Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i just need the debit and credits for letters b and e. As well as the common stock and retained earnings for the yellow chart.

i just need the debit and credits for letters b and e.

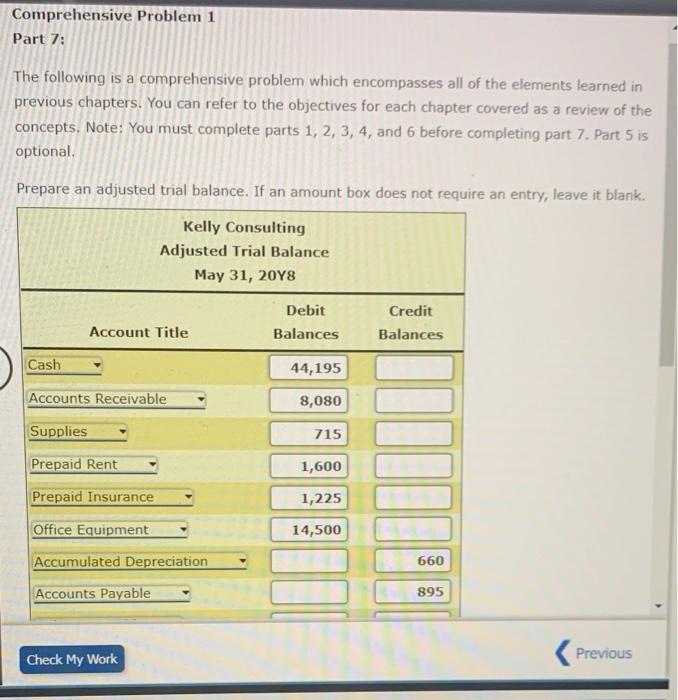

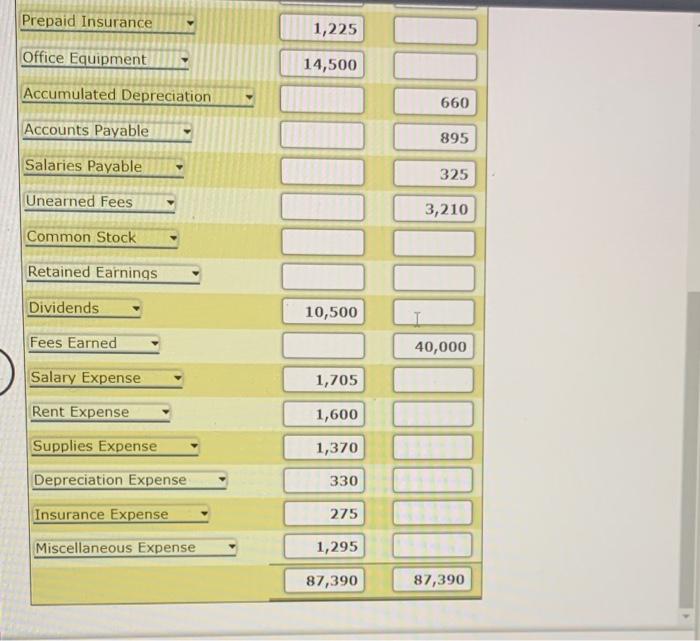

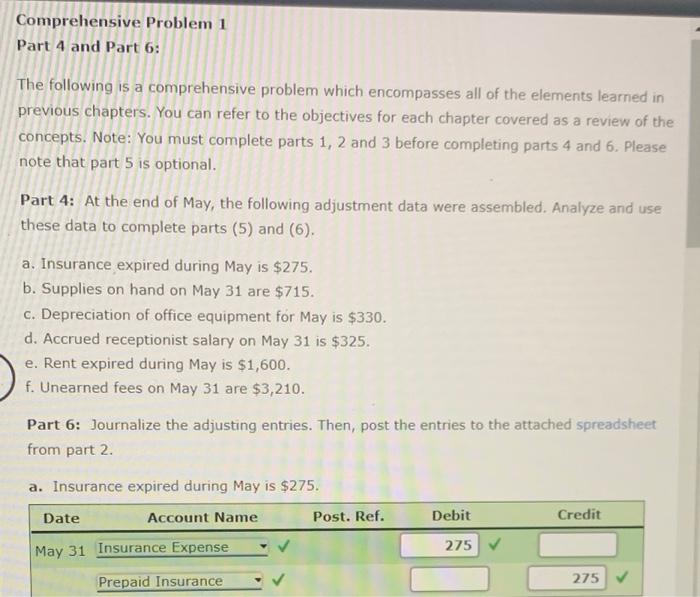

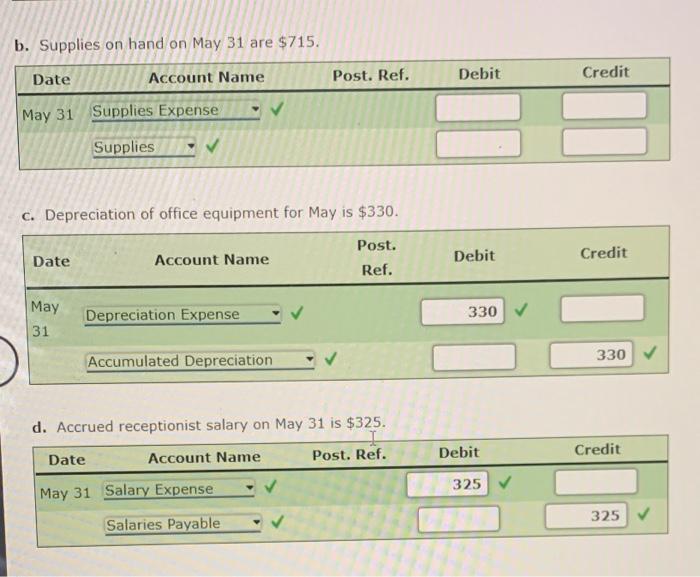

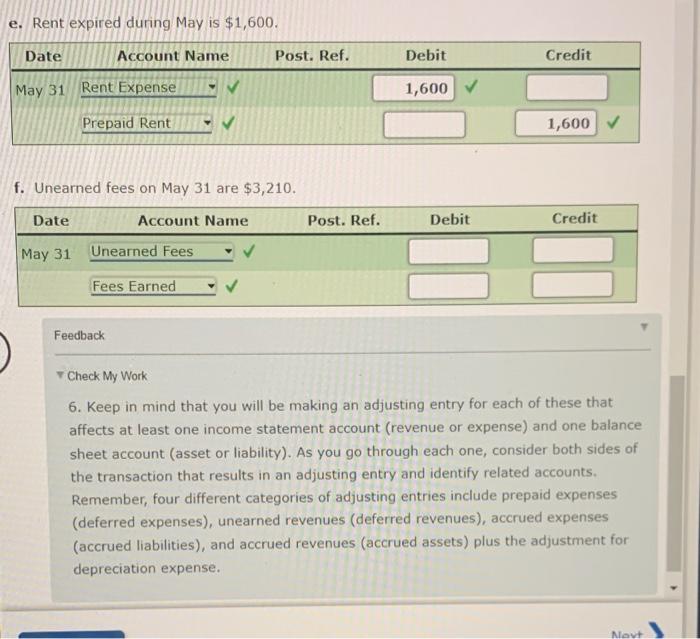

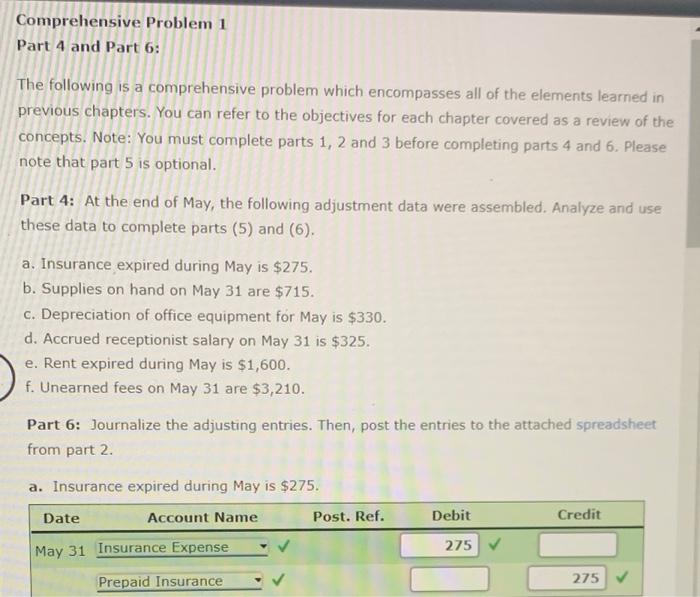

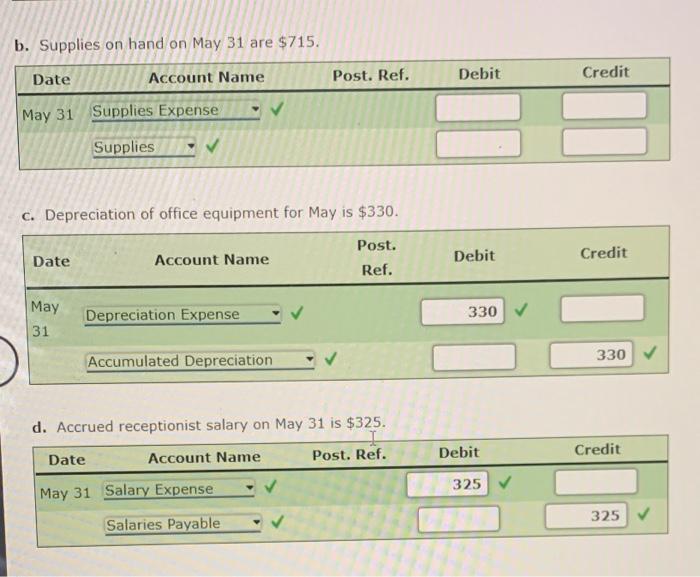

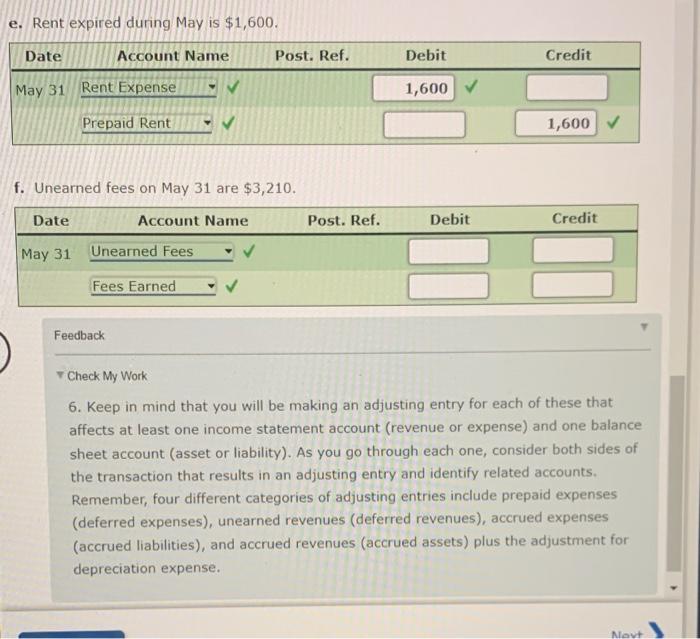

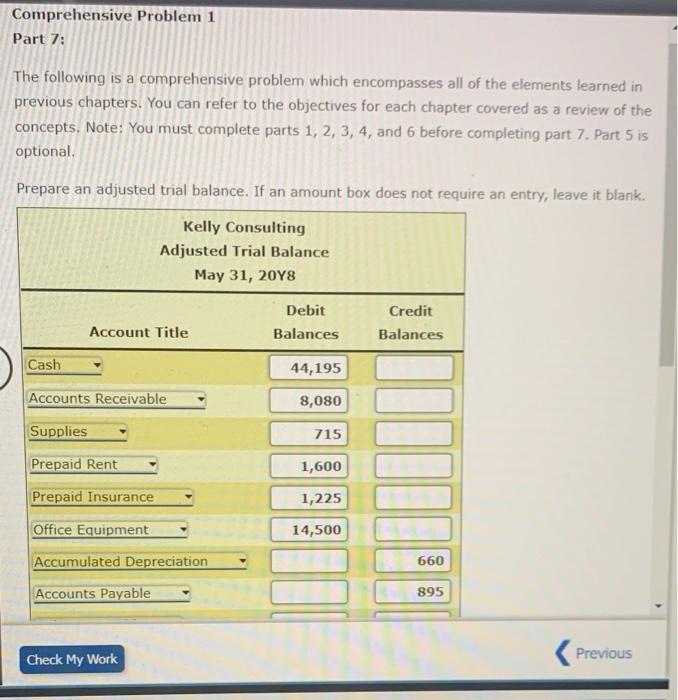

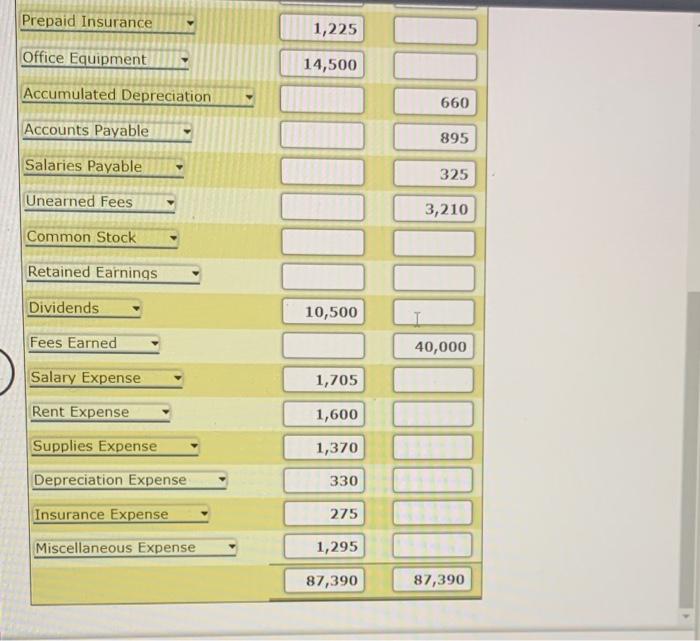

Comprehensive Problem 1 Part 4 and Part 6: The following is a comprehensive problem which encompasses all of the elements learned in previous chapters. You can refer to the objectives for each chapter covered as a review of the concepts. Note: You must complete parts 1, 2 and 3 before completing parts 4 and 6. Please note that part 5 is optional. Part 4: At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a. Insurance expired during May is $275. b. Supplies on hand on May 31 are $715. c. Depreciation of office equipment for May is $330. d. Accrued receptionist salary on May 31 is $325. e. Rent expired during May is $1,600. f. Unearned fees on May 31 are $3,210. Part 6: Journalize the adjusting entries. Then, post the entries to the attached spreadsheet from part 2. a. Insurance expired during May is $275. Date Account Name Post. Ref. Debit Credit May 31 Insurance Expense 275 Prepaid Insurance 275 b. Supplies on hand on May 31 are $715. Date Account Name Post. Ref. Debit Credit May 31 Supplies Expense Supplies c. Depreciation of office equipment for May is $330. Post. Date Account Name Debit Credit Ref. May Depreciation Expense 330 31 Accumulated Depreciation 330 d. Accrued receptionist salary on May 31 is $325. Date Debit Credit Account Name Post. Ref. 325 May 31 Salary Expense 325 Salaries Payable e. Rent expired during May is $1,600. Date Account Name Post. Ref. Debit Credit May 31 Rent Expense 1,600 Prepaid Rent 1,600 f. Unearned fees on May 31 are $3,210. Date Account Name Post. Ref. Debit Credit May 31 Unearned Fees Fees Earned Feedback Check My Work 6. Keep in mind that you will be making an adjusting entry for each of these that affects at least one income statement account (revenue or expense) and one balance sheet account (asset or liability). As you go through each one, consider both sides of the transaction that results in an adjusting entry and identify related accounts. Remember, four different categories of adjusting entries include prepaid expenses (deferred expenses), unearned revenues (deferred revenues), accrued expenses (accrued liabilities), and accrued revenues (accrued assets) plus the adjustment for depreciation expense. Movt Comprehensive Problem 1 Part 7: The following is a comprehensive problem which encompasses all of the elements learned in previous chapters. You can refer to the objectives for each chapter covered as a review of the concepts. Note: You must complete parts 1, 2, 3, 4, and 6 before completing part 7. Part 5 is optional Prepare an adjusted trial balance. If an amount box does not require an entry, leave it blank. Kelly Consulting Adjusted Trial Balance May 31, 2018 Debit Balances Credit Balances Account Title Cash 44,195 Accounts Receivable 8,080 Supplies 715 Prepaid Rent 1,600 Prepaid Insurance 1,225 Office Equipment 14,500 Accumulated Depreciation 660 Accounts Payable 895 Check My Work Previous Prepaid Insurance 1,225 Office Equipment 14,500 Accumulated Depreciation 660 Accounts Payable 895 Salaries Payable 325 Unearned Fees 3,210 Common Stock Retained Earnings Dividends 10,500 Fees Earned 40,000 Salary Expense 1,705 Rent Expense 1,600 Supplies Expense 1,370 Depreciation Expense 330 Insurance Expense 275 Miscellaneous Expense 1,295 87,390 87,390 As well as the common stock and retained earnings for the yellow chart. It says im not 100% complete but i dont know what else to put/cant figure it out

THANK YOU!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started