Answered step by step

Verified Expert Solution

Question

1 Approved Answer

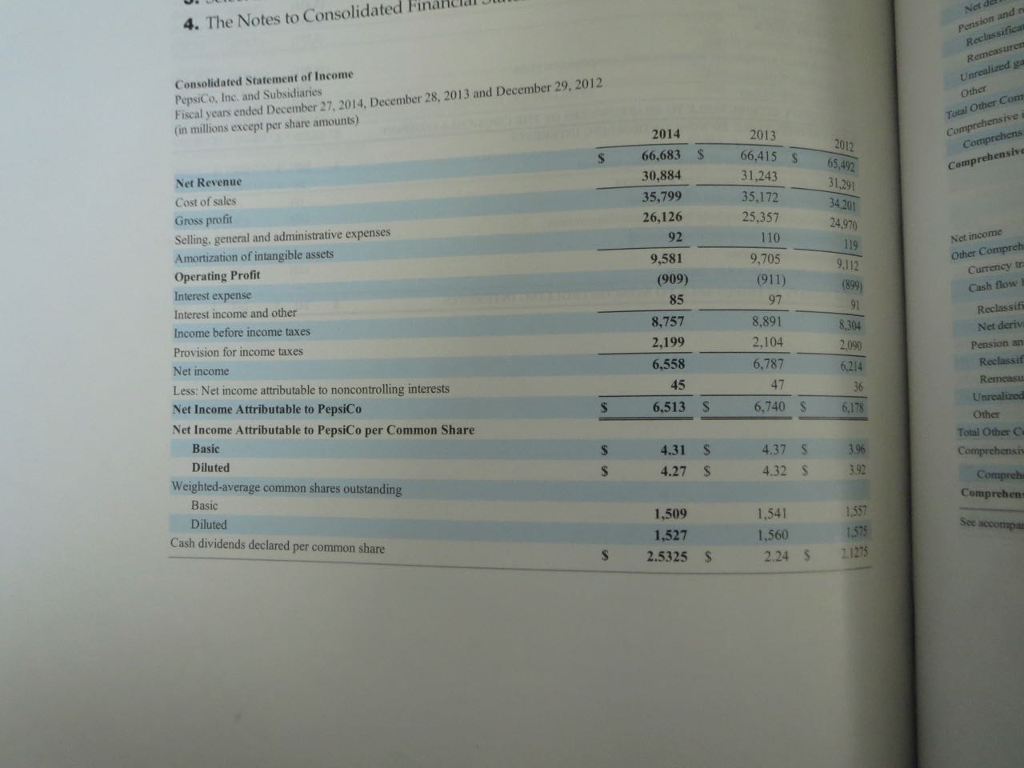

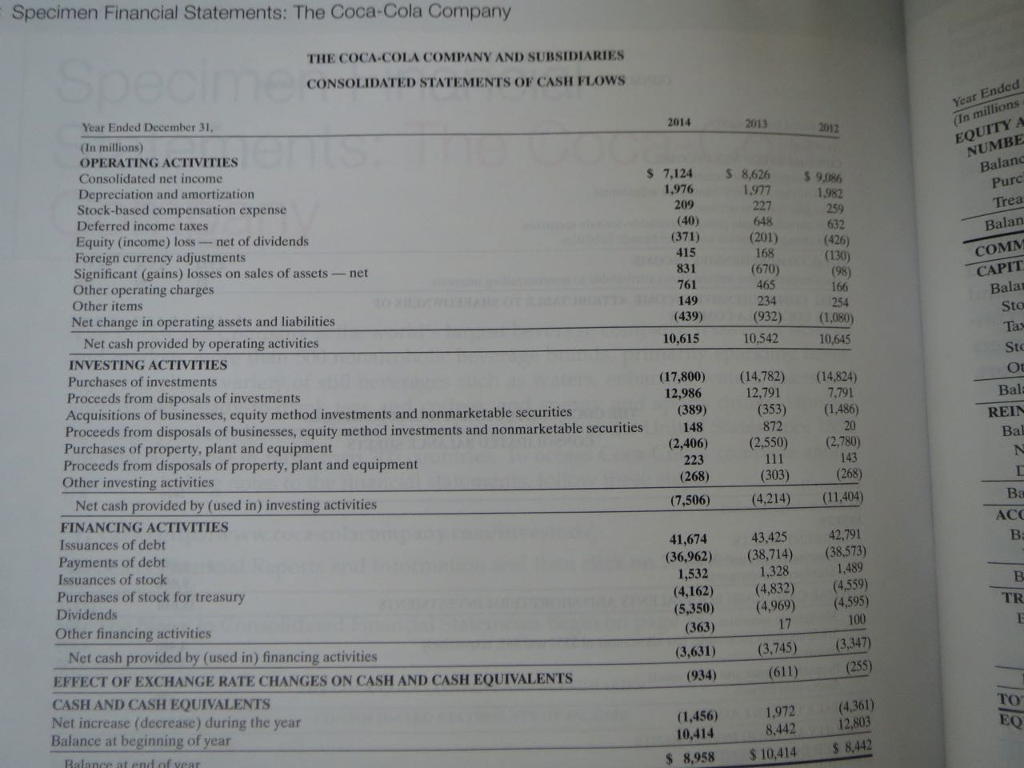

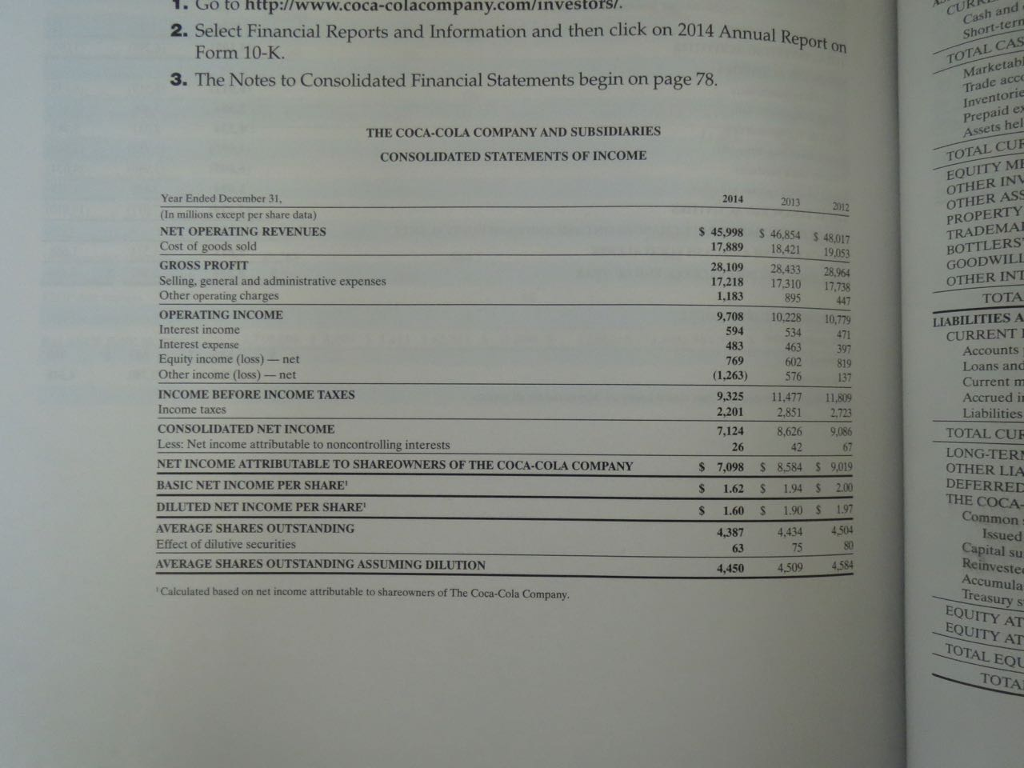

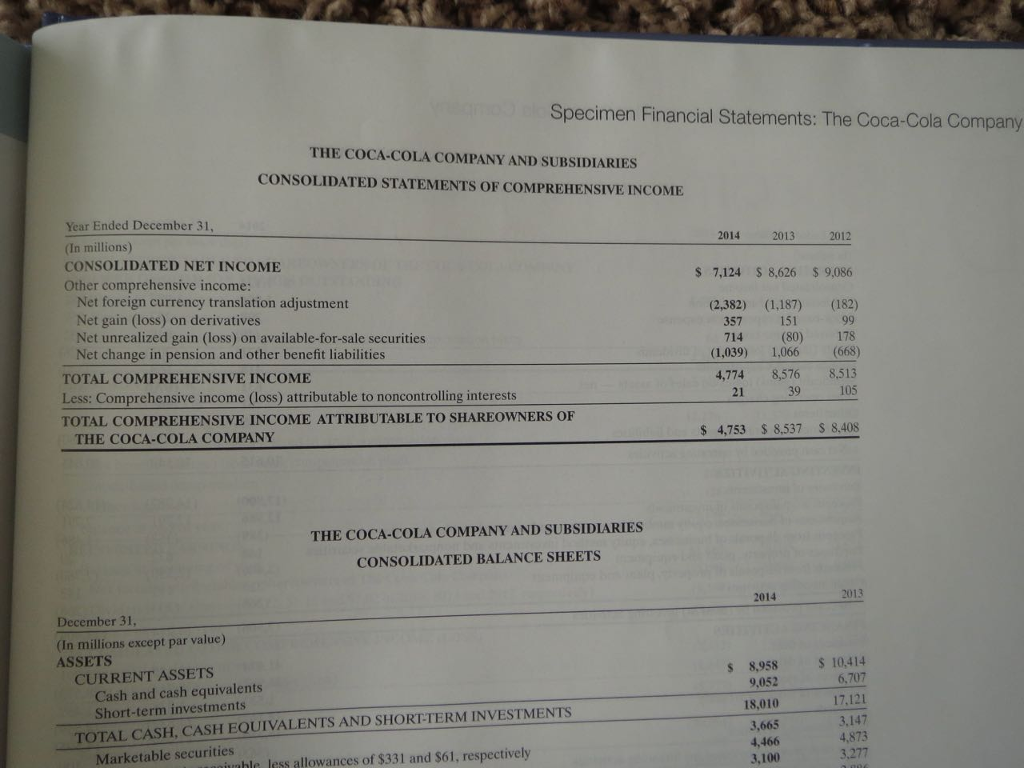

