Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I just need assistance with pages five and six. P22-3A Prepare flexible manufacturing overhead budget Ratchet Company uses budgets in controlling costs. The August 2017

I just need assistance with pages five and six.

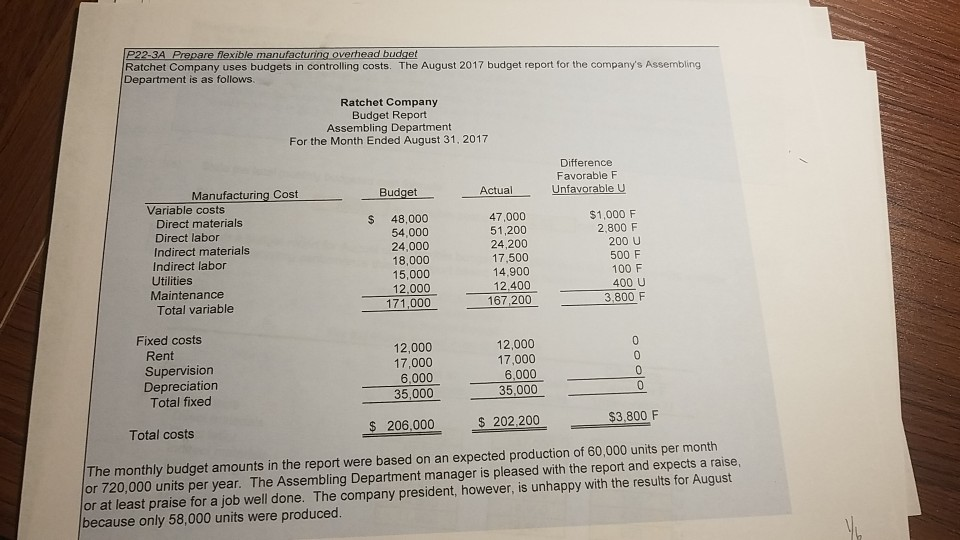

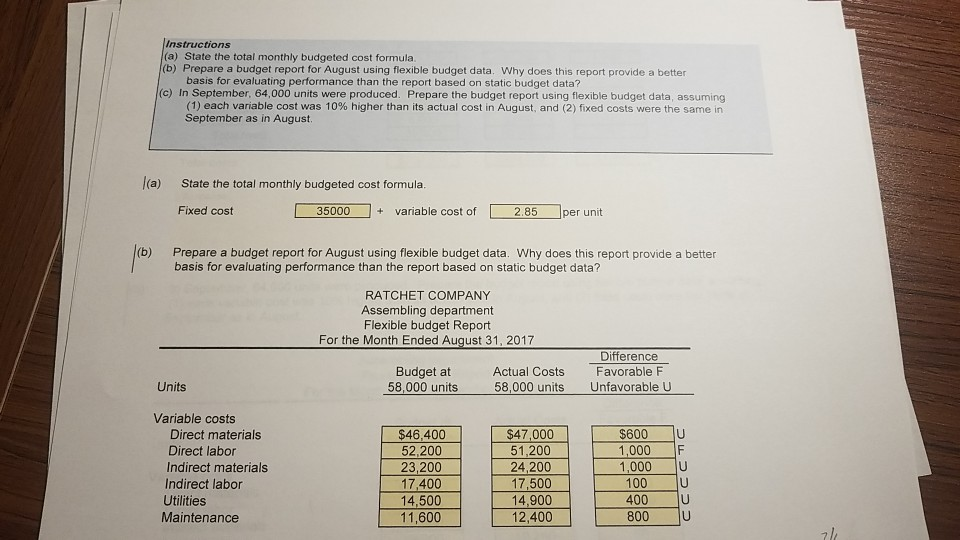

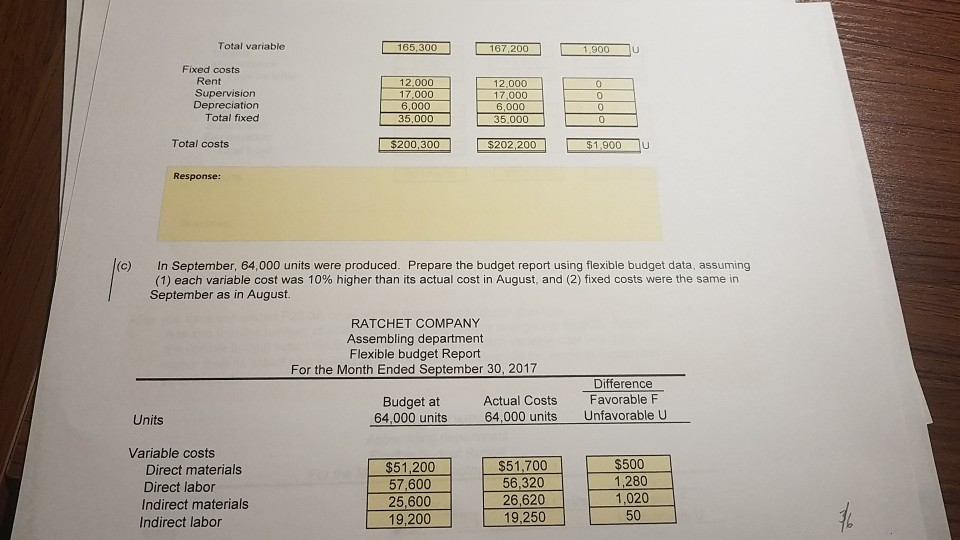

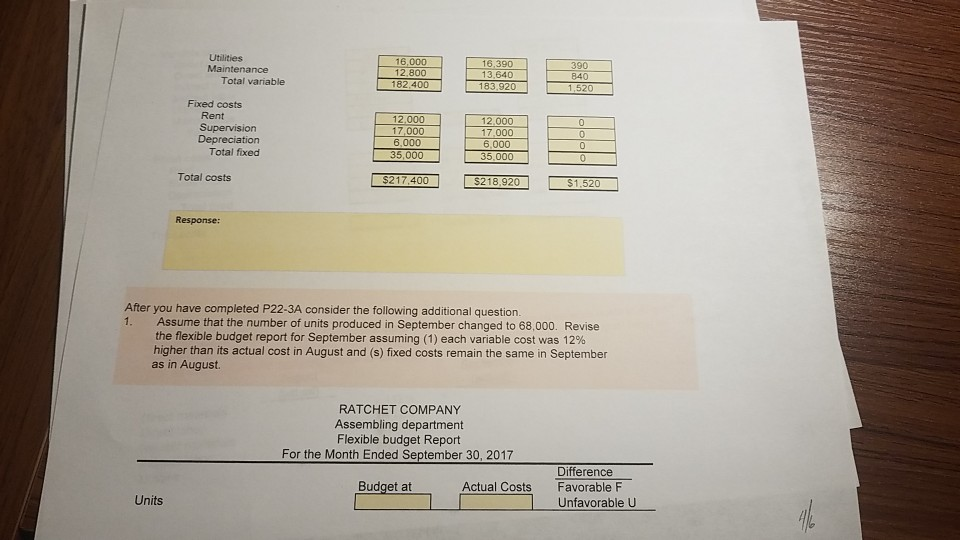

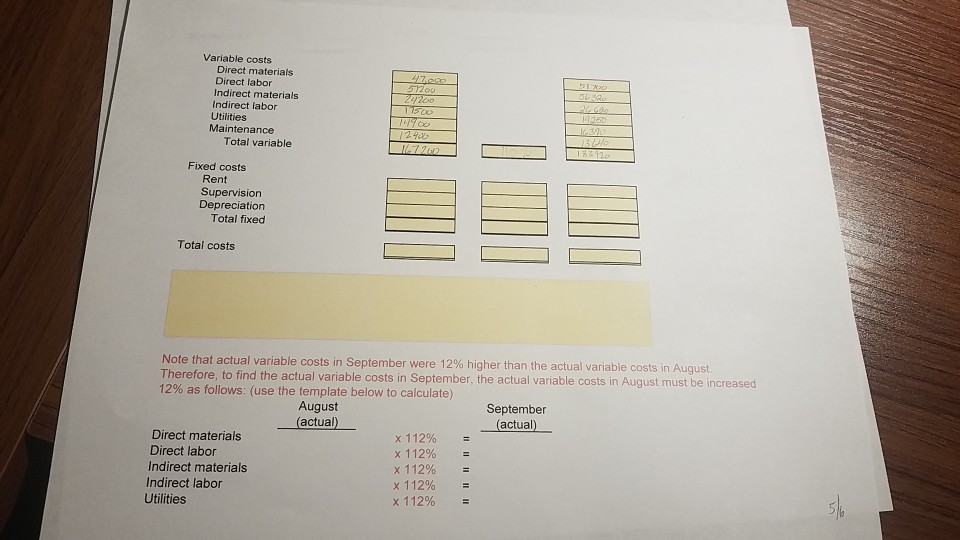

P22-3A Prepare flexible manufacturing overhead budget Ratchet Company uses budgets in controlling costs. The August 2017 budget report for the company's Assembling Department is as follows Ratchet Company Budget Report Assembling Department For the Month Ended August 31, 2017 Difference Favorable F Unfavorable U Budget Actual $ Manufacturing Cost Variable costs Direct materials Direct labor Indirect materials Indirect labor Utilities Maintenance Total variable 48,000 54.000 24,000 18,000 15,000 12.000 171,000 47,000 51,200 24,200 17,500 14,900 12,400 167,200 $1,000 F 2.800 F 200 U 500 F 100 F 400 U 3,800 F Fixed costs Rent Supervision Depreciation Total fixed 12,000 17,000 6.000 35,000 12,000 17,000 6,000 35,000 0 $ 206.000 $ 202,200 $3,800 F Total costs The monthly budget amounts in the report were based on an expected production of 60,000 units per month or 720,000 units per year. The Assembling Department manager is pleased with the report and expects a raise, or at least praise for a job well done. The company president, however, is unhappy with the results for August because only 58,000 units were produced. Instructions (a) State the