i just need help fixing the red x spots and also completing where else needs to be filled in!!

please set it up like mine so its clear what i need to fill in.

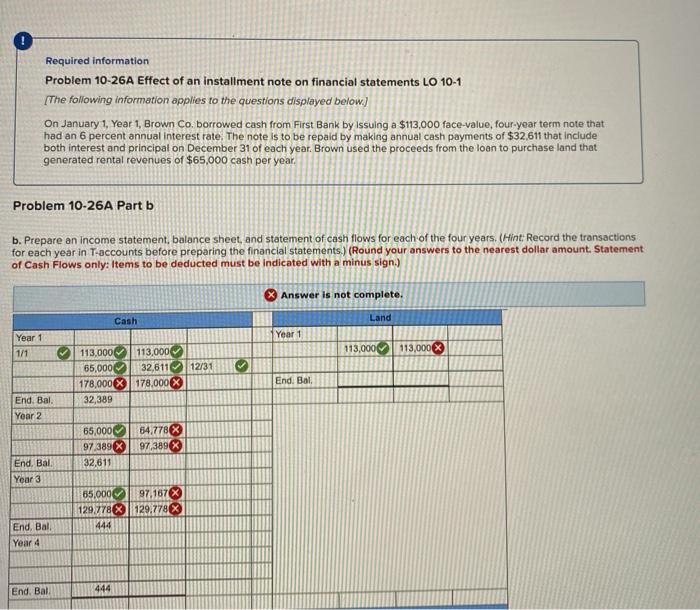

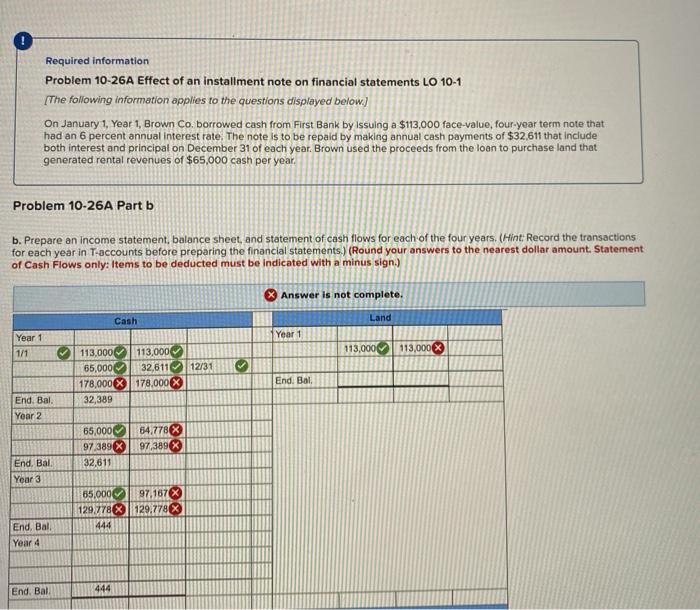

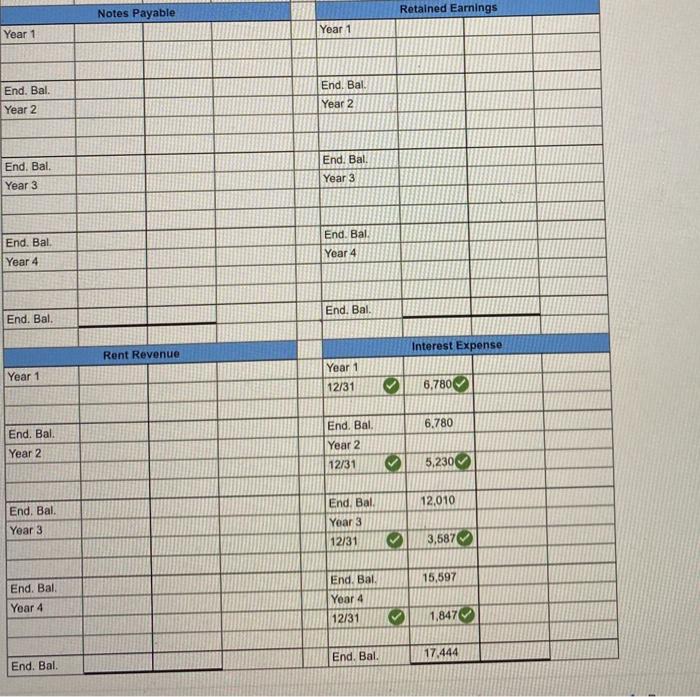

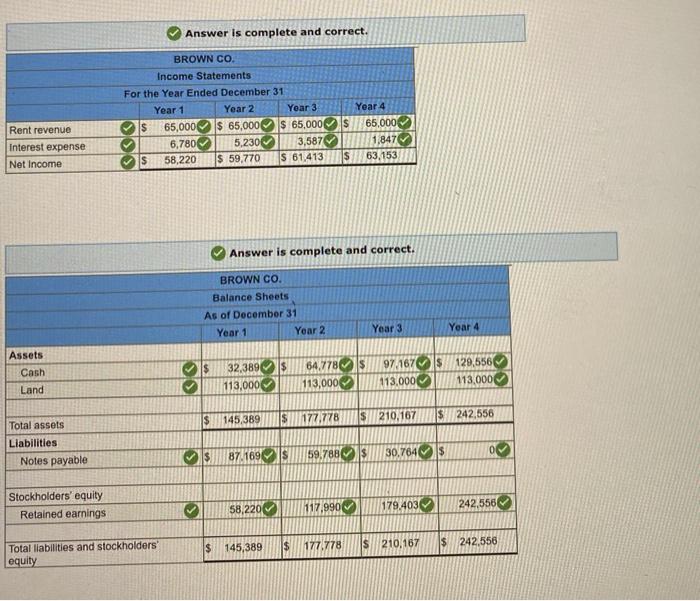

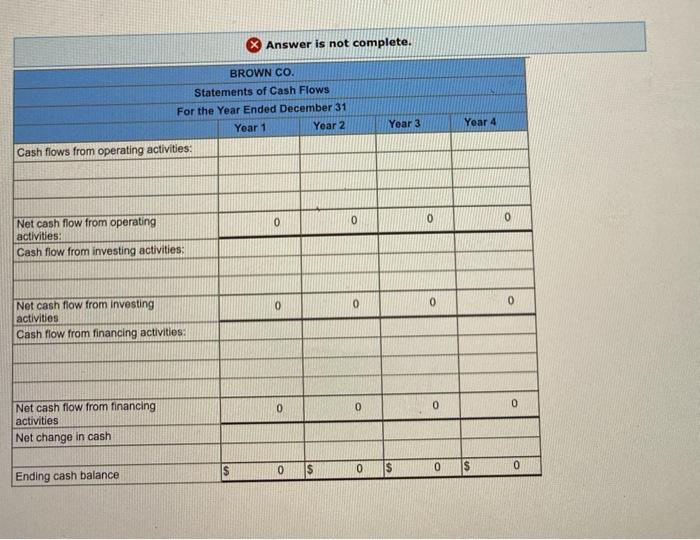

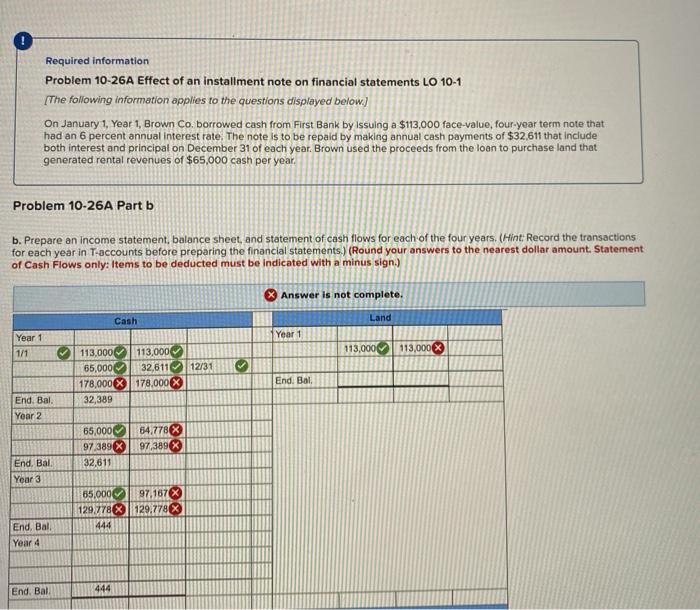

Required information Problem 10-26A Effect of an installment note on financial statements LO 10-1 [The following information applies to the questions displayed below) On January 1, Year 1, Brown Co. borrowed cash from First Bank by Issuing a $113,000 face-value, four-year term note that had an 6 percent annual interest rate. The note is to be repaid by making annual cash payments of $32,611 that include both interest and principal on December 31 of each year. Brown used the proceeds from the loan to purchase land that generated rental revenues of $65,000 cash per year, Problem 10-26A Part b b. Prepare an income statement, balance