I have two questions I had a hard time to figure it out. Based on the information contained in these financial statements, determine each of

I have two questions I had a hard time to figure it out.

Based on the information contained in these financial statements, determine each of the following for each company.

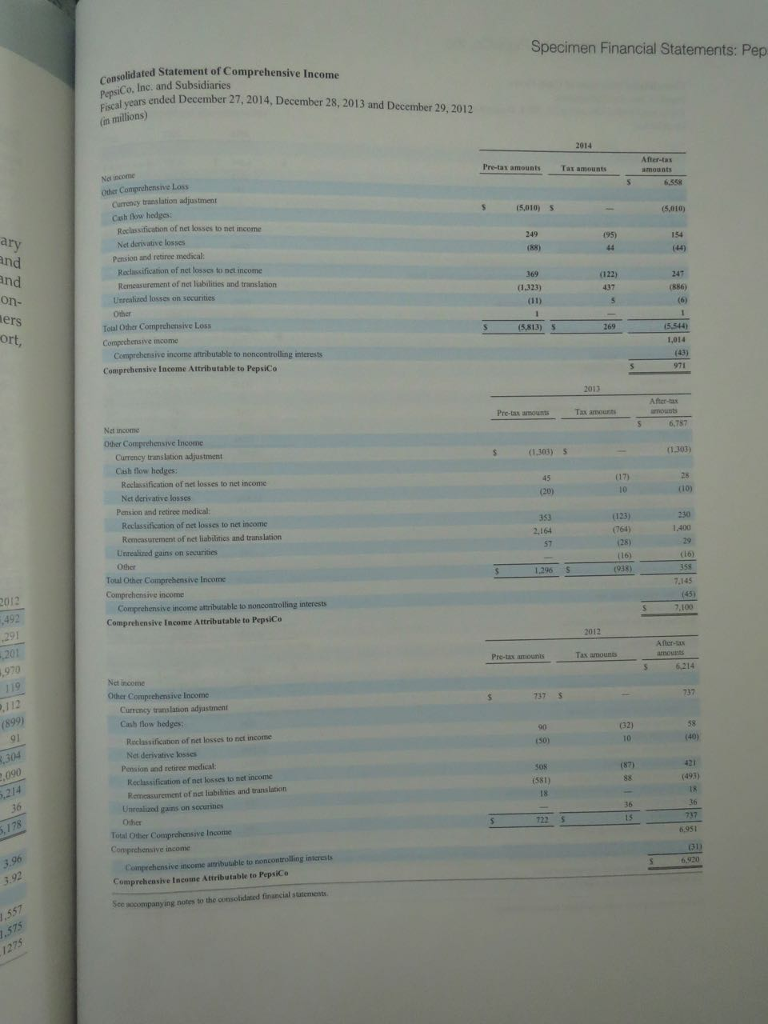

A) What was the unrealized gains or losses reported as part of other comprehensive income?

B) Compare the expected benefit payments and contributions for Coca-Cola and PepsiCo.

