I just need an answer for question # 1 and #5

full question is in the following pictures, kindly help me with the answers dor #1 and 5.

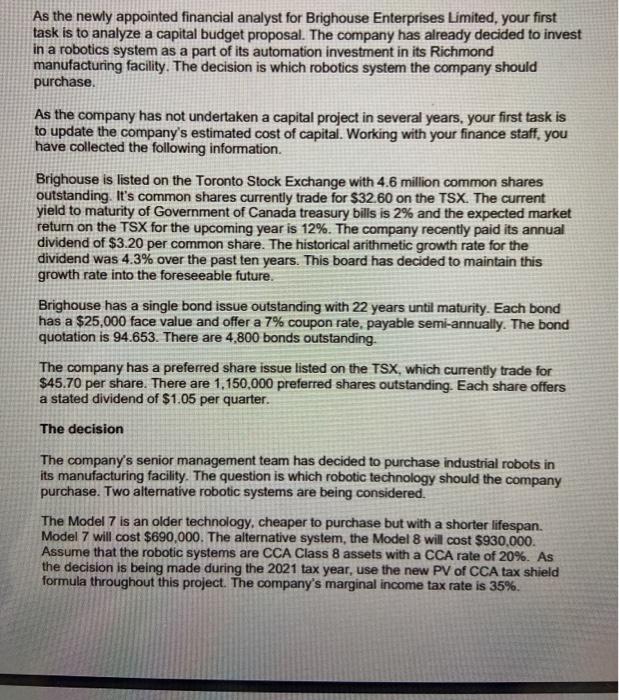

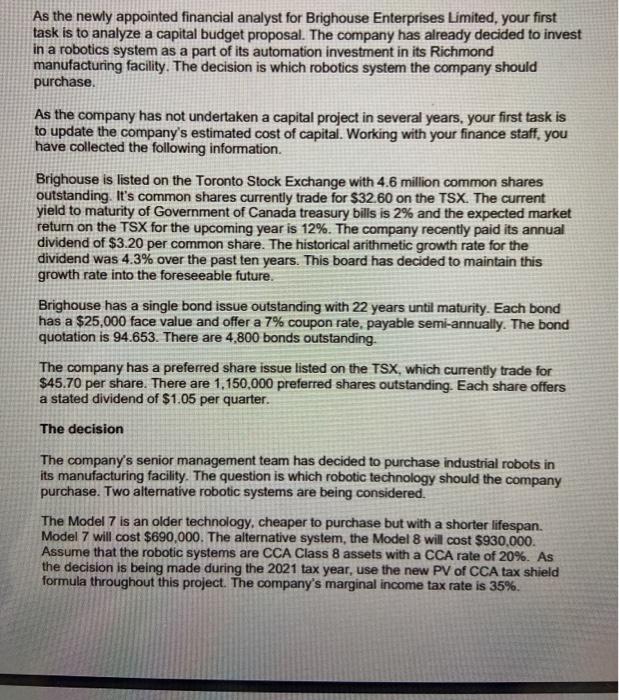

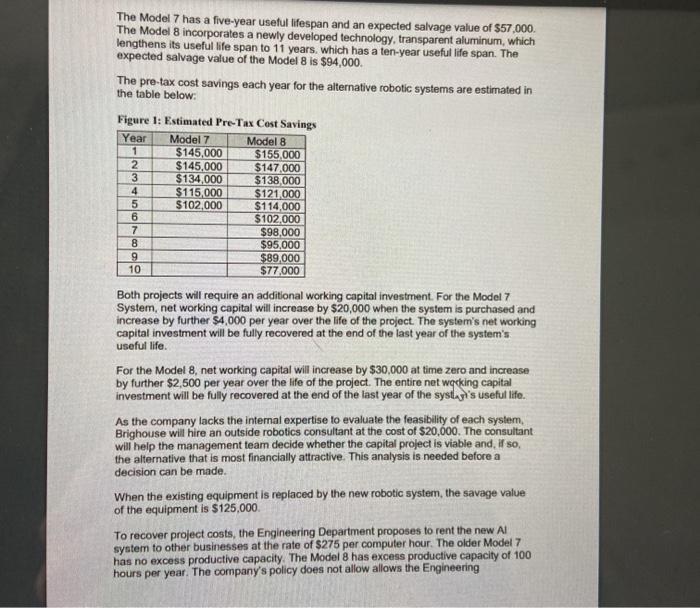

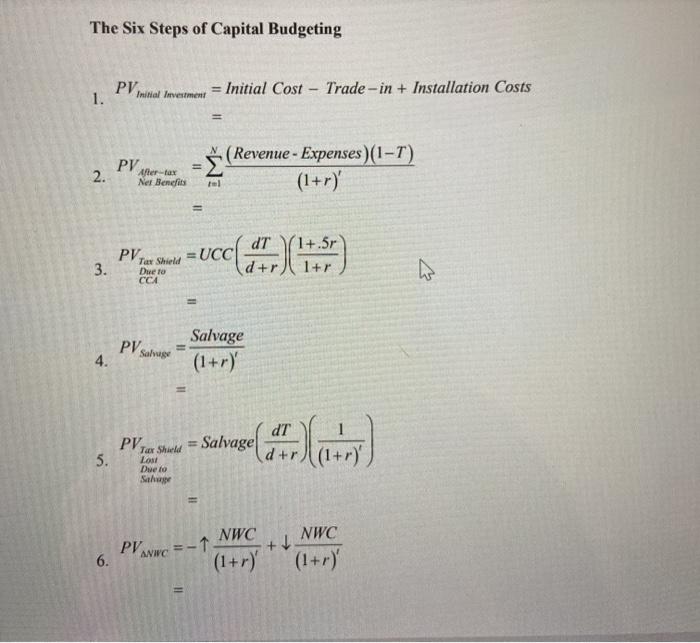

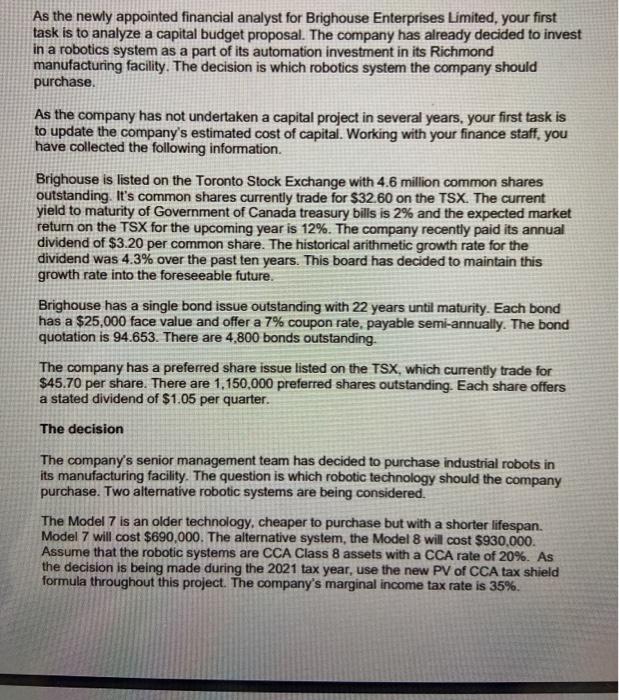

The Sporting --- www.es As the newly appointed financial analyst for Brighouse Enterprises Limited, your first task is to analyze a capital budget proposal . The company has already decided to invest in a robotics system as a part of its automation investment in its Richmond manufacturing facility. The decision is which robotics system the company should purchase. As the company has not undertaken a capital project in several years, your first task is to update the company's estimated cost of capital. Working with your finance staff, you have collected the following information. Brighouse is listed on the Toronto Stock Exchange with 4.6 million common shares outstanding. It's common shares currently trade for $32.60 on the TSX. The current yield to maturity of Government of Canada treasury bills is 2% and the expected market return on the TSX for the upcoming year is 12%. The company recently paid its annual dividend of $3.20 per common share. The historical arithmetic growth rate for the dividend was 4.3% over the past ten years. This board has decided to maintain this growth rate into the foreseeable future. Brighouse has a single bond issue outstanding with 22 years until maturity. Each bond has a $25,000 face value and offer a 7% coupon rate, payable semi-annually. The bond quotation is 94.653. There are 4,800 bonds outstanding. The company has a preferred share issue listed on the TSX, which currently trade for $45.70 per share. There are 1,150,000 preferred shares outstanding. Each share offers a stated dividend of $1.05 per quarter. The decision The company's senior management team has decided to purchase industrial robots in its manufacturing facility. The question is which robotic technology should the company purchase. Two alternative robotic systems are being considered. The Model 7 is an older technology, cheaper to purchase but with a shorter lifespan. Model 7 will cost $690,000. The alternative system, the Model 8 will cost $930,000. Assume that the robotic systems are CCA Class 8 assets with a CCA rate of 20%. As the decision is being made during the 2021 tax year, use the new PV of CCA tax shield formula throughout this project. The company's marginal income tax rate is 35%. The Model 7 has a five-year useful lifespan and an expected salvage value of $57.000 The Model 8 incorporates a newly developed technology, transparent aluminum, which lengthens its useful life span to 11 years, which has a ten-year useful life span. The expected salvage value of the Model 8 is $94,000 The pre-tax cost savings each year for the alternative robotic systems are estimated in the table below: Figure 1: Estimated Pre-Tax Cost Savings Year Model 7 Model 8 $145,000 $155,000 $145,000 $147 