I have trouble answering this problem. Please help me.

I have trouble answering this problem. Please help me.

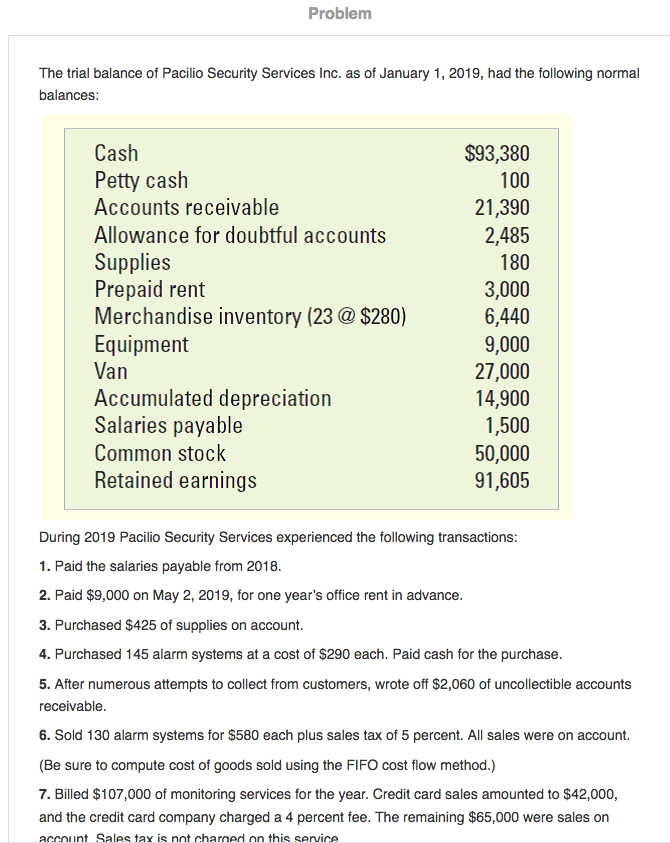

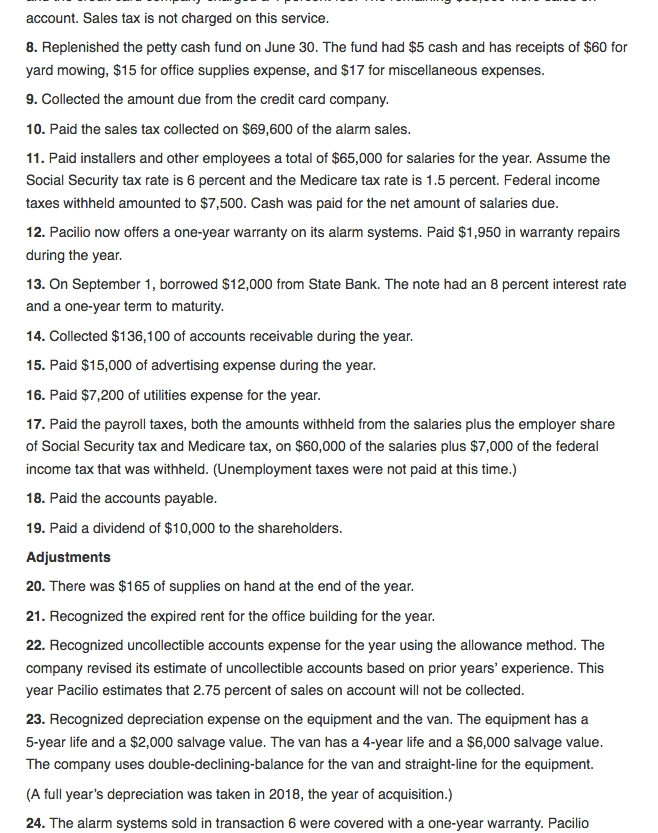

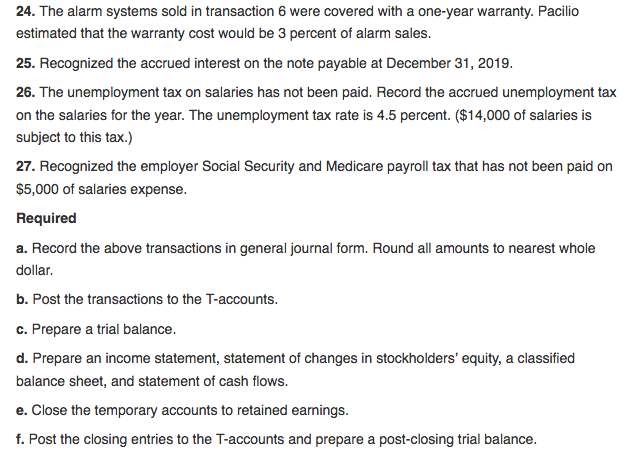

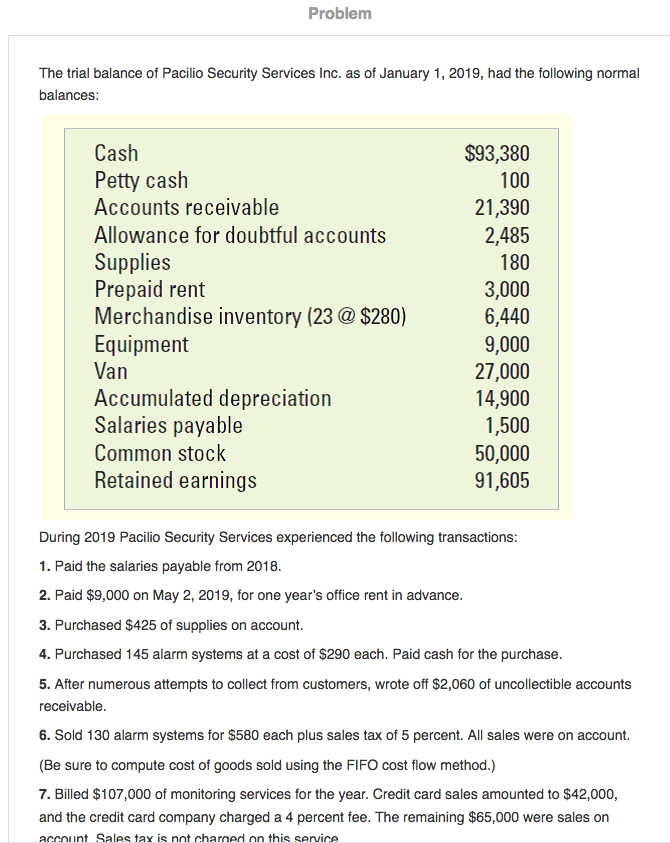

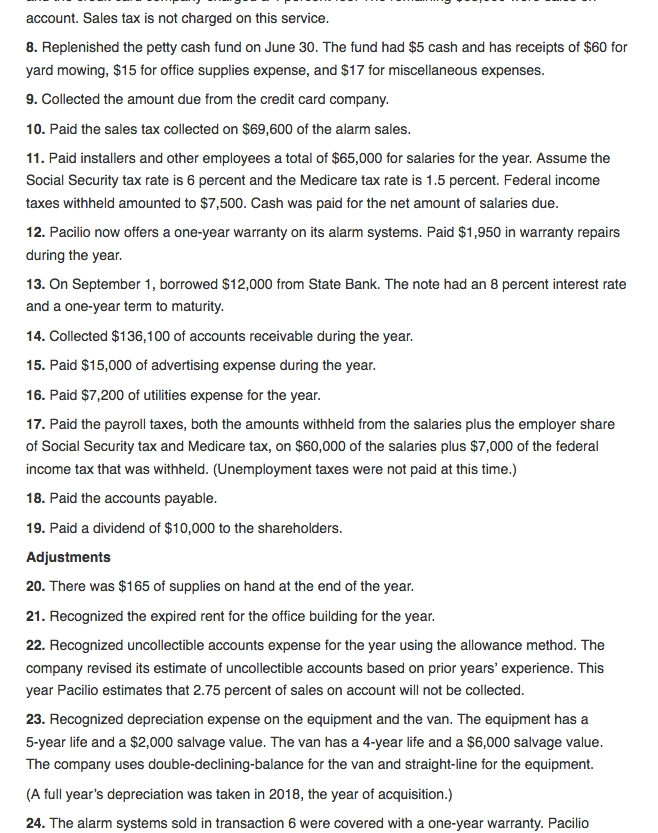

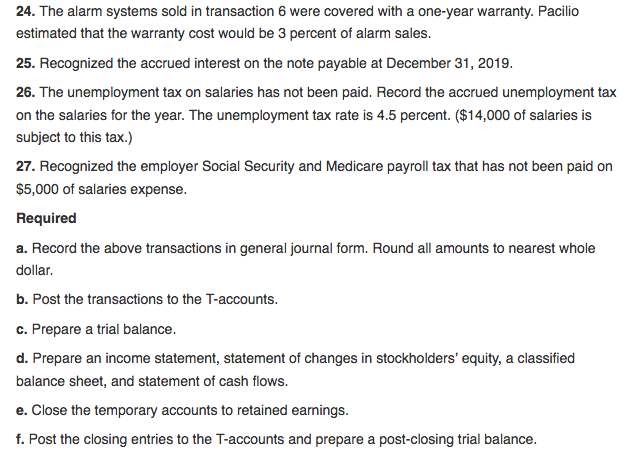

Problem The trial balance of Pacilio Security Services Inc. as of January 1, 2019, had the following normal balances: Cash Petty cash Accounts receivable Allowance for doubtful accounts Supplies Prepaid rent Merchandise inventory (23 @ $280) Equipment Van Accumulated depreciation Salaries payable Common stock Retained earnings $93,380 100 21,390 2,485 180 3,000 6,440 9,000 27,000 14,900 1,500 50,000 91,605 During 2019 Pacilio Security Services experienced the following transactions: 1. Paid the salaries payable from 2018. 2. Paid $9,000 on May 2, 2019, for one year's office rent in advance 3. Purchased $425 of supplies on account. 4. Purchased 145 alarm systems at a cost of $290 each. Paid cash for the purchase. 5. After numerous attempts to collect from customers, wrote off $2,060 of uncollectible accounts receivable. 6. Sold 130 alarm systems for $580 each plus sales tax of 5 percent. All sales were on account. (Be sure to compute cost of goods sold using the FIFO cost flow method.) 7. Billed $107,000 of monitoring services for the year. Credit card sales amounted to $42,000, and the credit card company charged a 4 percent fee. The remaining $65,000 were sales on account Sales tax is not charged on this service account. Sales tax is not charged on this service. 8. Replenished the petty cash fund on June 30. The fund had $5 cash and has receipts of $60 for yard mowing, $15 for office supplies expense, and $17 for miscellaneous expenses. 9. Collected the amount due from the credit card company. 10. Paid the sales tax collected on $69,600 of the alarm sales. 11. Paid installers and other employees a total of $65,000 for salaries for the year. Assume the Social Security tax rate is 6 percent and the Medicare tax rate is 1.5 percent. Federal income taxes withheld amounted to $7,500. Cash was paid for the net amount of salaries due. 12. Pacilio now offers a one-year warranty on its alarm systems. Paid $1,950 in warranty repairs during the year. 13. On September 1, borrowed $12,000 from State Bank. The note had an 8 percent interest rate and a one-year term to maturity. 