total monthly budgeted cost formula (b) Prepare a budget report for August using flexible budget data. Why does this report provide a better basis for evaluating performance than the report based on static budget data? (c) In September, 64,000 units were produced. Prepare the budget report using flexible budget data, assuming (1) each variable cost was 10% higher than its actual cost in August, and (2) fixed costs were the same in September as in August (a) State the total monthly budgeted cost formula Fixed cost 35000 + variable cost of 2.85 per unit Prepare a budget report for August using flexible budget data. Why does this report provide a better basis for evaluating performance than the report based on static budget data? RATCHET COMPANY Assembling department Flexible budget Report For the Month Ended August 31, 2017 Budget at 58,000 units Units Difference Favorable F Unfavorable U Actual Costs 58,000 units Variable costs Direct materials Direct labor Indirect materials Indirect labor Utilities Maintenance $46,400 52,200 23,200 17,400 14,500 11,600 $47,000 51,200 24,200 17,500 14,900 12,400 $600 1,000 1,000 100 400 800 U F U U U U Total variable 165.300 167,200 1.900 Fixed costs Rent Supervision Depreciation Total fixed 12.000 17.000 6.000 35,000 6.000 12.000 17 000 6,000 35.000 0 0 Total costs $200,300 $202,200 $1.900u Response: (c) in September, 64,000 units were produced. Prepare the budget report using flexible budget data, assuming (1) each variable cost was 10% higher than its actual cost in August, a September as in August. RATCHET COMPANY Assembling department Flexible budget Report For the Month