Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I just need help on Part 2 Dahlia, Rose, and Daisy decide to pool the resources from their respective sole proprietorships and form * Rose

I just need help on Part 2

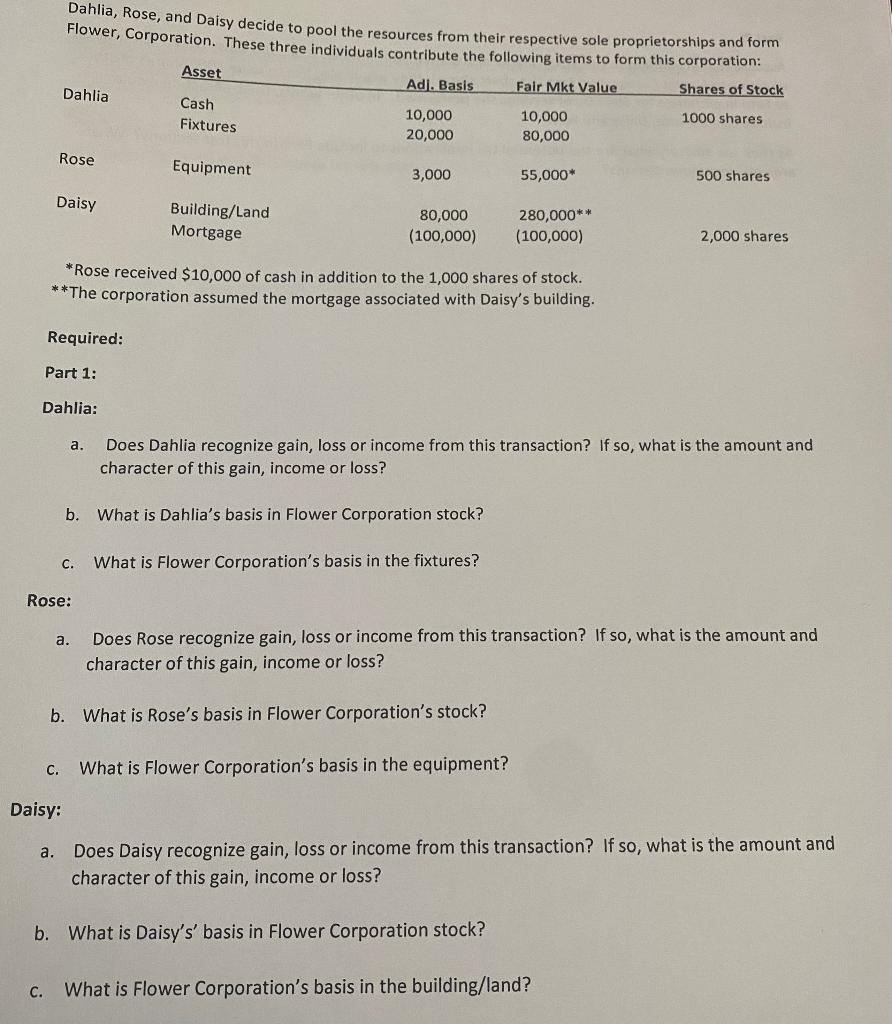

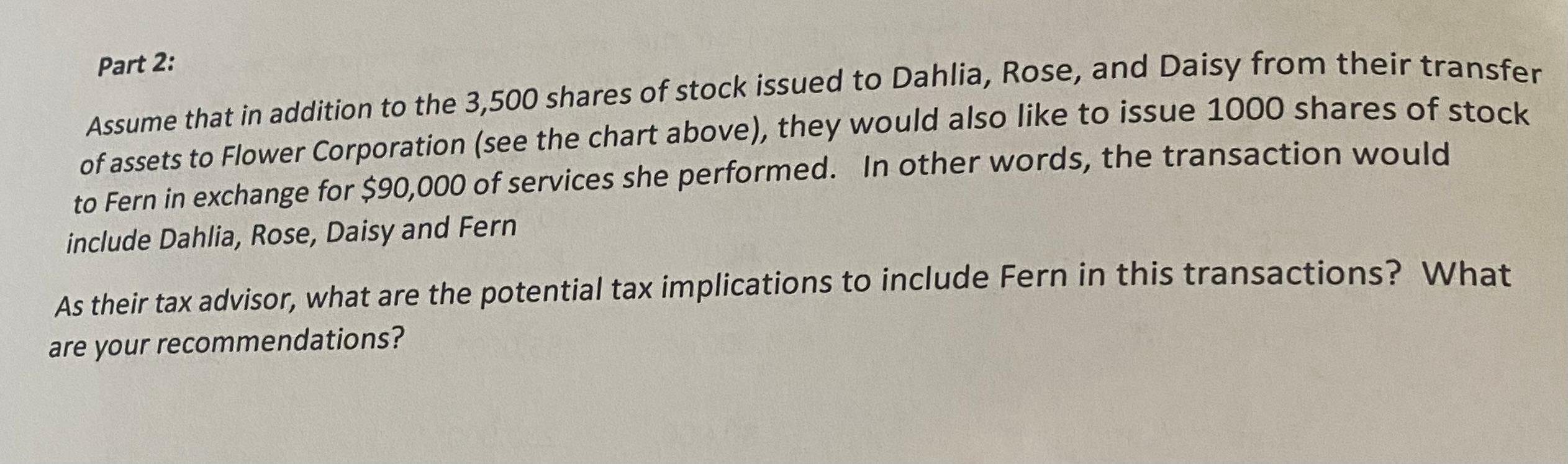

Dahlia, Rose, and Daisy decide to pool the resources from their respective sole proprietorships and form * Rose received $10,000 of cash in addition to the 1,000 shares of stock. Required: Part 1: Dahlia: a. Does Dahlia recognize gain, loss or income from this transaction? If so, what is the amount and character of this gain, income or loss? b. What is Dahlia's basis in Flower Corporation stock? c. What is Flower Corporation's basis in the fixtures? Rose: a. Does Rose recognize gain, loss or income from this transaction? If so, what is the amount and character of this gain, income or loss? b. What is Rose's basis in Flower Corporation's stock? c. What is Flower Corporation's basis in the equipment? Daisy: a. Does Daisy recognize gain, loss or income from this transaction? If so, what is the amount and character of this gain, income or loss? b. What is Daisy's s basis in Flower Corporation stock? c. What is Flower Corporation's basis in the building/land? Part 2: Assume that in addition to the 3,500 shares of stock issued to Dahlia, Rose, and Daisy from their transfer of assets to Flower Corporation (see the chart above), they would also like to issue 1000 shares of stock to Fern in exchange for $90,000 of services she performed. In other words, the transaction would include Dahlia, Rose, Daisy and Fern As their