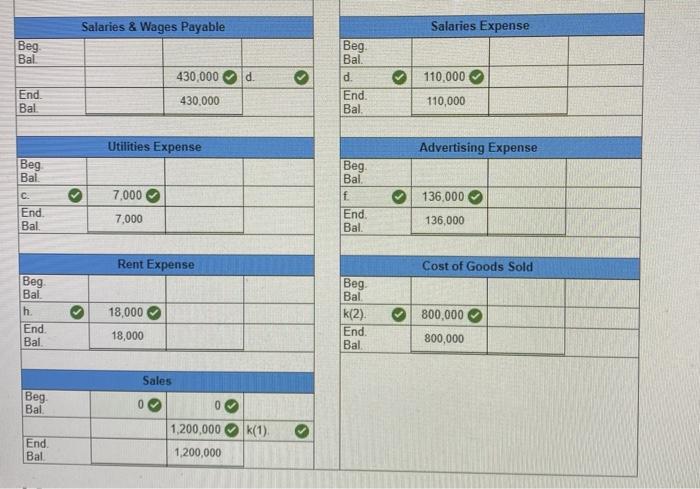

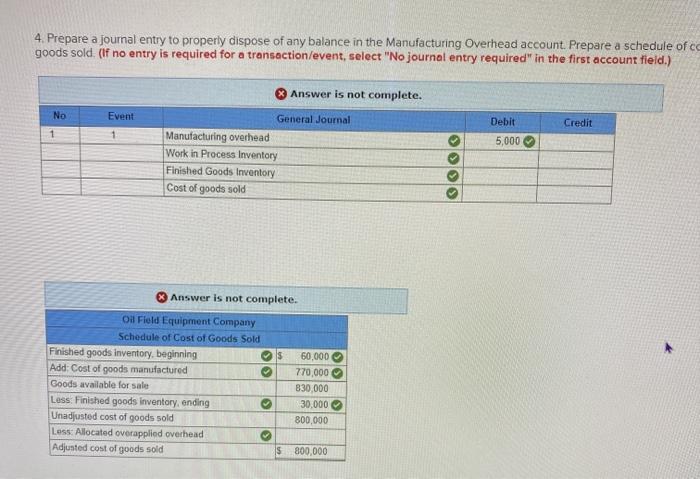

i just need help with question 4 i cannot figure out what goes for:

