Question

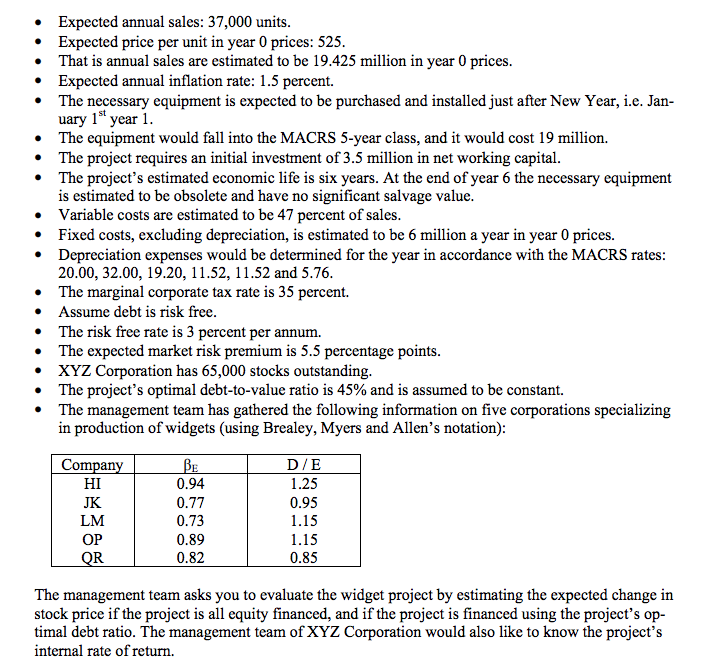

I have this capital budgeting question in my Corporate Finance course (book Brealey, Myers, Allen) with the all assumptions below. I know how to set

I have this capital budgeting question in my Corporate Finance course (book Brealey, Myers, Allen) with the all assumptions below. I know how to set it up in excel, but I am confused about how to deal with the inflation, considering that sales and prices are discounted to year one? I get the wrong npv result in the end, so I would like to know what I need to think about in this question. (Also, to see how stock prices changes considering the optimal debt ratio, does this mean that we use wacc when discounting? Because otherwise it would be APV to account for financing side effects, but ofcourse those were not given).

If someone could do somewhat of a step by step, that would be very helpful.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started