tax advisor, what are the potential tax implications to include Fern in this transactions? What are your recommendations? Dahlia, Rose, and Daisy decide to pool the resources from their respective sole proprietorships and form * Rose received $10,000 of cash in addition to the 1,000 shares of stock. Required: Part 1: Dahlia: a. Does Dahlia recognize gain, loss or income from this transaction? If so, what is the amount and character of this gain, income or loss? b. What is Dahlia's basis in Flower Corporation stock? c. What is Flower Corporation's basis in the fixtures? Rose: a. Does Rose recognize gain, loss or income from this transaction? If so, what is the amount and character of this gain, income or loss? b. What is Rose's basis in Flower Corporation's stock? c. What is Flower Corporation's basis in the equipment? Daisy: a. Does Daisy recognize gain, loss or income from this transaction? If so, what is the amount and character of this gain, income or loss? b. What is Daisy's s basis in Flower Corporation stock? c. What is Flower Corporation's basis in the building/land? Part 2: Assume that in addition to the 3,500 shares of stock issued to Dahlia, Rose, and Daisy from their transfer of assets to Flower Corporation (see the chart above), they would also like to issue 1000 shares of stock to Fern in exchange for $90,000 of services she performed. In other words, the transaction would include Dahlia, Rose, Daisy and Fern As their tax advisor, what are the potential tax implications to include Fern in this transactions? What are your recommendationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started