Question

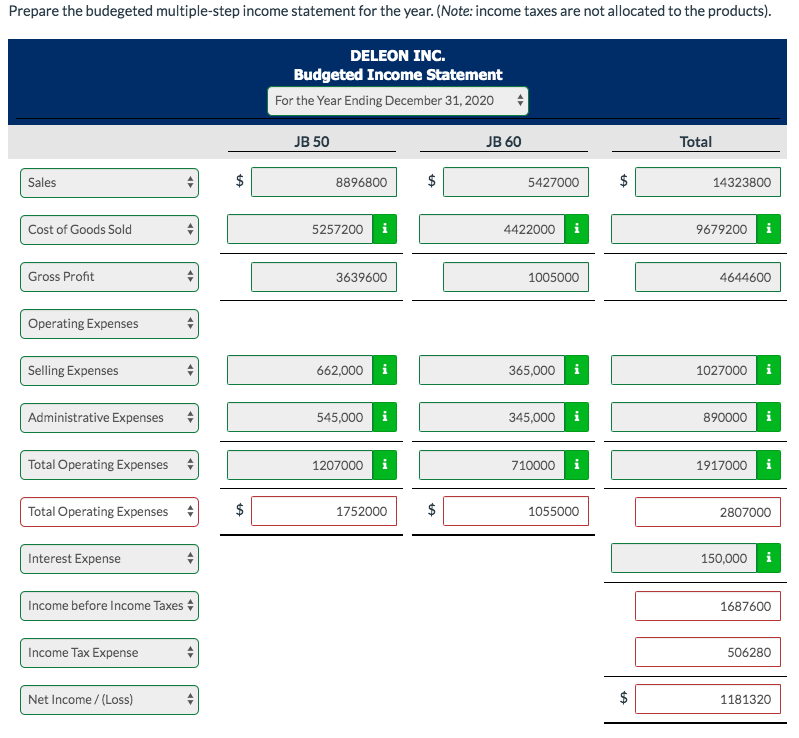

*****I just need the RED BOXES answered correctly***** Deleon Inc. is preparing its annual budgets for the year ending December 31, 2020. Accounting assistants furnish

*****I just need the RED BOXES answered correctly*****

Deleon Inc. is preparing its annual budgets for the year ending December 31, 2020. Accounting assistants furnish the data shown below.

| Product JB 50 | Product JB 60 | |||

|---|---|---|---|---|

| Sales budget: | ||||

| Anticipated volume in units | 404,400 | 201,000 | ||

| Unit selling price | $22 | $27 | ||

| Production budget: | ||||

| Desired ending finished goods units | 28,800 | 17,600 | ||

| Beginning finished goods units | 34,100 | 13,100 | ||

| Direct materials budget: | ||||

| Direct materials per unit (pounds) | 1 | 2 | ||

| Desired ending direct materials pounds | 34,600 | 16,400 | ||

| Beginning direct materials pounds | 41,100 | 13,000 | ||

| Cost per pound | $2 | $4 | ||

| Direct labor budget: | ||||

| Direct labor time per unit | 0.3 | 0.6 | ||

| Direct labor rate per hour | $10 | $10 | ||

| Budgeted income statement: | ||||

| Total unit cost | $13 | $22 |

An accounting assistant has prepared the detailed manufacturing overhead budget and the selling and administrative expense budget. The latter shows selling expenses of $662,000 for product JB 50 and $365,000 for product JB 60, and administrative expenses of $545,000 for product JB 50 and $345,000 for product JB 60. Interest expense is $150,000 (not allocated to products). Income taxes are expected to be 30%.

Prepare the budegeted multiple-step income statement for the year. (Note: income taxes are not allocated to the products) DELEON INC. Budgeted Income Statement For the Year Ending December 31, 2020 JB 60 JB 50 Total Sales 5427000 8896800 14323800 i Cost of Goods Sold 5257200 4422000 9679200 Gross Profit 3639600 1005000 4644600 Operating Expenses Selling Expenses 662,000 365,000 1027000 Administrative Expenses 545,000 890000 345,000 Total Operating Expenses 710000 1207000 1917000 $ $ Total Operating Expenses 1752000 1055000 2807000 Interest Expense 150,000 Income before Income Taxes 1687600 Income Tax Expense 506280 Net Income/(Loss) 1181320 +A tA tA LO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started