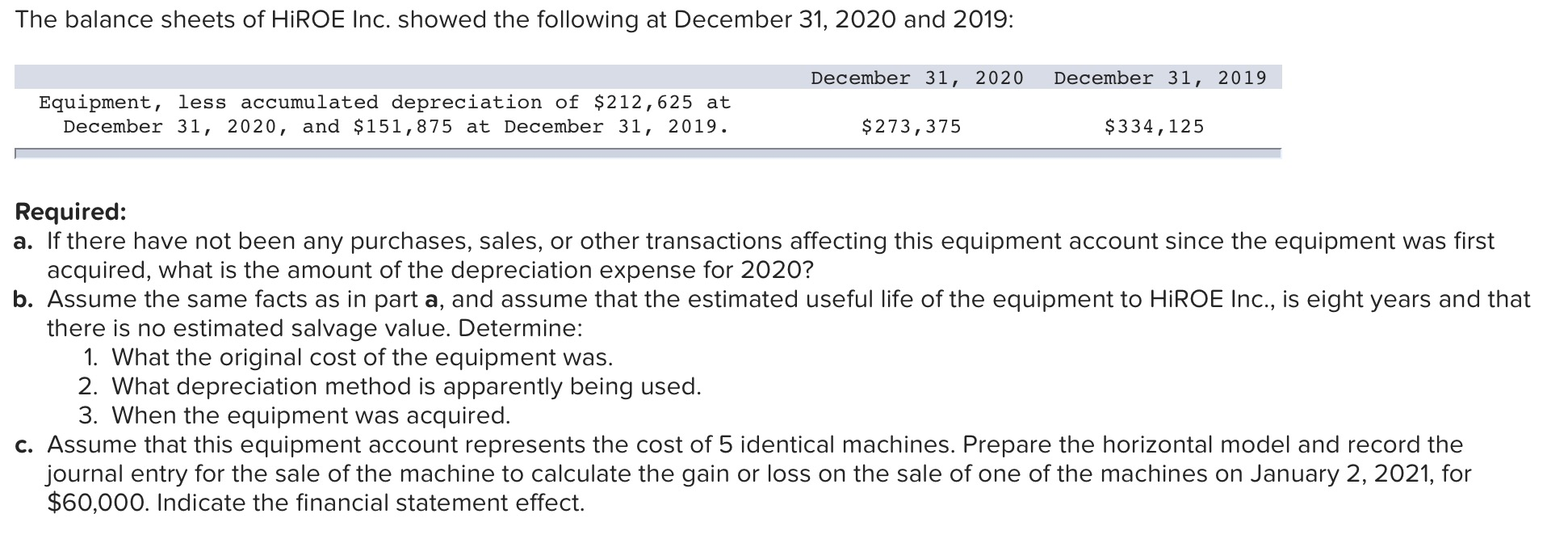

Question

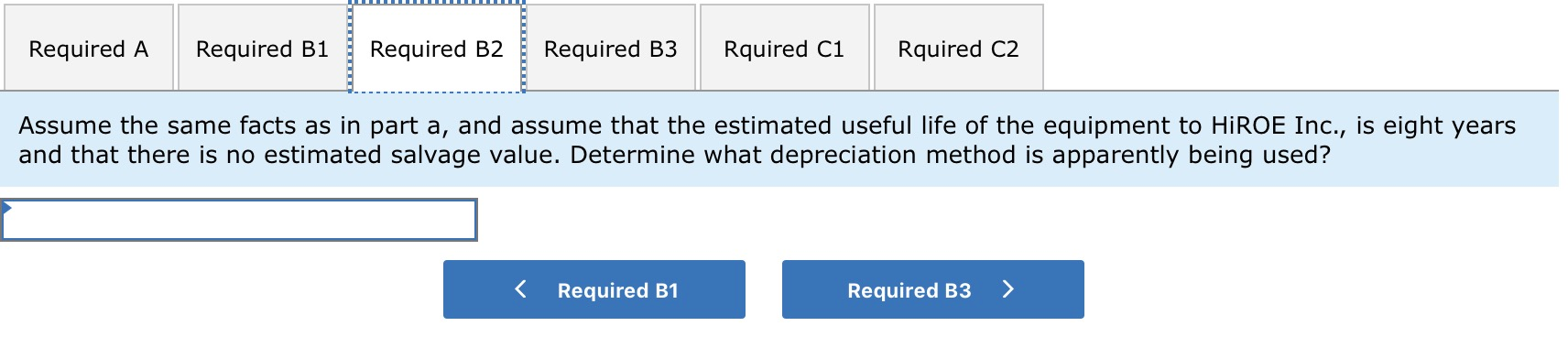

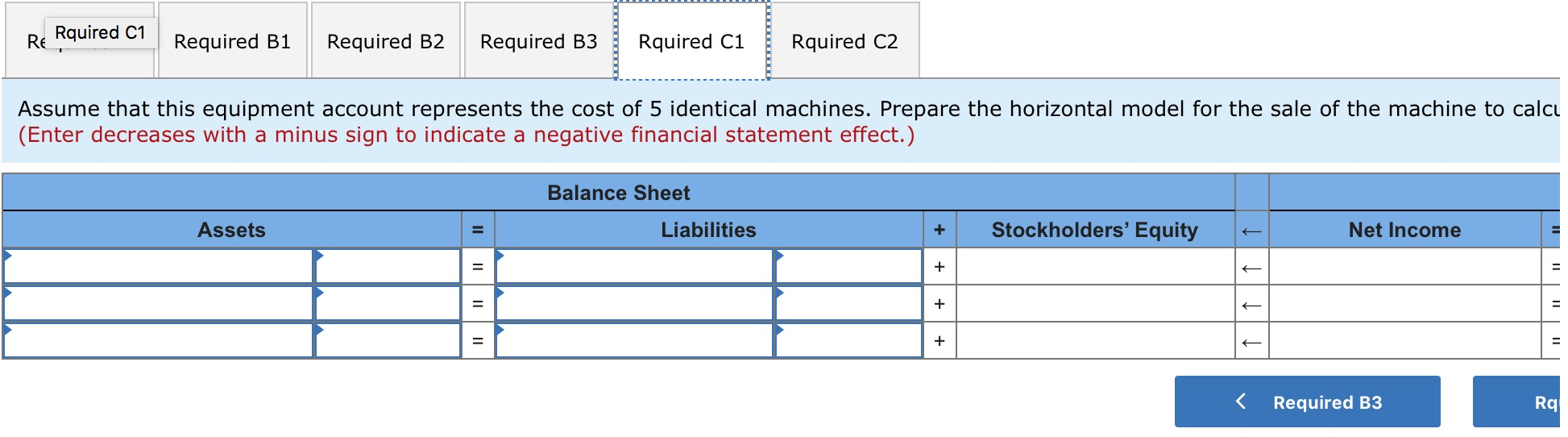

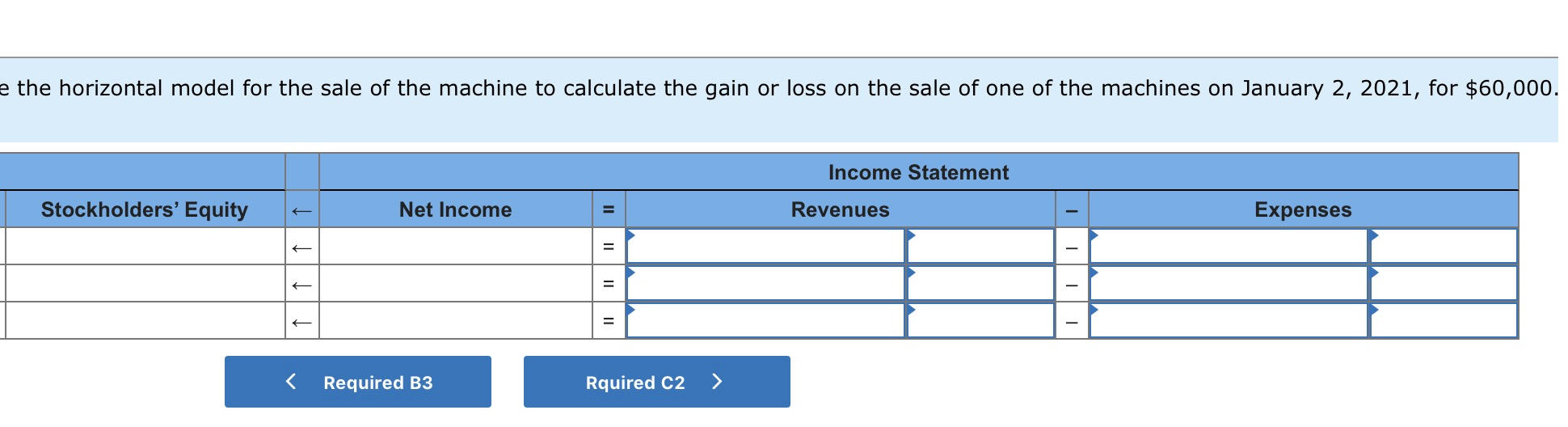

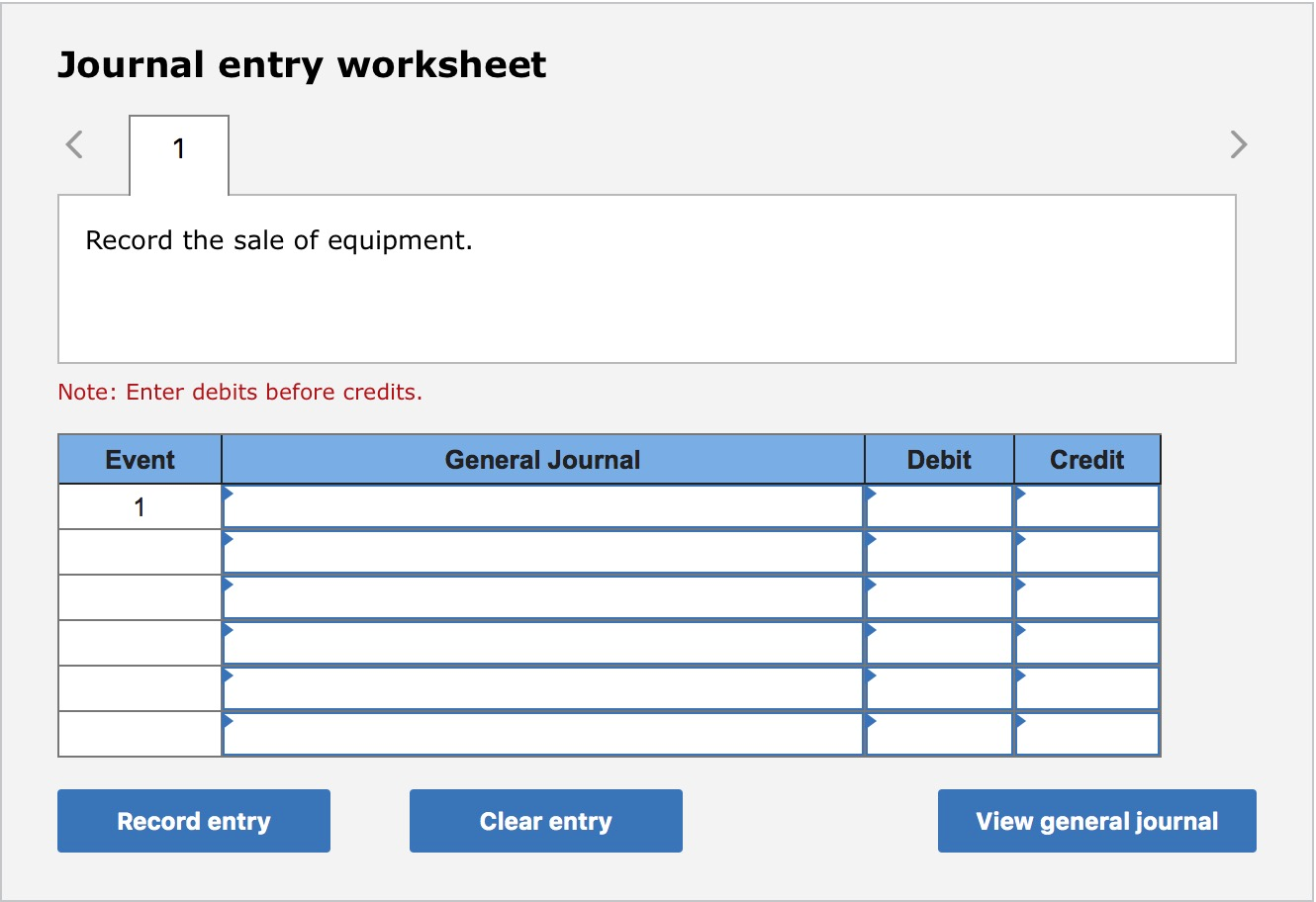

I just need help with part C1 and C2 ***no option to input for stockholder equity. It populates itself*** Options for assets column are accumulated

I just need help with part C1 and C2

***no option to input for stockholder equity. It populates itself***

Options for assets column are accumulated depreciation, cash equipment, gain on sale of equipment, and interest expense. Which I inputted accumulated depreciation(correct) - $54,675 (this number is wrong idk why), Equipment (correct) - $97,200 (this is wrong as well, and cash (correct)- $60,000 (correct)

I am given the option to input for liabilities but I don't know what to put if any.

Revenues and Expenses column options are accumulated depreciation, cash equipment, gain on sale of equipment, and interest expense.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started