Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i have the Income statment for 2018 and 2019, as well as the Cash flow statment for 2019, but I need to get the Balance

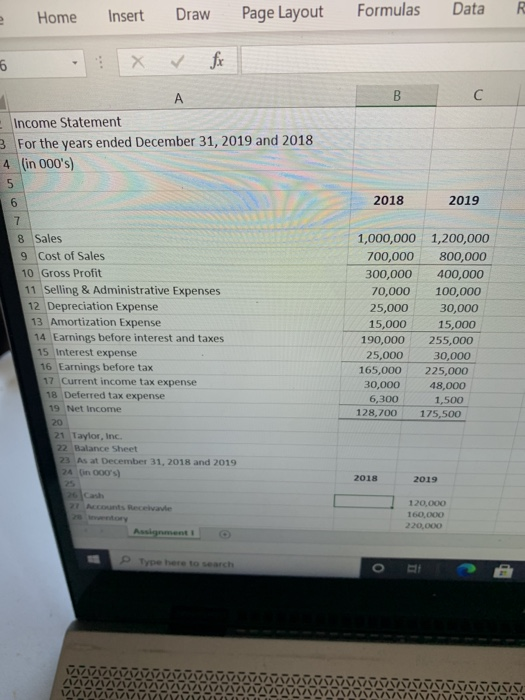

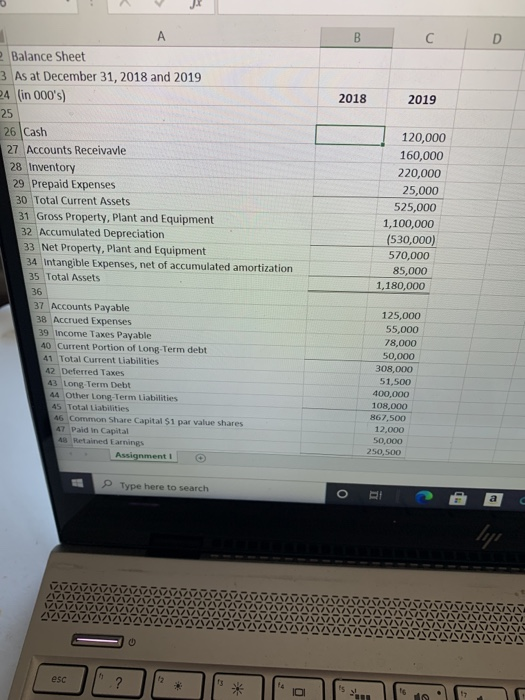

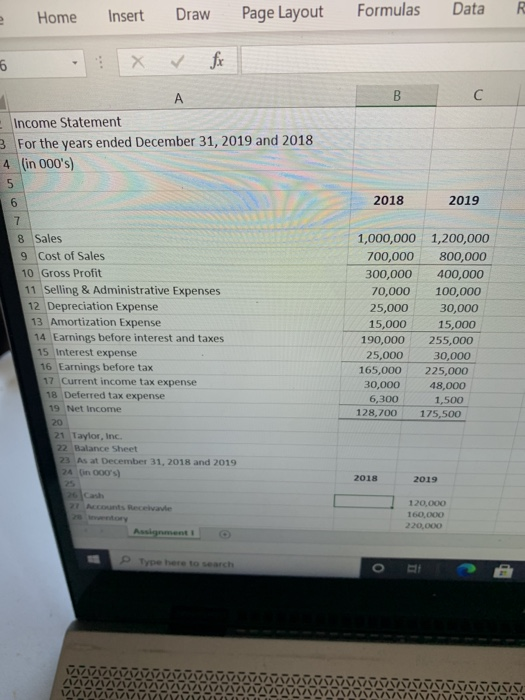

