Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i just need the answer to question E1 on the last photo for that problem Sorry, F1 Required information [The following information applies to the

i just need the answer to question E1 on the last photo for that problem

Sorry, F1

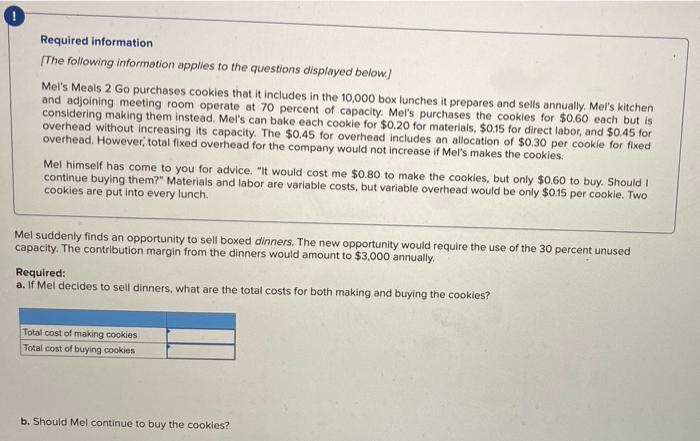

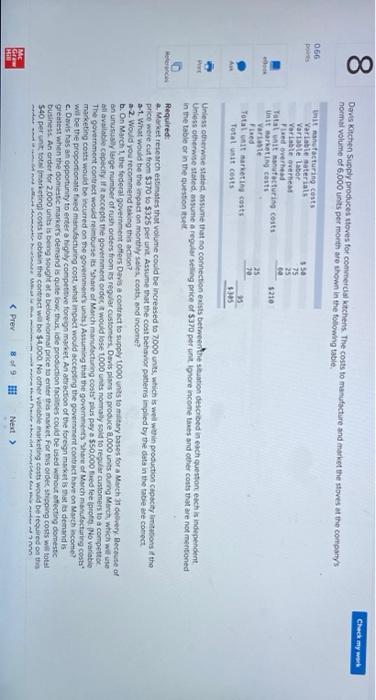

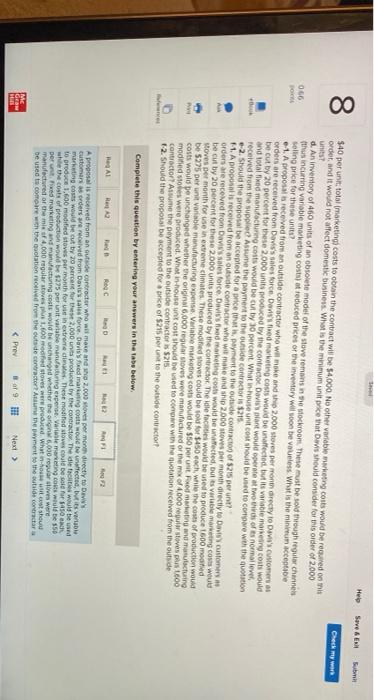

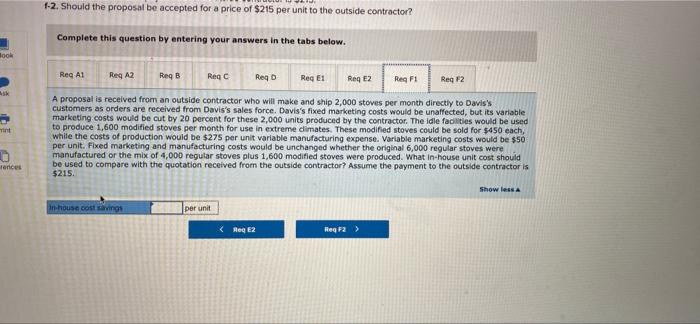

Required information [The following information applies to the questions displayed below) Mel's Meals 2 Go purchases cookies that it includes in the 10,000 box lunches it prepares and sells annually. Mel's kitchen and adjoining meeting room operate at 70 percent of capacity. Mel's purchases the cookies for $0.60 each but is considering making them instead. Mel's can bake each cookie for $0.20 for materials, $0.15 for direct labor, and $0.45 for overhead without increasing its capacity. The $0.45 for overhead includes an allocation of $0.30 per cookie for fixed overhead. However, total fixed overhead for the company would not increase if Mel's makes the cookies. Mel himself has come to you for advice. "It would cost me $0.80 to make the cookies, but only $0.60 to buy, Should I continue buying them?" Materials and labor are variable costs, but variable overhead would be only $0.15 per cookie. Two cookies are put into every lunch. Mel suddenly finds an opportunity to sell boxed dinners. The new opportunity would require the use of the 30 percent unused capacity. The contribution margin from the dinners would amount to $3,000 annually. Required: a. If Mel decides to sell dinners, what are the total costs for both making and buying the cookies? Total cost of making cookies Total cost of buying cookies b. Should Mel continue to buy the cookies? 00 8 Check my work Davis Kitchen Supply produces stoves for commercial kitchens. The costs to manufacture and market the stoves at the company's normal volume of 6.000 units per month are shown in the following table 066 35 it manufacturing costs Variable saterials Variable Labor Variable ever Fixed overhead Yotal wat manufacturing costs unit saring costs Variante Fused Total wait arketing costs Total unit costs $210 13 5.395 Unless otherwise stated, assume that no connection exists between the situation described in each question each is independent Unless otherwise stated assume a regular seling price of 5370 per unitore incomes and other costs that are not mentioned in the table or in the question itselt Required a Market research estimates that volume could be increased to 7000 units, which is well within production capacity imitations the price were cut from $370 to $325 per unit. Assume that the cost behavior patterns implied by the data in the table are correct a-1 What would be the impact on monthly sales, costs, and income? a-2. Would you recommend taking this action b. On March 1, the federal government offers Davis a contract to supply 1000 units to military bases for a March 31 delivery. Because of an unusual ge number of rush orders from its regular customers Devis plans to produce 8,000 units during March which wil all available capacity: Itaccepts the government order it would lose 1000 units nomaly sold to regular customers to a competitor The government contract would reimburse its share of March manufacturing costs plus pay a 350.000 Bedfee (prot. No variable marketing costs would be incurred on the government's units) Assuming that the governments Share of March manufacturing costs will be the proportionate fed manufacturing cost what impact would accepting the government contract have on March income? c. Davis has an opportunity to enter a highly competitive foreign market. An attraction of the foreign market is that is demandis greatest when the domestic market's demand is quite low, thus, ide production facies could be used without affecting domestic business. An order for 2000 units is being sought ata below normal price to enter this market. For this older shipping costs wil total $40 per un to marketing costs to obtain the contract will be $4.000. No other variable marketing costs