Ended September 30, 2017 Budget at 64,000 units Actual Costs 64,000 units Difference Favorable F Unfavorable U Units Variable costs Direct materials Direct labor Indirect materials Indirect labor $51,200 57,600 25,600 19,200 $51,700 56,320 26,620 19,250 $500 1.280 1,020 50 390 Utilities Maintenance Total variable 16.000 12.800 182.400 16.390 13.640 183.920 340 1.520 Fixed costs Rent Supervision Depreciation Total fixed 12.000 17.000 6.000 35,000 12.000 17.000 6.000 35.000 Total costs $217,400 $218.920 $1.520 Response: After you have completed P22-3A consider the following additional question Assume that the number of units produced in September changed to 68,000. Revise the flexible budget report for September assuming (1) each variable cost was 12% higher than its actual cost in August and (s) fixed costs remain the same in September as in August RATCHET COMPANY Assembling department Flexible budget Report For the Month Ended September 30, 2017 Budget at Actual Costs Difference Favorable F Unfavorable U Units Variable costs Direct labor Indirect materials Indirect labor Utilities Maintenance Total variable 24200 17500 741900 50 5 GR 3o 7 Fixed costs Rent Supervision Depreciation Total fixed Total costs Note that actual variable costs in September were 12% higher than the actual variable costs in August Therefore, to find the actual variable costs in September, the actual variable costs in August must be increased August (actual) September (actual) Direct materials Direct labor Indirect materials Indirect labor Utilities x 112% x 112% x 112% x 112% x 112%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started