Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I just need help with the analysis of this data based on these questions. Here is the data. Complete a short analytical review of your

I just need help with the analysis of this data based on these questions. Here is the data.

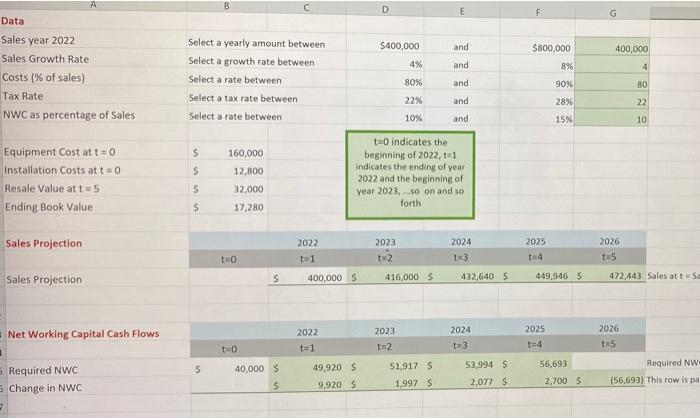

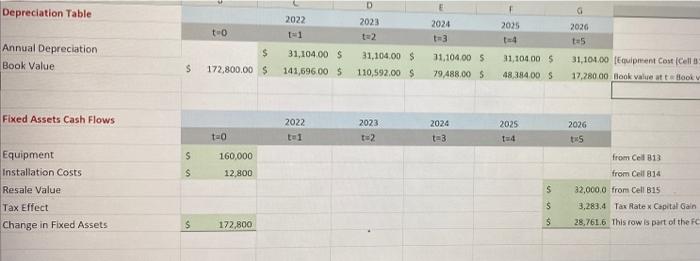

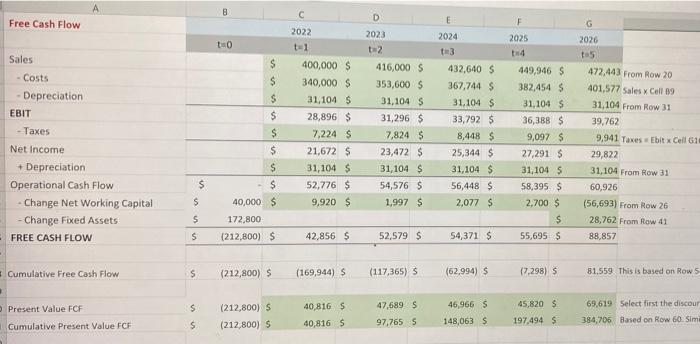

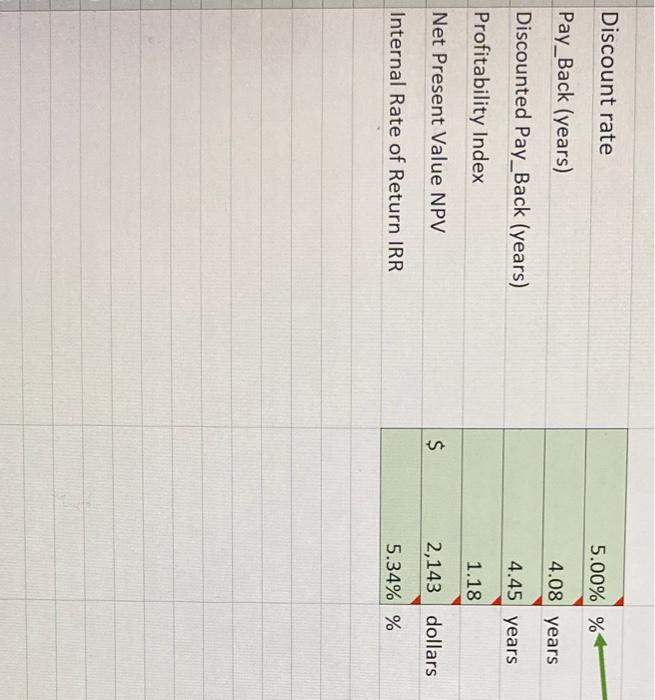

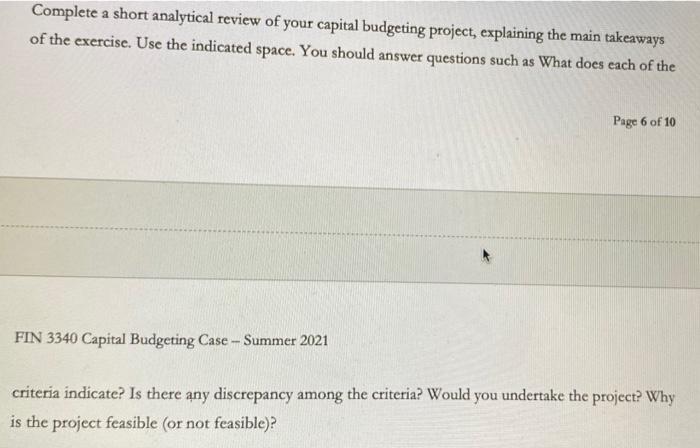

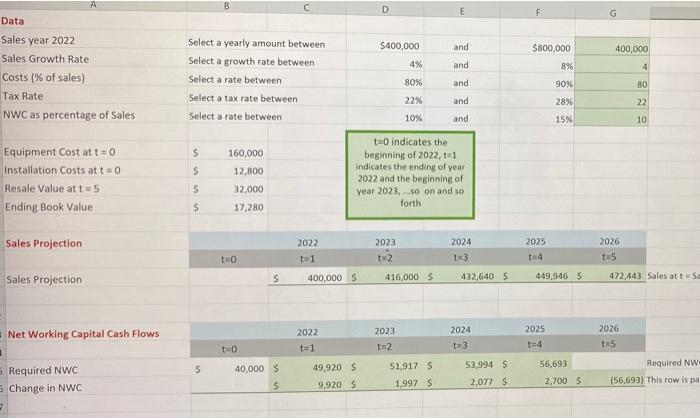

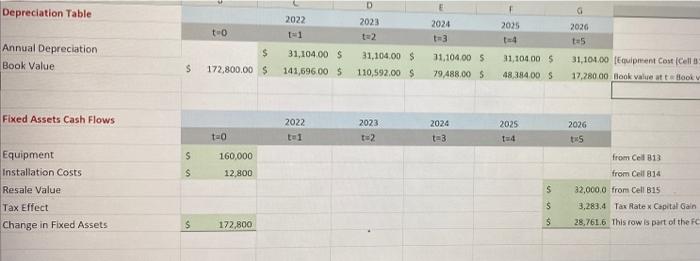

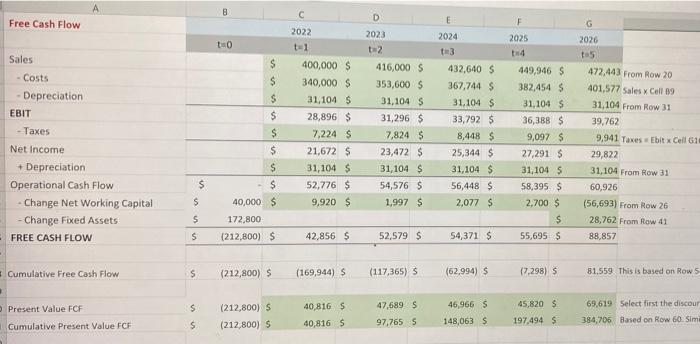

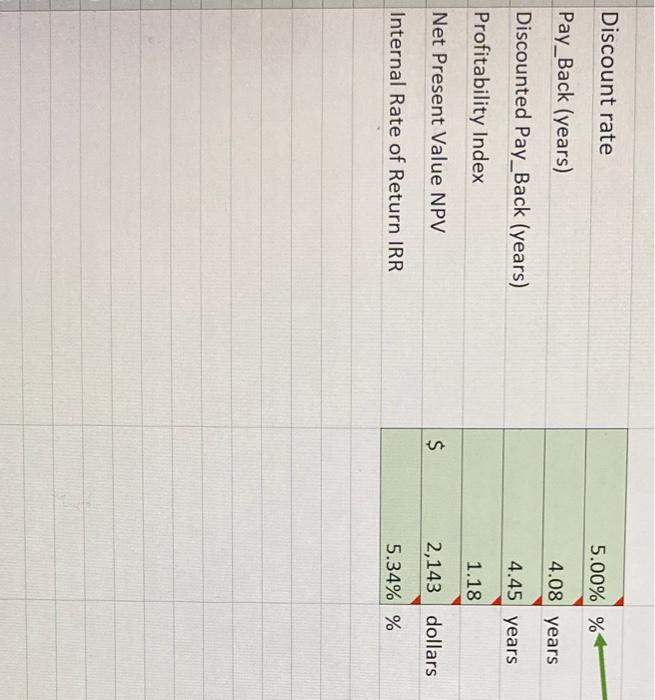

Complete a short analytical review of your capital budgeting project, explaining the main takeaways of the exercise. Use the indicated space. You should answer questions such as What does each of the Page 6 of 10 FIN 3340 Capital Budgeting Case - Summer 2021 criteria indicate? Is there any discrepancy among the criteria? Would you undertake the project? Why is the project feasible (or not feasible)? D E F G Data and $800,000 400,000 and $400,000 4% 80% 8% Sales year 2022 Sales Growth Rate Costs (% of sales) Tax Rate NWC as percentage of Sales 4 Select a yearly amount between Select a growth rate between Select a rate between Select a tax rate