I just need an answer for part B. Thank you

I just need an answer for part B. Thank you

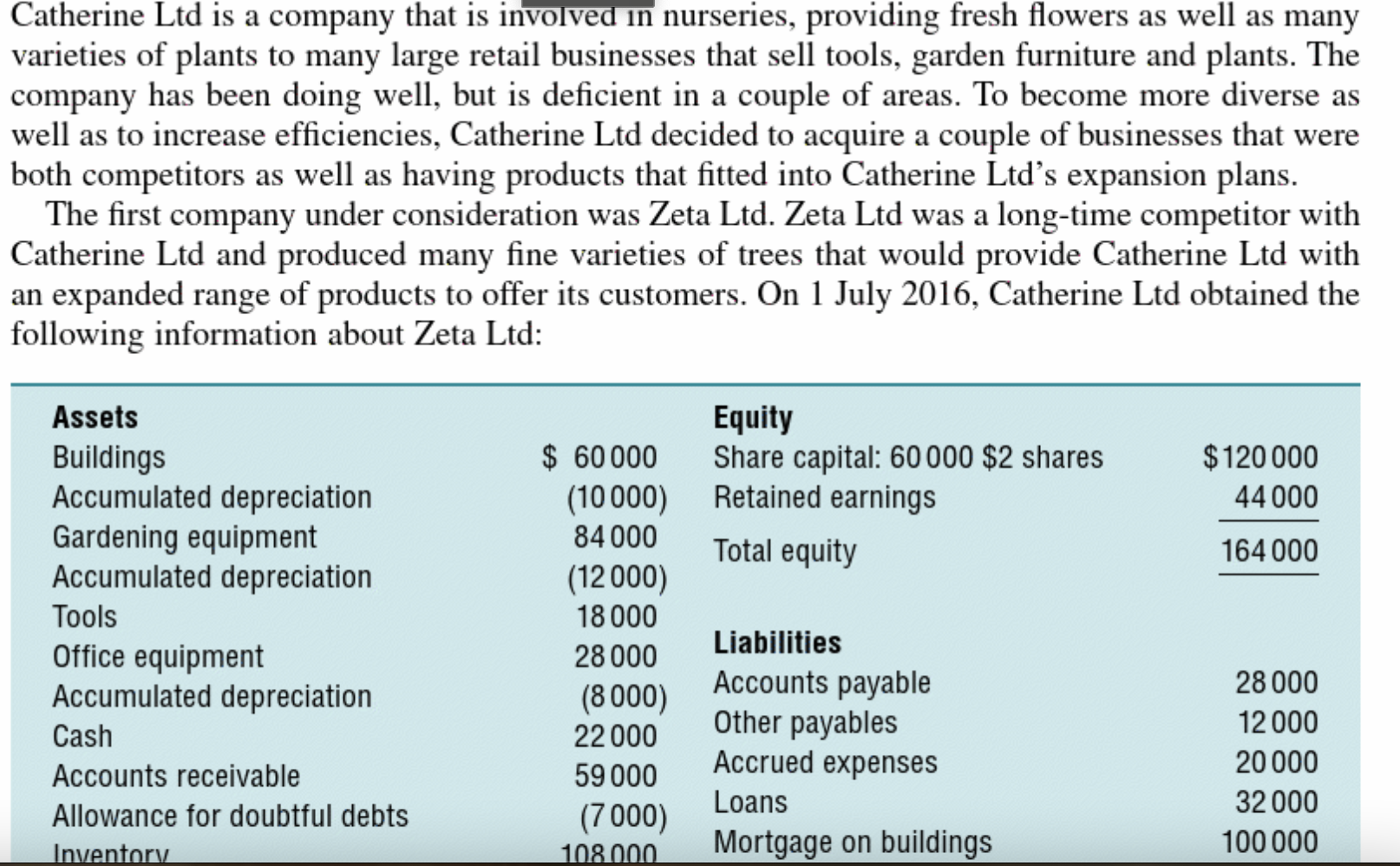

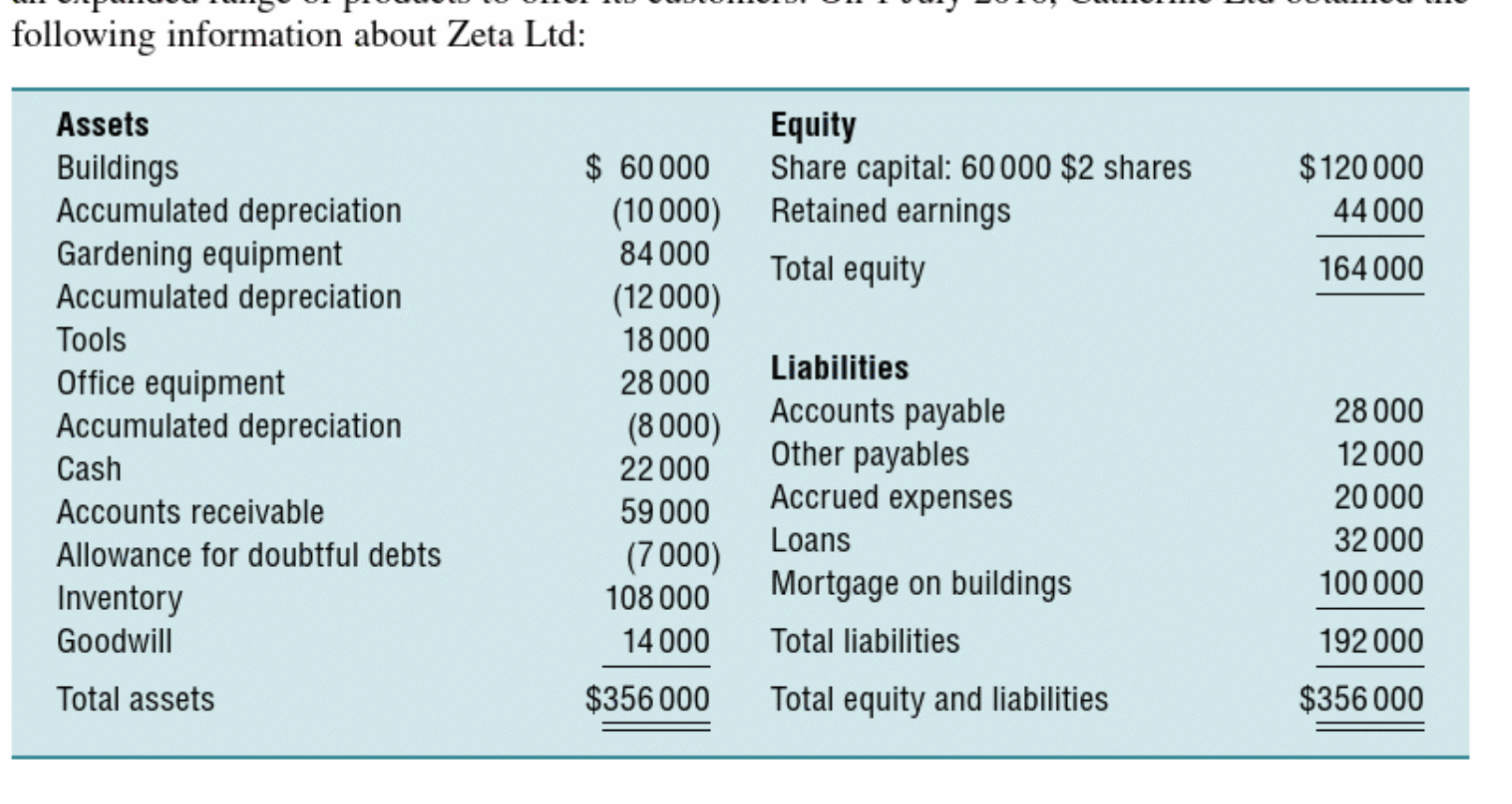

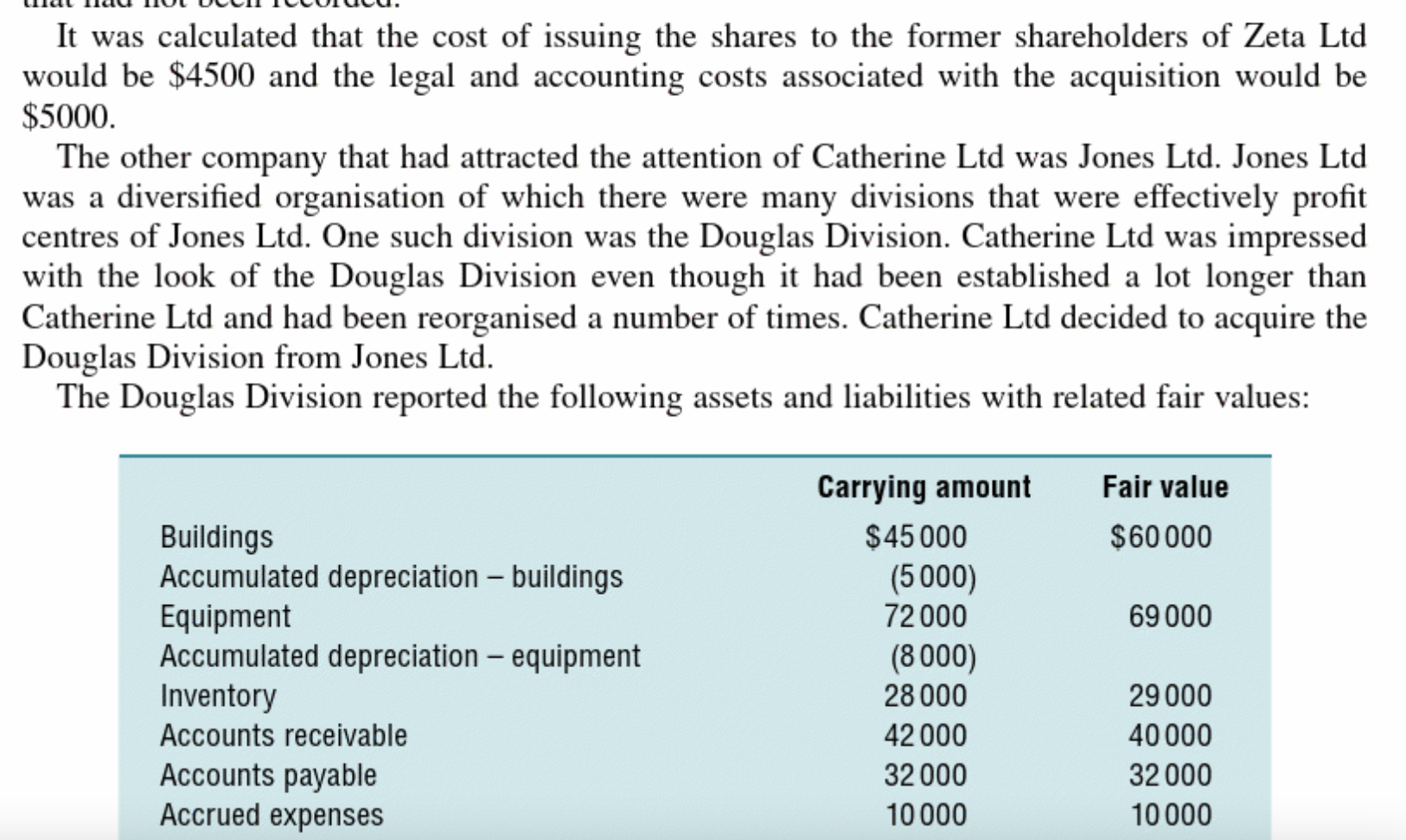

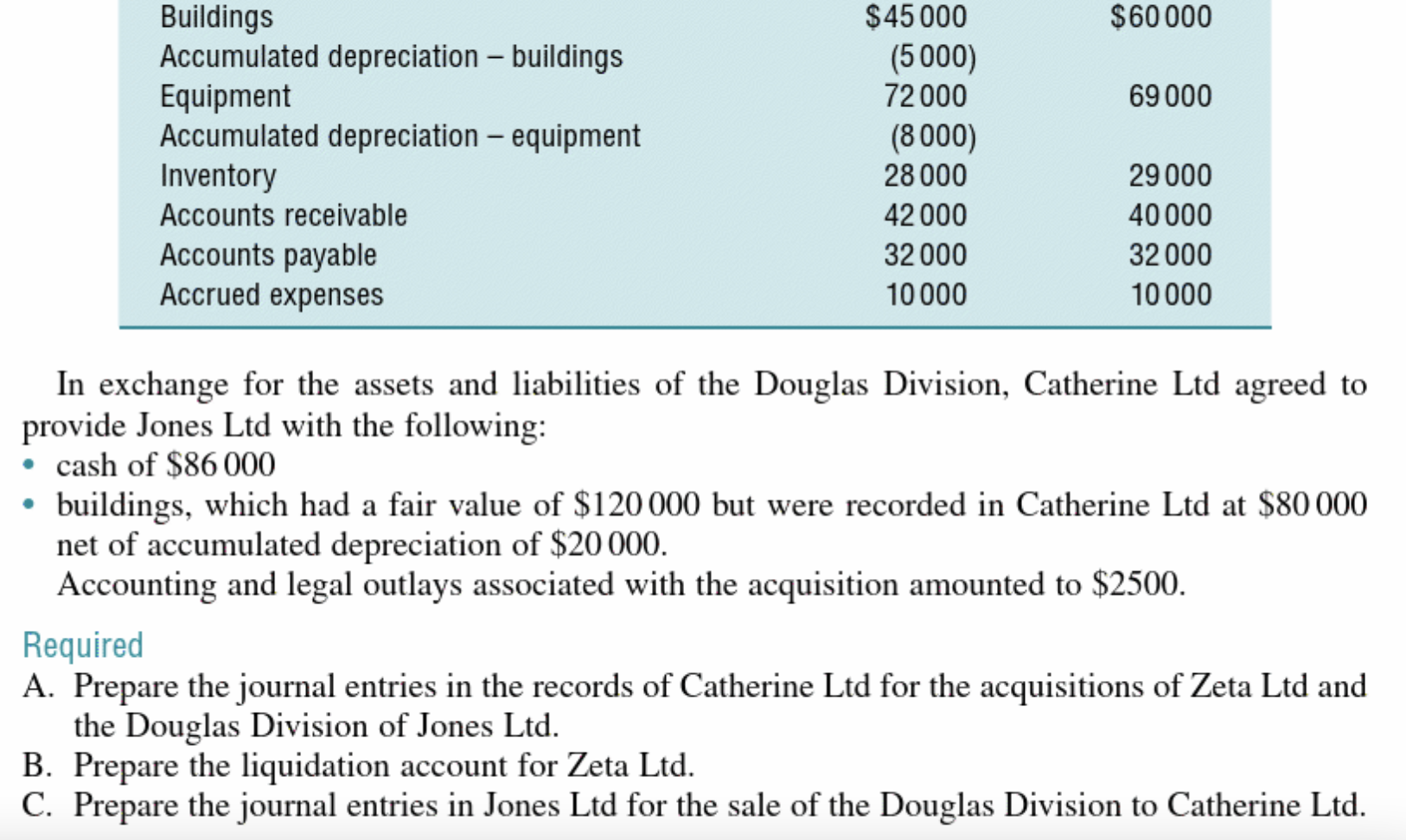

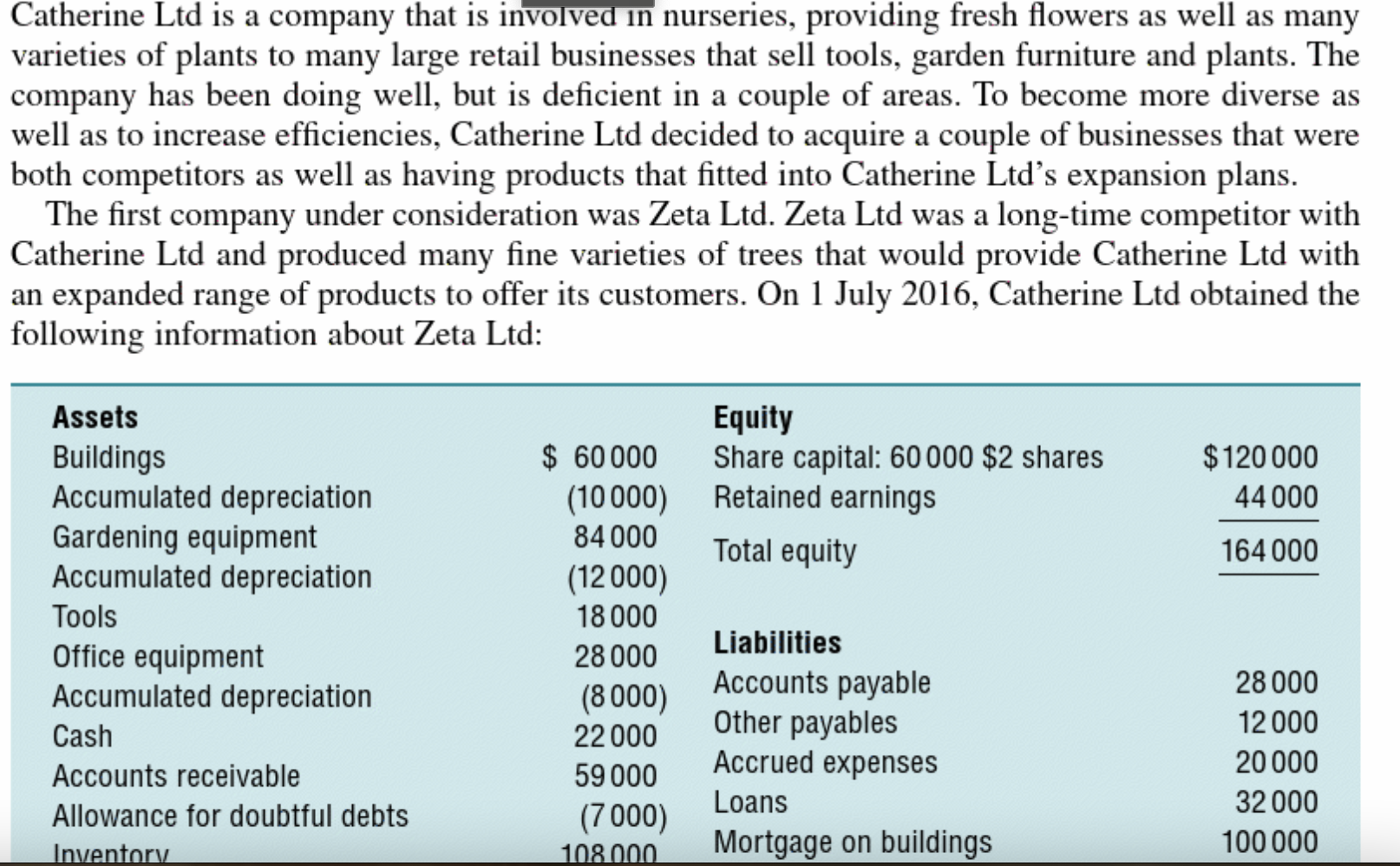

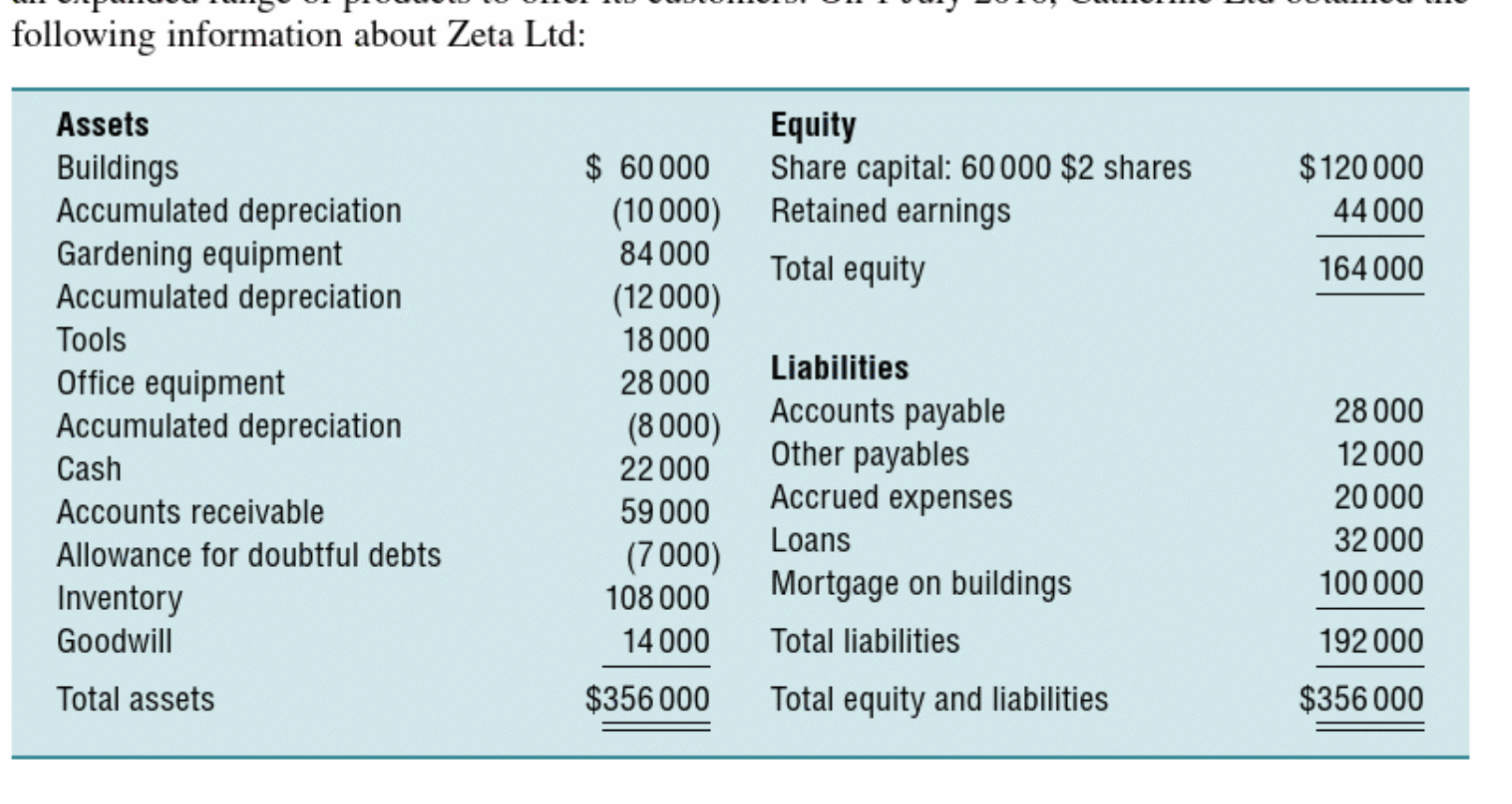

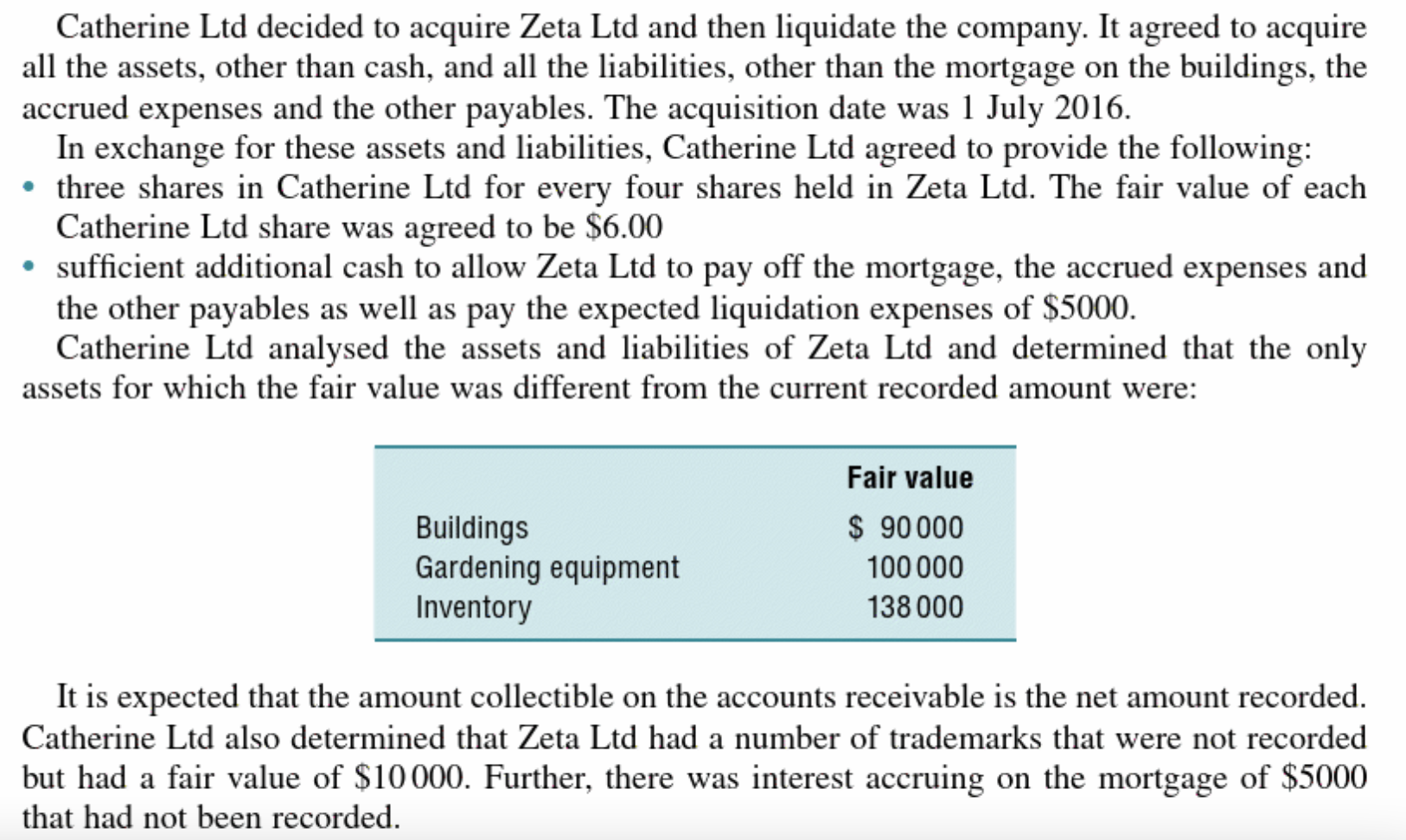

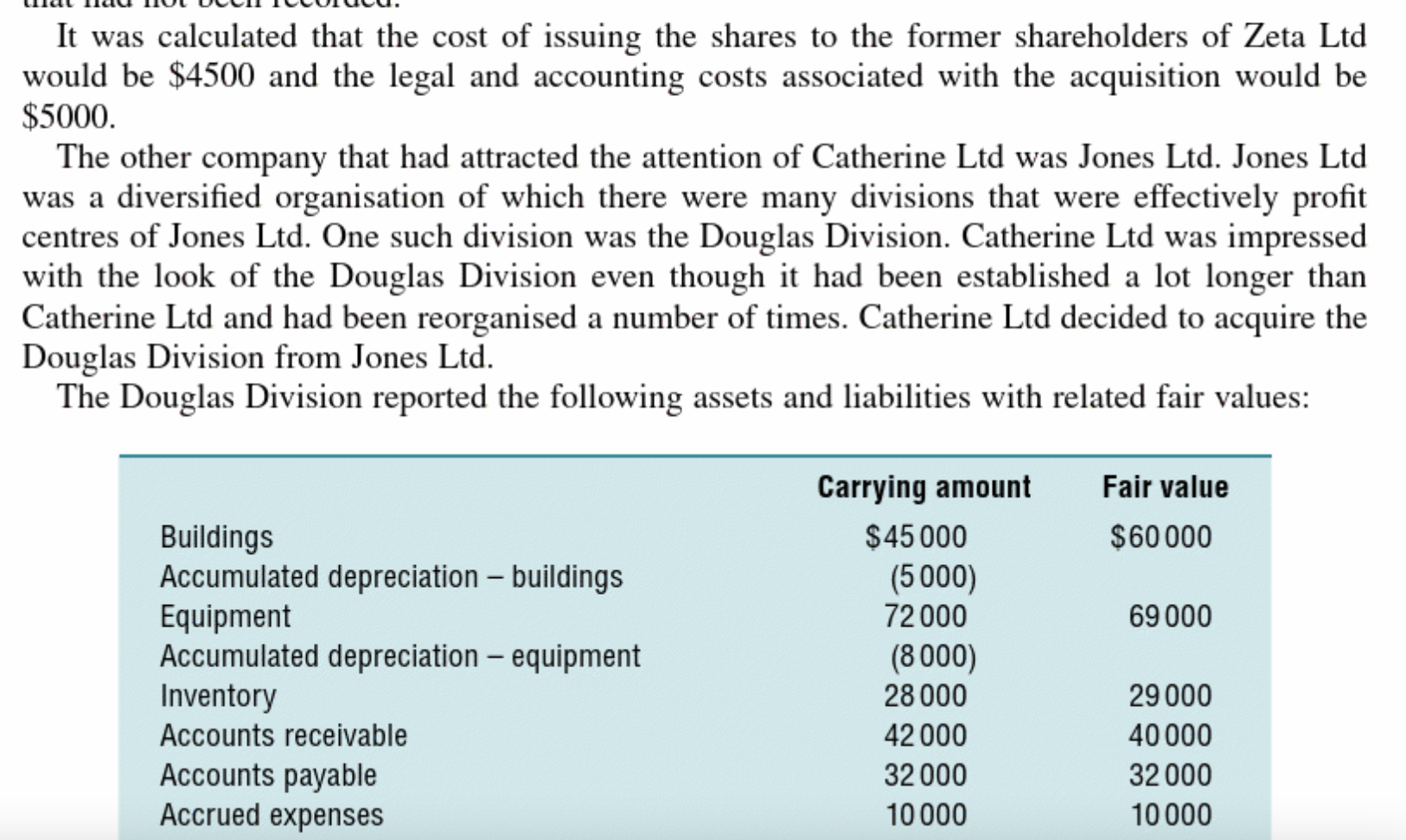

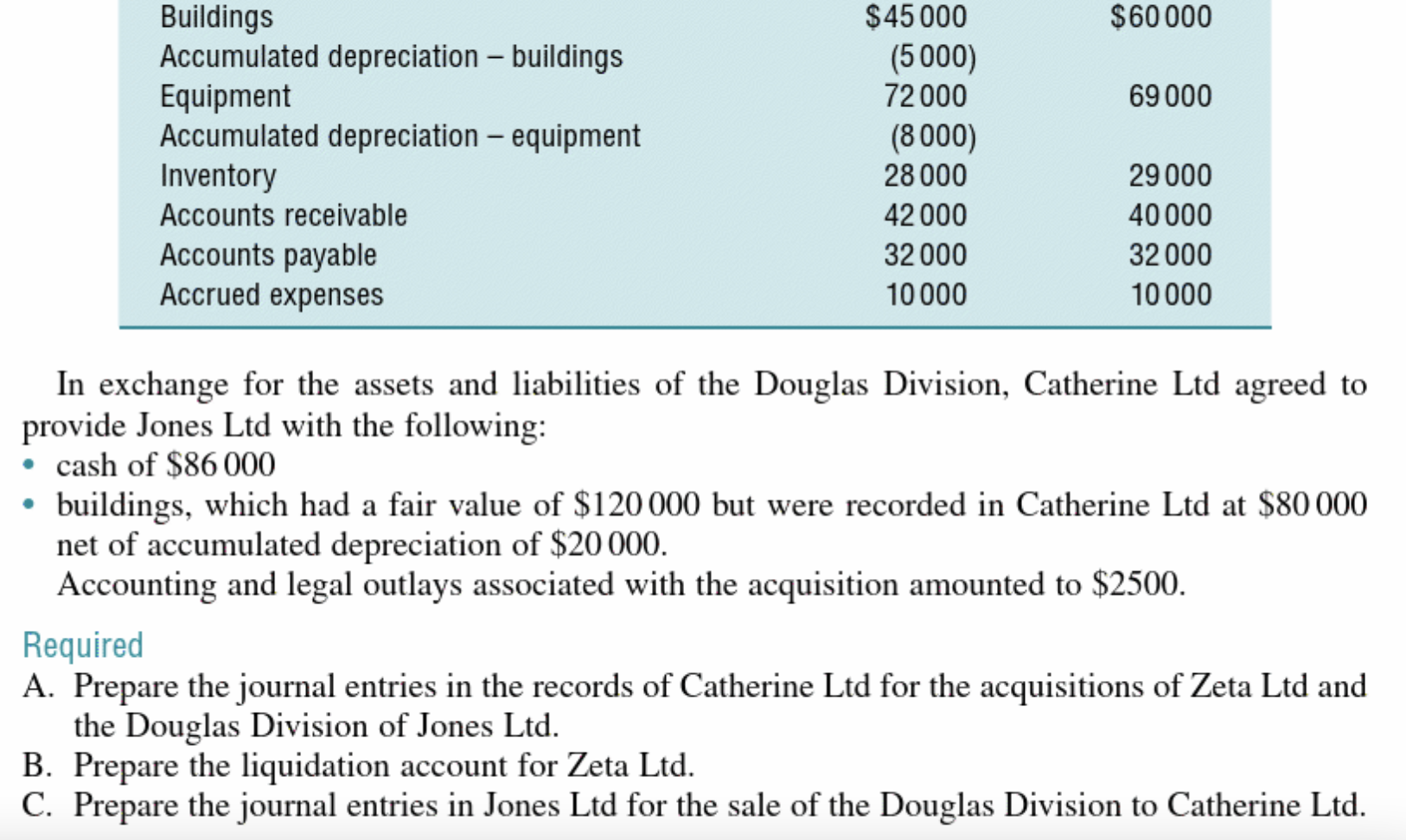

Catherine Ltd is a company that is involved in nurseries, providing fresh flowers as well as many varieties of plants to many large retail businesses that sell tools, garden furniture and plants. The company has been doing well, but is deficient in a couple of areas. To become more diverse as well as to increase efficiencies, Catherine Ltd decided to acquire a couple of businesses that were both competitors as well as having products that fitted into Catherine Ltd's expansion plans. The first company under consideration was Zeta Ltd. Zeta Ltd was a long-time competitor with Catherine Ltd and produced many fine varieties of trees that would provide Catherine Ltd with an expanded range of products to offer its customers. On 1 July 2016, Catherine Ltd obtained the following information about Zeta Ltd: Equity Share capital: 60 000 $2 shares Retained earnings Total equity $120 000 44000 