14. Collected $136,100 of accounts receivable during the year. 15. Paid $15,000 of advertising expense during the year. 16. Paid $7,200 of utilities expense for the year. 17. Paid the payroll taxes, both the amounts withheld from the salaries plus the employer share of Social Security tax and Medicare tax, on $60,000 of the salaries plus $7,000 of the federal income tax that was withheld. (Unemployment taxes were not paid at this time.) 18. Paid the accounts payable. 19. Paid a dividend of $10,000 to the shareholders. Adjustments 20. There was $165 of supplies on hand at the end of the year. 21. Recognized the expired rent for the office building for the year. 22. Recognized uncollectible accounts expense for the year using the allowance method. The company revised its estimate of uncollectible accounts based on prior years' experience. This year Pacilio estimates that 2.75 percent of sales on account will not be collected. 23. Recognized depreciation expense on the equipment and the van. The equipment has a 5-year life and a $2,000 salvage value. The van has a 4-year life and a $6,000 salvage value. The company uses double-declining-balance for the van and straight-line for the equipment. (A full year's depreciation was taken in 2018, the year of acquisition.) 24. The alarm systems sold in transaction 6 were covered with a one-year warranty. Pacilio 24. The alarm systems sold in transaction 6 were covered with a one-year warranty. Pacilio estimated that the warranty cost would be 3 percent of alarm sales. 25. Recognized the accrued interest on the note payable at December 31, 2019. 26. The unemployment tax on salaries has not been paid. Record the accrued unemployment tax on the salaries for the year. The unemployment tax rate is 4.5 percent. ($14,000 of salaries is subject to this tax.) 27. Recognized the employer Social Security and Medicare payroll tax that has not been paid on $5,000 of salaries expense. Required a. Record the above transactions in general journal form. Round all amounts to nearest whole dollar. b. Post the transactions to the T-accounts. c. Prepare a trial balance. d. Prepare an income statement, statement of changes in stockholders' equity, a classified balance sheet, and statement of cash flows. e. Close the