Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I hope i can have full step about how to find the answers Question 3 (20 marks) Paul plans to buy a flat in a

I hope i can have full step about how to find the answers

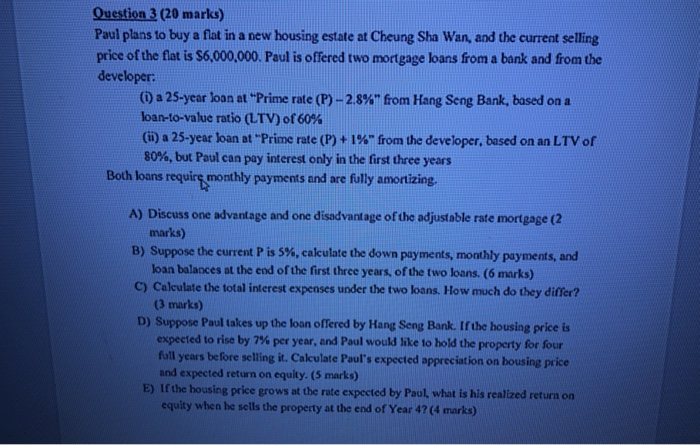

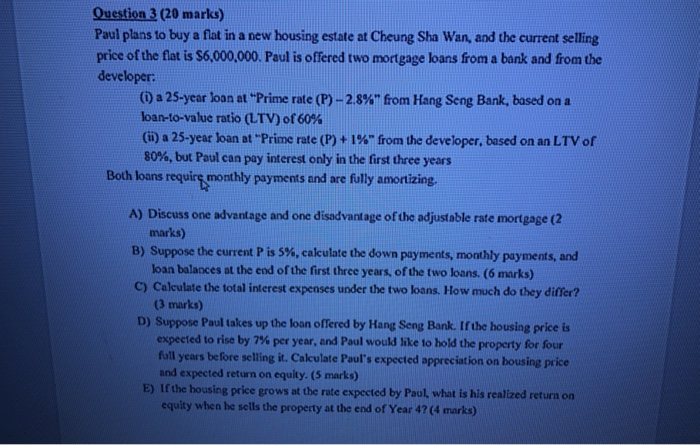

Question 3 (20 marks) Paul plans to buy a flat in a new housing estate at Cheung Sha Wan, and the current selling price of the flat is $6,000,000. Paul is offered two mortgage loans from a bank and from the developer: (1) a 25-year loan at "Prime rate (P) - 2.8%" from Hang Seng Bank, based on a loan-to-value ratio (LTV) of 60% (ii) a 25-year Joan at "Prime rate (P) + 1% from the developer, based on an LTV of 80%, but Paul can pay interest only in the first three years Both loans require monthly payments and are fully amortizing. A) Discuss one advantage and one disadvantage of the adjustable rate mortgage (2 marks) B) Suppose the current P is 5%, calculate the down payments, monthly payments, and loan balances at the end of the first three years, of the two loans. (6 marks) C) Calculate the total interest expenses under the two loans. How much do they differ? (3 marks) D) Suppose Paul takes up the loan offered by Hang Seng Bank. If the housing price is expected to rise by 7% per year, and Paul would like to hold the property for four full years before selling it. Calculate Paul's expected appreciation on housing price and expected return on equity. (5 marks) E) If the housing price grows at the rate expected by Paul, what is his realized return on equity when he sells the property at the end of Year 4? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started