Answered step by step

Verified Expert Solution

Question

1 Approved Answer

' I just need help with parts D and E. Required a. Does Coca-Cola have investments in affiliated companies for which it accounts using the

'

'

I just need help with parts D and E.

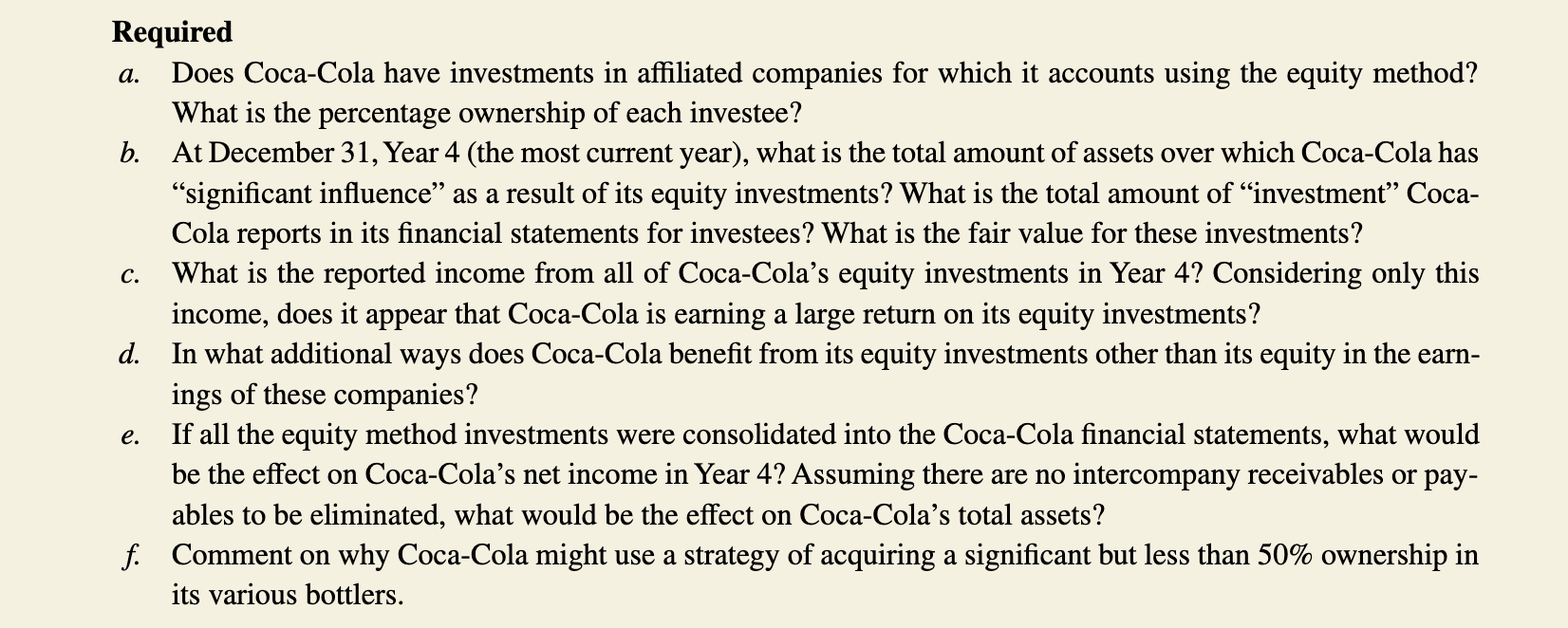

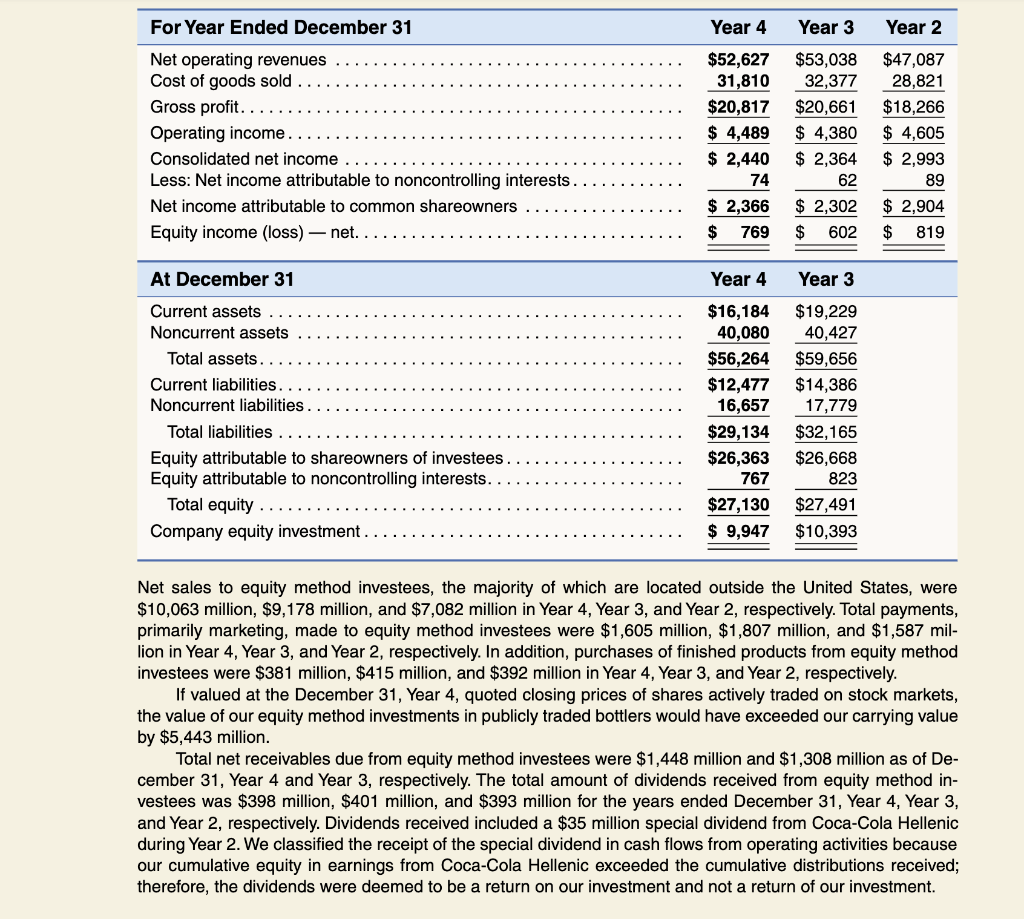

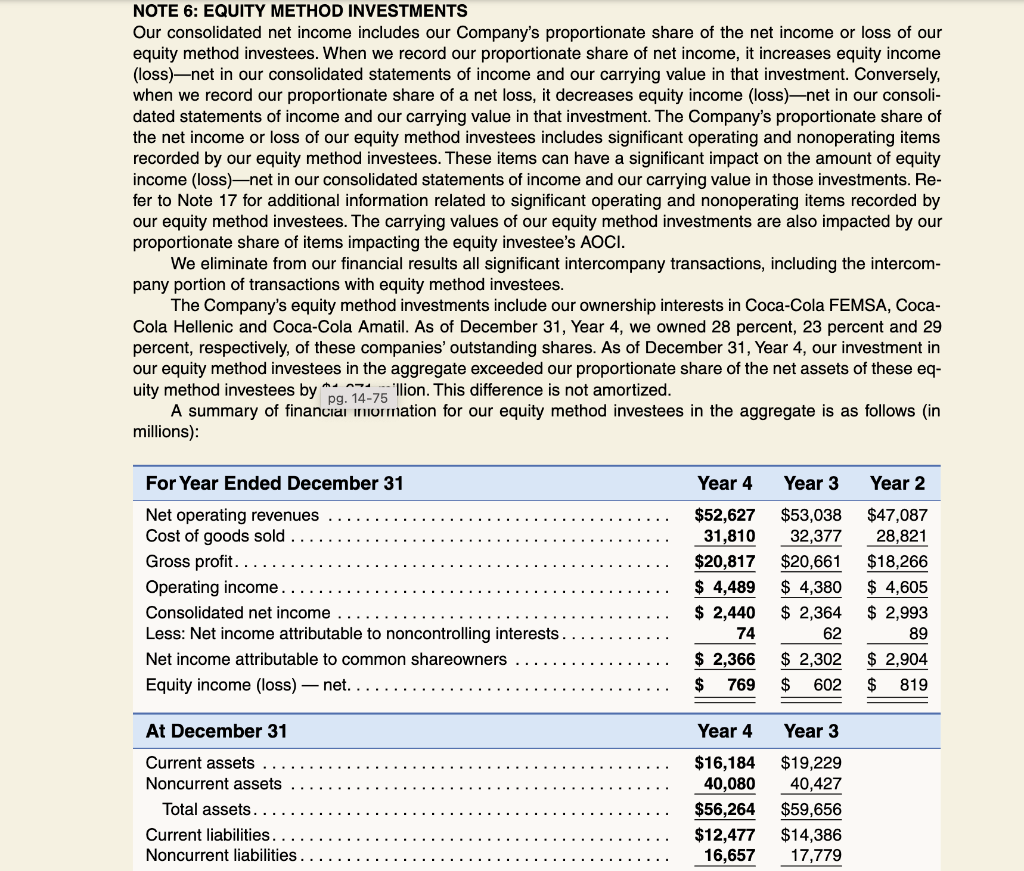

Required a. Does Coca-Cola have investments in affiliated companies for which it accounts using the equity method? What is the percentage ownership of each investee? b. At December 31, Year 4 (the most current year), what is the total amount of assets over which Coca-Cola has "significant influence" as a result of its equity investments? What is the total amount of "investment" CocaCola reports in its financial statements for investees? What is the fair value for these investments? c. What is the reported income from all of Coca-Cola's equity investments in Year 4? Considering only this income, does it appear that Coca-Cola is earning a large return on its equity investments? d. In what additional ways does Coca-Cola benefit from its equity investments other than its equity in the earnings of these companies? e. If all the equity method investments were consolidated into the Coca-Cola financial statements, what would be the effect on Coca-Cola's net income in Year 4? Assuming there are no intercompany receivables or payables to be eliminated, what would be the effect on Coca-Cola's total assets? f. Comment on why Coca-Cola might use a strategy of acquiring a significant but less than 50% ownership in its various bottlers. Net sales to equity method investees, the majority of which are located outside the United States, were $10,063 million, $9,178 million, and $7,082 million in Year 4, Year 3, and Year 2, respectively. Total payments, primarily marketing, made to equity method investees were $1,605 million, $1,807 million, and $1,587 million in Year 4, Year 3, and Year 2, respectively. In addition, purchases of finished products from equity method investees were $381 million, $415 million, and $392 million in Year 4, Year 3 , and Year 2, respectively. If valued at the December 31, Year 4, quoted closing prices of shares actively traded on stock markets, the value of our equity method investments in publicly traded bottlers would have exceeded our carrying value by $5,443 million. Total net receivables