Answered step by step

Verified Expert Solution

Question

1 Approved Answer

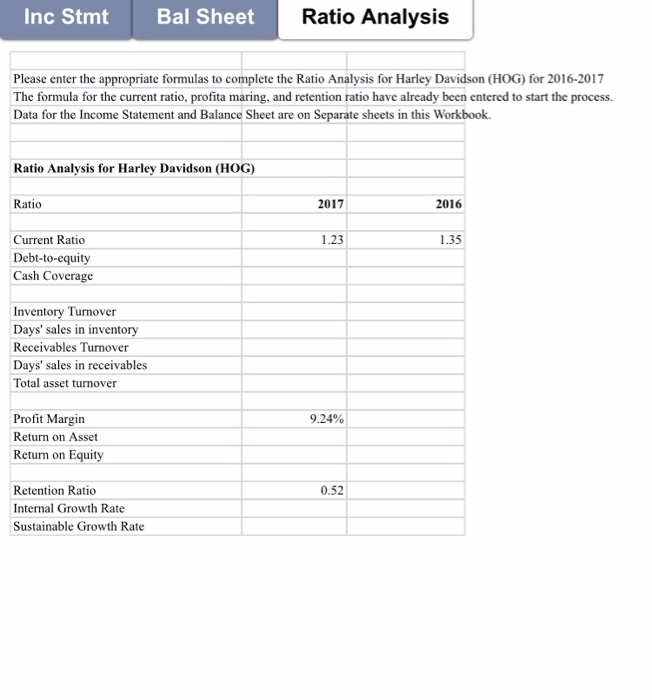

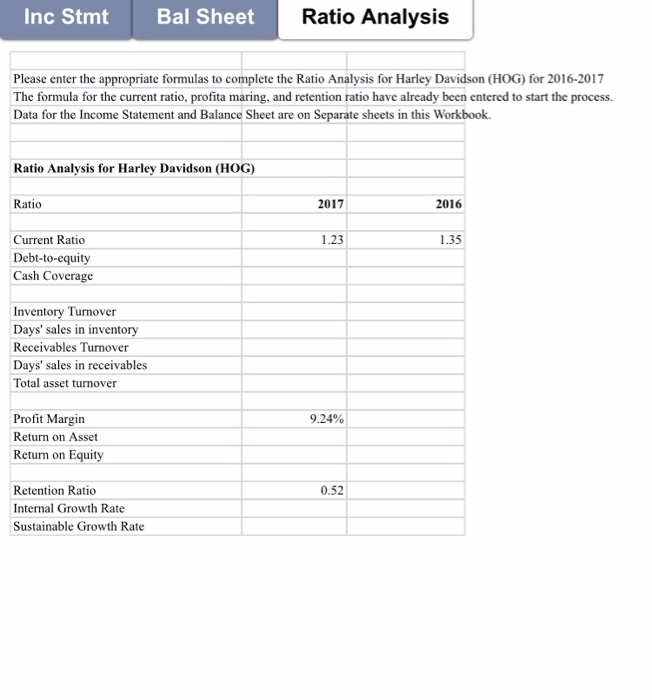

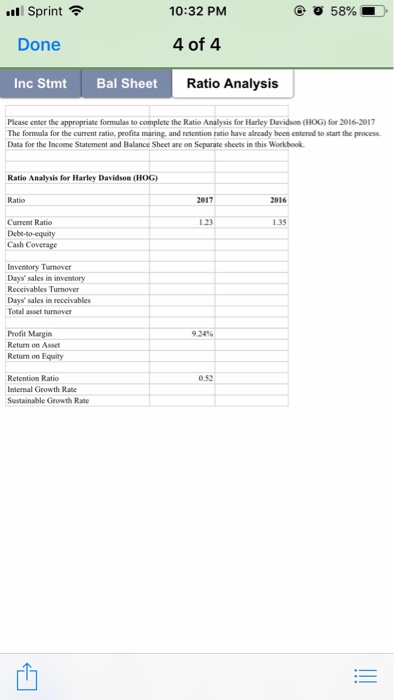

i have to put the formulas and let excel do the calculations for all the blabk numbers. the income and balance sheets are attached. there

i have to put the formulas and let excel do the calculations for all the blabk numbers. the income and balance sheets are attached. there is an example in the first blank. I really need to make sure I am doing it right.

