I just have no idea

I just have no idea

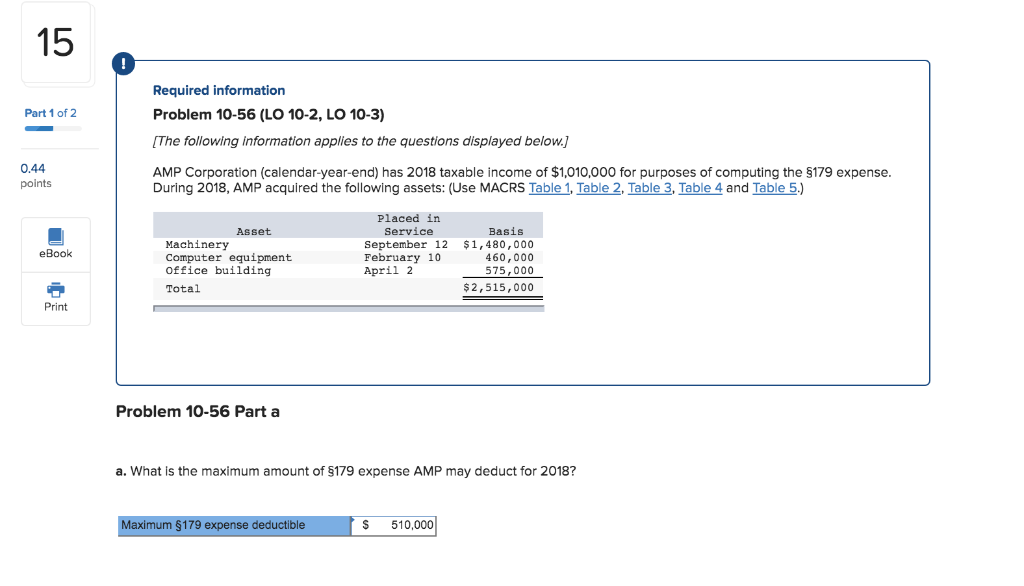

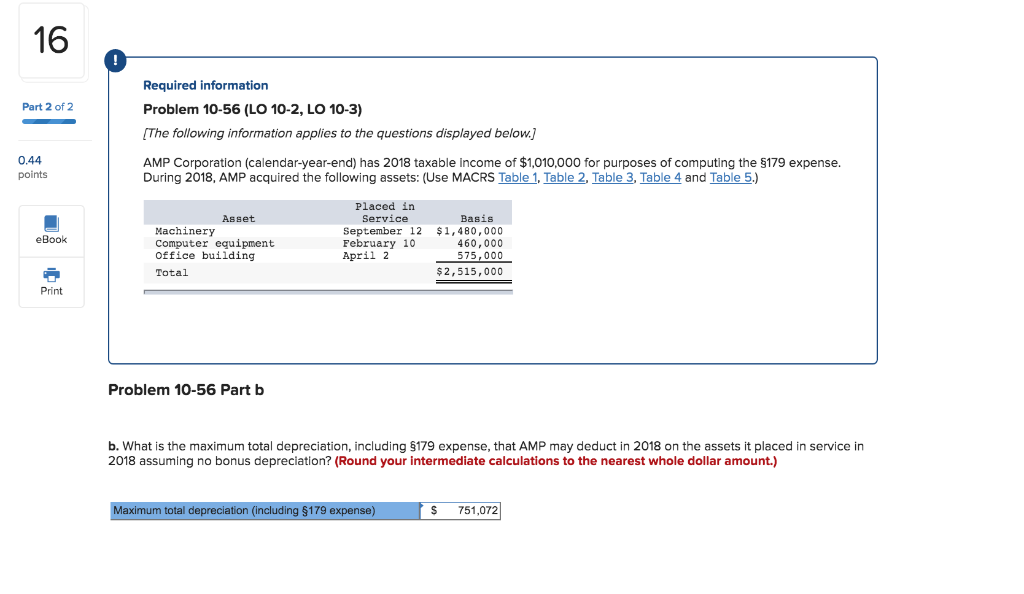

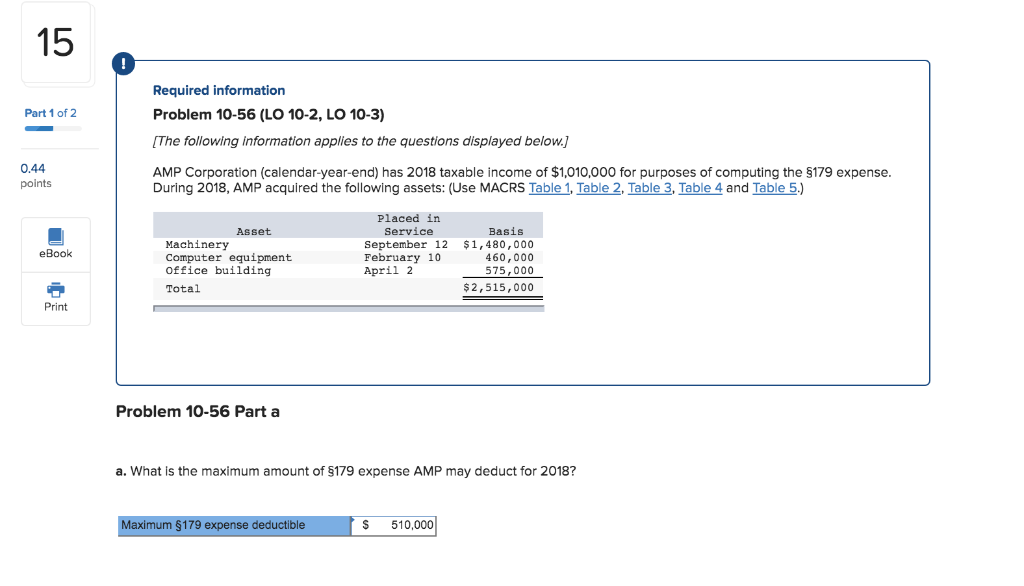

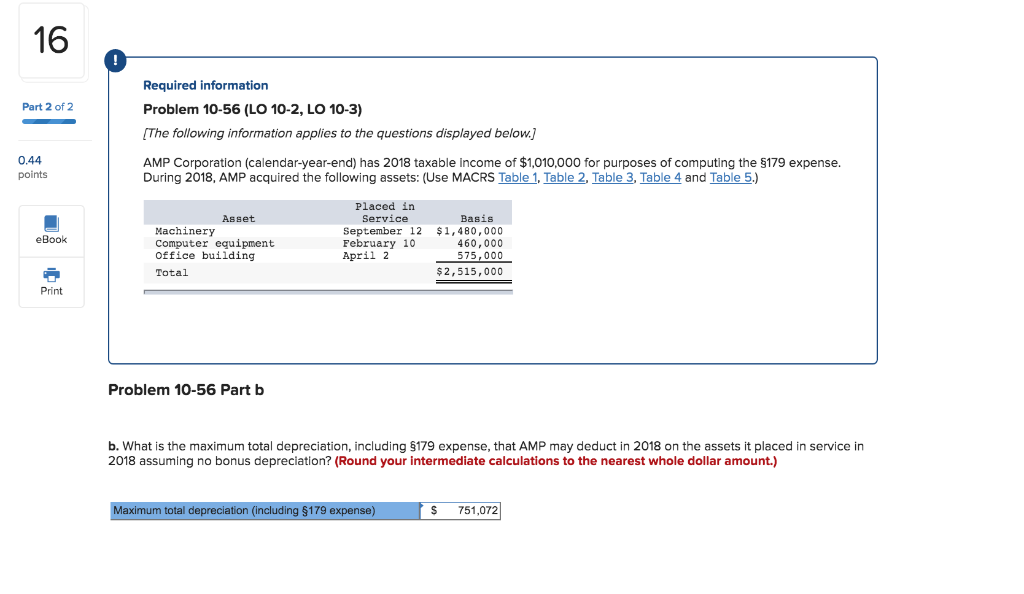

15 Required information Problem 10-56 (LO 10-2, LO 10-3) The following information applies to the questions displayed below. AMP Corporation (calendar-year-end) has 2018 taxable income of $1,010,000 for purposes of computing the 5179 expense Part 1 of2 0.44 points During 2018, AMP acquired the following assets: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) Placed in Asset Service Basis Machinery Computer equipment Office building Total September 12 $1,480,000 460,000 575,000 $2,515,000 eBook February 10 April 2 Print Problem 10-56 Part a a. What is the maximum amount of S179 expense AMP may deduct for 2018? $179 expense deductible S 510,000 16 Required information Problem 10-56 (LO 10-2, LO 10-3) [The following information applies to the questions displayed below. AMP Corporation (calendar-year-end) has 2018 taxable income of $1,010,000 for purposes of computing the 5179 expense Part 2 of2 0.44 points During 2018, AMP acquired the following assets: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) Placed in Asset Service Basis Machinery Computer equipment Office building September 12 $1,480,000 460,000 575,000 $2,515,000 eBook February 10 April 2 Total Print Problem 10-56 Part b b, what is the maximum total depreciation, including 179 expense, that AMP may deduct in 2018 on the assets it placed in service in 2018 assuming no bonus depreciation? Round your intermediate calculations to the