Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i) ii) iii) An Investment Analyst is predicting that Kesani Ltd will have a 25% per annum supernormal growth I the next two years.

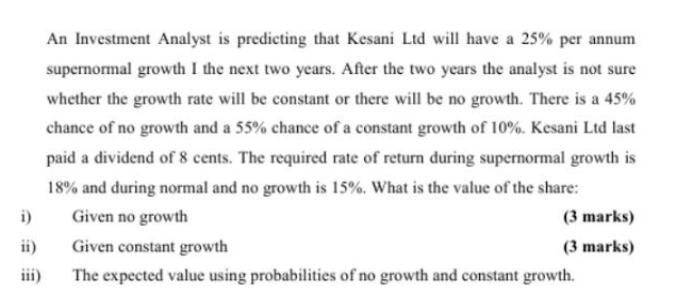

i) ii) iii) An Investment Analyst is predicting that Kesani Ltd will have a 25% per annum supernormal growth I the next two years. After the two years the analyst is not sure whether the growth rate will be constant or there will be no growth. There is a 45% chance of no growth and a 55% chance of a constant growth of 10%. Kesani Ltd last paid a dividend of 8 cents. The required rate of return during supernormal growth is 18% and during normal and no growth is 15%. What is the value of the share: Given no growth Given constant growth The expected value using probabilities of no growth and constant growth. (3 marks) (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the value of the share under different scenarios we can use the dividend discount model DDM The DDM calculates the present value of all future dividends Lets calculate the values ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started