Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I just need a basic answer so that I can check mine and make sure I did this right. Thanks! Billy Bob's Bootery had the

I just need a basic answer so that I can check mine and make sure I did this right. Thanks!

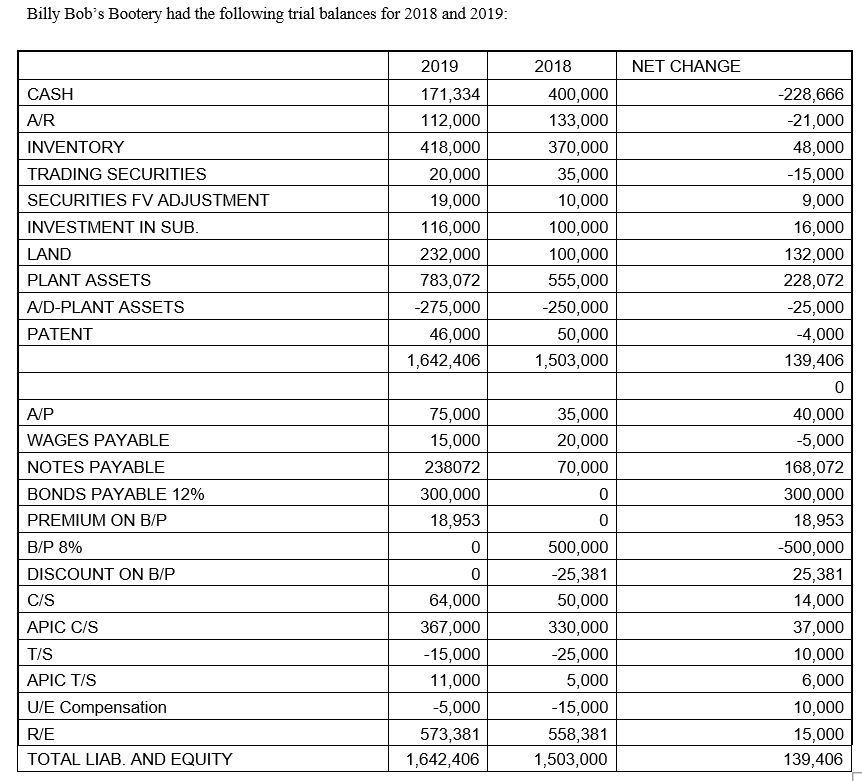

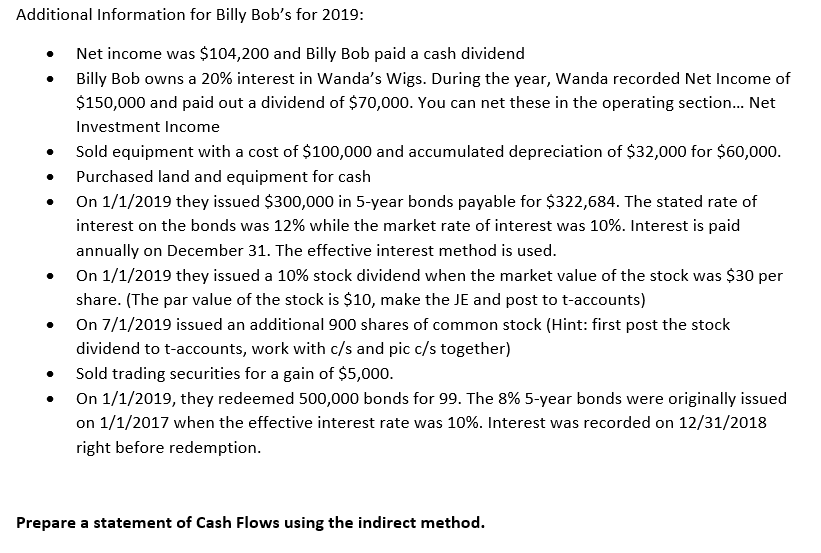

Billy Bob's Bootery had the following trial balances for 2018 and 2019: 2018 NET CHANGE CASH A/R INVENTORY TRADING SECURITIES SECURITIES FV ADJUSTMENT INVESTMENT IN SUB. LAND PLANT ASSETS A/D-PLANT ASSETS PATENT 2019 171,334 112,000 418,000 20,000 19,000 116,000 232,000 783,072 -275,000 46,000 1,642,406 400,000 133,000 370,000 35,000 10,000 100,000 100,000 555,000 -250,000 50,000 1,503,000 A/P WAGES PAYABLE NOTES PAYABLE BONDS PAYABLE 12% PREMIUM ON B/P B/P 8% DISCOUNT ON B/P C/S APIC C/S TIS APIC TIS U/E Compensation R/E TOTAL LIAB. AND EQUITY 75,000 15,000 238072 300,000 18,953 0 0 64,000 367,000 -15,000 11,000 -5,000 573,381 1,642,406 35,000 20,000 70,000 0 0 500,000 -25,381 50,000 330,000 -25,000 5,000 -15,000 558,381 1,503,000 -228,666 -21,000 48,000 -15,000 9,000 16,000 132,000 228,072 -25,000 -4,000 139,406 0 40,000 -5,000 168,072 300,000 18,953 -500,000 25,381 14,000 37,000 10,000 6,000 10,000 15,000 139,406 Additional Information for Billy Bob's for 2019: . . Net income was $104,200 and Billy Bob paid a cash dividend Billy Bob owns a 20% interest in Wanda's Wigs. During the year, Wanda recorded Net Income of $150,000 and paid out a dividend of $70,000. You can net these in the operating section... Net Investment Income Sold equipment with a cost of $100,000 and accumulated depreciation of $32,000 for $60,000. Purchased land and equipment for cash On 1/1/2019 they issued $300,000 in 5-year bonds payable for $322,684. The stated rate of interest on the bonds was 12% while the market rate of interest was 10%. Interest is paid annually on December 31. The effective interest method is used. On 1/1/2019 they issued a 10% stock dividend when the market value of the stock was $30 per share. (The par value of the stock is $10, make the JE and post to t-accounts) On 7/1/2019 issued an additional 900 shares of common stock (Hint: first post the stock dividend to t-accounts, work with c/s and pic c/s together) Sold trading securities for a gain of $5,000. On 1/1/2019, they redeemed 500,000 bonds for 99. The 8% 5-year bonds were originally issued on 1/1/2017 when the effective interest rate was 10%. Interest was recorded on 12/31/2018 right before redemption. Prepare a statement of Cash Flows using the indirect methodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started