000 $134,000 $138.000 $115,000 $121 000 5 $102,000 $114,000 $102.000 7 $98,000 8 $95,000 $89.000 10 $77,000 1 2 3 4 6 9 Both projects will require an additional working capital investment. For the Model 7 System, net working capital will increase by $20,000 when the system is purchased and increase by further $4,000 per year over the life of the project. The system's networking capital investment will be fully recovered at the end of the last year of the system's useful life. For the Model 8, net working capital will increase by $30,000 at time zero and increase by further $2,500 per year over the life of the project. The entire net wgeking capital investment will be fully recovered at the end of the last year of the systal's useful life. As the company lacks the internal expertise to evaluate the feasibility of each system, Brighouse will hire an outside robotics consultant at the cost of $20,000. The consultant will help the management team decide whether the capital project is viable and if so, the alternative that is most financially attractive. This analysis is needed before a decision can be made. When the existing equipment is replaced by the new robotic system, the savage value of the equipment is $125,000 To recover project costs, the Engineering Department proposes to rent the new Al system to other businesses at the rate of $275 per computer hour. The older Model 7 has no excess productive capacity. The Model 8 has excess productive capacity of 100 hours per year. The company's policy does not allow allows the Engineering Department to rent spare capacity of its equipment to outside companies for competitive reasons. As the financial analyst, you are required to draft a comprehensive memo, addressed to the Chief Operations Officer, answering the following questions: 1. What is the weighted average cost of capital for the company (e.g. the discount rate used for analyzing the budget proposals)? 2. How you would account for the $20,000 payment to the Consultant? Why? Be specific 3. How would you account for the salvage cost of the existing equipment? Why? Be specific 4. How you would account for the $275 per hour charged by the Engineering department? Why? Be specific. 5. Calculate the NPV of each alternative using the six steps of capital budgeting and the cost savings shown in Figure 1 above. Attach the spreadsheet that you used to solve for NPV as a separate file attachment. 6. Which alternative would you recommend? Attach the spreadsheet that you used to solve for NPV as a separate file attachment. Be specific and provide an explanation for you answer. 7. The COO is concerned that new technology might make the Al system obsolete after four years. If this occurs and you only obtain four years of cost savings (as per Figure 1 above), which alternative (if any), would you now recommend? Assume that either system has zero salvage value at the end of their useful lives. The Six Steps of Capital Budgeting PV 1. Initial Investment = Initial Cost Trade-in + Installation Costs PV After-tax Nel Benefits (Revenue - Expenses)(1-T) (1+r)' 