Formulas to put in the fx box so it can calculate the ratios in the ratio analysis sheet

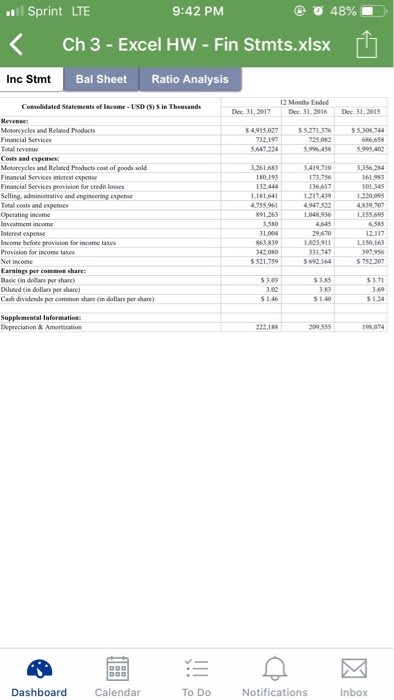

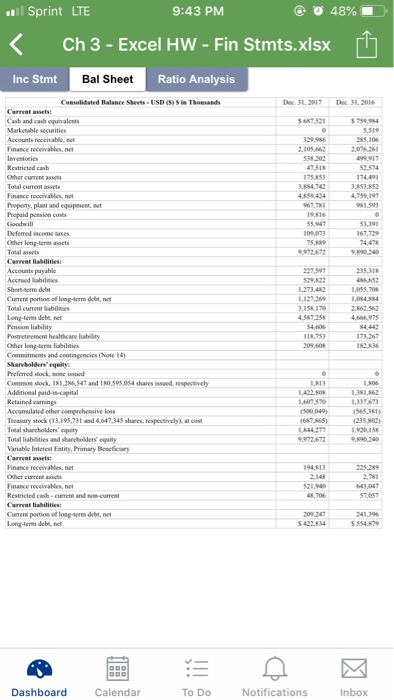

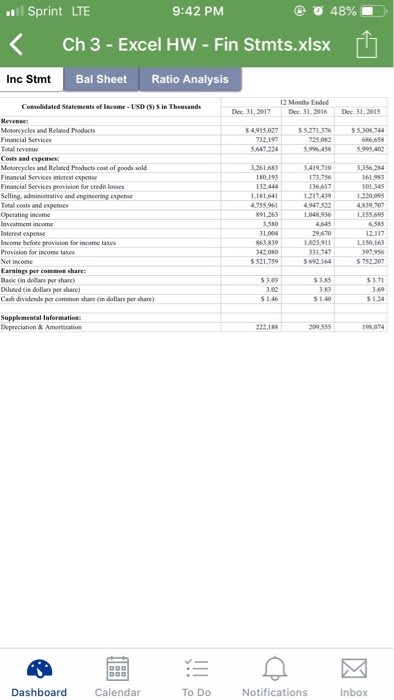

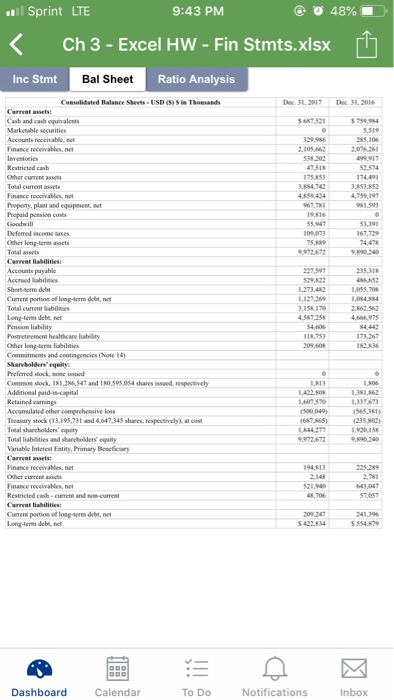

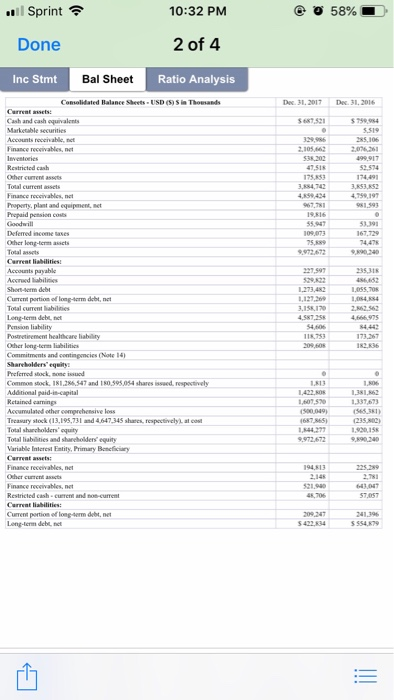

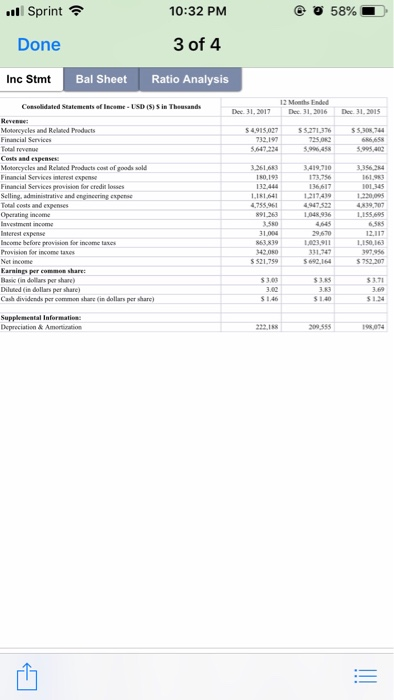

ue Sep 8 by 11:59pm le Types xls and xlsx Submitting a file upload Points 100 "lease download the attached Excel file, complete it according to the instructions, rename it using your last name and HWCh3 (example: FigueiredoHWCh3.xls) and then resubmit it as your homework solution. The purpose of this homework is to practice using Excel to calculate financial ratios. The attached Excel file contains data from the SEC website for Harley-Davidson (HOG) for the 2017-2016 period. Three of the ratios have already been calculated to start the process. Please format all ratios to display two digits after the decimal point. When appropriate, format the ratio as a percentage, such as in 'profit margin: Note that the data for the Income statement and Balance Sheet, necessary for calculating the ratios, are in separate worksheets. Just point to the appropriate 'cells' in these worksheets to build the formula in the 'Ratio Analysis' worksheet. Attaghments Ch 3-Excel HW-Fin Stmtsxlsx Next Previous scottHW Ch4 (3) xisx scottHW Ch4 (4)xlsx scottHw Ch4 (5)xdsx F11 F7 F10 F6 F8 F9 Ratio Analysis Bal Sheet Inc Stmt Please enter the appropriate formulas to complete the Ratio Analysis for Harley Davidson (HOG) for 2016-2017 The formula for the current ratio, profita maring, and retention ratio have already been entered to start the process. Data for the Income Statement and Balance Sheet are on Separate