Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I just have a question about assistance with the above question for homework. I don't really know what I am doing wrong. Is there anyone

I just have a question about assistance with the above question for homework. I don't really know what I am doing wrong.

Is there anyone that can step me through it or provide some sort of answer for it?

Thanks.

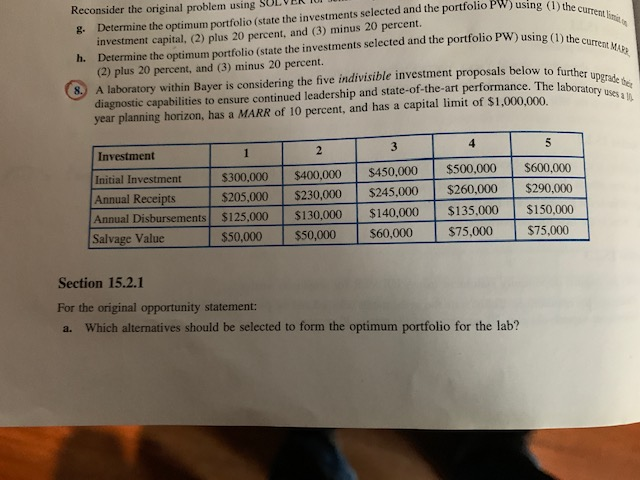

g us Reconsider the original problem using SULVER g. Determine the optimu (1) PW) the current limnitin ine the optimum portfolio (state the investments selected and the portfolio investment capital, (2) plus 20 percent, and (3) minus 20 percent. h. Determine the optimum portfolio (state the investments selected and the portfolio PW) using (1) the cu A laboratory within Bayer is considering the five indivisible investment proposals below to further u diagnostic capabilities to ensure continued leadership and state-of-the-art performance. The laborat year planning horizon, has a MARR of 10 percent, and has a capital limit of $1,000,000. (2) plus 20 percent, and (3) minus 20 percent. uses a l. Investment $300,000 $400,000 $450,000 $500,000 $600,000 $205,000$230,000 $245,000 $260,000 $290,000 Annual Disbursements $125,000 $130,000 $140,000 $135,000 $150,000 Initial Investment $75,000 $75,000 S50,000 $50,000 S60,000 Salvage Value Section 15.2.1 For the original opportunity statement: a. Which alternatives should be selected to form the optimum portfolio for the lab? shift afr In control option command 752 CHAPTER 15/ CAPITAL BUDGETING Section 15.2.3 Return to the original problem statement using SOLVER for sensitivity analysis: t limito g. Determine the optimum portfolio (state the investments selected and the portfolio PW) using (1) the current ind investment capital, (2) plus 20 percent, and (3) minus 20 percent. termine the optimum portfolio (state the investments selected and the portfolio PW) using (1) the u (2) plus 20 percent, and (3) minus 20 percent. g us Reconsider the original problem using SULVER g. Determine the optimu (1) PW) the current limnitin ine the optimum portfolio (state the investments selected and the portfolio investment capital, (2) plus 20 percent, and (3) minus 20 percent. h. Determine the optimum portfolio (state the investments selected and the portfolio PW) using (1) the cu A laboratory within Bayer is considering the five indivisible investment proposals below to further u diagnostic capabilities to ensure continued leadership and state-of-the-art performance. The laborat year planning horizon, has a MARR of 10 percent, and has a capital limit of $1,000,000. (2) plus 20 percent, and (3) minus 20 percent. uses a l. Investment $300,000 $400,000 $450,000 $500,000 $600,000 $205,000$230,000 $245,000 $260,000 $290,000 Annual Disbursements $125,000 $130,000 $140,000 $135,000 $150,000 Initial Investment $75,000 $75,000 S50,000 $50,000 S60,000 Salvage Value Section 15.2.1 For the original opportunity statement: a. Which alternatives should be selected to form the optimum portfolio for the lab? shift afr In control option command 752 CHAPTER 15/ CAPITAL BUDGETING Section 15.2.3 Return to the original problem statement using SOLVER for sensitivity analysis: t limito g. Determine the optimum portfolio (state the investments selected and the portfolio PW) using (1) the current ind investment capital, (2) plus 20 percent, and (3) minus 20 percent. termine the optimum portfolio (state the investments selected and the portfolio PW) using (1) the u (2) plus 20 percent, and (3) minus 20 percentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started