work in process inventory

finished goods inventory

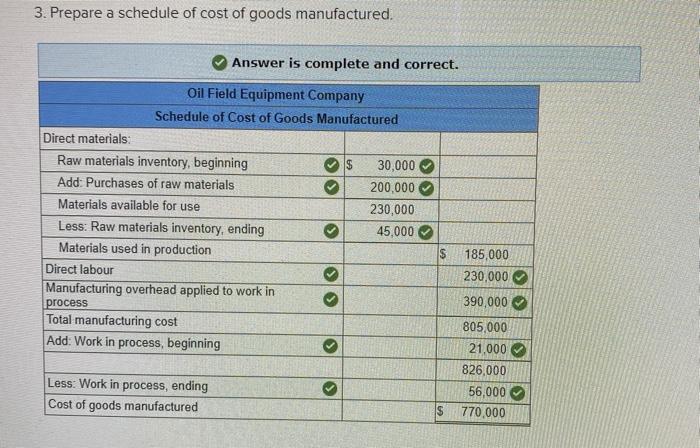

cost of goods sold

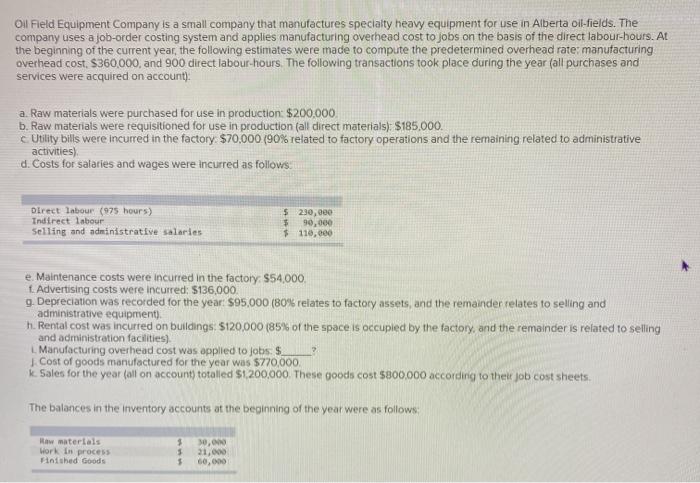

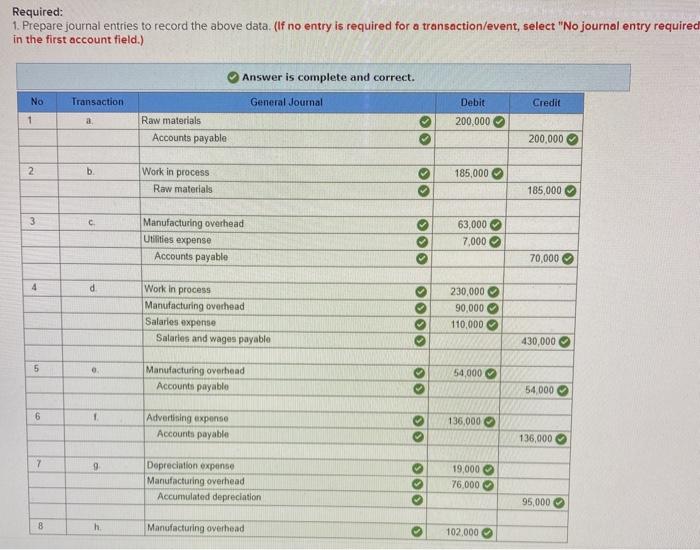

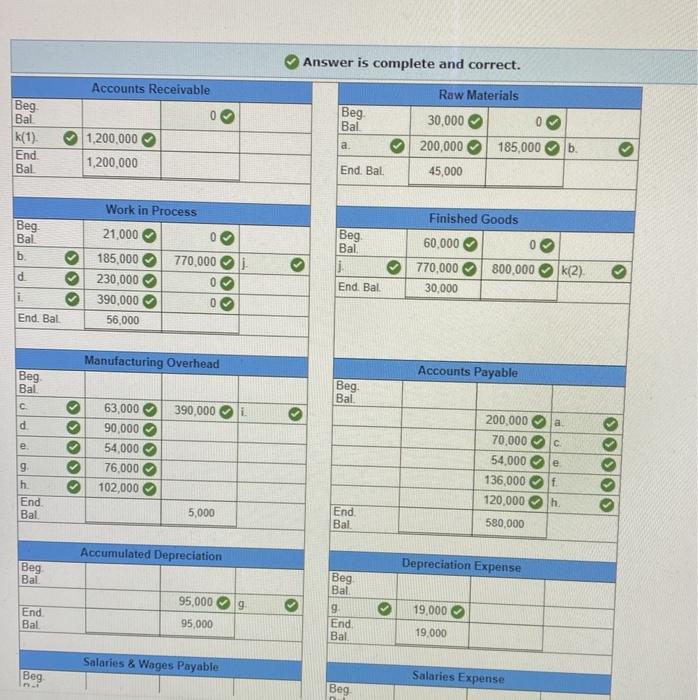

Oll Field Equipment Company is a small company that manufactures specialty heavy equipment for use in Alberta Oil-fields. The company uses a job-order costing system and applies manufacturing overhead cost to jobs on the basis of the direct labour-hours. At the beginning of the current year, the following estimates were made to compute the predetermined overhead rate manutacturing overhead cost, $360,000, and 900 direct labour-hours. The following transactions took place during the year (all purchases and services were acquired on account): a Raw materials were purchased for use in production: $200,000 b. Raw materials were requisitioned for use in production (all direct materials): $185.000. c Utility bills were incurred in the factory $70,000 (90% related to factory operations and the remaining related to administrative activities) d. Costs for salaries and wages were incurred as follows. Direct labour (975 hours) Indirect labour Selling and administrative salaries $ 230,000 $ 90,000 $ 110,000 e Maintenance costs were incurred in the factory S54,000, 1. Advertising costs were incurred: $136,000. g. Depreciation was recorded for the year $95,000 (80% relates to factory assets, and the remainder relates to selling and administrative equipment). h. Rental cost was incurred on buildings: 5120,000 (85% of the space is occupied by the factory, and the remainder is related to selling and administration facilities) Manufacturing overhead cost was applied to jobs $ Cost of goods manufactured for the year was 5770,000 k. Sales for the year (all on account) totalled $1.200,000. These goods cost $800.000 according to the job cost sheets The balances in the inventory accounts at the beginning of the year were as follows: Raw materials Work in process Finished Goods 3 $ 30,00 21,000 60,000 Required: 1. Prepare journal entries to record the above data. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) Answer is complete and correct. No Transaction General Journal Credit Debit 200,000 1 Raw materials Accounts payable 200,000 2 b. Work in process 185,000 Raw materials 185,000 3 Manufacturing overhead Utilities expense Accounts payable 63,000 7,000 70,000 4 d > Work in process Manufacturing overhead Salaries expense Salaries and wages payable OOO 230,000 90,000 110,000 430,000 5 54.000 Manufacturing overbond Accounts payable 54,000 6 1 136,000 Advertising expense Accounts payable 136,000 7 9 Depreciation expense Manufacturing overhead Accumulated depreciation 19,000 76,000 95,000 