temporary accounts to retained earnings. f. Post the closing entries to the T-accounts and prepare a post-closing trial balance. Problem The trial balance of Pacilio Security Services Inc. as of January 1, 2019, had the following normal balances: Cash Petty cash Accounts receivable Allowance for doubtful accounts Supplies Prepaid rent Merchandise inventory (23 @ $280) Equipment Van Accumulated depreciation Salaries payable Common stock Retained earnings $93,380 100 21,390 2,485 180 3,000 6,440 9,000 27,000 14,900 1,500 50,000 91,605 During 2019 Pacilio Security Services experienced the following transactions: 1. Paid the salaries payable from 2018. 2. Paid $9,000 on May 2, 2019, for one year's office rent in advance 3. Purchased $425 of supplies on account. 4. Purchased 145 alarm systems at a cost of $290 each. Paid cash for the purchase. 5. After numerous attempts to collect from customers, wrote off $2,060 of uncollectible accounts receivable. 6. Sold 130 alarm systems for $580 each plus sales tax of 5 percent. All sales were on account. (Be sure to compute cost of goods sold using the FIFO cost flow method.) 7. Billed $107,000 of monitoring services for the year. Credit card sales amounted to $42,000, and the credit card company charged a 4 percent fee. The remaining $65,000 were sales on account Sales tax is not charged on this service account. Sales tax is not charged on this service. 8. Replenished the petty cash fund on June 30. The fund had $5 cash and has receipts of $60 for yard mowing, $15 for office supplies expense, and $17 for miscellaneous expenses. 9. Collected the amount due from the credit card company. 10. Paid the sales tax collected on $69,600 of the alarm sales. 11. Paid installers and other employees a total of $65,000 for salaries for the year. Assume the Social Security tax rate is 6 percent and the Medicare tax rate is 1.5 percent. Federal income taxes withheld amounted to $7,500. Cash was paid for the net amount of salaries due. 12. Pacilio now offers a one-year warranty on its alarm systems. Paid $1,950 in warranty repairs during the year. 13. On September 1, borrowed $12,000 from State Bank. The note had an 8 percent interest rate and a one-year term to maturity. 