Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have some confusing about the solution (the solution is below the question) -Indirect method: Can anyone explain me how they can compute the interest

I have some confusing about the solution (the solution is below the question)

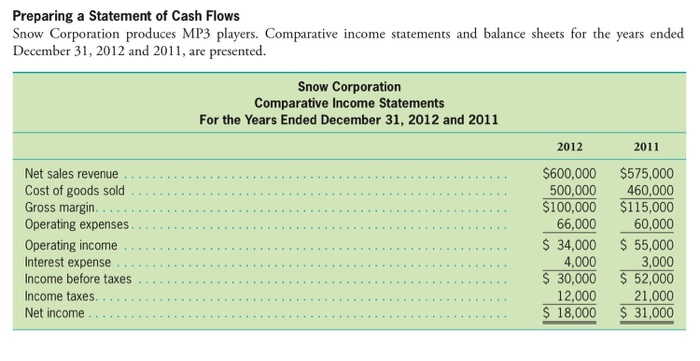

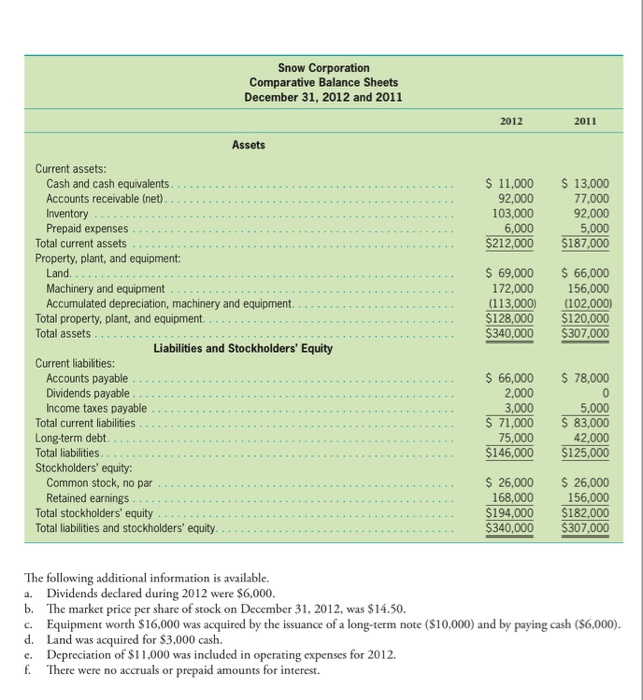

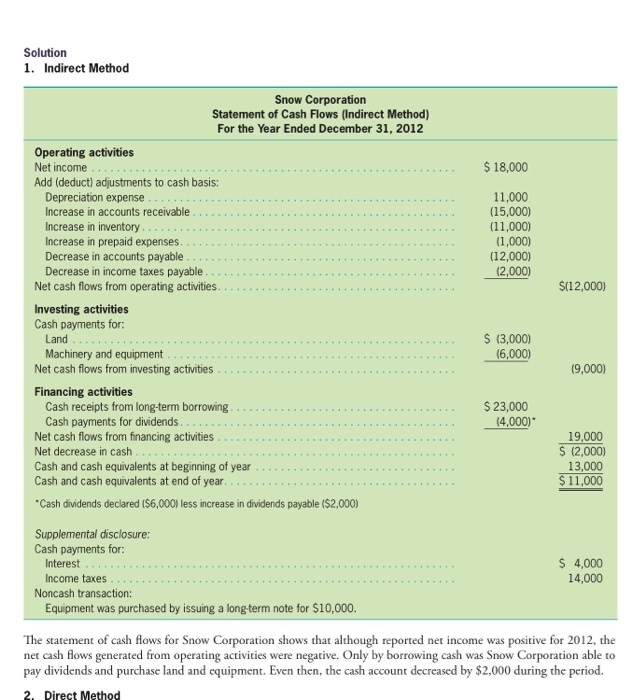

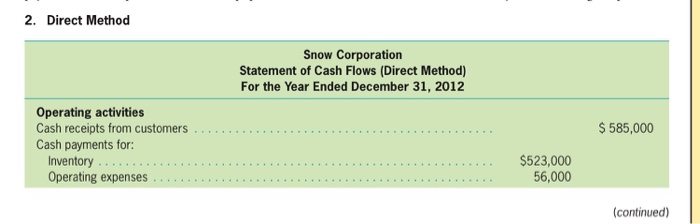

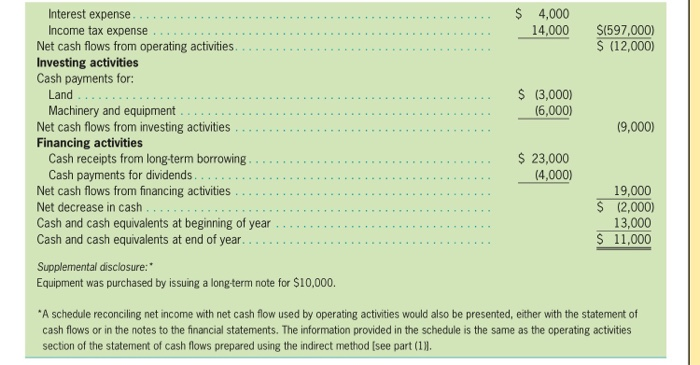

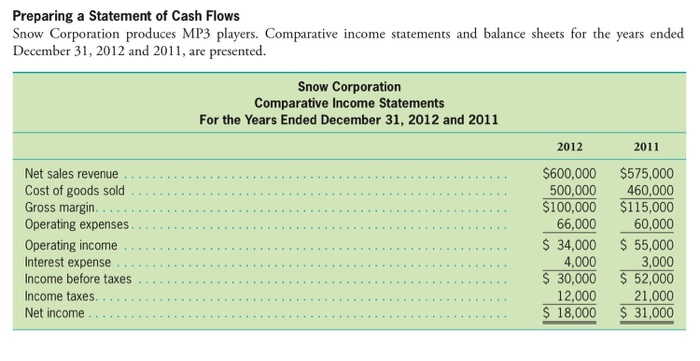

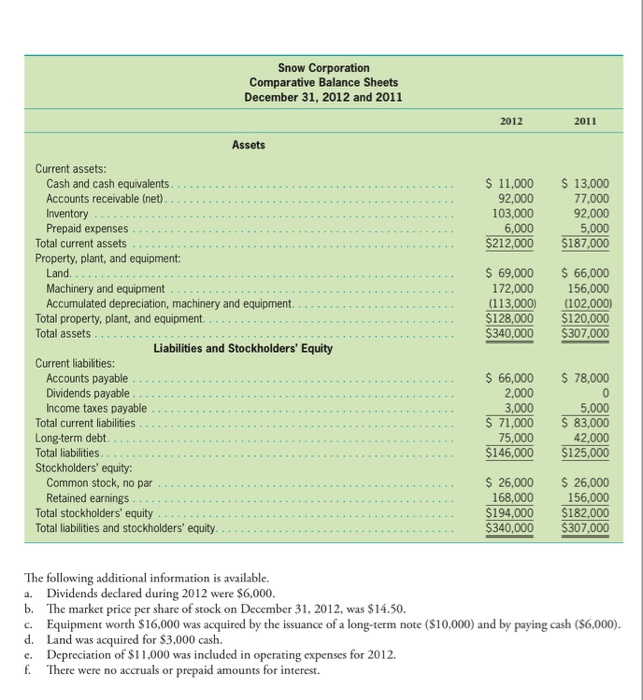

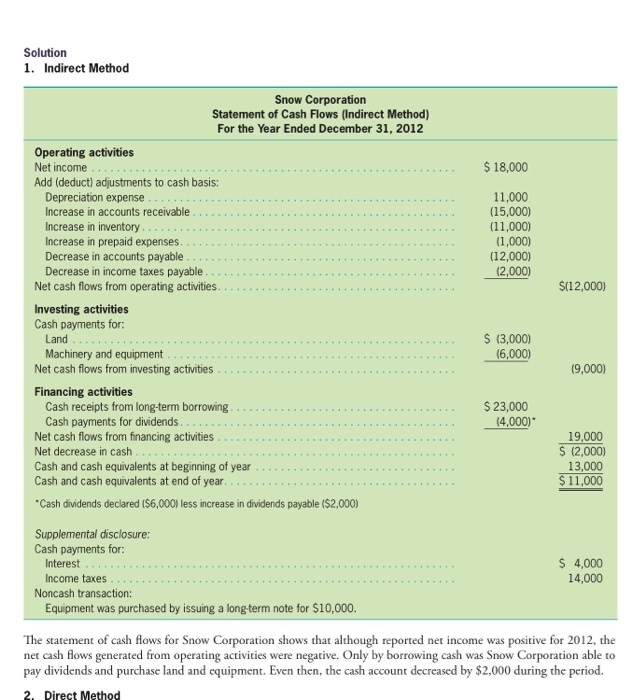

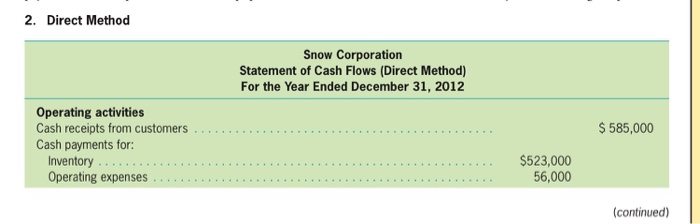

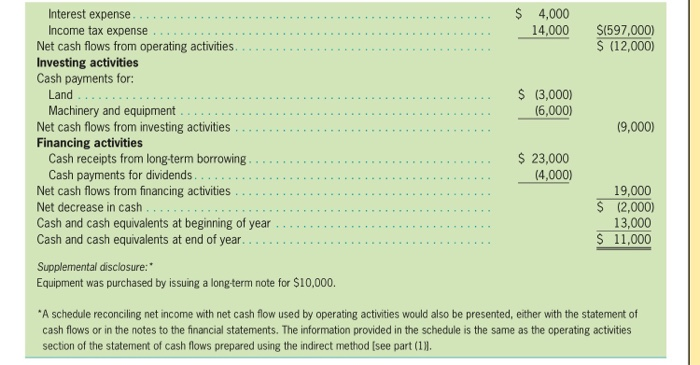

Preparing a Statement of Cash Flows Snow Corporation produces MP3 players. Comparative income statements and balance sheets for the years ended December 31, 2012 and 2011, are presented. Snow Corporation Comparative Income Statements For the Years Ended December 31, 2012 and 2011 2012 2011 Net sales revenue ....... Cost of goods sold ........ Gross margin............ Operating expenses........ Operating income Interest expense Income before taxes ........................ Income taxes...................... ...... Net income .............. $600,000 500,000 $100,000 66,000 $ 34,000 4,000 $ 30,000 12,000 $ 18,000 $575,000 460,000 $115,000 60,000 $ 55,000 3,000 $ 52,000 21,000 $ 31,000 Snow Corporation Comparative Balance Sheets December 31, 2012 and 2011 2012 2011 Assets $ 11,000 92,000 103,000 6,000 $212,000 $13,000 77,000 92,000 5,000 $187,000 $ 69,000 172,000 (113,000) $128,000 $340,000 $ 66,000 156,000 (102,000) $120,000 $307,000 Current assets: Cash and cash equivalents..... Accounts receivable (net). Inventory Prepaid expenses ................ Total current assets ..., Property, plant, and equipment: Land................ ... Machinery and equipment ... Accumulated depreciation, machinery and equipment. . . . . . . . . Total property, plant, and equipment....... Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Dividends payable Income taxes payable ............ Total current liabilities Long-term debt.... Total liabilities. Stockholders' equity: Common stock, no par ........ Retained earnings .. Total stockholders' equity .......... Total liabilities and stockholders' equity........ $ 78,000 $ 66,000 2,000 3,000 $ 71,000 75,000 $146,000 5.000 $83,000 42,000 $125,000 $ 26,000 168,000 $194,000 $340,000 $ 26,000 156,000 $182,000 $307,000 The following additional information is available. a. Dividends declared during 2012 were $6,000. b. The market price per share of stock on December 31, 2012, was $14.50. c. Equipment worth $16,000 was acquired by the issuance of a long-term note ($10,000) and by paying cash ($6,000). d. Land was acquired for $3,000 cash. c. Depreciation of $11,000 was included in operating expenses for 2012. f. There were no accruals or prepaid amounts for interest. Solution 1. Indirect Method Snow Corporation Statement of Cash Flows (Indirect Method) For the Year Ended December 31, 2012 $ 18,000 Operating activities Net income ........ Add (deduct) adjustments to cash basis: Depreciation expense Increase in accounts receivable.... Increase in inventory......................... Increase in prepaid expenses............. ......... Decrease in accounts payable ........ Decrease in income taxes payable........... Net cash flows from operating activities......... 11,000 (15,000) (11,000) (1,000) (12,000) 12,000) . ... $(12,000) $ (3,000) 16,000) (9,000) Investing activities Cash payments for: Land. Machinery and equipment Net cash flows from investing activities ............ Financing activities Cash receipts from long-term borrowing........ Cash payments for dividends.. Net cash flows from financing activities Net decrease in cash Cash and cash equivalents at beginning of year ......... Cash and cash equivalents at end of year. $ 23,000 (4,000) 19,000 $ (2.000) 13,000 $ 11,000 *Cash dividends declared ($6,0001 less increase in dividends payable ($2,000) Supplemental disclosure: Cash payments for: Interest ....... ... Income taxes Noncash transaction: Equipment was purchased by issuing a long-term note for $10,000. $ 4,000 14,000 The statement of cash flows for Snow Corporation shows that although reported net income was positive for 2012, the net cash flows generated from operating activities were negative. Only by borrowing cash was Snow Corporation able to pay dividends and purchase land and equipment. Even then, the cash account decreased by $2,000 during the period. 2. Direct Method 2. Direct Method Snow Corporation Statement of Cash Flows (Direct Method) For the Year Ended December 31, 2012 $ 585,000 Operating activities Cash receipts from customers ... Cash payments for: Inventory ................. .... ................ Operating expenses .................................................. $523,000 56,000 (continued) $ 4,000 14.000 $1597,000) $ (12,000) $ (3,000) (6,000) Interest expense........... Income tax expense .......... .......... Net cash flows from operating activities..... Investing activities Cash payments for: Land .............. . ............................. Machinery and equipment ............ Net cash flows from investing activities ......... Financing activities Cash receipts from long-term borrowing ......... ....... .. .. . Cash payments for dividends. Net cash flows from financing activities .................. Net decrease in cash ..... Cash and cash equivalents at beginning of year .......... Cash and cash equivalents at end of year. ............ (9,000) $ 23,000 (4,000) 19,000 $ 12,000) 13,000 $ 11,000 Supplemental disclosure:* Equipment was purchased by issuing a long-term note for $10,000. *A schedule reconciling net income with net cash flow used by operating activities would also be presented, either with the statement of cash flows or in the notes to the financial statements. The information provided in the schedule is the same as the operating activities section of the statement of cash flows prepared using the indirect method (see part (13) -Indirect method: Can anyone explain me how they can compute the interest and income taxes(below Supplemental disclosure)

-Direct method: How they can compute the operating expenses(56000)? I dont understand

Thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started