Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have the answers but not sure if correct...kindly answer it with complete calculations Saved Question 6 (22 points) Listen Decent Blokes Corporation issued 20-year

I have the answers but not sure if correct...kindly answer it with complete calculations

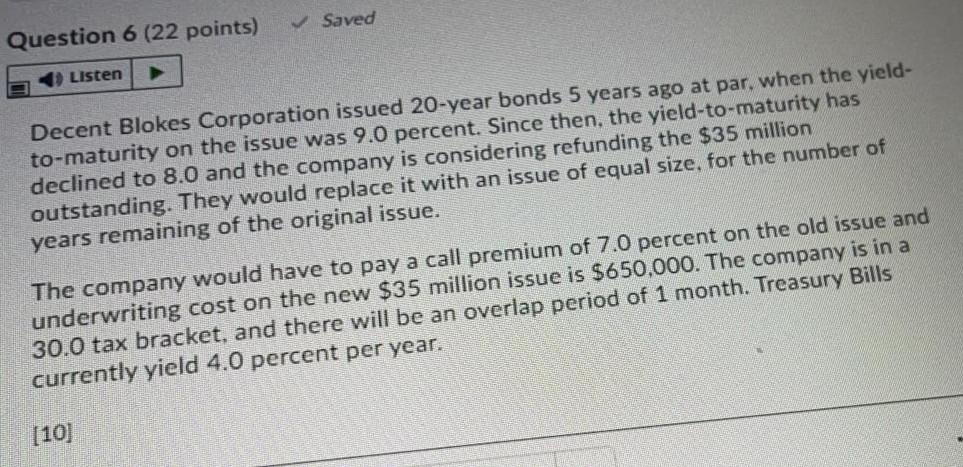

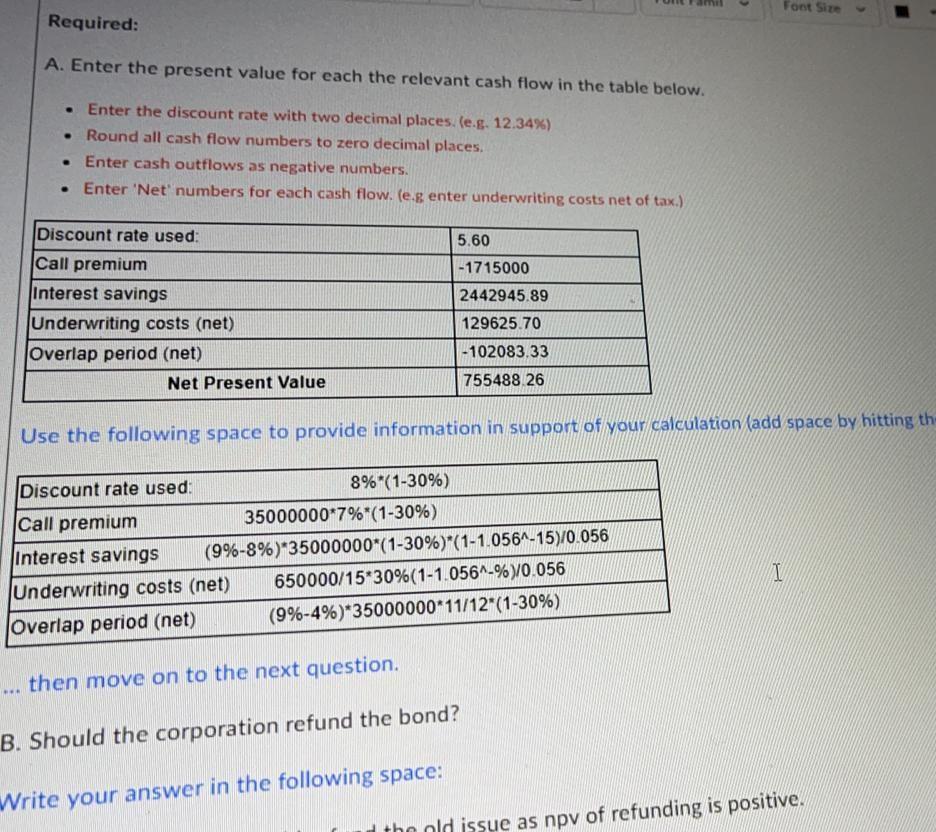

Saved Question 6 (22 points) Listen Decent Blokes Corporation issued 20-year bonds 5 years ago at par, when the yield- to-maturity on the issue was 9.0 percent. Since then, the yield-to-maturity has declined to 8.0 and the company is considering refunding the $35 million outstanding. They would replace it with an issue of equal size, for the number of years remaining of the original issue. The company would have to pay a call premium of 7.0 percent on the old issue and underwriting cost on the new $35 million issue is $650,000. The company is in a 30.0 tax bracket, and there will be an overlap period of 1 month. Treasury Bills currently yield 4.0 percent per year. [10] Font Size Required: A. Enter the present value for each the relevant cash flow in the table below. Enter the discount rate with two decimal places.(e.s. 12.34%) Round all cash flow numbers to zero decimal places Enter cash outflows as negative numbers. Enter 'Net' numbers for each cash flow. (e.g enter underwriting costs net of tax.) 5.60 -1715000 2442945.89 Discount rate used: Call premium Interest savings Underwriting costs (net) Overlap period (net) Net Present Value 129625.70 -102083.33 755488.26 Use the following space to provide information in support of your calculation (add space by hitting th- Discount rate used: 8%*(1-30%) Call premium 35000000*7%*(1-30%) interest savings (9%-8%)*35000000*(1-30%)*(1-1.0561-15)/0,056 Underwriting costs (net) 650000/15*30%(1-1.056-%0.056 Overlap period (net) (9%-4%)*35000000*11/12*(1-30%) 1 ... then move on to the next question. B. Should the corporation refund the bond? Write your answer in the following space: the old issue as npv of refunding is positiveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started