14. Collected $136,100 of accounts receivable during the year. 15. Paid $15,000 of advertising expense during the year. 16. Paid $7,200 of utilities expense for the year. 17. Paid the payroll taxes, both the amounts withheld from the salaries plus the employer share of Social Security tax and Medicare tax, on $60,000 of the salaries plus $7,000 of the federal income tax that was withheld. (Unemployment taxes were not paid at this time.) 18. Paid the accounts payable. 19. Paid a dividend of $10,000 to the shareholders. Adjustments 20. There was $165 of supplies on hand at the end of the year. 21. Recognized the expired rent for the office building for the year. 22. Recognized uncollectible accounts expense for the year using the allowance method. The company revised its estimate of uncollectible accounts based on prior years' experience. This year Pacilio estimates that 2.75 percent of sales on account will not be collected. 23. Recognized depreciation expense on the equipment and the van. The equipment has a 5-year life and a $2,000 salvage value. The van has a 4-year life and a $6,000 salvage value. The company uses double-declining-balance for the van and straight-line for the equipment. (A full year's depreciation was taken in 2018, the year of acquisition.) 24. The alarm systems sold in transaction 6 were covered with a one-year warranty. Pacilio 24. The alarm systems sold in transaction 6 were covered with a one-year warranty. Pacilio estimated that the warranty cost would be 3 percent of alarm sales. 25. Recognized the accrued interest on the note payable at December 31, 2019. 26. The unemployment tax on salaries has not been paid. Record the accrued unemployment tax on the salaries for the year. The unemployment tax rate is 4.5 percent. ($14,000 of salaries is subject to this tax.) 27. Recognized the employer Social Security and Medicare payroll tax that has not been paid on $5,000 of salaries expense. Required a. Record the above transactions in general journal form. Round all amounts to nearest whole dollar. b. Post the transactions to the T-accounts. c. Prepare a trial balance. d. Prepare an income statement, statement of changes in stockholders' equity, a classified balance sheet, and statement of cash flows. e. Close the temporary accounts to retained earnings. f. Post the closing entries to the T-accounts and prepare a post-closing trial balance

I have trouble answering this problem. Please help me.

I have trouble answering this problem. Please help me.