I have two questions that I am requesting help with and an explanation for the correct answer. Thank you

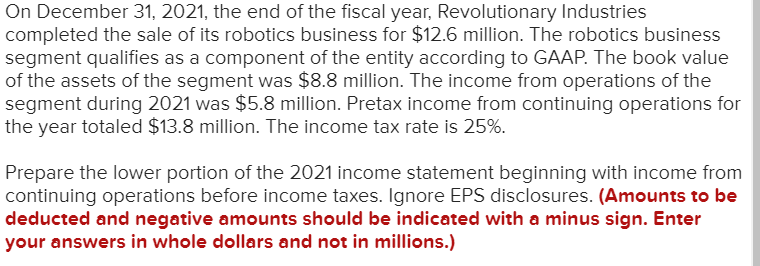

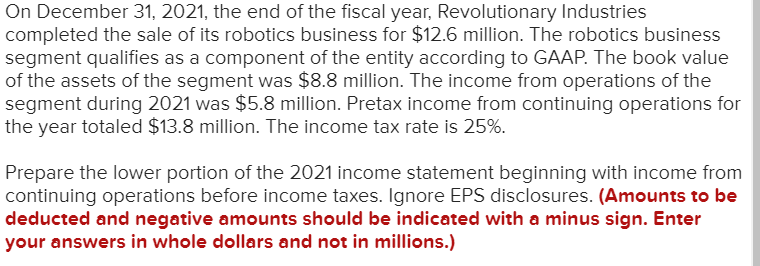

#2

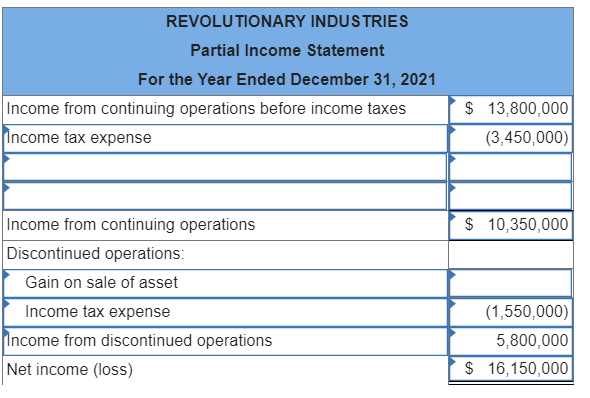

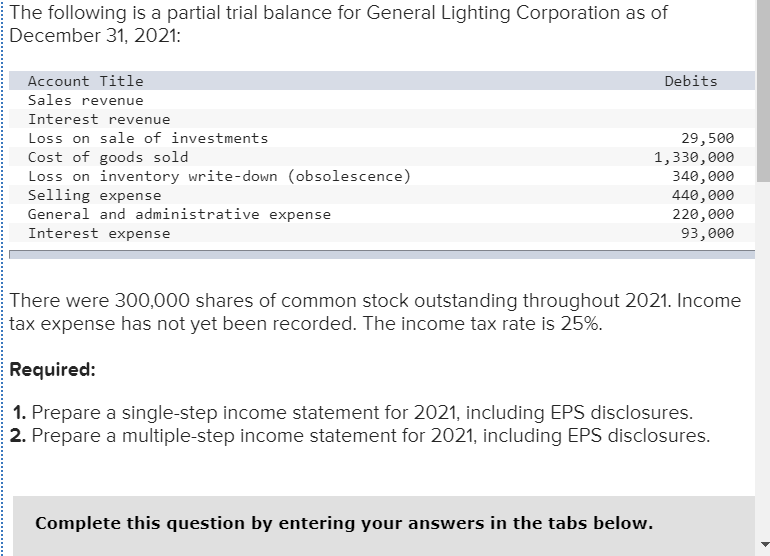

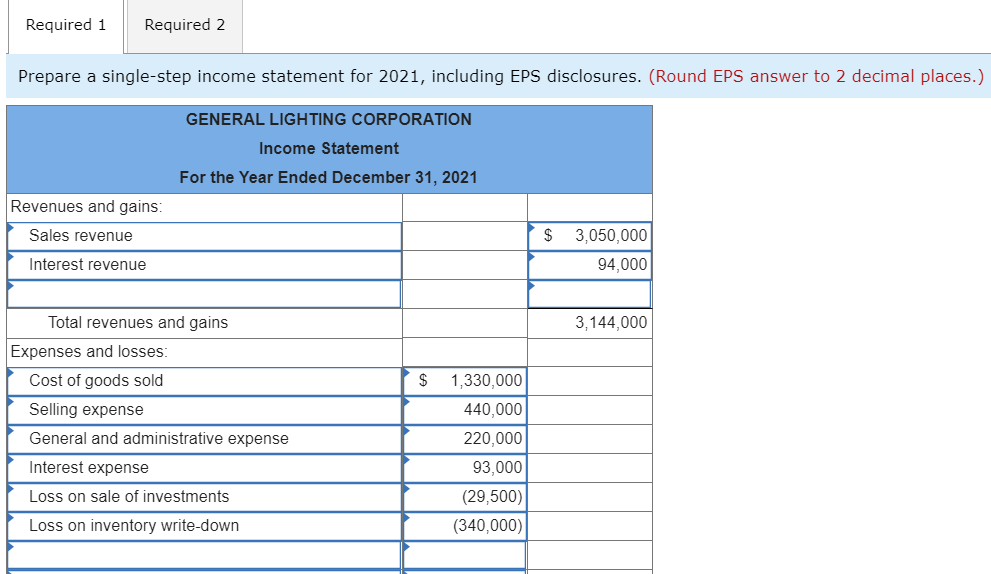

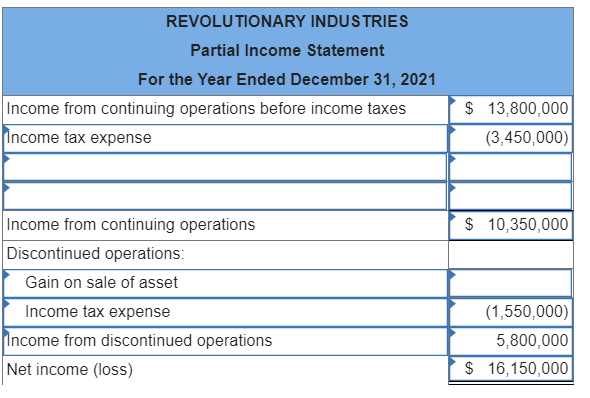

#4

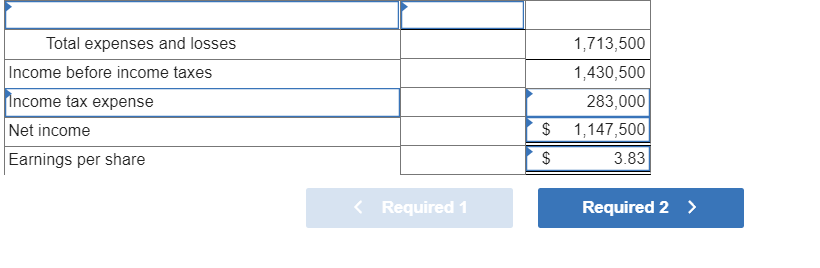

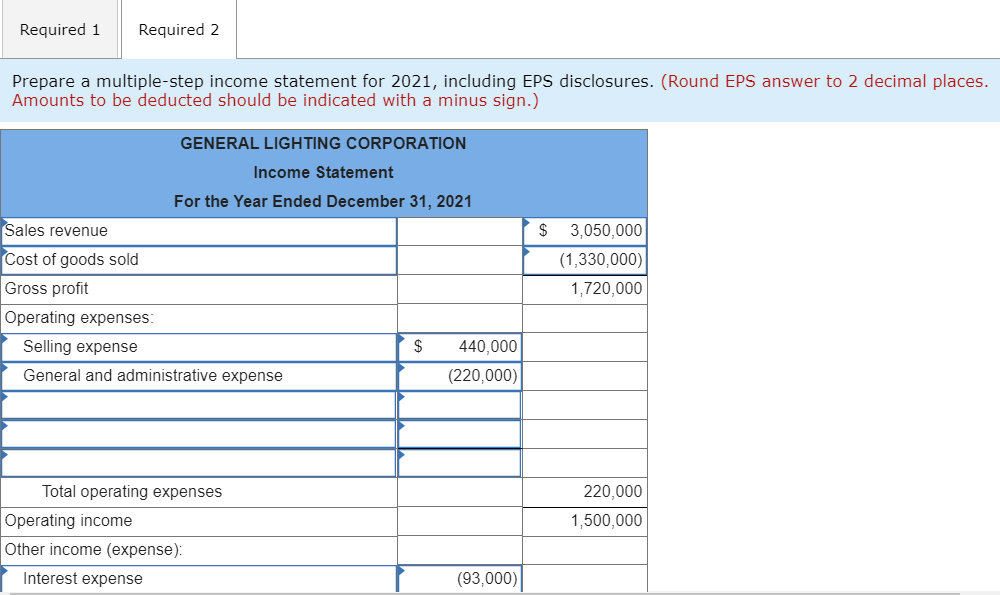

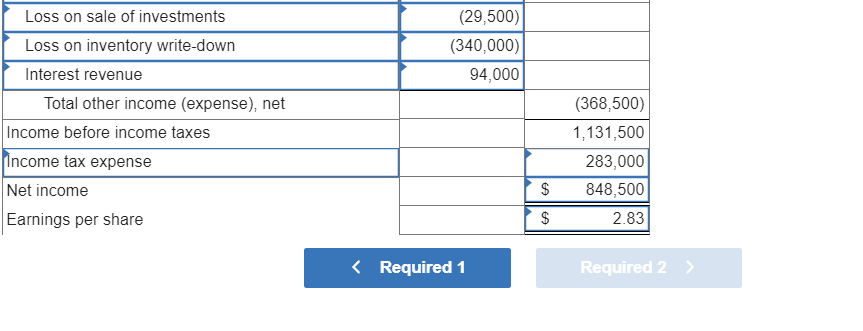

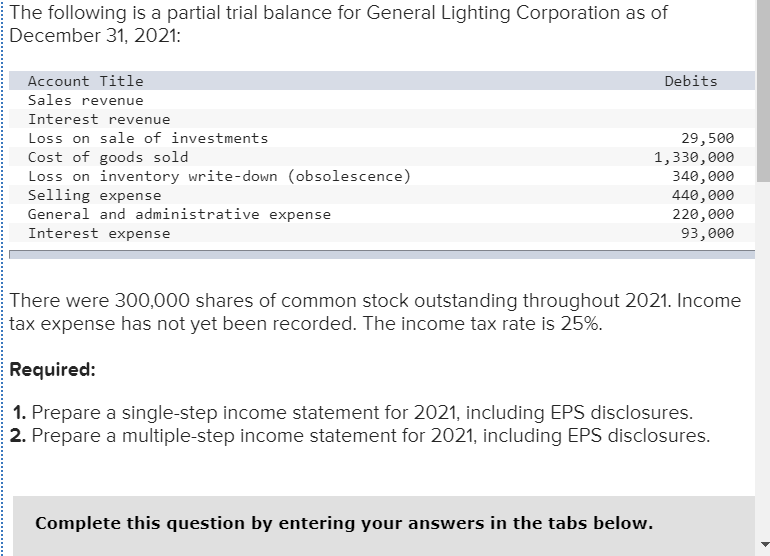

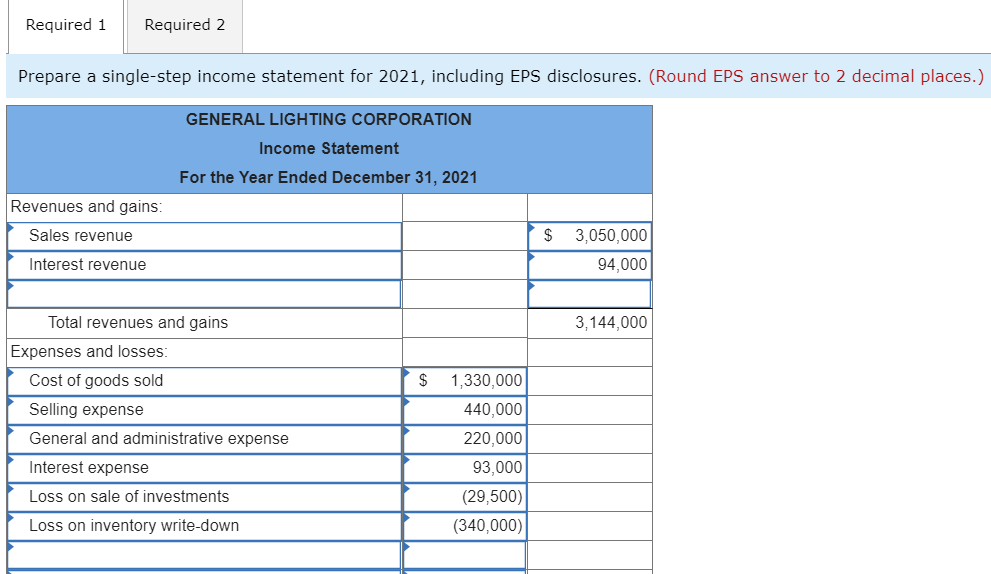

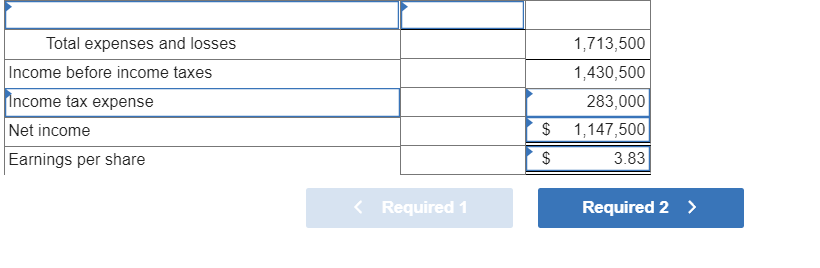

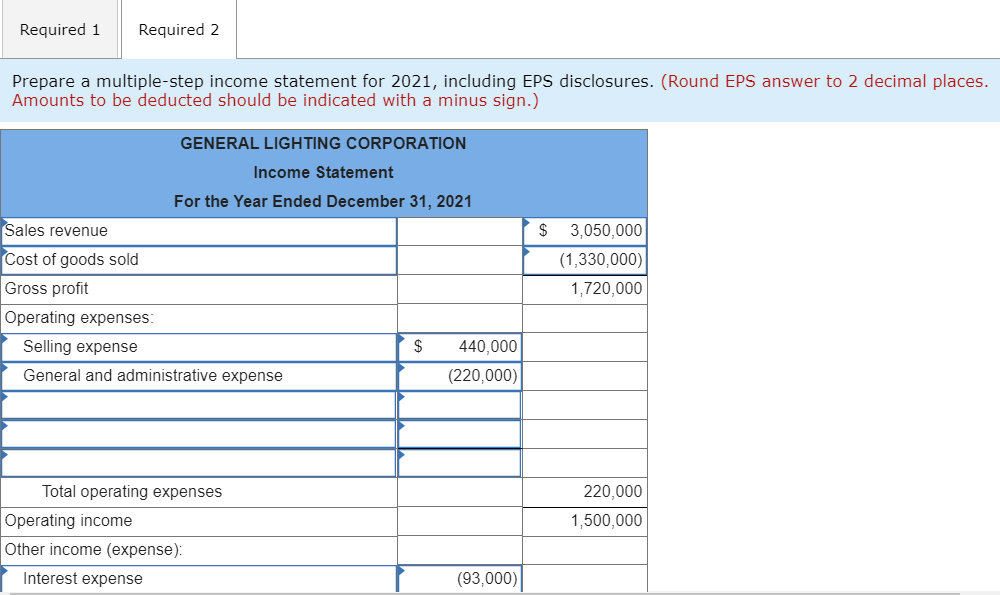

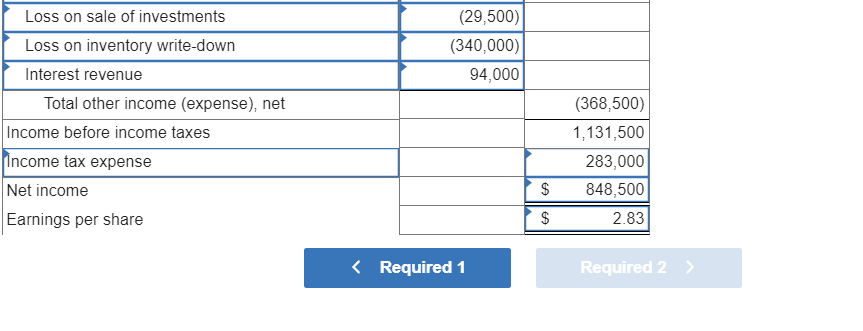

On December 31, 2021, the end of the fiscal year, Revolutionary Industries completed the sale of its robotics business for $12.6 million. The robotics business segment qualifies as a component of the entity according to GAAP. The book value of the assets of the segment was $8.8 million. The income from operations of the segment during 2021 was $5.8 million. Pretax income from continuing operations for the year totaled $13.8 million. The income tax rate is 25%. Prepare the lower portion of the 2021 income statement beginning with income from continuing operations before income taxes. Ignore EPS disclosures. (Amounts to be deducted and negative amounts should be indicated with a minus sign. Enter your answers in whole dollars and not in millions.) REVOLUTIONARY INDUSTRIES Partial Income Statement For the Year Ended December 31, 2021 Income from continuing operations before income taxes Income tax expense r$ 13,800,000 (3,450,000) $ 10,350,000 Income from continuing operations Discontinued operations: Gain on sale of asset Income tax expense Income from discontinued operations (1,550,000) 5,800,000 16,150,000 Net income (loss) $ The following is a partial trial balance for General Lighting Corporation as of December 31, 2021: Debits Account Title Sales revenue Interest revenue Loss on sale of investments Cost of goods sold Loss on inventory write-down (obsolescence) Selling expense General and administrative expense Interest expense 29,500 1,330,000 340,000 440,000 220,000 93,000 There were 300,000 shares of common stock outstanding throughout 2021. Income tax expense has not yet been recorded. The income tax rate is 25%. Required: 1. Prepare a single-step income statement for 2021, including EPS disclosures. 2. Prepare a multiple-step income statement for 2021, including EPS disclosures. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a single-step income statement for 2021, including EPS disclosures. (Round EPS answer to 2 decimal places.) GENERAL LIGHTING CORPORATION Income Statement For the Year Ended December 31, 2021 Revenues and gains: Sales revenue Interest revenue $ 3,050,000 94,000 3,144,000 $ Total revenues and gains Expenses and losses: Cost of goods sold Selling expense General and administrative expense Interest expense Loss on sale of investments Loss on inventory write-down 1,330,000 440,000 220,000 93,000 (29,500) (340,000) Total expenses and losses Income before income taxes Income tax expense Net income Earnings per share 1,713,500 1,430,500 283,000 1,147,500 3.83 $ $ - Required 1 Required 2 > Required 1 Required 2 Prepare a multiple-step income statement for 2021, including EPS disclosures. (Round EPS answer to 2 decimal places. Amounts to be deducted should be indicated with a minus sign.) $ GENERAL LIGHTING CORPORATION Income Statement For the Year Ended December 31, 2021 Sales revenue Cost of goods sold Gross profit Operating expenses: Selling expense $ 440,000 General and administrative expense (220,000) 3,050,000 (1,330,000) 1,720,000 220,000 1,500,000 Total operating expenses Operating income Other income (expense): Interest expense (93,000) (29,500) (340,000) 94,000 Loss on sale of investments Loss on inventory write-down Interest revenue Total other income (expense), net Income before income taxes Income tax expense Net income Earnings per share (368,500) 1,131,500 283,000 848,500 2.83 $ $ Required 1 Required 2 >