Question

I just need help on part 3 Management Analysis Brief: Your management analysis brief should explain financial information to management. Provide evidence from your accounting

I just need help on part 3

Management Analysis Brief: Your management analysis brief should explain financial information to management. Provide evidence from your accounting workbook to support your ideas where applicable.

A. Discuss the impact of the pro forma financial statements for predicting ability to meet future expansion goals.

B. Describe the implications of inventory costing, contingent liabilities, and revenue recognition

C. Identify potential issues in interpretation of financial information, providing examples to support your ideas

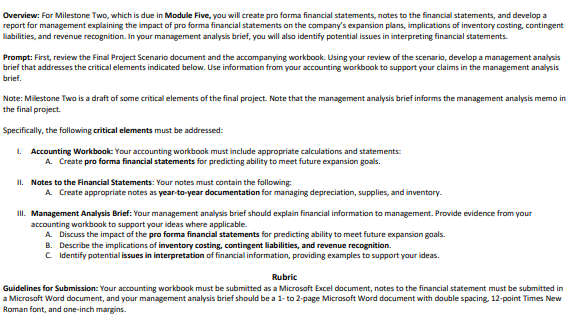

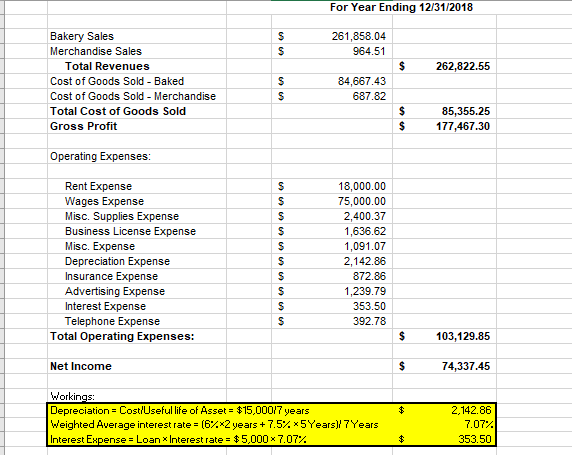

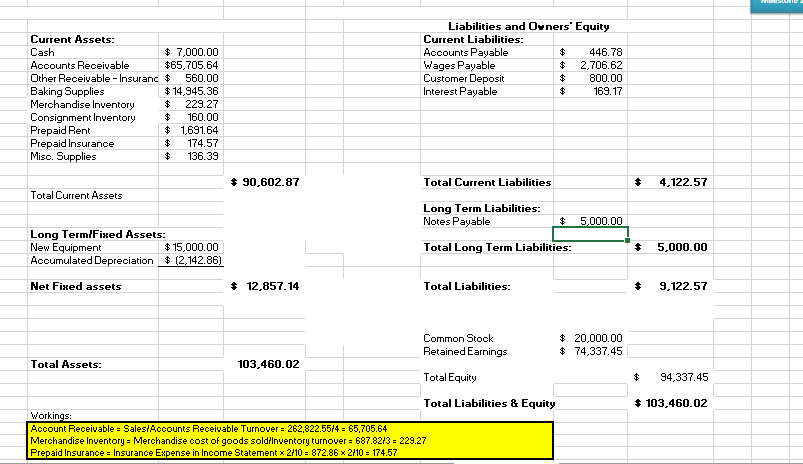

Overview: For Milestone Two, which is due in Module Five, you will create pro forma financial statements, notes to the financial statements, and develop a report for management explaining the impact of pro forma financial statements on the company's expansion plans, implications of inventory costing, contingent liabilities, and revenue recognition. In your management analysis brief, you will also identify potential issues in interpreting financial statements. Prompt: First, review the Final Project Scenario document and the accompanying workbook. Using your review of the scenario, develop a management analysis brief that addresses the critical elements indicated below. Use information from your accounting workbook to support your claims in the management analysis brief. Note: Milestone Two is a draft of some critical elements of the final project. Note that the management analysis brief informs the management analysis memo in the final project Specifically, the following critical elements must be addressed: 1. Accounting Workbook: Your accounting workbook must include appropriate calculations and statements: A. Create pro forma financial statements for predicting ability to meet future expansion goals. II. Notes to the Financial Statements: Your nates must contain the following A. Create appropriate notes as year-to-year documentation for managing depreciation, supplies, and inventory III. Management Analysis Brief: Your management analysis brief should explain financial information to management. Provide evidence from your accounting workbook to support your ideas where applicable. A Discuss the impact of the pro forma financial statements for predicting ability to meet future expansion goals. B. Describe the implications of inventory costing, contingent liabilities, and revenue recognition. Identify potential issues in interpretation of financial information, providing examples to support your ideas. Rubric Guidelines for Submission: Your accounting workbook must be submitted as a Microsoft Excel document, notes to the financial statement must be submitted in a Microsoft Word document, and your management analysis brief should be a 1- to 2-page Microsoft Word document with double spacing 12-point Times New Roman font, and one-inch