Answered step by step

Verified Expert Solution

Question

1 Approved Answer

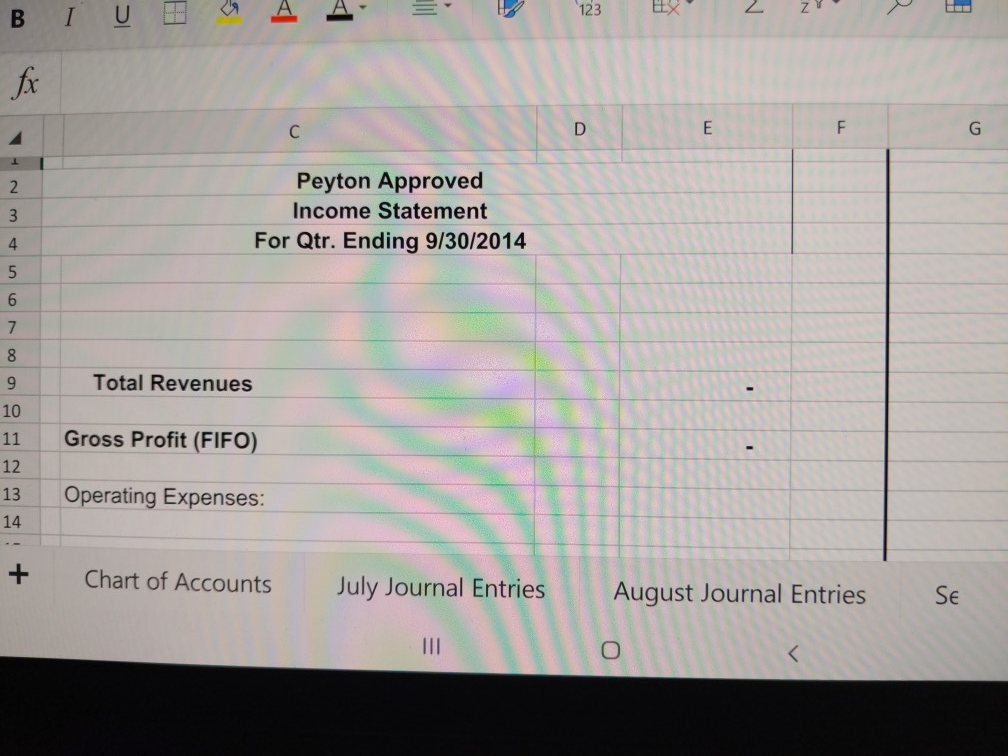

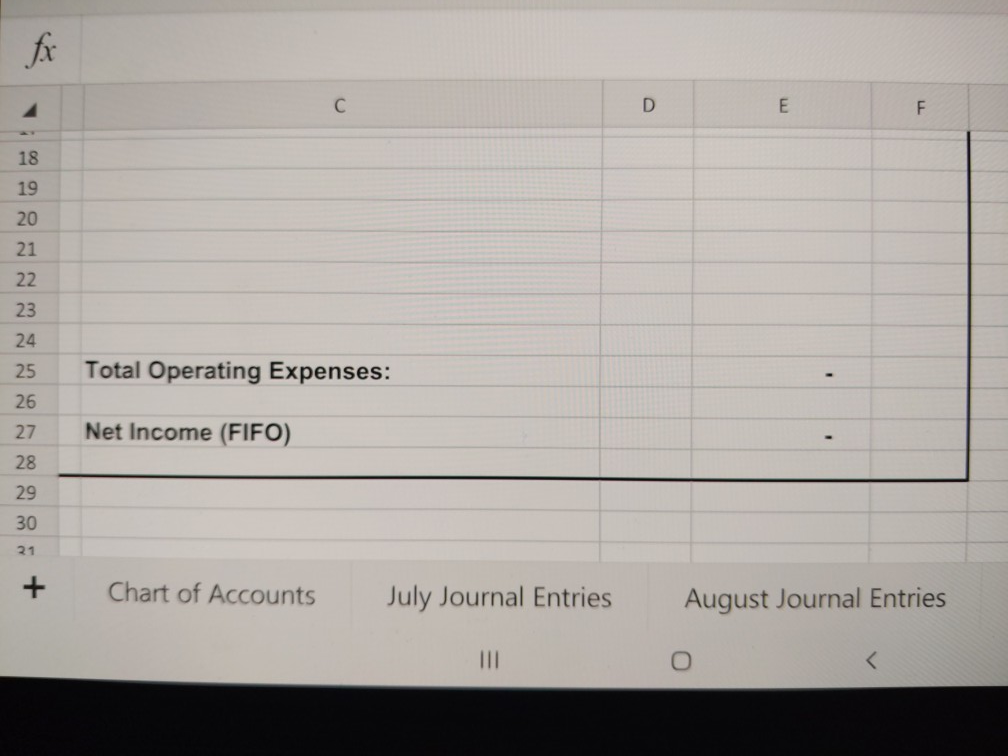

I have the info in a post from before if you need more information.. I'm hoping I imputed the correct numbers how do I get

I have the info in a post from before if you need more information.. I'm hoping I imputed the correct numbers

how do I get the calculation to this information?