between Select a rate between and 90% 80 and 22% 10% 28% 15% 22 10 and $ s Equipment Cost att = 0 Installation Costs at t=0 Resale Value at t5 Ending Book Value 160,000 12,800 32,000 17,280 to indicates the beginning of 2022, t=1 indicates the ending of year 2022 and the beginning of Year 2023,...so on and so forth S S Sales Projection 2022 t1 2023 t-2 2024 t=3 2025 t4 2026 t5 too Sales Projection $ 400,000 $ 416,000 S 432,640 449,946 $ 472,443 Sales at tsa 2024 2025 = Net Working Capital Cash Flows 2022 t=1 2023 t=2 2026 t=5 t=0 t=3 t=4 S Required NWC 5 Change in NWC 40,000 $ $ 49,920 $ 9,920$ 51,917 S 1,997 S 53,994 S 2,077 S 56,693 2,700 S Required NW: (56,693) This row is pa D 1 Depreciation Table 2022 1 2023 ta2 2025 to G 2020 tas 2024 3 Annual Depreciation Book Value $ 172,800.00 $ 31,104.00 $ 141,696.00 $ $ 31,104.00 $ 110,592,00 31,104005 79.488.00 $ 91,104.00 $ 48,384.00 $ 31,101.00 Equipment Cost Cells 17.280.00 flook value at took Fixed Assets Cash Flows 2022 ta1 2023 t2 2024 ta3 2025 154 2026 ts tao $ from Cell 313 160,000 12,800 S Equipment Installation Costs Resale Value Tax Effect Change in Fixed Assets s from Cell 814 32,000.0 from Cell B15 3,283.4 Tax Rate Capital Gain 28,761.6 This row is part of the FC 5 5 $ 172,800 8 D Free Cash Flow F G E 2024 3 2026 100 Sales - Costs Depreciation