margins. For Year Ending 12/31/2018 $ $ 261,858.04 964.51 $ 262,822.55 Bakery Sales Merchandise Sales Total Revenues Cost of Goods Sold - Baked Cost of Goods Sold - Merchandise Total Cost of Goods Sold Gross Profit $ S 84,667.43 687.82 $ $ 85,355.25 177,467.30 Operating Expenses: $ $ S Rent Expense Wages Expense Misc. Supplies Expense Busin nse Expense Misc. Expense Depreciation Expense Insurance Expense Advertising Expense Interest Expense Telephone Expense Total Operating Expenses: S $ $ $ $ $ 18,000.00 75,000.00 2,400.37 1,636.62 1,091.07 2,142.86 872.86 1,239.79 353.50 392.78 $ 103,129.85 Net Income $ 74,337.45 $ Workings: Depreciation = Cost/Useful life of Asset = $15,000/7 years Weighted Average interest rate = (62X2 years + 7.5% *5Years)/ 7 Years Interest Expense = Loan * Interest rate = $5,000 x 7.07% 2.142.86 7.07% 353.50 $ Liabilities and Owners' Equity Current Liabilities: Accounts Payable $ 446.78 Wages Payable $ 2,706.62 Customer Deposit $ 800.00 Interest Payable $ 169.17 Current Assets: Cash $ 7,000.00 Accounts Receivable $65,705.64 Other Receivable - Insuranc $ 560.00 Baking Supplies $14,945.36 Merchandise Inventory 229.27 Consignment Inventory $ 160.00 Prepaid Rent $ 1,691.64 Prepaid Insurance $ 174.57 Miso. Supplies 136.39 $ 90,602.87 Total Current Liabilities $ 4,122.57 Total Current Assets Long Term Liabilities: Notes Payable 5,000.00 Long Term/Fixed Assets: New Equipment $ 15,000.00 Accumulated Depreciation $ (2,142.86) Total Long Term Liabilities: $ 5,000.00 Net Fixed assets $ 12,857.14 Total Liabilities: $ 9,122.57 Common Stock Retained Earnings $ 20,000.00 $ 74,337.45 Total Assets: 103,460.02 Total Equity 94,337.45 $ 103,460.02 Total Liabilities & Equity Workings: Account Receivable - Sales/Accounts Receivable Turnover = 262,822.55/4 = 65,705.64 Merchandise Inventory = Merchandise cost of goods soldiInventory turnover = 687.82/3 = 229.27 Prepaid Insurance = Insurance Expense in Income Statement x 2/10 = 872.86 x 2/10 = 174.57 Overview: For Milestone Two, which is due in Module Five, you will create pro forma financial statements, notes to the financial statements, and develop a report for management explaining the impact of pro forma financial statements on the company's expansion plans, implications of inventory costing, contingent liabilities, and revenue recognition. In your management analysis brief, you will also identify potential issues in interpreting financial statements. Prompt: First, review the Final Project Scenario document and the accompanying workbook. Using your review of the scenario, develop a management analysis brief that addresses the critical elements indicated below. Use information from your accounting workbook to support your claims in the management analysis brief. Note: Milestone Two is a draft of some critical elements of the final project. Note that the management analysis brief informs the management analysis memo in the final project Specifically, the following critical elements must be addressed: 1. Accounting Workbook: Your accounting workbook must include appropriate calculations and statements: A. Create pro forma financial statements