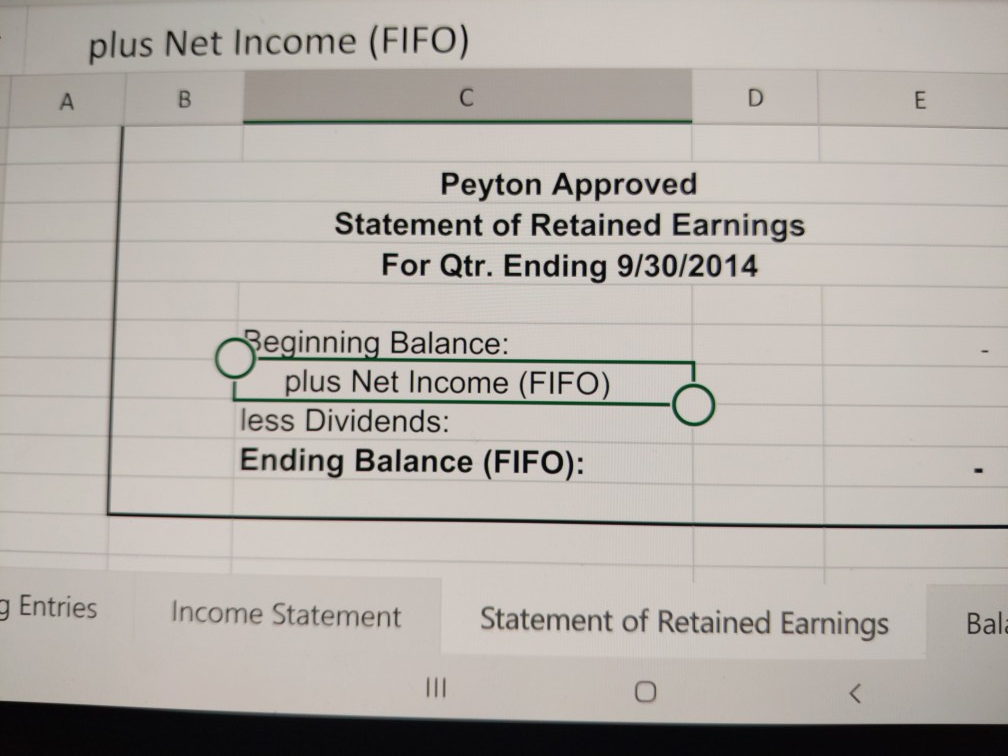

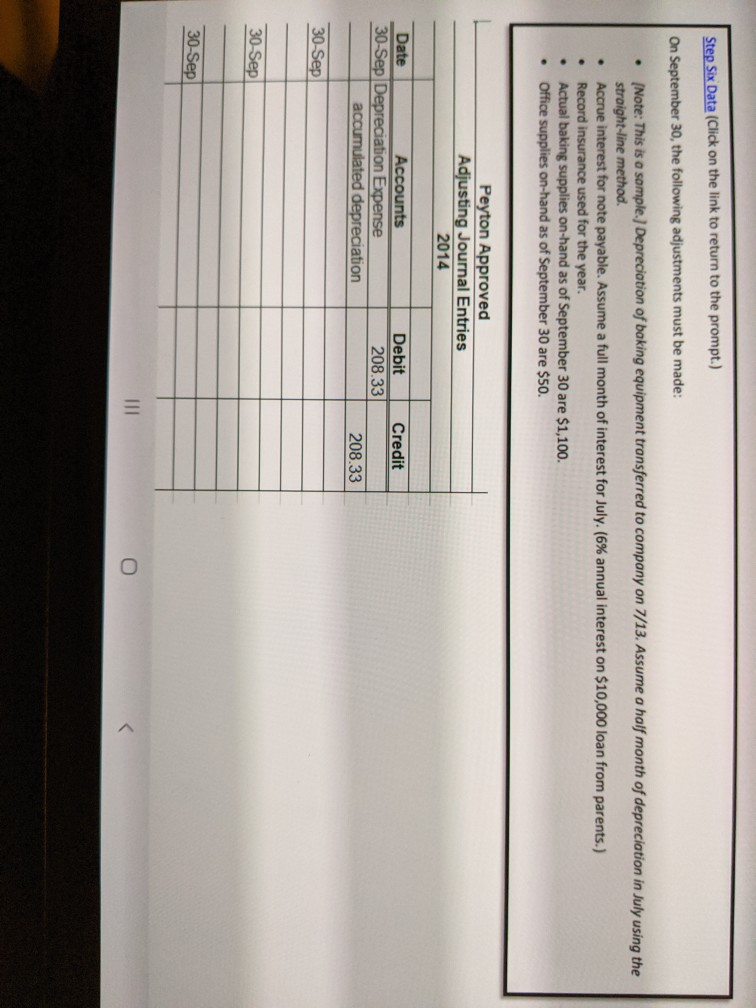

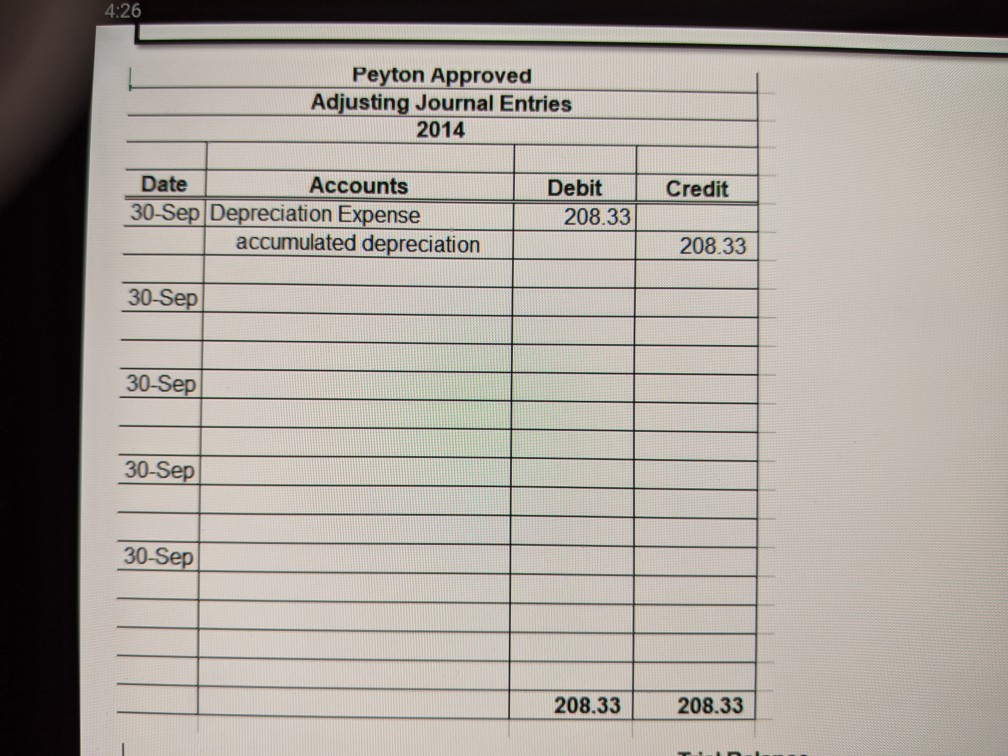

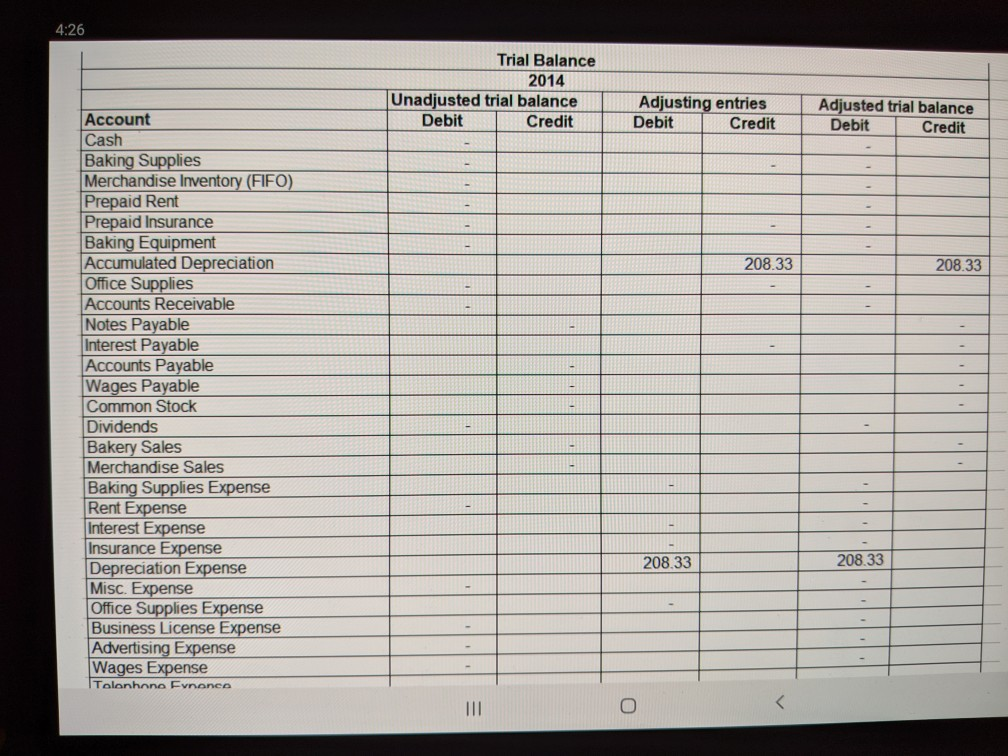

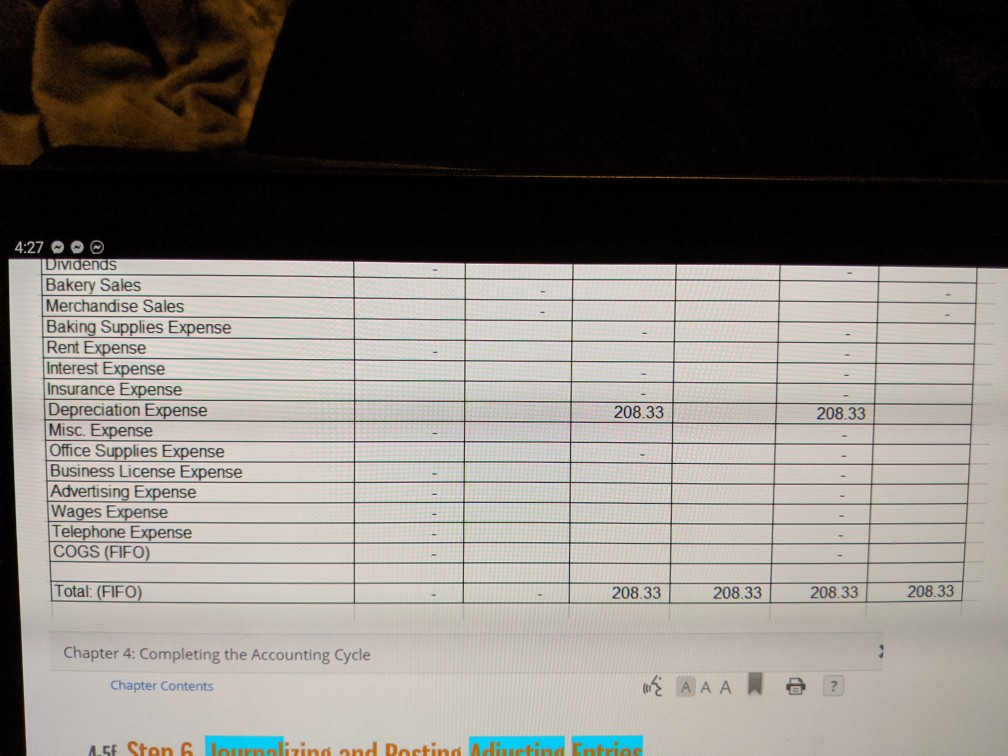

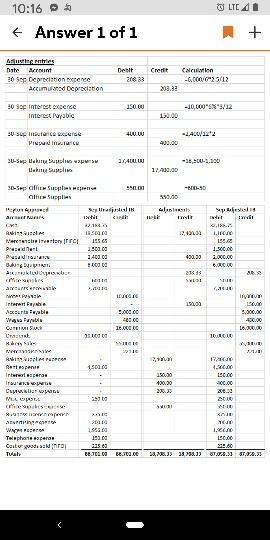

N BI UEL Peyton Approved Income Statement For Qtr. Ending 9/30/2014 9 Total Revenues 10 11 Gross Profit (FIFO) 12 13 14 Operating Expenses: Chart of Accounts July Journal Entries August Journal Entries SE 18 19 20 21 22 23 24 25 Total Operating Expenses: 26 27 Net Income (FIFO) 28 29 30 Chart of Accounts July Journal Entries August Journal Entries plus Net Income (FIFO) TAB Peyton Approved Statement of Retained Earnings For Qtr. Ending 9/30/2014 o Beginning Balance: Y plus Net Income (FIFO) less Dividends: Ending