2. (1+.5r PV Tax Shield CCA cc.) ( 42 d . der Due to PV Salva Salvage (1+r) 4. dT Tax Shield = Salvage dtr PV Lost Due to Shige 5. NWC PV ANWC -1 + NWC (1+r) 6. = The Sporting --- www.es As the newly appointed financial analyst for Brighouse Enterprises Limited, your first task is to analyze a capital budget proposal . The company has already decided to invest in a robotics system as a part of its automation investment in its Richmond manufacturing facility. The decision is which robotics system the company should purchase. As the company has not undertaken a capital project in several years, your first task is to update the company's estimated cost of capital. Working with your finance staff, you have collected the following information. Brighouse is listed on the Toronto Stock Exchange with 4.6 million common shares outstanding. It's common shares currently trade for $32.60 on the TSX. The current yield to maturity of Government of Canada treasury bills is 2% and the expected market return on the TSX for the upcoming year is 12%. The company recently paid its annual dividend of $3.20 per common share. The historical arithmetic growth rate for the dividend was 4.3% over the past ten years. This board has decided to maintain this growth rate into the foreseeable future. Brighouse has a single bond issue outstanding with 22 years until maturity. Each bond has a $25,000 face value and offer a 7% coupon rate, payable semi-annually. The bond quotation is 94.653. There are 4,800 bonds outstanding. The company has a preferred share issue listed on the TSX, which currently trade for $45.70 per share. There are 1,150,000 preferred shares outstanding. Each share offers a stated dividend of $1.05 per quarter. The decision The company's senior management team has decided to purchase industrial robots in its manufacturing facility. The question is which robotic technology should the company purchase. Two alternative robotic systems are being considered. The Model 7 is an older technology, cheaper to purchase but with a shorter lifespan. Model 7 will cost $690,000. The alternative system, the Model 8 will cost $930,000. Assume that the robotic systems are CCA Class 8 assets with a CCA rate of 20%. As the decision is being made during the 2021 tax year, use the new PV of CCA tax shield formula throughout this project. The company's marginal income tax rate is 35%. The Model 7 has a five-year useful lifespan and an expected salvage value of $57.000 The Model 8 incorporates a newly developed technology, transparent aluminum, which lengthens its useful life span to 11 years, which has a ten-year useful life span. The expected salvage value of the Model 8 is $94,000 The pre-tax cost savings each year for the alternative robotic systems are estimated in the table below: Figure 1: Estimated Pre-Tax Cost Savings Year Model 7 Model 8 $145,000 $155,000 $145,000 $147 000 $134,000 $138.000 $115,000 $121 000 5 $102,000 $114,000 $102.000 7 $98,000 8 $95,000 $89.000 10 $77,000 1 2 3 4 6 9 Both projects will require an additional working capital