I just need help with the last 4 blank parts of this question at the bottom. Thanks !

What I need help with (please show how you worked on the numbers):

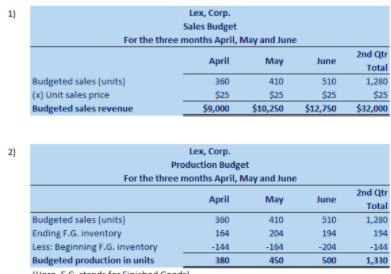

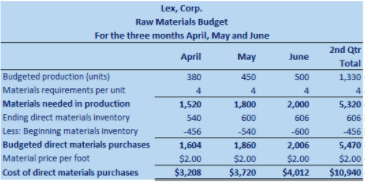

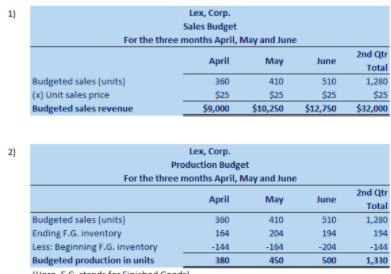

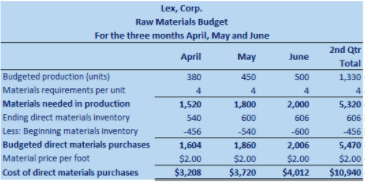

Lex, Corp., manufactures bamboo coat racks that sel for $25 each. Each rack requires 4 linear feet of bamboo, which costs $2.00 per foot. Each rack takes approximately 30 minutes to build, and the labor rate averages $14 per hour. Lex has the following inventory policies: Ending finished goods inventory should be 40 percent of next month's sales. Ending direct materials inventory should be 30 percent of next month's production. Expected unit sales (racks) for the upcoming months follow: March April May June 330 360 410 510 July 485 535 August Variable manufacturing overhead is incurred at a rate of $0.40 per unit produced. Annual fixed manufacturing overhead is estimated to be $8.400 ($700 per month) for expected production of 4,000 units for the year. Selling and administrative expenses are estimated at $750 per month plus $0.50 per unit sold Lex, Corp., had $13,500 cash on hand on April 1. Of its sales, 80 percent is in cash. Of the credit sales, 50 percent is collected during the month of the sale, and 50 percent is collected during the month following the sale. Assume the company can borrow in increments of $1,000 to maintain a $13,000 minimum cash balance and that the amount will be repaid in the subsequent month, provided there is adequate cash flow. Borrowings are made at the beginning of the month and repayments occur at the end of the month. Interest on borrowings is 12% annually and is paid monthly on amounts outstanding. Of direct materials purchases, 80 percent is paid for during the month purchased and 20 percent is paid in the following month. Direct material purchases for March 1 totaled $2,800. All other operating costs are paid during the month incurred. Monthly foxed manufacturing overhead includes $260 in depreciation. During May. Lex plans to pay $4,500 for a piece of equipment. 1) 1 Lex, Corp. Sales Budget For the three months April May and June April May Budgeted sales (units) 360 410 (x) Unit sales price $25 $25 Budgeted sales revenue $9,000 $10,250 June 510 $25 $12,750 2nd Qur Total 1,280 $25 $32,000 2) June Lex, Corp. Production Budget For the three months April May and June April May Budgeted sales (units) 360 410 Ending F.G. inventory 164 204 Less: Beginning F.G. inventory -144 -164 Budgeted production in units 380 450 510 194 2nd Qtr Total 1,280 194 -144 1,330 -204 500 June 2nd Qtr Total 1,330 Lex, Corp. Raw Materials Budget For the three months April, May and June April May Budgeted production (units) 380 450 Materials requirements per unit 4 4 Materials needed in production 1,520 1,800 Ending direct materials inventory 540 600 Less: Beginning materials inventory -456 -540 Budgeted direct materials purchases 1,604 1,860 Material price per foot $2.00 $2.00 Cost of direct materials purchases $3,208 $3,720 500 4 2,000 606 -600 2,006 $2.00 $4,012 5,320 606 -456 5,470 $2.00 $10,940 Lex, Corp. Direct Labor Budget For the three months April, May and June April May Budgeted production (units) 380 450 Direct labor hours per unit 0.50 0.50 Direct labor hours required 190 225 Direct labor rate per hour $14.00 $14.00 Budgeted direct labor cost $2,660 $3,150 June nd Qtr Total 500 1,330 0.50 0.50 250 665 $14.00 $14.00 $3,500 $9,310 Description Budgeted Production Variable Manufacturing overhead rate Budgeted Variable Manufacturing Fixed Manufacturing overhead Budgeted Manufacturing Overhead Overhead Budget Apr May 380 $ 0.40 $ $ 152.00$ $ 700.00 $ $ 852.00 $ June 2nd Quarter Total 450 500 1,330 0.40 $ 0.40 $ 0.40 180.00 $ 200.00 $ 532.00 700.00 $ 700.00 $ 2,100.00 880.00 $ 900.00 $ 2,632.00 Cost of Goods sold Budget Budgeted Manufacturing Cost per unit Direct Material Direct Labor Variable Manufacturing overhead Fixed Manufacturing overhead Budgeted Manufacturing Cost per unit $ 8.00 $ 7.00 $ 0.40 $ 2.10 $ 17.50 Apr May June 2nd Quarter Total 360 410 510 1,280 $ 17.50 $ 17.50 $ 17.50 $ 17.50 $ 6,300.00 $ 7,175.00 $ 8,925.00 $ 22,400.00 Budgeted Sales (Units) Budgeted Manufacturing Cost per unit Budgeted Cost of Goods Sold 510 Selling and Administrative Budget Description Apr | May Budgeted Sales 360 Variable selling and Administrative Rate $ 0.50 $ Budgeted Variable selling and Administrative expenses $ 180.00 $ Budgeted Fixed selling and Administrative expenses $ 750.00 $ Total Budgeted selling and Administrative expenses $ 930.00 $ June 2nd Quarter Total 410 1,280 0.50 $ 0.50 $ 0.50 205.00 $ 255.00 $ 640.00 750.00 $ 750.00 $ 2,250.00 955.00 $ 1,005.00 $ 2,890.00 Budgeted Income Statement Lex Corporation Budgeted Income Statement For the Quarter Endine June 2nd Quarter Total April May June Duurpeted Sales Reverie Budgeted Cost of Goods Sold Budgeted Gross Margin Budgeted Selling and Administrative Expenses Budgeted Net Operating Income Cash Collection Budget 2nd Quarter Total April May June Budgeted sales revenue Cash collections Credit collections Cash collected from current month sales Cash collected from prior month sales Budgeted cash receipts Cash Disbursement Budget Total 2nd Quarter April May June Budgeted direct materials purchases Cash disbursements: Direct materials purchases Current month purchases Prior month purchases Direct labor Manufacturing overhead Less: Depreciation (given) Selling and administrative expenses Purchase of cquipment Total budgeted cash payments Cash Budget 2nd Quarter Total April May June Beginning Cash Balance Plus: Budgeted Cash Receipts Less: Budgeted Cash Payrnents Preliminary Cash Balance Cash Borrowed / Repaid (with interest Ending Cash Balance