sheets in this Workbook. Ratio Analysis for Harley Davidson (HOG) Ratio 2017 2016 1.35 Current Ratio 1.23 Debt-to-equity Cash Coverage Inventory Turnover Days' sales in inventory Receivables Turnover Days' sales in receivables Total asset turnover Profit Margin 9.24% Return on Asset Return on Equity Retention Ratio 0.52 Internal Growth Rate Sustainable Growth Rate l Sprint LTE 9:42 PM 48% Ch 3 - Excel HW - Fin Stmts.xlsx Ratio Analysis Inc Stmt Bal Sheet 12 Months Ended Consolidated Statements of Income - USD (S) S in Theusands Dec. 31, 2017 Dec. 31, 2016 Dec. 31, 2015 Revense Motercycles and Relaed Prodacts S5271376 $4915,027 $5308,744 686.658 Financial Services 732.197 5647 224 725,082 5996458 Total revenue Costs and espenses Motorcycles and Related Prodacts cost of goods sold Financial Services interest expense 5995 402 3,356 284 3261.683 180,193 3,419,710 173.756 136.617 161983 10L345 1220,095 4830 70 Financial Services provision for credit losses 132.444 L181641 4,755.96 Selling, administrative and engineering expense Total costs and epenses 1217439 4947522 Operating income Iavestment income Interest expense 891 263 3580 1,048,936 LIS5,695 4.645 6.585 31.004 29,670 12.117 L023,911 Income before provision for income tases Provision for income tases 863.839 LIS0.163 342080 331.747 397,956 $752.207 Net income S 521.759 S692.164 Earnings per common share: $300 $3.85 $3.7 Basic (in dollars per share) Diluted (in dollars per share) Cash dividends per common share (in dollars per sharc) 3.02 3.83 3.69 S146 S1.40 $124 Supplemental Information Depreciation & Amortization 222.188 209.555 198,074 Dashboard Calendar To Do Notifications Inbox ..l Sprint LTE 9:43 PM @ 48% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started