Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have to reply to two classmate discussions, attached you will see their posting. My reply only needs to be 150 words. This is a

I have to reply to two classmate discussions, attached you will see their posting. My reply only needs to be 150 words. This is a discussion someone wrote up my ONLY assignment is to comment on this****************

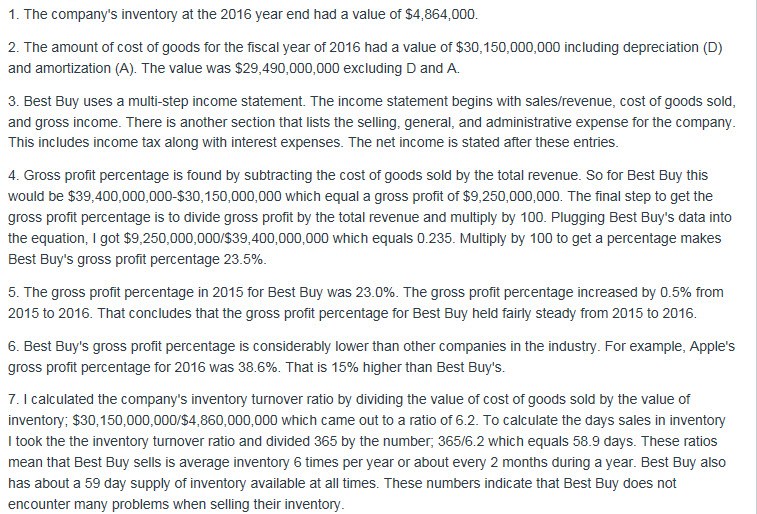

1. The company's inventory at the 2016 year end had a value of $4,864,000 2. The amount of cost of goods for the fiscal year of 2016 had a value 150,000,000 including depreciation (D and amortization (A). The value was $29,490,000,000 excluding D and A. 3. Best Buy uses a multi-step income statement. The income statement begins with sales/revenue, cost of goods sold and gross income. There is another section that lists the selling, general, and administrative expense for the company This includes income tax along with interest expenses. The net income is stated after these entries 4. Gross profit percentage is found by subtracting the cost of goods sold by the total revenue. So for Best Buy this would be $39,400,000,000-$30,150,000,000 which equal a gross profit of$9,250,000,000. The final step to get the gross profit percentage is to divide gross profit by the total revenue and multiply by 100. Plugging Best Buy's data into the equation, I got $9,250,000,000/$39,400,000,000 which equals 0.235. Multiply by 100 to get a percentage makes Best Buy's gross profit percentage 23.5% 5. The gross profit percentage in 2015 for Best Buy was 23.0%. The gross profit percentage increased by 0.5% from 2015 to 2016. That concludes that the gross profit percentage for Best Buy held fairly steady from 2015 to 2016 6. Best Buy's gross profit percentage is considerably lower than other companies in the industry. For example, Apple's gross profit percentage for 2016 was 38.6%. That is 15% higher than Best Buy's 7. l calculated the company's inventory turnover ratio by dividing the value of cost of goods sold by the value of inventory; $30,150,000,000/$4,860,000,000 which came out to a ratio of 6.2. To calculate the days sales in inventory I took the the inventory turnover ratio and divided 365 by the number, 365/6.2 which equals 58.9 days. These ratios mean that Best Buy sells is average inventory 6 times per year or about every 2 months during a year. Best Buy also has about a 59 day supply of inventory available at all times. These numbers indicate that Best Buy does not encounter many problems when selling their inventoryStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started