164 000 Assets Buildings Accumulated depreciation Gardening equipment Accumulated depreciation Tools Office equipment Accumulated depreciation Cash Accounts receivable Allowance for doubtful debts Inventory $ 60 000 (10 000) 84000 (12 000) 18 000 28 000 (8 000) 22 000 59000 (7000) 108.000 Liabilities Accounts payable Other payables Accrued expenses Loans Mortgage on buildings 28 000 12 000 20 000 32 000 100 000 following information about Zeta Ltd: Equity Share capital: 60 000 $2 shares Retained earnings Total equity $120 000 44000 164 000 Assets Buildings Accumulated depreciation Gardening equipment Accumulated depreciation Tools Office equipment Accumulated depreciation Cash Accounts receivable Allowance for doubtful debts Inventory Goodwill $ 60 000 (10 000) 84000 (12000) 18 000 28 000 (8 000) 22000 59 000 (7000) 108 000 14000 Liabilities Accounts payable Other payables Accrued expenses Loans Mortgage on buildings Total liabilities Total equity and liabilities 28 000 12 000 20 000 32 000 100 000 192 000 Total assets $356 000 $356 000 Catherine Ltd decided to acquire Zeta Ltd and then liquidate the company. It agreed to acquire all the assets, other than cash, and all the liabilities, other than the mortgage on the buildings, the accrued expenses and the other payables. The acquisition date was 1 July 2016. In exchange for these assets and