for predicting ability to meet future expansion goals. II. Notes to the Financial Statements: Your nates must contain the following A. Create appropriate notes as year-to-year documentation for managing depreciation, supplies, and inventory III. Management Analysis Brief: Your management analysis brief should explain financial information to management. Provide evidence from your accounting workbook to support your ideas where applicable. A Discuss the impact of the pro forma financial statements for predicting ability to meet future expansion goals. B. Describe the implications of inventory costing, contingent liabilities, and revenue recognition. Identify potential issues in interpretation of financial information, providing examples to support your ideas. Rubric Guidelines for Submission: Your accounting workbook must be submitted as a Microsoft Excel document, notes to the financial statement must be submitted in a Microsoft Word document, and your management analysis brief should be a 1- to 2-page Microsoft Word document with double spacing 12-point Times New Roman font, and one-inch margins. For Year Ending 12/31/2018 $ $ 261,858.04 964.51 $ 262,822.55 Bakery Sales Merchandise Sales Total Revenues Cost of Goods Sold - Baked Cost of Goods Sold - Merchandise Total Cost of Goods Sold Gross Profit $ S 84,667.43 687.82 $ $ 85,355.25 177,467.30 Operating Expenses: $ $ S Rent Expense Wages Expense Misc. Supplies Expense Busin nse Expense Misc. Expense Depreciation Expense Insurance Expense Advertising Expense Interest Expense Telephone Expense Total Operating Expenses: S $ $ $ $ $ 18,000.00 75,000.00 2,400.37 1,636.62 1,091.07 2,142.86 872.86 1,239.79 353.50 392.78 $ 103,129.85 Net Income $ 74,337.45 $ Workings: Depreciation = Cost/Useful life of Asset = $15,000/7 years Weighted Average interest rate = (62X2 years + 7.5% *5Years)/ 7 Years Interest Expense = Loan * Interest rate = $5,000 x 7.07% 2.142.86 7.07% 353.50 $ Liabilities and Owners' Equity Current Liabilities: Accounts Payable $ 446.78 Wages Payable $ 2,706.62 Customer Deposit $ 800.00 Interest Payable $ 169.17 Current Assets: Cash $ 7,000.00 Accounts Receivable $65,705.64 Other Receivable - Insuranc $ 560.00 Baking Supplies $14,945.36 Merchandise Inventory 229.27 Consignment Inventory $ 160.00 Prepaid Rent $ 1,691.64 Prepaid Insurance $ 174.57 Miso. Supplies 136.39 $ 90,602.87 Total Current Liabilities $ 4,122.57 Total Current Assets Long Term Liabilities: Notes Payable 5,000.00 Long Term/Fixed Assets: New Equipment $ 15,000.00 Accumulated Depreciation $ (2,142.86) Total Long Term Liabilities: $ 5,000.00 Net Fixed assets $ 12,857.14 Total Liabilities: $ 9,122.57 Common Stock Retained Earnings $ 20,000.00 $ 74,337.45 Total Assets: 103,460.02 Total Equity 94,337.45 $ 103,460.02 Total Liabilities & Equity Workings: Account Receivable - Sales/Accounts Receivable Turnover = 262,822.55/4 = 65,705.64 Merchandise Inventory = Merchandise cost of goods soldiInventory turnover = 687.82/3 = 229.27 Prepaid Insurance = Insurance Expense in Income Statement x 2/10 = 872.86 x 2/10 = 174.57Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started