sheet, and statement of cash flows for each of the four years. (Hint: Record the transactions for each year in T-accounts before preparing the financial statements.) (Round your answers to the nearest dollar amount. Statement of Cash Flows only: Items to be deducted must be indicated with a minus sign.) X Answer is not complete. Cash Land Year 1 Year 1 1/1 113,000 113,000 113,000 113,000 65,000 32,61112/31 178,000 X 178,000X 32,389 End. Bat. End. Bal. Year 2 65,000 97.389% 32,611 64,778 97,389 End, Bal Year 3 65,000 97,167X 129.778X129.778X 444 End, Bal Year 4 End. Bal 444 Notes Payable Retained Earnings Year 1 Year 1 End. Bal. End, Bal Year 2 Year 2 End. Bal Year 3 End. Bal Year 3 End. Bal Year 4 End. Bal. Year 4 End. Bal. End. Bal. Interest Expense Rent Revenue Year 1 Year 1 12/31 6,780 6,780 End. Bal. Year 2 End. Bal Year 2 12/31 5,230 End Bal. 12,010 End. Bal. Year 3 Year 3 12/31 3,587 15,597 End. Bal Year 4 End. Bal. Year 4 12/31 1,847 End. Bal. 17.444 End. Bal. Answer is complete and correct. BROWN CO. Income Statements For the Year