8 h Manufacturing overhead 102,000 > wwww 8 h Manufacturing overhead Rent expense Accounts payable OOO 102,000 18,000 120,000 9 i Work in process 390,000 > Manufacturing overhead O 390,000 10 Finished goods Work in process 770,000 770,000 11 k(1) Accounts receivable Sales DIS 1.200,000 1,200,000 12 k(2) Cost of goods sold Finished goods 800,000 800,000 Answer is complete and correct. Accounts Receivable Raw Materials 0 0 Beg Bal |k(1) End. Bal Beg Bal a. 1,200,000 1,200,000 30,000 200,000 45,000 185,000 End. Bal Finished Goods Beg Bal b Beg Bal 0 Work in Process 21,000 0 185,000 770.000 230,000 0 390,000 0 56,000 i 60,000 770,000 30,000 800,000 d k(2) DO End Bal i. End. Bal Manufacturing Overhead Accounts Payable Beg Bal Beg Bal. C 390,000 >> > d a ID OOOOO . 63,000 90,000 54,000 76,000 102,000 e 200.000 70,000 54000 136,000 120,000 580,000 9 h End Bal 000 f h 5,000 End Bal Accumulated Depreciation Depreciation Expense Beg Bal Beg Bal 95,000 9 > 9 19,000 End Bal 95,000 End Bal 19.000 Salaries & Wages Payable Beg Salaries Expense Beg Salaries & Wages Payable Salaries Expense Beg Bal d. Beg Bal d End Bal. 430,000 430,000 110,000 End. Bal 110,000 Utilities Expense Advertising Expense Beg Bal c. End Bal. > 7,000 Beg Bal f End. Bal. 136,000 7,000 136,000 Rent Expense Cost of Goods Sold Beg Bal h End Bal 18,000 Beg Bal k(2) End. Bal 800,000 800,000 18,000 Sales Beg Bal 0 k(1) End. Bal 1,200,000 1,200,000 3. Prepare a schedule of cost of goods manufactured. Answer is complete and correct. Oil Field Equipment Company Schedule of Cost of Goods Manufactured Direct materials: Raw materials inventory, beginning $ 30,000 Add: Purchases of raw materials 200,000 Materials available for use 230,000 Less: Raw materials inventory, ending 45,000 Materials used in production Direct labour Manufacturing overhead applied to work in process Total manufacturing cost Add: Work in process, beginning S 185,000 230,000 390,000 805,000 21,000 826,000 56,000 $ 770,000 Less: Work in process, ending Cost of goods manufactured 4. Prepare a journal entry to properly dispose of any balance in the Manufacturing Overhead account. Prepare a schedule of co goods sold. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) Answer is not complete. No Event Credit 1 1 Debit 5,000 General Journal Manufacturing overhead Work in Process Inventory Finished Goods Inventory Cost of goods sold >>> Answer is not complete. oa Field Equipment Company Schedule of Cost of Goods Sold Finished goods inventory beginning IS 60.000 Add: Cost of goods manufactured 770,000 Goods available for sale 830,000 Less: Finished goods inventory, ending 30.000 Unadjusted cost of goods sold 800,000 Less: Allocated overapplied overhead Adjusted cost of goods sold $ 800,000 > >