i hope this picture better

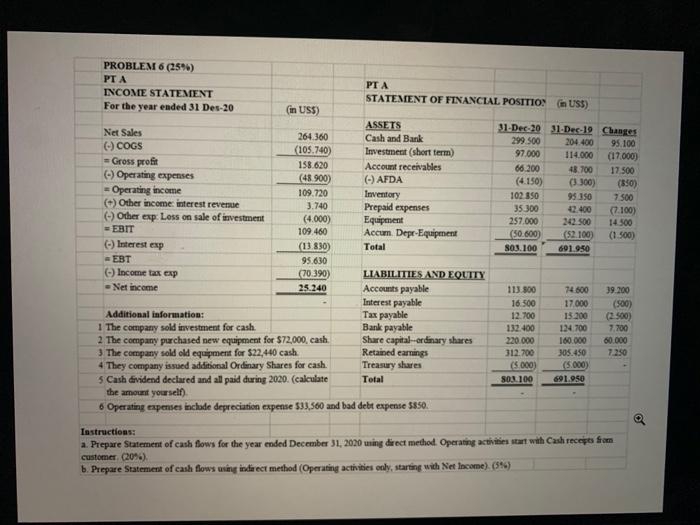

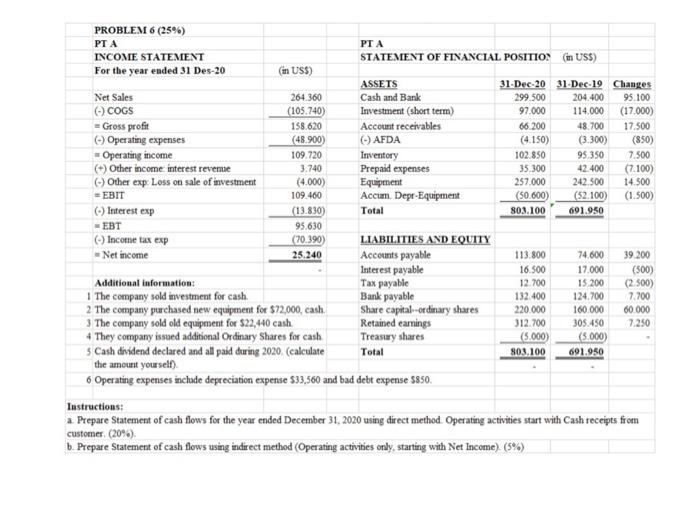

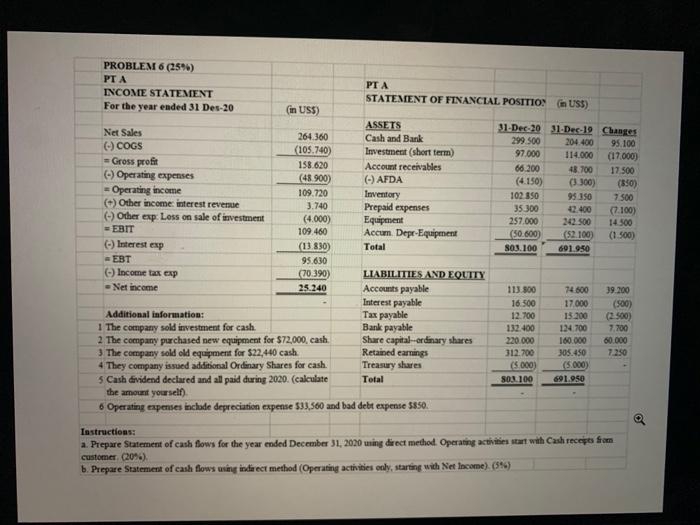

(850) PROBLEM 6 (25%) PT A PT A INCOME STATEMENT STATEMENT OF FINANCIAL POSITIOS (in USS) For the year ended 31 Des 20 in US$) ASSETS 31-Dec-20 31-Dec-19 Changes Net Sales 264.360 Cash and Bank 299.500 204.400 95.100 COGS (105.740) Investment (short term) 97.000 114.000 (17.000) = Gross profit 158.620 Account receivables 66.200 48.700 17.500 (-) Operating expenses (48.900) (AFDA (4.150) (3.300) - Operating income 109.720 Inventory 102.850 95.350 7.500 (+) Other income interest revenue 3.740 Prepaid expenses 35.300 42.400 (7.100 (-) Other exp Loss on sale of investment (4.000) Equipment 257.000 242.500 14.500 = EBIT 109.460 Accum. Dept-Equipment (50.600) (52.100) (1.500) (-) Interest exp (13.830) Total S03.100 691.950 -EBT 95.630 (-) Income tax exp (70.390) LIABILITIES AND EQUITY Net income 25.240 Accounts payable 113.800 74.600 39 200 Interest payable 16.500 17.000 (500) Additional information! Tax payable 12.700 15.200 (2.500) 1 The company sold investment for cash. Bank payable 132.400 124.700 7.700 2 The company purchased new equipment for $72,000, cash, Share capital.-ordinary shares 220.000 160.000 60 000 3 The company sold old equipment for $22,440 cash. Retained earnings 312.700 305.450 4 They company issued additional Ordinary Shares for cash Treasury shares (5.000) (3.000) 5 Cash dividend declared and all paid during 2020 (calculate Total 803.100 691.950 the amount yourself) 6 Operating expenses include depreciation expense 533,560 and bad debt expense $850. 7.250 Instructions: a Prepare Statement of cash flows for the year ended December 31, 2020 using direct method. Operating activities start with Cash receipts from customer (20%) b. Prepare Statement of cash flows using indirect method (Operating activities only, starting with Net Income) (5%) PROBLEM 6 (2546) PIA PT A INCOME STATEMENT STATEMENT OF FINANCIAL POSITIOS (in USS) For the year ended 31 Des 20 (in USS) ASSETS 31-Dec-20 31-Dec-19 Changes Net Sales 264.360 Cash and Bank 299 500 204.400 95.100 COGS (105.740) Investment (short term) 97.000 114.000 (17.000) =Gross profit 158.620 Account receivables 66.200 18.700 17.500 - Operating expenses (48.900) (-) AFDA (4.150) (3300) (550) = Operating income 109.720 Inventory 102.350 95.350 7.500 (-) Other income interest revenue 3.740 Prepaid expenses 35.300 42.400 (7.100) Other exp Loss on sale of investment (4.000) Equipment 257.000 242.500 14.500 EBIT 109.460 Accum Depr-Equipment (50.600) (52.100) (1.500) (-) Interest exp (13.830 Total 803.100 691.950 -EBT 95.630 Income tax exp 00.390) LIABILITIES AND EQUTTY -Net income 25.240 Accounts payable 113.800 74600 39.200 Interest payable 16.500 17.000 (900) Additional information: Tax payable 12.700 13200 (2.500) 1 The company sold investment for cash. Bank payable 132.400 124.700 7.700 2 The company purchased new equipment for $72,000, cash Share capital ordinary shares 220.000 160.000 60.000 Retained earrings 312.700 305.450 3 The company sold old equipment for $22,440 cash 7.250 Treasury shares (5000) 4 They company issued additional Ordinary Shares for cash. (5.000 5 Cash dividend declared and all paid during 2020. (calculate Total S03.100 891.950 the amount yourself) 6 Operating expenses include depreciation expense 533,560 and bad debt expense $850. Instructions: a. Prepare Statement of cash flows for the year ended December 31, 2020 ming direct method Operating activities start with Cash receptes from customer (20%). b. Prepare Statement of cash flows using indirect method (Operating activities only, starting with Net Income) (54)

i hope this picture better

i hope this picture better