Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i) If the project's after tax annual cash flows decrease by 20% lower than the one forecasted in (ii) throughout the project's life, how can

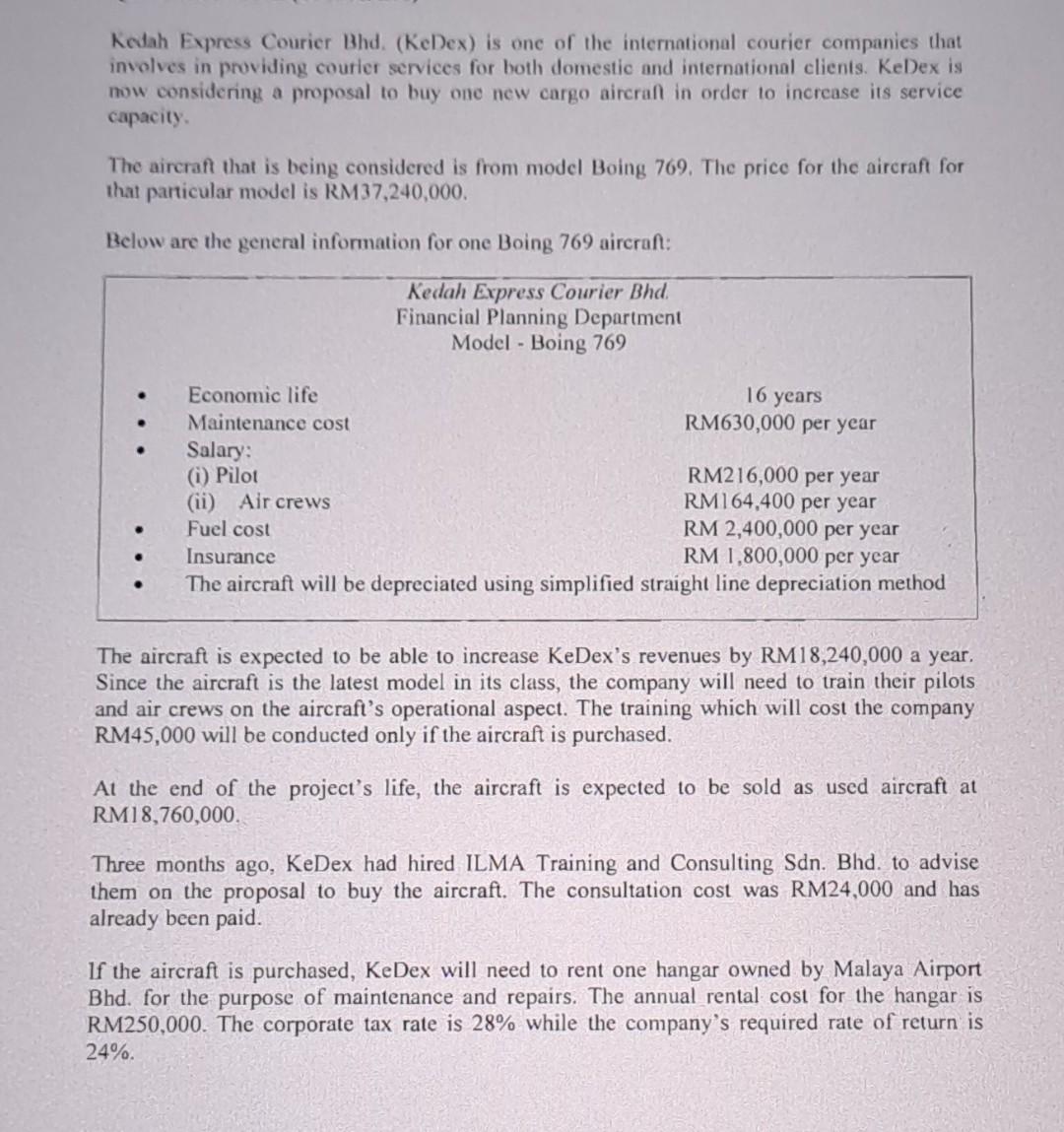

i) If the project's after tax annual cash flows decrease by 20% lower than the one forecasted in (ii) throughout the project's life, how can this scenario affect your decision in (v) ? (4 marks) A. Based on the information given, (i) calculate the project's total initial outlay. (2 marks) (ii) calculate the project's after tax annual cash flows. (6 marks) (iii) calculate the project's terminal cash flows. (4 marks) (iv) calculate the project's Net Present Value (NPV). (3 marks) (v) should the company proceed with the project? Explain your answer. Kedah Express Courier Bhd. (KeDex) is one of the international courier companies that involves in providing courier services for both domestic and international clients. KeDex is now considering a proposal to buy one new cargo aircraf in order to increase its service capacity. The aircraft that is being considered is from model Boing 769. The price for the aircraft for that particular model is RM 37,240,000. Below are the general information for one Boing 769 aircraft: The aircraft is expected to be able to increase KeDex's revenues by RM18,240,000 a year. Since the aircraft is the latest model in its class, the company will need to train their pilots and air crews on the aircraft's operational aspect. The training which will cost the company RM45,000 will be conducted only if the aircraft is purchased. At the end of the project's life, the aircraft is expected to be sold as used aircraft at RM18,760,000. Three months ago, KeDex had hired ILMA Training and Consulting Sdn. Bhd. to advise them on the proposal to buy the aircraft. The consultation cost was RM24,000 and has already been paid. If the aircraft is purchased, KeDex will need to rent one hangar owned by Malaya Airport Bhd. for the purpose of maintenance and repairs. The annual rental cost for the hangar is RM250,000. The corporate tax rate is 28% while the company's required rate of return is 24%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started