would be required on this - - - Anne ME Gr Help Save & EX Subm 8 00 0.66 $40 per un total marketing costs to obtain the contract will be 54.000. No other variable wing costs would be recured on order, and it would not affect domestic business. What is the minimum price that is should consider for this order of 2.000 unt? d. An inventory of 460 units of an absolute model of the stoverstockroom. These must be sold through regular channels thus incurring variable marketing costs reduced prices of the inventory will soon be vueless. What is the minimum acceptable Selling price for these units? -- 1. A propos received from outside contractor who will make and th 2.000 stoves per mon directly to customers orders are received from Davids salesforce. Dowiedning costs would be affected but its variable moreng coit would be cut by 20 percent for these 2.000 units produced by the contractor Davis would operate at two of normal level and total manufacturing costs would be cut by 10 percent What she could be wed to come with the quotion received from the suppleAsume the payment to the outside Contractoris $215 2. Should the proposal be accepted for a price that payment to the de contraction of $215 port? M. A proposals received from an ous de contractor who want 2.000 teves per directly to customers orders are received from Davis's salesforce Davis' fed marcou would be affected, but ts varem co w be cut by 20 percent for these 2.000 units produced by the Cook The defects would be used to produce 1600 moned Moves per month for use in extreme climates. These modified stoves could be sold for $450 each, while the cost of production would be 5275 per unit variable manufacturing expense Variable marketing costs would be $50 per unit red marketing and manufacturing costs would be unchanged whether the original 6,000 regular stoves were manufactured of the mix of 4.000 regular stoves pus 600 modified stores were produced. What in house un cost should be used to come with the quotation received from the outside contractor Assume the payment to the outside contractor is $215 12. Should the propose accepted for a nice of $215 per unit to the outside contractor fo Complete this question by entering your answers in the labe below. RAI RRA he Anac 2 Aprel is received from an de contractor who wil mod 2.000 oven per month directly to DIN customers as orders are received from Davis' sa force Davis' fed martes costs would we unfected, but it was marketing costs would be cut by 20 percent for the 2,000 units produced by the contractor The die tites would be used to produce 1.600 modified stoves per month for use in extremedimThese mothed stoves could be le for $450 while the cost of production would be $225 per unit variable mancing expense Variable mating costull be $50 per ved marketing and manufacturing costs would be changed whether the 6,000regular lives were manufactured or the misf4,000 regular stoves 1.600 modified stoves werded. What is the be used to come with the quotation over the outside contractor the went to the outside contractar Mc GEON Bar 9: II Next > 1-2. Should the proposal be accepted for a price of $215 per unit to the outside contractor? Complete this question by entering your answers in the tabs below. ook Reg A1 Reg A2 Reg B Reqc Req Reg E1 Req E2 Reg F1 Reg F2 Tint A proposal is received from an outside contractor who will make and ship 2,000 stoves per month directly to Davis's customers as orders are received from Davis's sales force. Davis's fixed marketing costs would be unaffected, but its variable marketing costs would be cut by 20 percent for these 2,000 units produced by the contractor. The Idle facilities would be used to produce 1,600 modified stoves per month for use in extreme climates. These modified stoves could be sold for $450 each, while the costs of production would be $275 per unit variable manufacturing expense. Variable marketing costs would be $50 per unit. Fixed marketing and manufacturing costs would be unchanged whether the original 6,000 regular stoves were manufactured or the mix of 4,000 regular stoves plus 1,600 modified stoves were produced. What in-house