Balance (FIFO): y Entries Income Statement Statement of Retained Earnings Bal Step Six Data (Click on the link to return to the prompt.) On September 30, the following adjustments must be made: . (Note: This is a sample.) Depreciation of baking equipment transferred to company on 7/13. Assume a half month of depreciation in July using the straight-line method. Accrue interest for note payable. Assume a full month of interest for July (6% annual interest on $10,000 loan from parents.) Record insurance used for the year. Actual baking supplies on-hand as of September 30 are $1,100. Office supplies on-hand as of September 30 are $50. Peyton Approved Adjusting Journal Entries 2014 Credit Date Accounts 30-Sep Depreciation Expense accumulated depreciation Debit 208.33 208.33 30-Sep 30-Sep 30-Sep 4:26 Peyton Approved Adjusting Journal Entries 2014 Credit Date Accounts 30-Sep Depreciation Expense accumulated depreciation Debit 208.33 208.33 30-Sep 30-Sep 30-Sep 30-Sep 208.33 208.33 4:26 Trial Balance 2014 Unadjusted trial balance Debit Credit Adjusting entries Debit Credit Adjusted trial balance Debit Credit 208.33 208.33 Account Cash Baking Supplies Merchandise Inventory (FIFO) Prepaid Rent Prepaid Insurance Baking Equipment Accumulated Depreciation Office Supplies Accounts Receivable Notes Payable Interest Payable Accounts Payable Wages Payable Common Stock Dividends Bakery Sales Merchandise Sales Baking Supplies Expense Rent Expense Interest Expense Insurance Expense Depreciation Expense Misc. Expense Office Supplies Expense Business License Expense Advertising Expense Wages Expense Tolonhono Eynonce 208.33 208.33 4:27 QO Dividends Bakery Sales Merchandise Sales Baking Supplies Expense Rent Expense Interest Expense Insurance Expense Depreciation Expense Misc. Expense Office Supplies Expense Business License Expense Advertising Expense Wages Expense Telephone Expense COGS (FIFO) 208.33 208.33 Total: (FIFO) 208.33 208.33 208.33 208.33 Chapter 4: Completing the Accounting Cycle Chapter Contents A A A A A5F Ston 6 Tourmalizing and Porting Adimai 10:16 & Answer 1 of 1 LTC 41 + Debit Credit Calon Date A rt 10 See Degree cerce acumulated Dediction 12 Se int erce -0.00 - Baku Ba Gruples Cod BJELO B. . 38.72.33 3.798.33Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started