due from equity method investees were $1,448 million and $1,308 million as of December 31, Year 4 and Year 3, respectively. The total amount of dividends received from equity method investees was $398 million, $401 million, and $393 million for the years ended December 31 , Year 4 , Year 3 , and Year 2, respectively. Dividends received included a $35 million special dividend from Coca-Cola Hellenic during Year 2. We classified the receipt of the special dividend in cash flows from operating activities because our cumulative equity in earnings from Coca-Cola Hellenic exceeded the cumulative distributions received; therefore, the dividends were deemed to be a return on our investment and not a return of our investment. NOTE 6: EQUITY METHOD INVESTMENTS Our consolidated net income includes our Company's proportionate share of the net income or loss of our equity method investees. When we record our proportionate share of net income, it increases equity income (loss) -net in our consolidated statements of income and our carrying value in that investment. Conversely, when we record our proportionate share of a net loss, it decreases equity income (loss)-net in our consolidated statements of income and our carrying value in that investment. The Company's proportionate share of the net income or loss of our equity method investees includes significant operating and nonoperating items recorded by our equity method investees. These items can have a significant impact on the amount of equity income (loss) - net in our consolidated statements of income and our carrying value in those investments. Refer to Note 17 for additional information related to significant operating and nonoperating items recorded by our equity method investees. The carrying values of our equity method investments are also impacted by our proportionate share of items impacting the equity investee's AOCI. We eliminate from our financial results all significant intercompany transactions, including the intercompany portion of transactions with equity method investees. The Company's equity method investments include our ownership interests in Coca-Cola FEMSA, CocaCola Hellenic and Coca-Cola Amatil. As of December 31, Year 4, we owned 28 percent, 23 percent and 29 percent, respectively, of these companies' outstanding shares. As of December 31 , Year 4 , our investment in our equity method investees in the aggregate exceeded our