Answered step by step

Verified Expert Solution

Question

1 Approved Answer

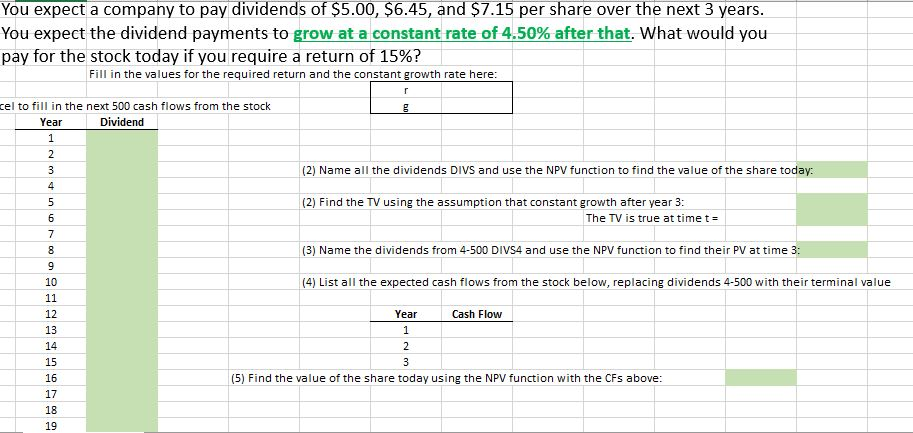

I just need help on the second photo..the data tabel thanks!!!! You expect a company to pay dividends of $5.00, $6.45, and $7.15 per share

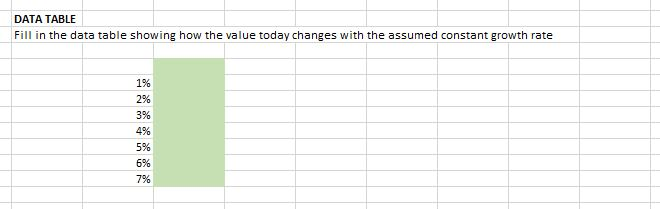

I just need help on the second photo..the data tabel

thanks!!!!

You expect a company to pay dividends of $5.00, $6.45, and $7.15 per share over the next 3 years. You expect the dividend payments to grow at a constant rate of 4.50% after that. What would you pay for the stock today if you require a return of 15%? Fill in the values for the required return and the constant growth rate here: cel to fill in the next 500 cash flows from the stock g Dividend Year 1 2 (2) Name all the dividends DIVS and use the NPV function to find the value of the share today: A 5 (2) Find the TV using the assumption that constant growth after year 3: The TV is true at time t 6 7 (3) Name the dividends from 4-500 DIVS4 and use the NPV function to find their PV at time 3: 10 (4) List all the expected cash flows from the stock below, replacing dividends 4-500 with their terminal value 11 12 Year Cash Flow 13 1 14 2 15 3 16 (5) Find the value of the share today using the NPV function with the CFs above: 17 18 19 co st DATA TABLE Fill in the data table showing how the value today changes with the assumed constant growth rate 1% 2% 3% 4% 5% 6% 7 %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started