Question: i have total five questions Due for submission: May 14th, 2020 CE 241 ENGINEERING ECONOMICS FOR CIVIL ENGINEERS SPRING 2020 HOMEWORK No.2 1) Operating and

i have total five questions

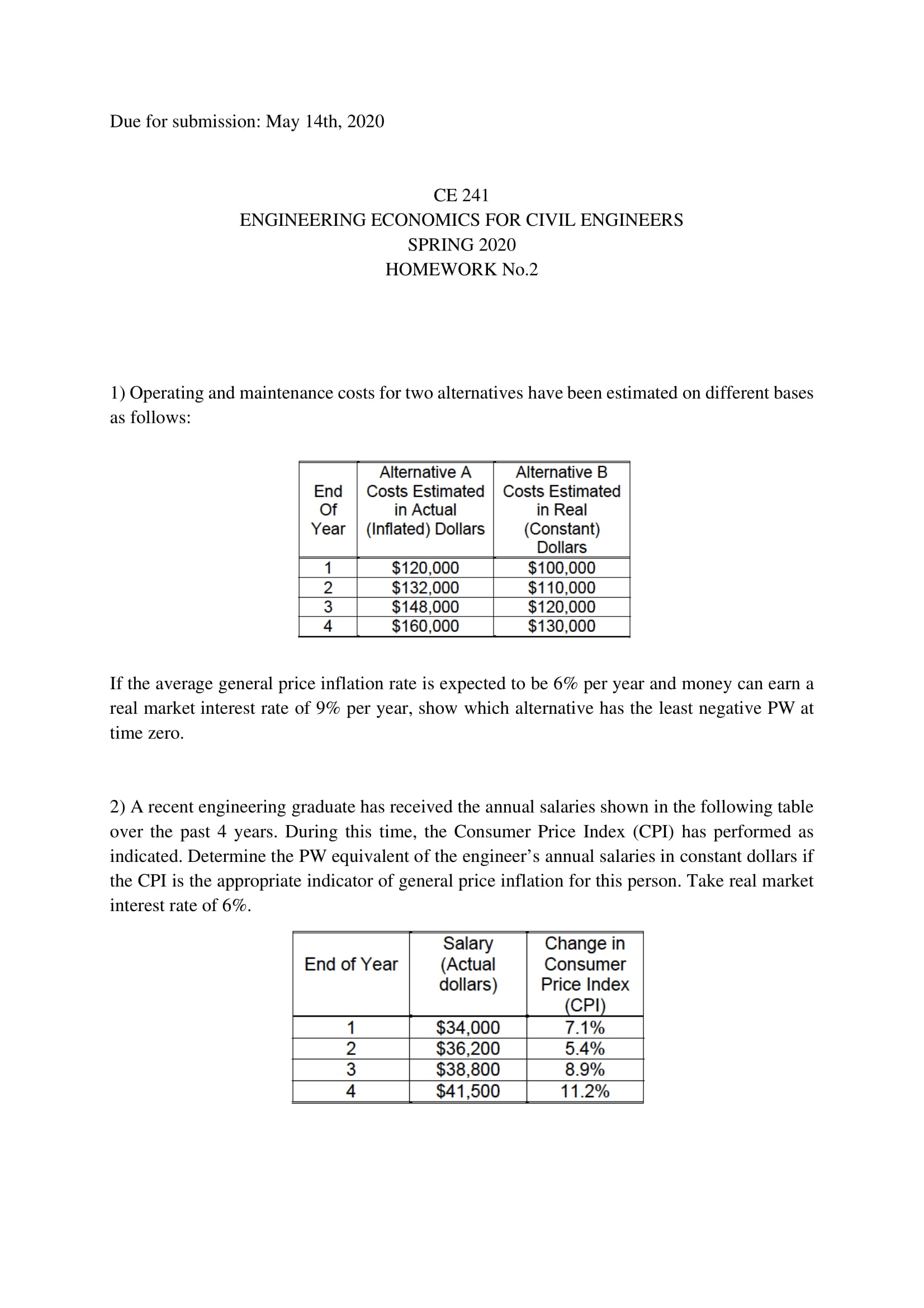

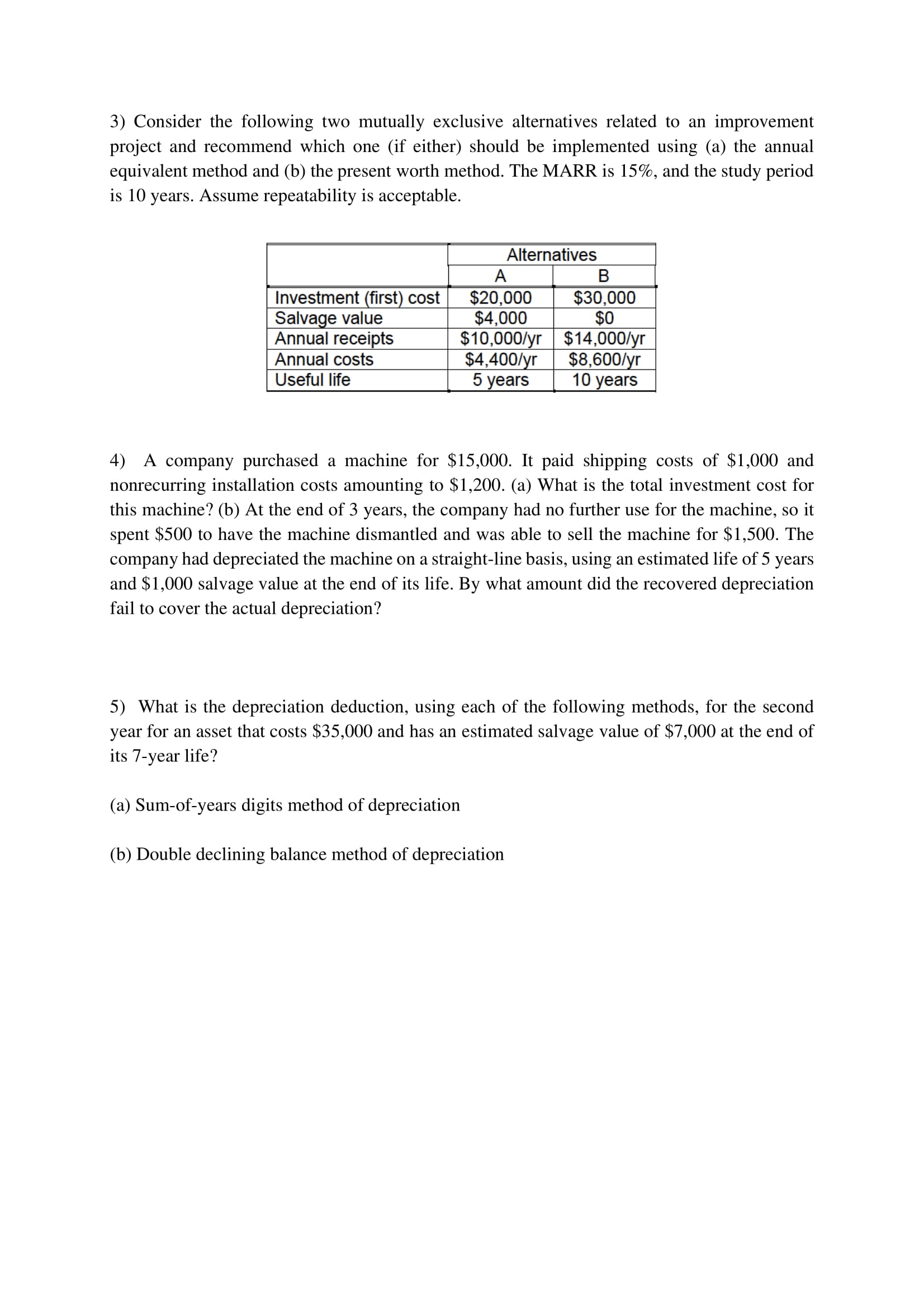

Due for submission: May 14th, 2020 CE 241 ENGINEERING ECONOMICS FOR CIVIL ENGINEERS SPRING 2020 HOMEWORK No.2 1) Operating and maintenance costs for two alternatives have been estimated on different bases as follows: Alternative A Alternative B End Costs Estimated Costs Estimated 0f in Actual in Real Year (Inated) Dollars (Constant) Dollars .- $120 000 $100,000 $132000 $110,000 :- $148Z000 $120,000 $160,000 $130,000 If the average general price ination rate is expected to be 6% per year and money can earn a real market interest rate of 9% per year, show which alternative has the least negative PW at time zero. 2) A recent engineering graduate has received the annual salaries shown in the following table over the past 4 years. During this time, the Consumer Price Index (CPI) has performed as indicated. Determine the PW equivalent of the engineer's annual salaries in constant dollars if the CPI is the appropriate indicator of general price ination for this person. Take real market interest rate of 6%. Salary Change in End of Year (Actual Consumer dollars) Price Index $38,800 8.9% 2 $36,200 5.4% .- $41.500 11.2% 3) Consider the following two mutually exclusive alternatives related to an improvement project and recommend which one (if either) should be implemented using (a) the annual equivalent method and (b) the present worth method. The MARR is 15%, and the study period is 10 years. Assume repeatability is acceptable. Alternatives g Investment (rst) cost $20,000 $30,000 | Salvage value $4,000 $0 Annual receipts $10.000/yr $14,000Iyr $4.400! r $8.600I r Useful life 4) A company purchased a machine for $15,000. It paid shipping costs of $1,000 and nonrecurring installation costs amounting to $1,200. (a) What is the total investment cost for this machine? (b) At the end of 3 years, the company had no further use for the machine, so it spent $500 to have the machine dismantled and was able to sell the machine for $1,500. The company had depreciated the machine on a straight-line basis, using an estimated life of 5 years and $1,000 salvage value at the end of its life. By what amount did the recovered depreciation fail to cover the actual depreciation? 5) What is the depreciation deduction, using each of the following methods, for the second year for an asset that costs $35,000 and has an estimated salvage value of $7,000 at the end of its 7year life? (a) Sumofyears digits method of depreciation (b) Double declining balance method of depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts