Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i have worked this and think im on the right track. but would like to check it and compare with a tutor before being done

i have worked this and think im on the right track. but would like to check it and compare with a tutor before being done with it.

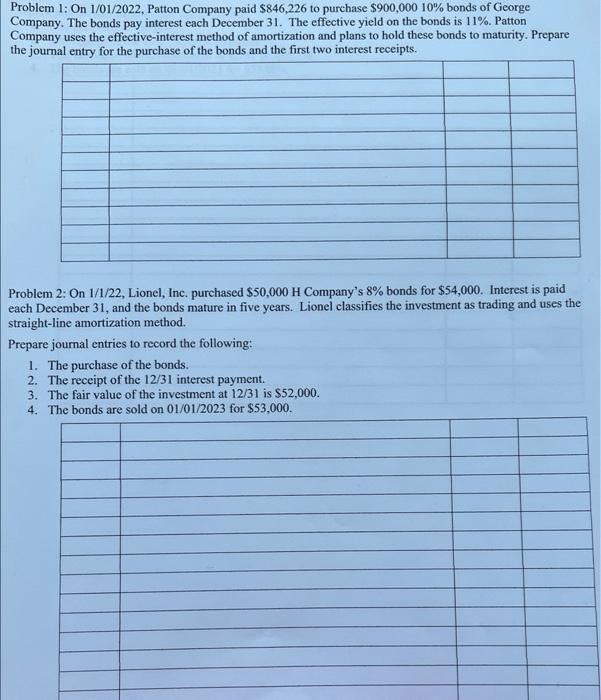

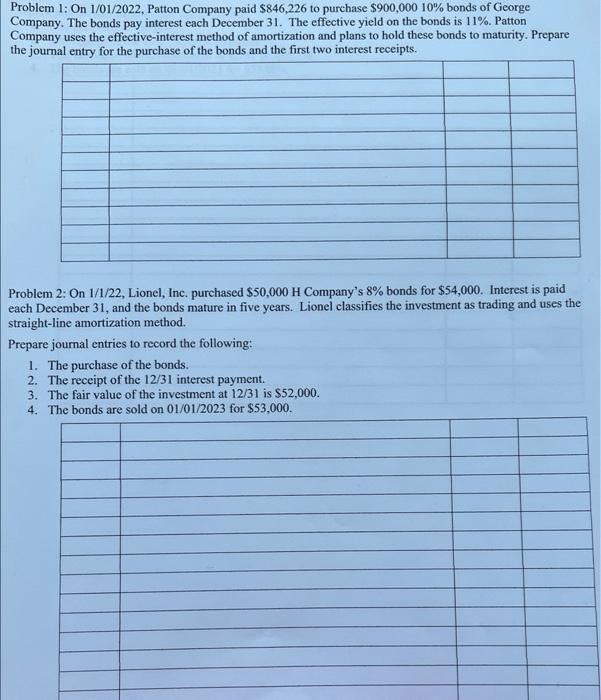

Problem 1: On 1/01/2022, Patton Company paid \$846,226 to purchase $900,00010% bonds of George Company. The bonds pay interest each December 31 . The effective yield on the bonds is 11%. Patton Company uses the effective-interest method of amortization and plans to hold these bonds to maturity. Prepare the journal entry for the purchase of the bonds and the first two interest receipts. Problem 2: On 1/1/22, Lionel, Inc. purchased $50,000H Company's 8% bonds for $54,000. Interest is paid each December 31 , and the bonds mature in five years. Lionel classifies the investment as trading and uses the straight-line amortization method. Prepare journal entries to record the following: 1. The purchase of the bonds. 2. The receipt of the 12/31 interest payment. 3. The fair value of the investment at 12/31 is $52,000. 4. The bonds are sold on 01/01/2023 for $53,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started