unit cost should be used to compare with the quotation received from the outside contractor? Assume the payment to the outside contractor is $215. Show less 0 Tences in-house cost saving per unit Required information [The following information applies to the questions displayed below) Mel's Meals 2 Go purchases cookies that it includes in the 10,000 box lunches it prepares and sells annually. Mel's kitchen and adjoining meeting room operate at 70 percent of capacity. Mel's purchases the cookies for $0.60 each but is considering making them instead. Mel's can bake each cookie for $0.20 for materials, $0.15 for direct labor, and $0.45 for overhead without increasing its capacity. The $0.45 for overhead includes an allocation of $0.30 per cookie for fixed overhead. However, total fixed overhead for the company would not increase if Mel's makes the cookies. Mel himself has come to you for advice. "It would cost me $0.80 to make the cookies, but only $0.60 to buy, Should I continue buying them?" Materials and labor are variable costs, but variable overhead would be only $0.15 per cookie. Two cookies are put into every lunch. Mel suddenly finds an opportunity to sell boxed dinners. The new opportunity would require the use of the 30 percent unused capacity. The contribution margin from the dinners would amount to $3,000 annually. Required: a. If Mel decides to sell dinners, what are the total costs for both making and buying the cookies? Total cost of making cookies Total cost of buying cookies b. Should Mel continue to buy the cookies? 00 8 Check my work Davis Kitchen Supply produces stoves for commercial kitchens. The costs to manufacture and market the stoves at the company's normal volume of 6.000 units per month are shown in the following table 066 35 it manufacturing costs Variable saterials Variable Labor Variable ever Fixed overhead Yotal wat manufacturing costs unit saring costs Variante Fused Total wait arketing costs Total unit costs $210 13 5.395 Unless otherwise stated, assume that no connection exists between the situation described in each question each is independent Unless otherwise stated assume a regular seling price of 5370 per unitore incomes and other costs that are not mentioned in the table or in the question itselt Required a Market research estimates that volume could be increased to 7000 units, which is well within production capacity imitations the price were cut from $370 to $325 per unit. Assume that the cost behavior patterns implied by the data in the table are correct a-1 What would be the impact on monthly sales, costs, and income? a-2. Would you recommend taking this action b. On March 1, the federal government offers Davis a contract to supply 1000 units to military bases for a March 31 delivery. Because of an unusual ge number of rush orders from its regular customers Devis plans to produce 8,000 units during March which wil all available capacity: Itaccepts the government order it would lose 1000 units nomaly sold to regular customers to a competitor The government contract would reimburse its share of March manufacturing costs plus pay a 350.000 Bedfee (prot. No variable marketing costs would be incurred on the government's units) Assuming that the governments Share of March manufacturing costs will be the proportionate fed manufacturing cost what impact would accepting the government contract have on March income? c. Davis has an opportunity to enter a highly competitive foreign market. An attraction of the foreign market is that is demandis greatest when the domestic market's demand is quite low, thus, ide production facies could be used without affecting domestic business. An order for 2000 units is being sought ata below normal price to enter this market. For this older shipping costs wil total $40 per un to marketing costs to obtain the contract will be $4.000. No other variable marketing costs would be required on this - - - Anne ME Gr Help Save & EX Subm 8 00 0.66 $40 per un total marketing costs to obtain the contract will be 54.000. No other variable wing costs would be recured on order, and it would not affect domestic business. What is the