Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I just need help with B. Bonnie, who is single and itemizes deductions, reports a zero taxable income for 2021. She incurs positive timing adjustments

I just need help with B.

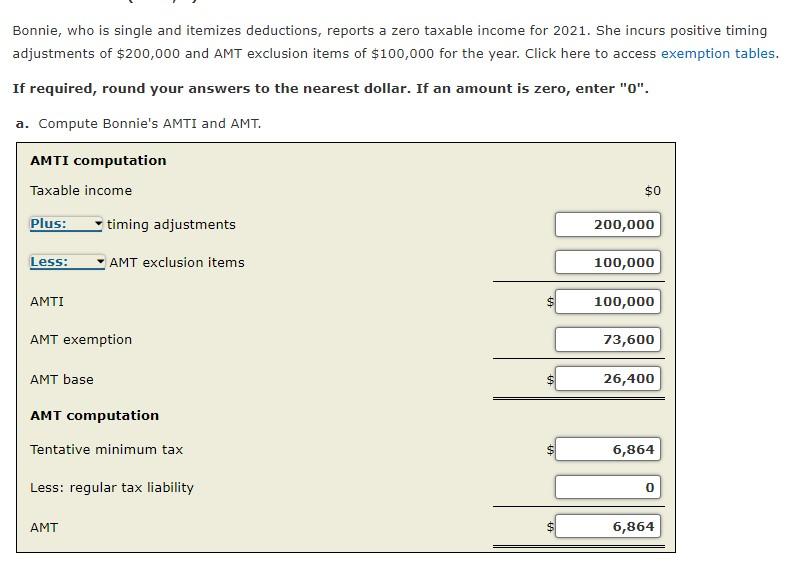

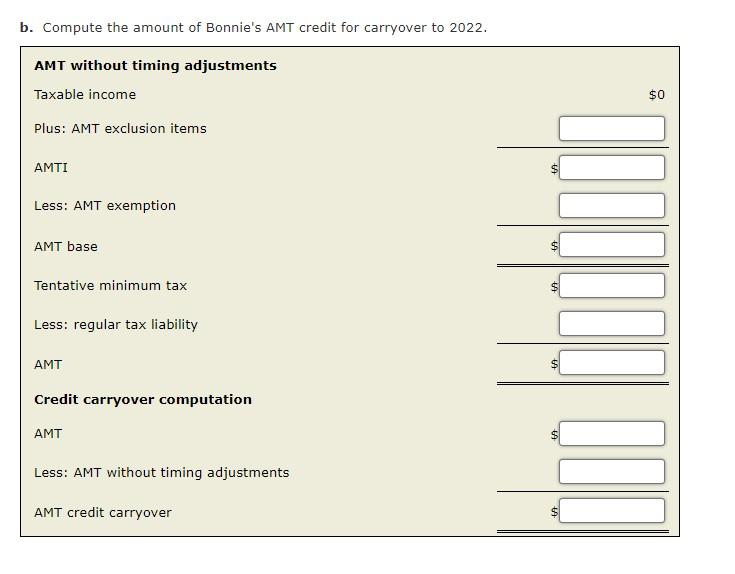

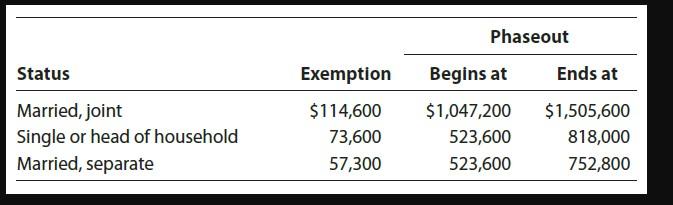

Bonnie, who is single and itemizes deductions, reports a zero taxable income for 2021. She incurs positive timing adjustments of $200,000 and AMT exclusion items of $100,000 for the year. Click here to access exemption tables, If required, round your answers to the nearest dollar. If an amount is zero, enter "O". a. Compute Bonnie's AMTI and AMT. AMTI computation Taxable income $0 Plus: timing adjustments 200,000 Less: AMT exclusion items 100,000 AMTI W 100,000 AMT exemption 73,600 AMT base 26,400 AMT computation Tentative minimum tax $ 6,864 Less: regular tax liability 0 AMT $ 6,864 b. Compute the amount of Bonnie's AMT credit for carryover to 2022. AMT without timing adjustments Taxable income $0 Plus: AMT exclusion items AMTI Less: AMT exemption AMT base $ Tentative minimum tax Less: regular tax liability AMT Credit carryover computation AMT Less: AMT without timing adjustments II AMT credit carryover Phaseout Status Begins at Ends at Married, joint Single or head of household Married, separate Exemption $114,600 73,600 57,300 $1,047,200 523,600 523,600 $1,505,600 818,000 752,800Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started