nearest whole dollar amount.) ximum total depreciation ding $179 expense) S 751,072 15 Required information Problem 10-56 (LO 10-2, LO 10-3) The following information applies to the questions displayed below. AMP Corporation (calendar-year-end) has 2018 taxable income of $1,010,000 for purposes of computing the 5179 expense Part 1 of2 0.44 points During 2018, AMP acquired the following assets: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) Placed in Asset Service Basis Machinery Computer equipment Office building Total September 12 $1,480,000 460,000 575,000 $2,515,000 eBook February 10 April 2 Print Problem 10-56 Part a a. What is the maximum amount of S179 expense AMP may deduct for 2018? $179 expense deductible S 510,000 16 Required information Problem 10-56 (LO 10-2, LO 10-3) [The following information applies to the questions displayed below. AMP Corporation (calendar-year-end) has 2018 taxable income of $1,010,000 for purposes of computing the 5179 expense Part 2 of2 0.44 points During 2018, AMP acquired the following assets: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) Placed in Asset Service Basis Machinery Computer equipment Office building September 12 $1,480,000 460,000 575,000 $2,515,000 eBook February 10 April 2 Total Print Problem 10-56 Part b b, what is the maximum total depreciation, including 179 expense, that AMP may deduct in 2018 on the assets it placed in service in 2018 assuming no bonus depreciation? Round your intermediate calculations to the nearest whole dollar amount.) ximum total depreciation ding $179 expense) S 751,072

I just have no idea

I just have no idea