EBIT - Taxes Net Income + Depreciation Operational Cash Flow Change Net Working Capital -Change Fixed Assets FREE CASH FLOW $ $ S $ $ $ $ $ 40,000 $ 2022 1 400,000 $ 340,000 $ 31,104 $ 28,896 $ 7,224 $ 21,672 $ 31,104 S 52,776 $ 9,920 $ 2023 t2 416,000 S 353,600 $ 31,104 S 31,296 $ 7,824 $ 23,472 $ 31,104 $ 54,576 $ 1.997 $ 432,640 S 367,744 $ 31.104 $ 33,792 $ 8,448 $ 25,344 $ 31,104 $ 56,448 $ 2,077 $ 2025 4 449,946 S 382,454 S 31,104 $ 36,388 S 9,097 $ 27,291 $ 31,1045 58,395 $ 2,700 $ $ 55,695 $ 472,443 From Row 20 401,577 Sales x Cell 39 31,104 From Row 31 39.762 9,941 Taxes Ebit x Cell 1 29,822 31,104 From Row 31 60,926 (56,693) From Row 26 28,762 From Row 41 88,857 $ S S 172,800 (212,800) S S 42,856 $ 52,579 $ 54,371 $ Cumulative Free Cash Flow S (212,800) S (169,944) S (117,365) S (62,994) S (7.298) 5 81,559 This is based on Row 5 45,820 $ Present Value FCF Cumulative Present Value FCF i u (212,800) S (212.800) $ 40,816 S 40,816 S 47,689 $ 97,765 5 46,966 S 148,063 S 69,619 Select first the discour 384,706 Based on Row 60: Sim 197.494 S Discount rate 5.00% % 4.08 years Pay_Back (years) Discounted Pay_Back (years) Profitability Index 4.45 years 1.18 Net Present Value NPV $ 2,143 dollars Internal Rate of Return IRR 5.34% %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started