liabilities, Catherine Ltd agreed to provide the following: three shares in Catherine Ltd for every four shares held in Zeta Ltd. The fair value of each Catherine Ltd share was agreed to be $6.00 sufficient additional cash to allow Zeta Ltd to pay off the mortgage, the accrued expenses and the other payables as well as pay the expected liquidation expenses of $5000. Catherine Ltd analysed the assets and liabilities of Zeta Ltd and determined that the only assets for which the fair value was different from the current recorded amount were: Buildings Gardening equipment Inventory Fair value $ 90 000 100 000 138 000 It is expected that the amount collectible on the accounts receivable is the net amount recorded. Catherine Ltd also determined that Zeta Ltd had a number of trademarks that were not recorded but had a fair value of $10000. Further, there was interest accruing on the mortgage of $5000 that had not been recorded. It was calculated that the cost of issuing the shares to the former shareholders of Zeta Ltd would be $4500 and the legal and accounting costs associated with the acquisition would be $5000. The other company that had attracted the attention of Catherine Ltd was Jones Ltd. Jones Ltd was a diversified organisation of which there were many divisions that were effectively profit centres of Jones Ltd. One such division was the Douglas Division. Catherine Ltd was impressed with the look of the Douglas Division even though it had been established a lot longer than Catherine Ltd and had been reorganised a number of times. Catherine Ltd decided to acquire the Douglas Division from Jones Ltd. The Douglas Division reported the following assets and liabilities with related fair values: Fair value $60000 69 000 Buildings Accumulated depreciation - buildings Equipment Accumulated depreciation - equipment Inventory Accounts receivable Accounts payable Accrued expenses Carrying amount $45000 (5000) 72 000 (8000) 28 000 42 000 32 000 10 000 29 000 40 000 32 000 10 000 $60 000 69 000 Buildings Accumulated depreciation - buildings Equipment Accumulated depreciation - equipment Inventory Accounts receivable Accounts payable Accrued expenses $45 000 (5000) 72 000 (8000) 28 000 42 000 32 000 10 000 29000 40 000 32 000 10 000 In exchange for the assets and liabilities of the Douglas Division, Catherine Ltd agreed to provide Jones Ltd with the following: cash of $86 000 buildings, which had a fair value of $120 000 but were recorded in Catherine Ltd at $80000 net of accumulated depreciation of $20 000. Accounting and legal outlays associated with the acquisition amounted to $2500. Required A. Prepare the journal entries in the records of Catherine Ltd for the acquisitions of Zeta