Ended December 31 Year 1 Year 2 Yoar 3 65,000 $ 65,000 $ 65,000 $ 5.2306 58,220 $ 59,770 $ 61,413 $ Yoar 4 65,000 1,847 63,153 Rent revenue Interest expense Net Income 6,780 3,587 Answer is complete and correct. BROWN CO. Balance Sheets As of December 31 Year 1 Year 2 Year 3 Year 4 $ Is $ Assets Cash Land 32,389 113,000 64,7780 113,000 97 167 113,000 129,556 113,000 145,389 $ S 177,778 242,556 $ 210,167 Total assets Liabilities s 87.169 IS 59.788 VIS 30,764 Notes payable Stockholders' equity Retained earnings 117.990 V 58,220 179,403 242,556 $ IS 145,389 177.778 IS $ 242,556 210,167 Total liabilities and stockholders equity Answer is not complete. BROWN CO. Statements of Cash Flows For the Year Ended December 31 Year 1 Year 2 Cash flows from operating activities: Year 3 Year 4 0 0 0 Net cash flow from operating activities: Cash flow from investing activities: 0 0 0 Net cash flow from investing activities Cash flow from financing activities: 0 0 0 0 Net cash flow from financing activities Net change in cash $ 0 0 0 0 $ Ending cash balance