proportionate share of the net assets of these eq- A summary of financiai iniormation for our equity method investees in the aggregate is as follows (in millions): Required a. Does Coca-Cola have investments in affiliated companies for which it accounts using the equity method? What is the percentage ownership of each investee? b. At December 31, Year 4 (the most current year), what is the total amount of assets over which Coca-Cola has "significant influence" as a result of its equity investments? What is the total amount of "investment" CocaCola reports in its financial statements for investees? What is the fair value for these investments? c. What is the reported income from all of Coca-Cola's equity investments in Year 4? Considering only this income, does it appear that Coca-Cola is earning a large return on its equity investments? d. In what additional ways does Coca-Cola benefit from its equity investments other than its equity in the earnings of these companies? e. If all the equity method investments were consolidated into the Coca-Cola financial statements, what would be the effect on Coca-Cola's net income in Year 4? Assuming there are no intercompany receivables or payables to be eliminated, what would be the effect on Coca-Cola's total assets? f. Comment on why Coca-Cola might use a strategy of acquiring a significant but less than 50% ownership in its various bottlers. Net sales to equity method investees, the majority of which are located outside the United States, were $10,063 million, $9,178 million, and $7,082 million in Year 4, Year 3, and Year 2, respectively. Total payments, primarily marketing, made to equity method investees were $1,605 million, $1,807 million, and $1,587 million in Year 4, Year 3, and Year 2, respectively. In addition, purchases of finished products from equity method investees were $381 million, $415 million, and $392 million in Year 4, Year 3 , and Year 2, respectively. If valued at the December 31, Year 4, quoted closing prices of shares actively traded on stock markets, the value of our equity method investments in publicly traded bottlers would have exceeded our carrying value by $5,443 million. Total net receivables due from equity method investees were $1,448 million and $1,308 million as of December 31, Year 4 and Year 3, respectively. The total amount of dividends received from equity method investees was $398 million, $401 million, and $393 million for the years ended December 31 , Year 4 , Year 3 , and Year 2, respectively. Dividends received included a $35 million special dividend from Coca-Cola Hellenic during Year 2. We classified the receipt of the special dividend in cash flows from operating activities because our cumulative equity in earnings from Coca-Cola Hellenic exceeded the cumulative distributions received; therefore, the dividends were deemed to be a return on our investment and not a return of our investment. NOTE 6: EQUITY METHOD INVESTMENTS Our consolidated net income includes our Company's proportionate share of the net income or loss of our equity method investees. When we record our proportionate share of net income, it increases equity income (loss) -net in our consolidated statements of income and our carrying value in that investment. Conversely, when we record our proportionate share of a net loss, it decreases equity income (loss)-net in our consolidated statements of income and our carrying value in that investment. The Company's proportionate share of the net income or loss of our equity method investees includes significant operating and nonoperating items recorded by our equity method investees. These items can have a significant impact on the amount of equity income (loss) - net in our consolidated statements of income and our carrying value in those investments. Refer to Note 17 for additional information related to significant operating and nonoperating items recorded by our equity method investees. The carrying values of our equity method investments are also impacted by our proportionate share of items impacting the equity investee's AOCI. We eliminate from our financial results all significant intercompany transactions, including the intercompany portion of transactions with equity method investees. The Company's equity method investments include our ownership interests in Coca-Cola FEMSA, CocaCola Hellenic and Coca-Cola Amatil. As of December 31, Year 4, we owned 28 percent, 23 percent and 29 percent, respectively, of these companies' outstanding shares. As of December 31 , Year 4 , our investment in our equity method investees in the aggregate exceeded our proportionate share of the net assets of these eq- A summary of financiai iniormation for our equity method investees in the aggregate is as follows (in millions)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started