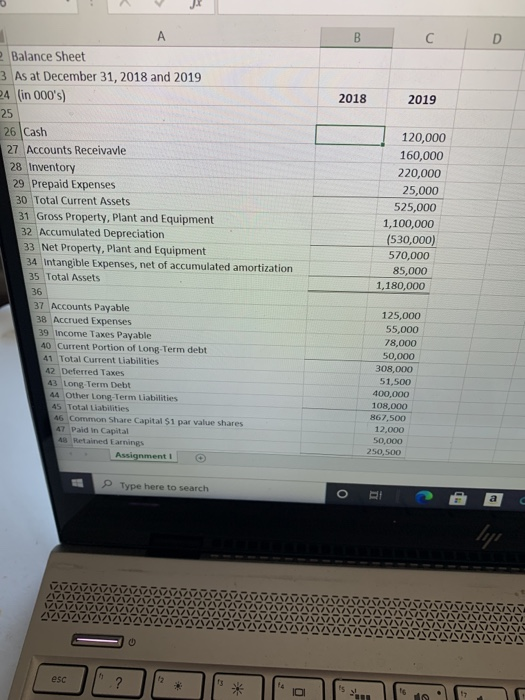

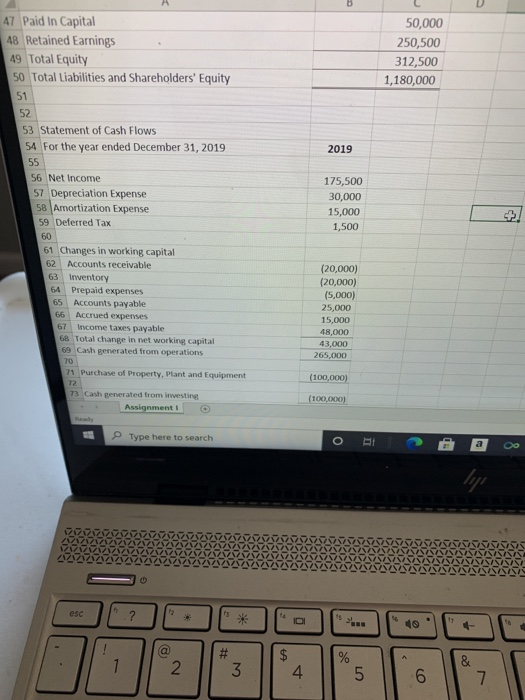

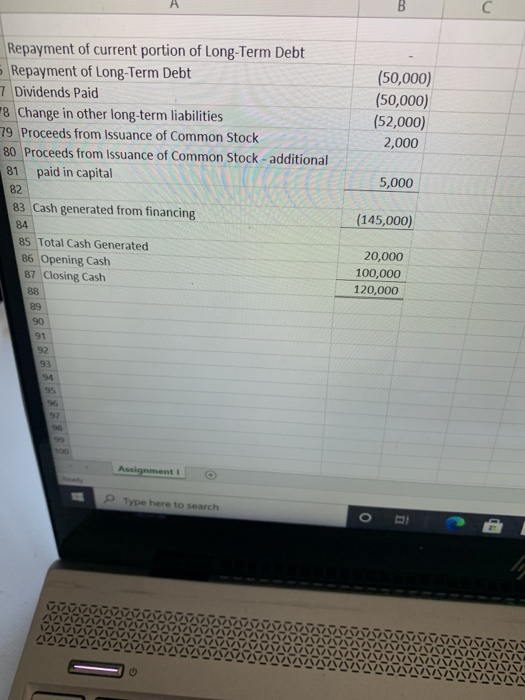

i have the Income statment for 2018 and 2019, as well as the Cash flow statment for 2019, but I need to get the Balance sheet for 2018