minimum price that is should consider for this order of 2.000 unt? d. An inventory of 460 units of an absolute model of the stoverstockroom. These must be sold through regular channels thus incurring variable marketing costs reduced prices of the inventory will soon be vueless. What is the minimum acceptable Selling price for these units? -- 1. A propos received from outside contractor who will make and th 2.000 stoves per mon directly to customers orders are received from Davids salesforce. Dowiedning costs would be affected but its variable moreng coit would be cut by 20 percent for these 2.000 units produced by the contractor Davis would operate at two of normal level and total manufacturing costs would be cut by 10 percent What she could be wed to come with the quotion received from the suppleAsume the payment to the outside Contractoris $215 2. Should the proposal be accepted for a price that payment to the de contraction of $215 port? M. A proposals received from an ous de contractor who want 2.000 teves per directly to customers orders are received from Davis's salesforce Davis' fed marcou would be affected, but ts varem co w be cut by 20 percent for these 2.000 units produced by the Cook The defects would be used to produce 1600 moned Moves per month for use in extreme climates. These modified stoves could be sold for $450 each, while the cost of production would be 5275 per unit variable manufacturing expense Variable marketing costs would be $50 per unit red marketing and manufacturing costs would be unchanged whether the original 6,000 regular stoves were manufactured of the mix of 4.000 regular stoves pus 600 modified stores were produced. What in house un cost should be used to come with the quotation received from the outside contractor Assume the payment to the outside contractor is $215 12. Should the propose accepted for a nice of $215 per unit to the outside contractor fo Complete this question by entering your answers in the labe below. RAI RRA he Anac 2 Aprel is received from an de contractor who wil mod 2.000 oven per month directly to DIN customers as orders are received from Davis' sa force Davis' fed martes costs would we unfected, but it was marketing costs would be cut by 20 percent for the 2,000 units produced by the contractor The die tites would be used to produce 1.600 modified stoves per month for use in extremedimThese mothed stoves could be le for $450 while the cost of production would be $225 per unit variable mancing expense Variable mating costull be $50 per ved marketing and manufacturing costs would be changed whether the 6,000regular lives were manufactured or the misf4,000 regular stoves 1.600 modified stoves werded. What is the be used to come with the quotation over the outside contractor the went to the outside contractar Mc GEON Bar 9: II Next > 1-2. Should the proposal be accepted for a price of $215 per unit to the outside contractor? Complete this question by entering your answers in the tabs below. ook Reg A1 Reg A2 Reg B Reqc Req Reg E1 Req E2 Reg F1 Reg F2 Tint A proposal is received from an outside contractor who will make and ship 2,000 stoves per month directly to Davis's customers as orders are received from Davis's sales force. Davis's fixed marketing costs would be unaffected, but its variable marketing costs would be cut by 20 percent for these 2,000 units produced by the contractor. The Idle facilities would be used to produce 1,600 modified stoves per month for use in extreme climates. These modified stoves could be sold for $450 each, while the costs of production would be $275 per unit variable manufacturing expense. Variable marketing costs would be $50 per unit. Fixed marketing and manufacturing costs would be unchanged whether the original 6,000 regular stoves were manufactured or the mix of 4,000 regular stoves plus 1,600 modified stoves were produced. What in-house unit cost should be used to compare with the quotation received from the outside contractor? Assume the payment to the outside contractor is $215. Show less 0 Tences in-house cost saving per unit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started