Ltd and the Douglas Division of Jones Ltd. B. Prepare the liquidation account for Zeta Ltd. C. Prepare the journal entries in Jones Ltd for the sale of the Douglas Division to Catherine Ltd. Catherine Ltd is a company that is involved in nurseries, providing fresh flowers as well as many varieties of plants to many large retail businesses that sell tools, garden furniture and plants. The company has been doing well, but is deficient in a couple of areas. To become more diverse as well as to increase efficiencies, Catherine Ltd decided to acquire a couple of businesses that were both competitors as well as having products that fitted into Catherine Ltd's expansion plans. The first company under consideration was Zeta Ltd. Zeta Ltd was a long-time competitor with Catherine Ltd and produced many fine varieties of trees that would provide Catherine Ltd with an expanded range of products to offer its customers. On 1 July 2016, Catherine Ltd obtained the following information about Zeta Ltd: Equity Share capital: 60 000 $2 shares Retained earnings Total equity $120 000 44000 164 000 Assets Buildings Accumulated depreciation Gardening equipment Accumulated depreciation Tools Office equipment Accumulated depreciation Cash Accounts receivable Allowance for doubtful debts Inventory $ 60 000 (10 000) 84000 (12 000) 18 000 28 000 (8 000) 22 000 59000 (7000) 108.000 Liabilities Accounts payable Other payables Accrued expenses Loans Mortgage on buildings 28 000 12 000 20 000 32 000 100 000 following information about Zeta Ltd: Equity Share capital: 60 000 $2 shares Retained earnings Total equity $120 000 44000 164 000 Assets Buildings Accumulated depreciation Gardening equipment Accumulated depreciation Tools Office equipment Accumulated depreciation Cash Accounts receivable Allowance for doubtful debts Inventory Goodwill $ 60 000 (10 000) 84000 (12000) 18 000 28 000 (8 000) 22000 59 000 (7000) 108 000 14000 Liabilities Accounts payable Other payables Accrued expenses Loans Mortgage on buildings Total liabilities Total equity and liabilities 28 000 12 000 20 000 32 000 100 000 192 000 Total assets $356 000 $356 000 Catherine Ltd decided to acquire Zeta Ltd and then liquidate the company. It agreed to acquire all the assets, other than cash, and all the liabilities, other than the mortgage on the buildings, the accrued expenses and the other payables. The acquisition date was 1 July 2016. In exchange for these assets and liabilities, Catherine Ltd agreed to provide the following: three shares in Catherine Ltd for every four shares held in Zeta Ltd. The fair value of each Catherine Ltd share was agreed to be $6.00 sufficient additional cash to allow Zeta Ltd to pay off the mortgage, the accrued