Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have to prepare one worksheet from this date too. Can anyone help me with the answer of this? Thank you. 3. Thomas Magnum began

I have to prepare one worksheet from this date too. Can anyone help me with the answer of this? Thank you.

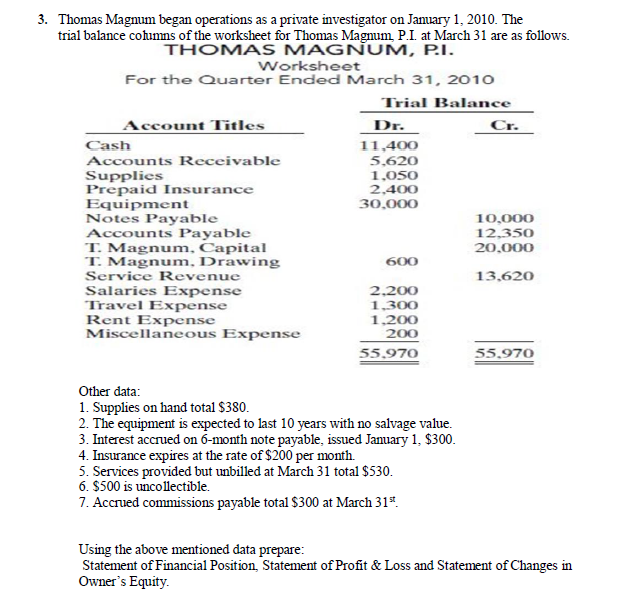

3. Thomas Magnum began operations as a private investigator on January 1, 2010. The trial balance cohimns of the worksheet for Thomas Magnum P.I. at March 31 are as follows. THOMAS MAGNUM, P.I. Worksheet For the Quarter Ended March 31, 2010 Trial Balance Account Titles Dr. Cr. Cash 11,400 Accounts Receivable 5.620 Supplies 1.050 Prepaid Insurance 2,400 Equipment 30,000 Notes Payable 10,000 Accounts Payable 12,350 T. Magnum, Capital 20.000 T. Magnum, Drawing 600 Service Revenue 13,620 Salaries Expense 2.200 Travel Expense 1.300 Rent Expense 1.200 Miscellaneous Expense 200 55,970 55.970 Other data: 1. Supplies on hand total $380. 2. The equipment is expected to last 10 years with no salvage value. 3. Interest accrued on 6-month note payable, issued January 1, $300. 4. Insurance expires at the rate of $200 per month. 5. Services provided but unbilled at March 31 total $530. 6. $500 is uncollectible. 7. Accrued commissions payable total $300 at March 31% Using the above mentioned data prepare: Statement of Financial Position Statement of Profit & Loss and Statement of Changes in Owner's EquityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started