6.7291 con To Find A Given F AIF 1.0000 0.4695 0.2935 0.2062 0.1543 0.1202 0.0961 0.0784 0.0649 0.0543 0.0458 0.0390 0.0334 0.0287 0.0247 0.0214 0.0186 To Find A Given P 1.1300 0.5995 0.4235 0.3362 0.2843 0.2502 0.2261 0.2084 0.1949 0.1843 0.1758 0.1690 0.1634 0.1587 0.1547 0.1514 0.1486 +40 10 Point Done Today, you have $35.000 to invest Two Investment alternatives are available to you one would require you to invest your $35.000 now, the other would require the $35.000 investment two years from now In either case, the investments will end five years from now. The cash fous for each alternative are provided below. Using a MARR of 11%, what should you do with the 535,000 you have? Click the icon to view the alternatives description Check the len to view the trust and arnuty table for discrete compounds when the MARR IS 11% per year. The FW of the hernatives (Round to the nearest dollar) FW of the hartie 25 Round to the nearest dolar) shoudbe seed

Today, you have $40,000 to Invest. Two investment alternatives are available to you one would require you to invest your 540.000 now, the other would require the $40.000 investment two years from now. In elher case, the investments will end five years from now. The cash flows for each alternative are provided below Using a MARR of 13% what should you do with the $40,000 you have? Click the icon to view the alteratives description Click the icon to view the Interest and annuity table for discrete compounding when the MARR IS 13% per year The FW of the Alternative 1 (Round to the nearest dollar) The FW of the Alternative 25 (Round to the nearest dollar) should be selected - More Info ent two yea at th tid . N 2 3 n 5 6 7 8 9 10 11 12 13 14 15 16 17 To Find Glven P FIP 1.1300 1.2769 1.4429 1.6305 1.8424 2.0820 2.3526 2.6584 3.0040 3.3946 3.8359 4 3345 4.8980 5.5348 6.2543 7.0673 7 9861 n2 To Find P Given F PIF 0.8850 0.7831 0.6931 0.6133 0.5428 0.4803 0.4251 0.3762 0.3329 0.2946 0.2607 0.2307 0.2042 0.1807 0.1599 0.1415 0.1252 no To Find F Given A FIA 1.0000 2.1300 3.4069 4.8498 6.4803 8.3227 10.4047 12.7573 15.4157 18.4197 21.8143 25.6502 29.9847 34.8827 40.4175 46.6717 53.7391 C17 To Find P Given A PIA 0.8850 1.6681 2.3612 2.9745 3.5172 3.9975 4.4226 4.7988 5.1317 5.4262 5.6869 5.9176 6.1218 6.3025 6.4624 6.6039 6.7291 con To Find A Given F AIF 1.0000 0.4695 0.2935 0.2062 0.1543 0.1202 0.0961 0.0784 0.0649 0.0543 0.0458 0.0390 0.0334 0.0287 0.0247 0.0214 0.0186 To Find A Given P 1.1300 0.5995 0.4235 0.3362 0.2843 0.2502 0.2261 0.2084 0.1949 0.1843 0.1758 0.1690 0.1634 0.1587 0.1547 0.1514 0.1486 +40 10 Point Done Today, you have $35.000 to invest Two Investment alternatives are available to you one would require you to invest your $35.000 now, the other would require the $35.000 investment two years from now In either case, the investments will end five years from now. The cash fous for each alternative are provided below. Using a MARR of 11%, what should you do with the 535,000 you have? Click the icon to view the alternatives description Check the len to view the trust and arnuty table for discrete compounds when the MARR IS 11% per year. The FW of the hernatives (Round to the nearest dollar) FW of the hartie 25 Round to the nearest dolar) shoudbe seed Today, you have $40,000 to Invest. Two investment alternatives are available to you one would require you to invest your 540.000 now, the other would require the $40.000 investment two years from now. In elher case, the investments will end five years from now. The cash flows for each alternative are provided below Using a MARR of 13% what should you do with the $40,000 you have? Click the icon to view the alteratives description Click the icon to view the Interest and annuity table for discrete compounding when the MARR IS 13% per year The FW of the Alternative 1 (Round to the nearest dollar) The FW of the Alternative 25 (Round to the nearest dollar) should be selected - More Info ent two yea at th tid . N 2 3 n 5 6 7 8 9 10 11 12 13 14 15 16 17 To Find Glven P FIP 1.1300 1.2769 1.4429 1.6305 1.8424 2.0820 2.3526 2.6584 3.0040 3.3946 3.8359 4 3345 4.8980 5.5348 6.2543 7.0673 7 9861 n2 To Find P Given F PIF 0.8850 0.7831 0.6931 0.6133 0.5428 0.4803 0.4251 0.3762 0.3329 0.2946 0.2607 0.2307 0.2042 0.1807 0.1599 0.1415 0.1252 no To Find F Given A FIA 1.0000 2.1300 3.4069 4.8498 6.4803 8.3227 10.4047 12.7573 15.4157 18.4197 21.8143 25.6502 29.9847 34.8827 40.4175 46.6717 53.7391 C17 To Find P Given A PIA 0.8850 1.6681 2.3612 2.9745 3.5172 3.9975 4.4226 4.7988 5.1317 5.4262 5.6869 5.9176 6.1218 6.3025 6.4624 6.6039 6.7291 con To Find A Given F AIF 1.0000 0.4695 0.2935 0.2062 0.1543 0.1202 0.0961 0.0784 0.0649 0.0543 0.0458 0.0390 0.0334 0.0287 0.0247 0.0214 0.0186 To Find A Given P 1.1300 0.5995 0.4235 0.3362 0.2843 0.2502 0.2261 0.2084 0.1949 0.1843 0.1758 0.1690 0.1634 0.1587 0.1547 0.1514 0.1486 +40 10 Point Done Today, you have $35.000 to invest Two Investment alternatives are available to you one would require you to invest your $35.000 now, the other would require the $35.000 investment two years from now In either case, the investments will end five years from now. The cash fous for each alternative are provided below. Using a MARR of 11%, what should you do with the 535,000 you have? Click the icon to view the alternatives description Check the len to view the trust and arnuty table for discrete compounds when the MARR IS 11% per year. The FW of the hernatives (Round to the nearest dollar) FW of the hartie 25 Round to the nearest dolar) shoudbe seed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started