I JUST NEED THE ANSWER FOR PART C

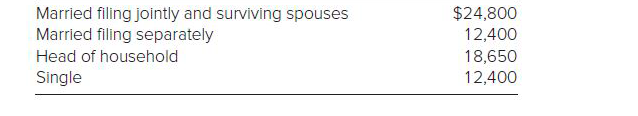

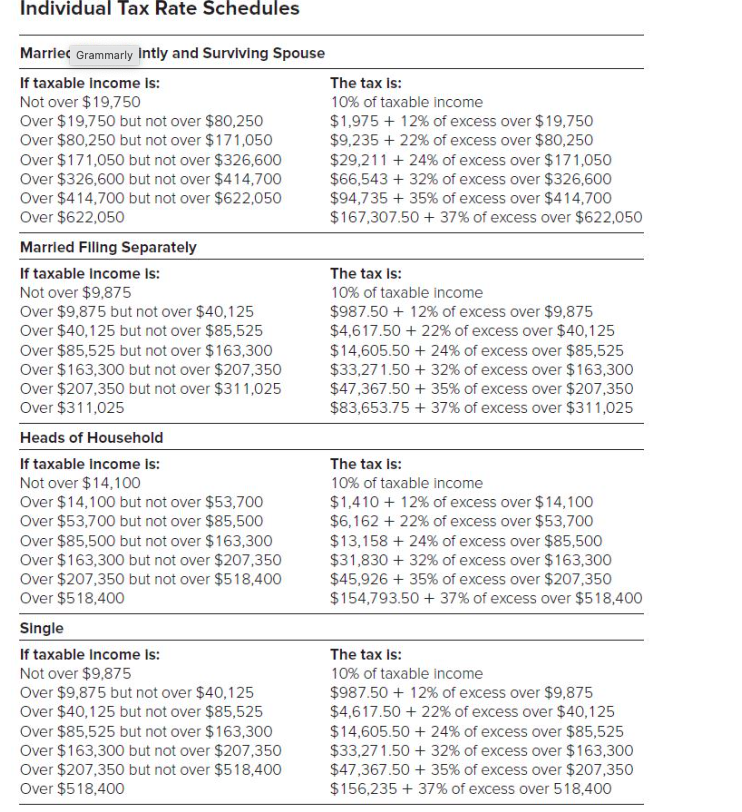

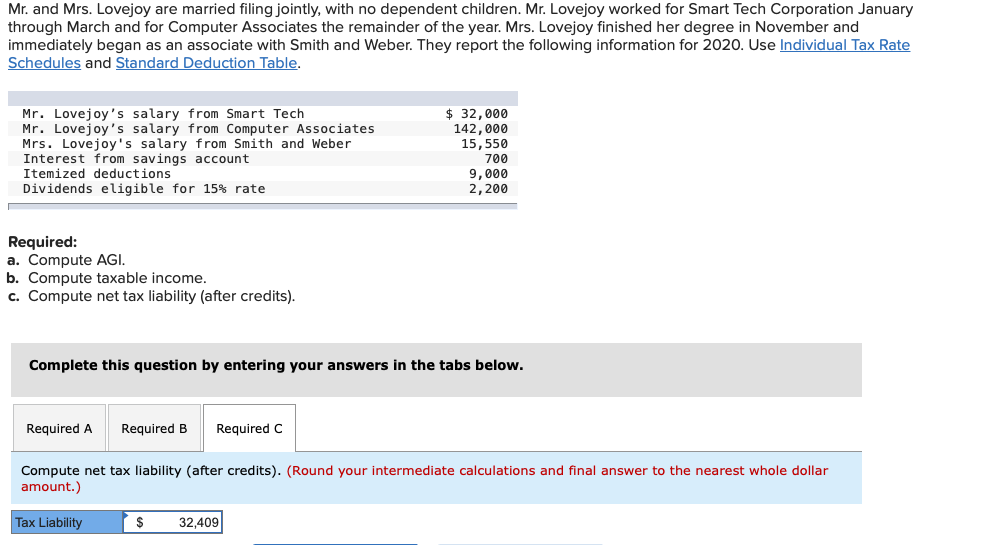

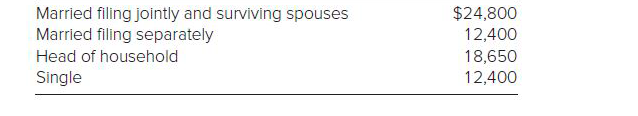

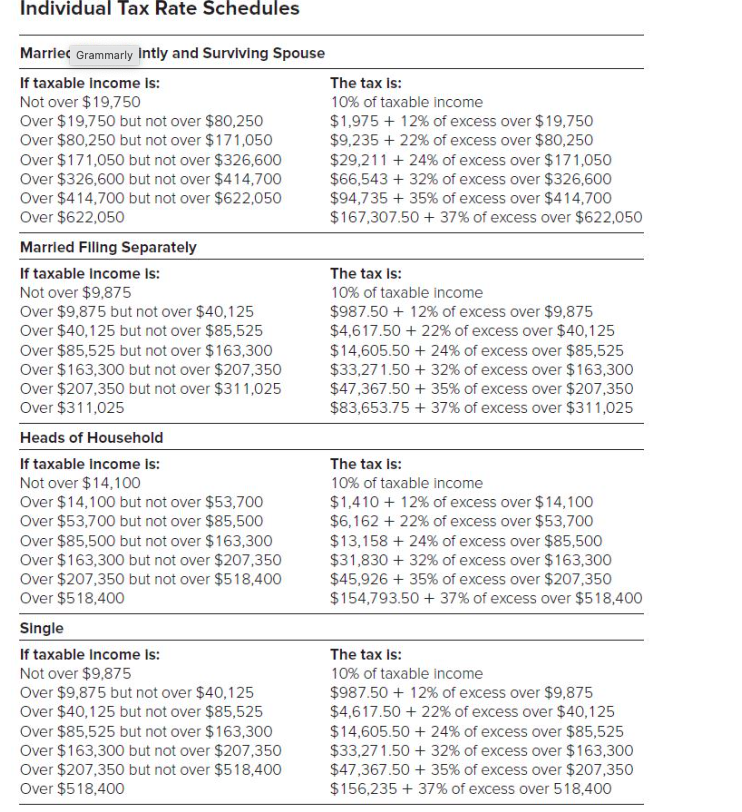

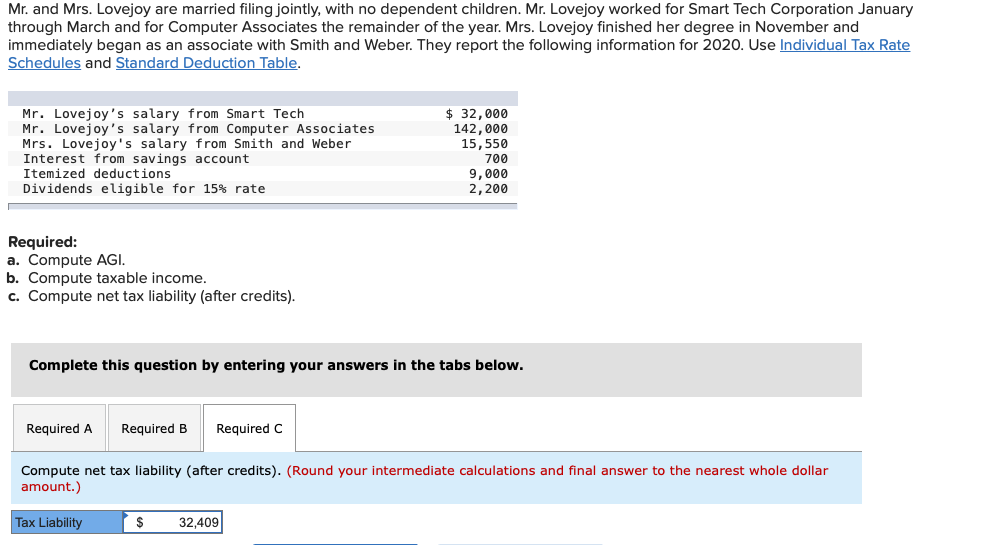

Married filing jointly and surviving spouses Married filing separately Head of household Single $24,800 12,400 18,650 12,400 Individual Tax Rate Schedules Marriec Grammarly Intly and Surviving Spouse If taxable income is: The tax is: Not over $19,750 10% of taxable income Over $19,750 but not over $80,250 $1,975 + 12% of excess over $19,750 Over $80,250 but not over $171,050 $9,235 + 22% of excess over $80,250 Over $171,050 but not over $326,600 $29,211 + 24% of excess over $171,050 Over $326,600 but not over $414,700 $66,543 + 32% of excess over $326,600 Over $414,700 but not over $622,050 $94,735 + 35% of excess over $414,700 Over $622,050 $167,307.50 + 37% of excess over $622,050 Married Filing Separately If taxable income is: The tax is: Not over $9,875 10% of taxable income Over $9,875 but not over $40,125 $987.50 + 12% of excess over $9,875 Over $40,125 but