investment. For the Model 7 System, net working capital will increase by $20,000 when the system is purchased and increase by further $4,000 per year over the life of the project. The system's networking capital investment will be fully recovered at the end of the last year of the system's useful life. For the Model 8, net working capital will increase by $30,000 at time zero and increase by further $2,500 per year over the life of the project. The entire net wgeking capital investment will be fully recovered at the end of the last year of the systal's useful life. As the company lacks the internal expertise to evaluate the feasibility of each system, Brighouse will hire an outside robotics consultant at the cost of $20,000. The consultant will help the management team decide whether the capital project is viable and if so, the alternative that is most financially attractive. This analysis is needed before a decision can be made. When the existing equipment is replaced by the new robotic system, the savage value of the equipment is $125,000 To recover project costs, the Engineering Department proposes to rent the new Al system to other businesses at the rate of $275 per computer hour. The older Model 7 has no excess productive capacity. The Model 8 has excess productive capacity of 100 hours per year. The company's policy does not allow allows the Engineering Department to rent spare capacity of its equipment to outside companies for competitive reasons. As the financial analyst, you are required to draft a comprehensive memo, addressed to the Chief Operations Officer, answering the following questions: 1. What is the weighted average cost of capital for the company (e.g. the discount rate used for analyzing the budget proposals)? 2. How you would account for the $20,000 payment to the Consultant? Why? Be specific 3. How would you account for the salvage cost of the existing equipment? Why? Be specific 4. How you would account for the $275 per hour charged by the Engineering department? Why? Be specific. 5. Calculate the NPV of each alternative using the six steps of capital budgeting and the cost savings shown in Figure 1 above. Attach the spreadsheet that you used to solve for NPV as a separate file attachment. 6. Which alternative would you recommend? Attach the spreadsheet that you used to solve for NPV as a separate file attachment. Be specific and provide an explanation for you answer. 7. The COO is concerned that new technology might make the Al system obsolete after four years. If this occurs and you only obtain four years of cost savings (as per Figure 1 above), which alternative (if any), would you now recommend? Assume that either system has zero salvage value at the end of their useful lives. The Six Steps of Capital Budgeting PV 1. Initial Investment = Initial Cost Trade-in + Installation Costs PV After-tax Nel Benefits (Revenue - Expenses)(1-T) (1+r)' 2. (1+.5r PV Tax Shield CCA cc.) ( 42 d . der Due to PV Salva Salvage (1+r) 4. dT Tax Shield = Salvage dtr PV Lost Due to Shige 5. NWC PV ANWC -1 + NWC (1+r) 6. =