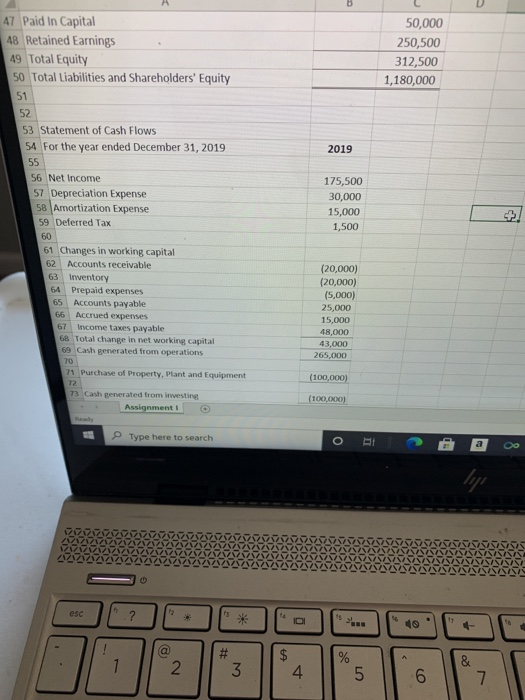

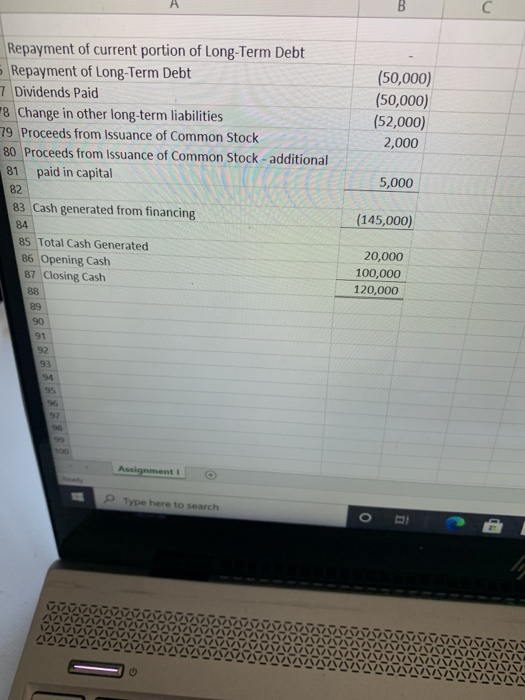

Home Insert Draw Page Layout Formulas Data 6 B C Income Statement 3 For the years ended December 31, 2019 and 2018 4 in 000's) 5 6 2018 2019 7 8 Sales 9 Cost of Sales 10 Gross Profit 11 Selling & Administrative Expenses 12 Depreciation Expense 13 Amortization Expense 14 Earnings before interest and taxes 15 Interest expense 16 Earnings before tax 17 Current income tax expense 18 Deferred tax expense 19 Net Income 20 21 Taylor, Inc. 22 Balance Sheet 23 As at December 31, 2018 and 2019 24 in 100's) 1,000,000 1,200,000 700,000 800,000 300,000 400,000 70,000 100,000 25,000 30,000 15,000 15,000 190,000 255,000 25,000 30,000 165,000 225,000 30,000 48,000 6,300 1,500 128,700 175,500 2018 2019 21 Accounts Receivave 120,000 160.000 220,000 Assignment Ptype here to search o A B C D 2018 2019 e Balance Sheet 3 As at December 31, 2018 and 2019 24 (in 000's) 25 26 Cash 27 Accounts Receivavle 28 Inventory 29 Prepaid Expenses 30 Total Current Assets 31 Gross Property, Plant and Equipment 32 Accumulated Depreciation 33 Net Property, Plant and Equipment 34 Intangible Expenses, net of accumulated amortization 35 Total Assets 36 37 Accounts Payable 38 Accrued Expenses 39 Income Taxes Payable 40 Current Portion of Long-Term debt 41 Total Current Liabilities 42 Deferred Taxes 43 Long Term Debt 44 Other Long-Term Liabilities 45 Total Liabilities 46 Common Share Capital $1 par value shares AT Paid in Capital AS Retained Earnings Assignment 120,000 160,000 220,000 25,000 525,000 1,100,000 (530,000) 570,000 85,000 1,180,000 125,000 55,000 78,000 50,000 308,000 51,500 400,000 108,000 867,500 12.000 50,000 250,500 Type here to search o a esc ? 090 50,000 250,500 312,500 1,180,000 47 Paid In Capital 48 Retained Earnings 49 Total Equity 50 Total Liabilities and Shareholders' Equity 51 52 53 Statement of Cash Flows 54 For the year ended December 31, 2019 55 2019 175,500 30,000 15,000 1,500 56 Net Income 57 Depreciation Expense 58 Amortization Expense 59 Deferred Tax 60 61 Changes in working capital 62 Accounts receivable 63 Inventory 64 Prepaid expenses 65 Accounts payable 66 Accrued expenses 67 Income taxes payable 68 Total change in net working capital 69 Cash generated from operations 70 71 Purchase of Property. Plant and Equipment T2 73 Cash generated from investing Assignment ry (20,000) (20,000) (5,000) 25,000 15,000 48,000 43,000 265,000 (100,000) (100.000) Type here to search o RI a esc a : 1 2 3 3 $ 4 % 5 6 & 7 A B (50,000) (50,000) (52,000) 2,000 5,000 Repayment of current portion of Long-Term Debt 5 Repayment of Long-Term Debt 7 Dividends Paid 8 Change in other long-term liabilities 79 Proceeds from Issuance of Common Stock 80 Proceeds from Issuance of Common Stock - additional 81 paid in capital 82 83 Cash generated from financing 84 85 Total Cash Generated 86 Opening Cash 87 Closing Cash 88 89 90 91 92 (145,000) 20,000 100,000 120,000 93 94 95 50 Assignment Type here to search o

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started