not over $85,525 $4,617.50 + 22% of excess over $40,125 Over $85,525 but not over $ 163,300 $14,605.50 + 24% of excess over $85,525 Over $163,300 but not over $207,350 $33,271.50 + 32% of excess over $ 163,300 Over $207,350 but not over $311,025 $47,367.50 + 35% of excess over $207,350 Over $311,025 $83,653.75 + 37% of excess over $311,025 Heads of Household If taxable income is: The tax is: Not over $14,100 10% of taxable income Over $14, 100 but not over $53,700 $1,410 + 12% of excess over $14,100 Over $53,700 but not over $85,500 $6,162 + 22% of excess over $53,700 Over $85,500 but not over $ 163,300 $13,158 + 24% of excess over $85,500 Over $163,300 but not over $207,350 $31,830 + 32% of excess over $163,300 Over $207,350 but not over $518,400 $45,926 + 35% of excess over $207,350 Over $518,400 $154,793.50 + 37% of excess over $518,400 Single If taxable income is: The tax is: Not over $9,875 10% of taxable income Over $9,875 but not over $40,125 $987.50 + 12% of excess over $9,875 Over $40,125 but not over $85,525 $4,617.50 + 22% of excess over $40,125 Over $85,525 but not over $ 163,300 $14,605.50 + 24% of excess over $85,525 Over $ 163,300 but not over $207,350 $33,271.50 + 32% of excess over $ 163,300 Over $207,350 but not over $518,400 $47,367.50 + 35% of excess over $207,350 Over $518,400 $156,235 + 37% of excess over 518,400 Mr. and Mrs. Lovejoy are married filing jointly, with no dependent children. Mr. Lovejoy worked for Smart Tech Corporation January through March and for Computer Associates the remainder of the year. Mrs. Lovejoy finished her degree in November and immediately began as an associate with Smith and Weber. They report the following information for 2020. Use Individual Tax Rate Schedules and Standard Deduction Table. Mr. Lovejoy's salary from Smart Tech Mr. Lovejoy's salary from Computer Associates Mrs. Lovejoy's salary from Smith and Weber Interest from savings account Itemized deductions Dividends eligible for 15% rate $ 32,000 142,000 15,550 700 9,000 2,200 Required: a. Compute AGI. b. Compute taxable income. c. Compute net tax liability (after credits). Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute net tax liability (after credits). (Round your intermediate calculations and final answer to the nearest whole dollar amount.) Tax Liability $ 32,409