Answered step by step

Verified Expert Solution

Question

1 Approved Answer

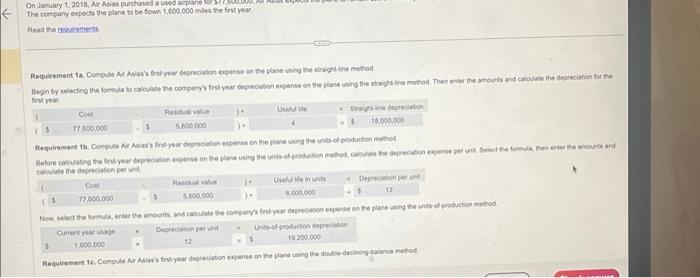

I just need help on the last requirement! Requlrement 12. Corpudo Ar Aviat's frnt-yeer cupreciaton expense on the plase ving the straghiline method reiadale the

I just need help on the last requirement!

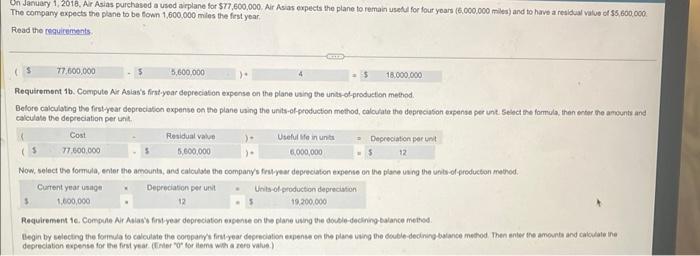

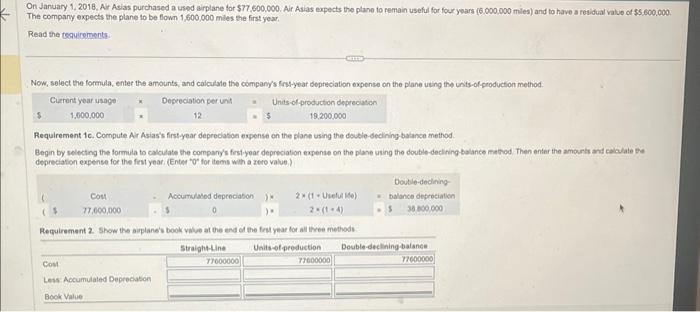

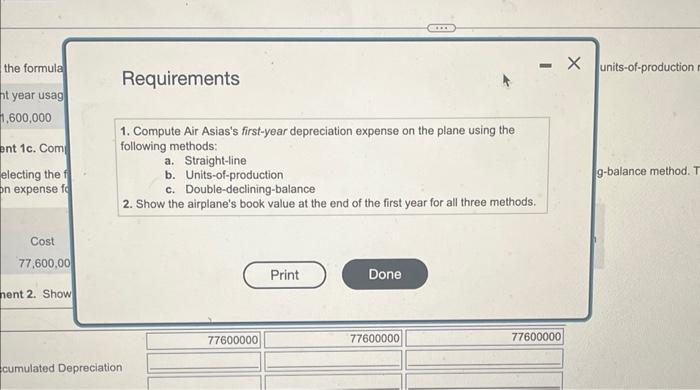

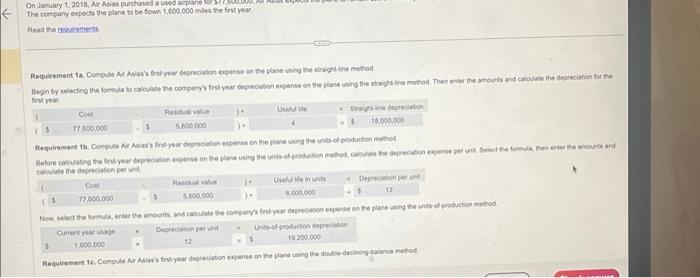

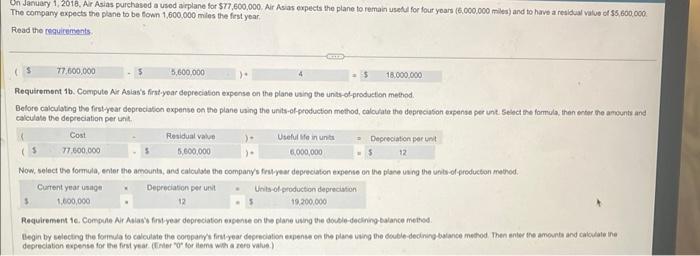

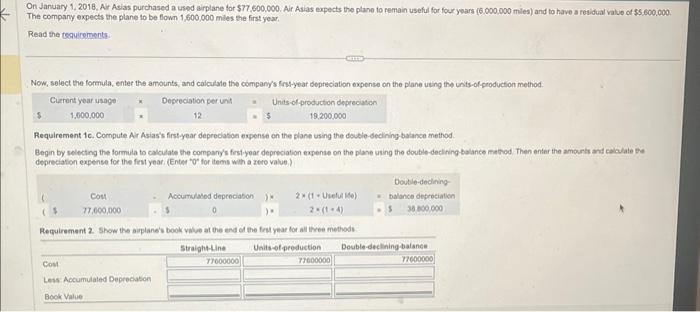

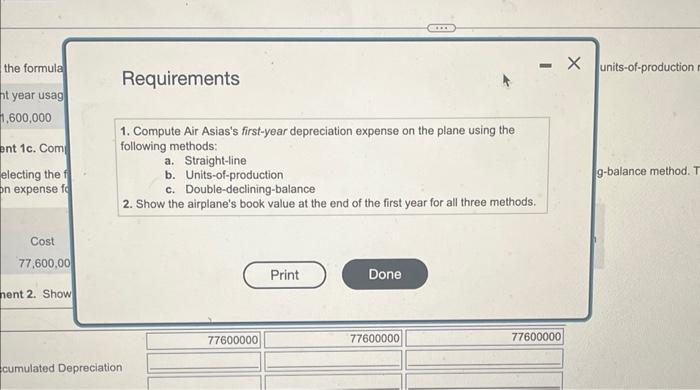

Requlrement 12. Corpudo Ar Aviat's frnt-yeer cupreciaton expense on the plase ving the straghiline method reiadale the identeriative ber int. Requirement Ac. Conqule Ar Aslavis fintyear depreciaton wstente on the plase using the dobble decleng-balance method The company axpects the plane to be eown 1,600,000 miles the flest year. Read the requirements. Requirement 1b. Compute Ar Aslas's frat-year deprecialion expense on the plane ising the unts-of-producton method. Belore calculating the first-year deprociabion expense on the plane using the units-of-production method, caladati the depreciason expense per unt. Select the farmula, then enter the amounts and calculate the depreciation per une. Now, select the formula, enler the amounta, and calculate the companyss frupear depreciaton expense on the blace uaing the unisid-producton method. Requirement 1e. Compode Ar Aalasy finclyear depreciaton espense on the dlane uing the double-decling-balance mebed depreciaton expense for the fint year. (finler "o" tor dema with a rero valie.) On January 1, 2018, Ar Asias purchased a used airplane for 577.600 .000 . Air Asias expects the plane to remain useful for four years (6,000,000 miles) and to have a residual value of $5. 600,000 . The company expects the plane to be flown 1,600,000 miles the first year, Read the tequirements: Now, select the formula, enter the amouints, and calculate the company's frs-year dopreciation oxpense on the plane using the unts-of-production method. Requirement 1c. Compute Ar Asias's first-year depreciatoe espense on the plane using the double-decining balance method. Begin by selecting the formula to calcilate the company's fest-year depreciation exense on the plane uting the double-decliring-balance method Then entar the amesrits and calciate the depreciation expense for the first year. (Ented "O" for items with a zero value). units-of-production Requirements 1. Compute Air Asias's first-year depreciation expense on the plane using the following methods: a. Straight-line b. Units-of-production 9 -balance method. T c. Double-declining-balance 2. Show the airplane's book value at the end of the first year for all three methods

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started