Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I just need part B answer no need part A please urgent and answer correctly its 30 mark Assume that you are the accountant of

I just need part B answer no need part A please urgent and answer correctly its 30 mark

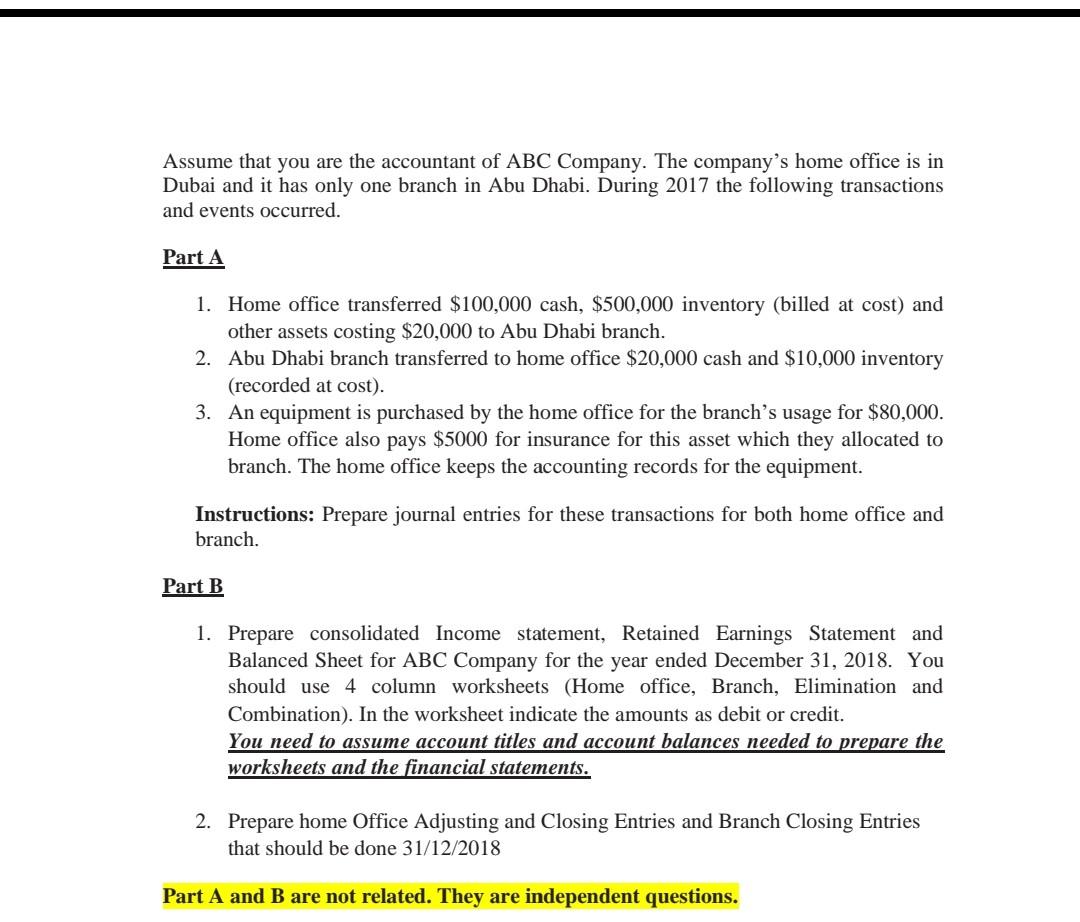

Assume that you are the accountant of ABC Company. The company's home office is in Dubai and it has only one branch in Abu Dhabi. During 2017 the following transactions and events occurred. Part A 1. Home office transferred $100,000 cash, $500,000 inventory (billed at cost) and other assets costing $20,000 to Abu Dhabi branch. 2. Abu Dhabi branch transferred to home office $20,000 cash and $10,000 inventory (recorded at cost). 3. An equipment is purchased by the home office for the branch's usage for $80,000. Home office also pays $5000 for insurance for this asset which they allocated to branch. The home office keeps the accounting records for the equipment. Instructions: Prepare journal entries for these transactions for both home office and branch. Part B 1. Prepare consolidated Income statement, Retained Earnings Statement and Balanced Sheet for ABC Company for the year ended December 31, 2018. You should use 4 column worksheets (Home office, Branch, Elimination and Combination). In the worksheet indicate the amounts as debit or credit. You need to assume account titles and account balances needed to prepare the worksheets and the financial statements. 2. Prepare home Office Adjusting and Closing Entries and Branch Closing Entries that should be done 31/12/2018 Part A and B are not related. They are independent questionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started