Answered step by step

Verified Expert Solution

Question

1 Approved Answer

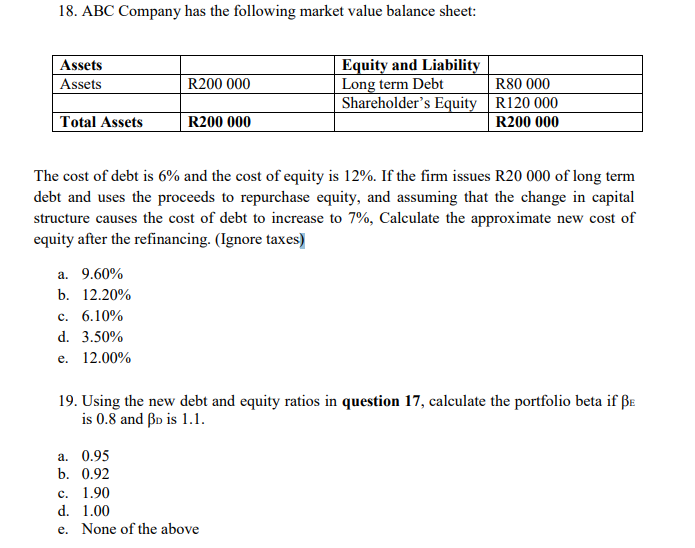

I just need help with question 19, the answer for 18 is 12.2% 18. ABC Company has the following market value balance sheet: Assets Assets

I just need help with question 19, the answer for 18 is 12.2%

18. ABC Company has the following market value balance sheet: Assets Assets Equity and Liability Long term Debt R200 000 R80 000 Shareholder's Equity R120 000 R200 000 Total Assets R200 000 The cost of debt is 6% and the cost of equity is 12%. If the firm issues R20 000 of long term debt and uses the proceeds to repurchase equity, and assuming that the change in capital structure causes the cost of debt to increase to 7%, Calculate the approximate new cost of equity after the refinancing. (Ignore taxes) a. 9.60% b. 12.20% c. 6.10% d. 3.50% e. 12.00% 19. Using the new debt and equity ratios in question 17, calculate the portfolio beta if BE is 0.8 and BD is 1.1. a. 0.95 b. 0.92 c. 1.90 d. 1.00 e. None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started