expenses and the other payables as well as pay the expected liquidation expenses of $5000. Catherine Ltd analysed the assets and liabilities of Zeta Ltd and determined that the only assets for which the fair value was different from the current recorded amount were: Buildings Gardening equipment Inventory Fair value $ 90 000 100 000 138 000 It is expected that the amount collectible on the accounts receivable is the net amount recorded. Catherine Ltd also determined that Zeta Ltd had a number of trademarks that were not recorded but had a fair value of $10000. Further, there was interest accruing on the mortgage of $5000 that had not been recorded. It was calculated that the cost of issuing the shares to the former shareholders of Zeta Ltd would be $4500 and the legal and accounting costs associated with the acquisition would be $5000. The other company that had attracted the attention of Catherine Ltd was Jones Ltd. Jones Ltd was a diversified organisation of which there were many divisions that were effectively profit centres of Jones Ltd. One such division was the Douglas Division. Catherine Ltd was impressed with the look of the Douglas Division even though it had been established a lot longer than Catherine Ltd and had been reorganised a number of times. Catherine Ltd decided to acquire the Douglas Division from Jones Ltd. The Douglas Division reported the following assets and liabilities with related fair values: Fair value $60000 69 000 Buildings Accumulated depreciation - buildings Equipment Accumulated depreciation - equipment Inventory Accounts receivable Accounts payable Accrued expenses Carrying amount $45000 (5000) 72 000 (8000) 28 000 42 000 32 000 10 000 29 000 40 000 32 000 10 000 $60 000 69 000 Buildings Accumulated depreciation - buildings Equipment Accumulated depreciation - equipment Inventory Accounts receivable Accounts payable Accrued expenses $45 000 (5000) 72 000 (8000) 28 000 42 000 32 000 10 000 29000 40 000 32 000 10 000 In exchange for the assets and liabilities of the Douglas Division, Catherine Ltd agreed to provide Jones Ltd with the following: cash of $86 000 buildings, which had a fair value of $120 000 but were recorded in Catherine Ltd at $80000 net of accumulated depreciation of $20 000. Accounting and legal outlays associated with the acquisition amounted to $2500. Required A. Prepare the journal entries in the records of Catherine Ltd for the acquisitions of Zeta Ltd and the Douglas Division of Jones Ltd. B. Prepare the liquidation account for Zeta Ltd. C. Prepare the journal entries in Jones Ltd for the sale of the Douglas Division to Catherine Ltd

I just need an answer for part B. Thank you

I just need an answer for part B. Thank you