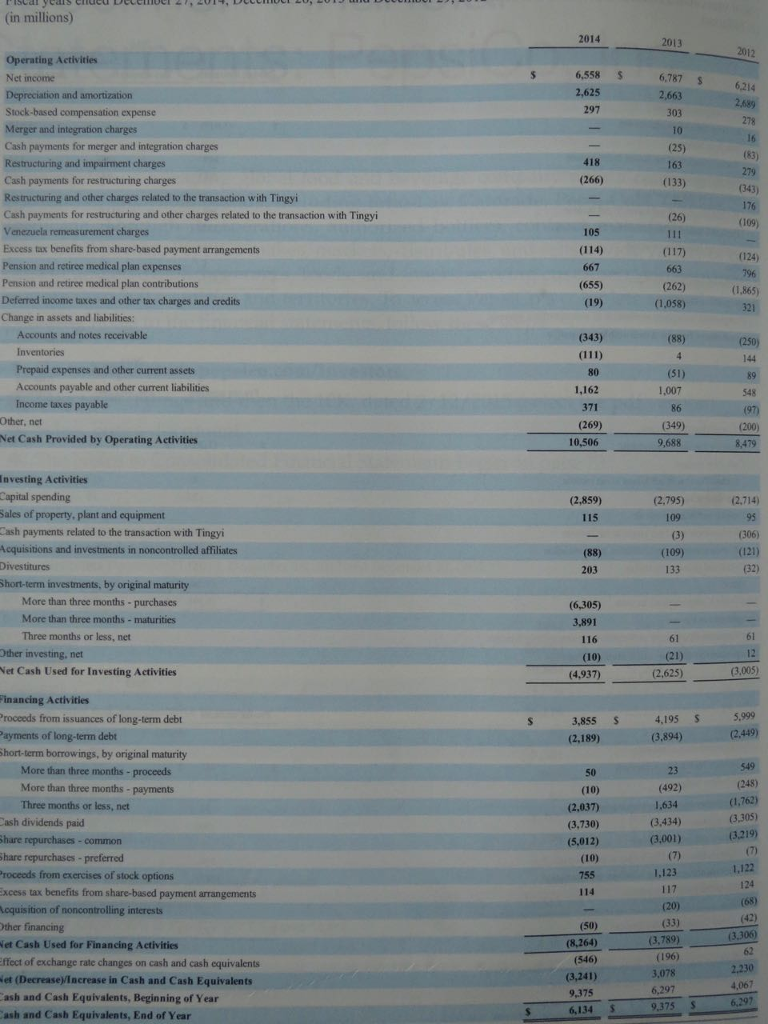

Note: 1st picture is Cash flow for Pepsi Company.

Thank you so much for your help.

Here is the second part.

Here is the second part.

Thank you, Ramesh, for help.

(in millions) 2014 Operating Activities Net income Depreciation and amortization Stock-based compensation expense Merger and integration charges Cash payments for merger and integration charges Restructuring and impairment charges Cash payments for res tructuring charges Restructuring and other charges related to the transaction with Tingyi Cash payments for restructuring and other charges related to the transaction with Tingyi Venezuela remeasurement charges Excess tax benefits from share-based payment arrangements Pension and retiree medical plan expenses Pension and retiree medical plan contributions Deferred income taxes and other tax charges and credits Change in assets and liabilities 6,558 S 6,787 6214 2,663 303 10 (25) 297 (83) (266) (133) (34 (109) (114) 667 (124) (262) (1,058) (655) (1,865) 321 Accounts and notes receivable (343) Prepaid expenses and other current assets Accounts payable and other current liabilities Income taxes payable 1,007 86 1,162 548 Other, net (269) 10,506 Net Cash Provided by Operating Activities 9,688 Investing Activities Capital spending Sales of property, plant and equipment ash payments related to the transaction with Tingyi cquisitions and investments in noncontrolled affiliates Divestitures Short-term investments, by original maturity (2,859) (2.795) (2.714) 95 (88) 203 (109) (32) More than three months purchases More than three months - maturities Three months or less, net (6,305) 3,891 61 Other investing, net Vet Cash Used for Investing Activities (10) (4,937) (2,625) (3,005) Financing Activities rocceds from issuances of long-term debt ayments of long-term debt short-term borrowings, by original maturity 5,999 S 3,855 S 4,195 S . - (2,189) (3.894) (2,449) More than three months- proceeds 50 (492) 1,634 (3,434) (3,001) More than three months - payments (1,762) (3,305) (3.219) Three months or less, net ash dividends paid hare repurchases-common hare repurchases-preferred roceeds from exercises of stock options xcess cquisition of noncontrolling interests ther financing et Cash Used for Financing Activities fect of exchange rate changes on cash and cash equivalents et (DecreaseVIncrease in Cash and Cash Equivalents ash and Cash Equivalents, Beginning of Year ash and Cash Equivalents, End of Year (2,037) (3,730) (5,012) 1,122 tax benefits from share-based payment arrangements (20) (33) (50) (3,789) (196) 3,078 6,297 9,375 (8,264) (546) (3,241) 9,375 6,134 $ 4,067 6,297Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started