i just need the work in order to know how to do it. I provided the answers if it makes things easier..

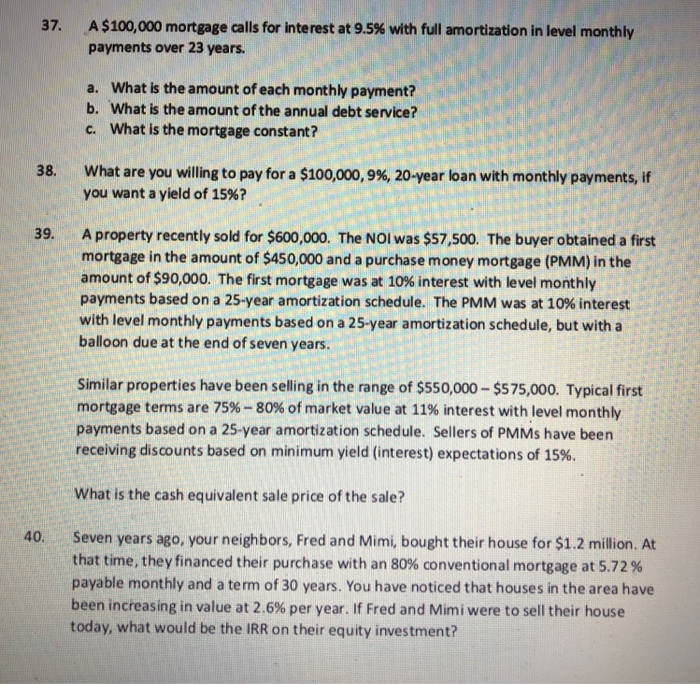

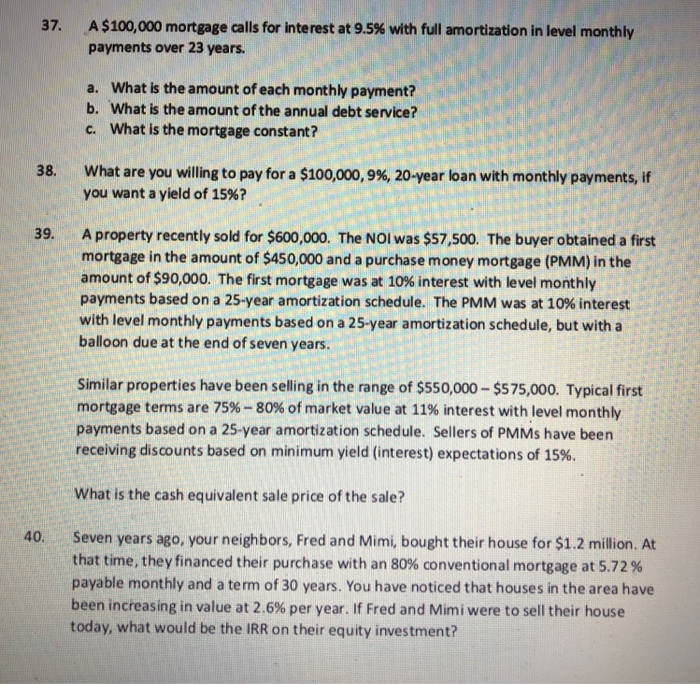

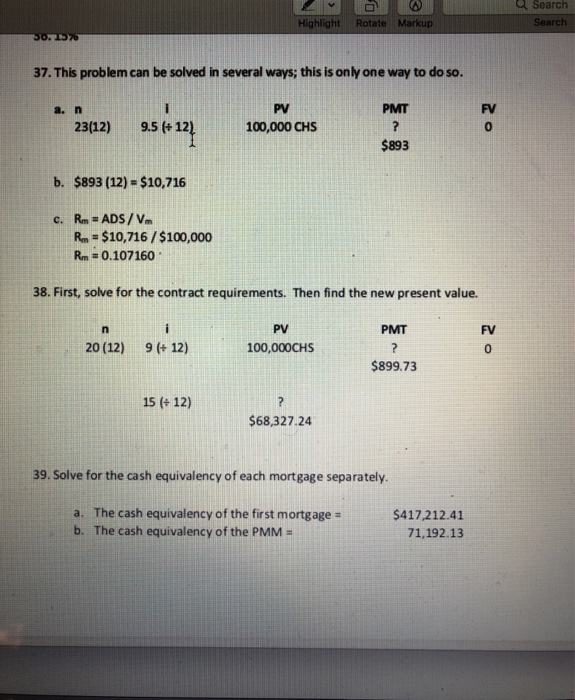

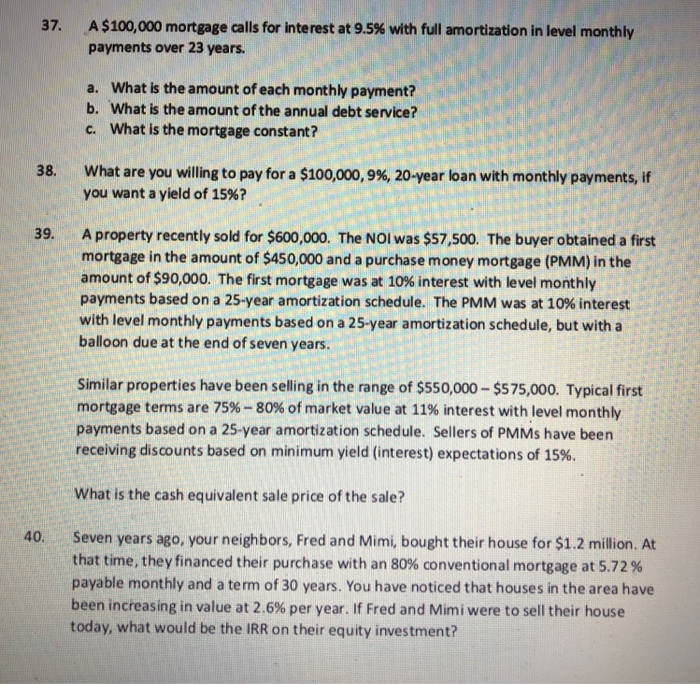

37. A $100,000 mortgage calls for interest at 9.5% with full amortization in level monthly payments over 23 years. a. What is the amount of each monthly payment? b. What is the amount of the annual debt service? c. What is the mortgage constant? 38. What are you willing to pay for a $100,000,9%, 20-year loan with monthly payments, if you want a yield of 15%? 39. A property recently sold for $600,000. The NOI was $57,500. The buyer obtained a first mortgage in the amount of $450,000 and a purchase money mortgage (PMM) in the amount of $90,000. The first mortgage was at 10% interest with level monthly payments based on a 25-year amortization schedule. The PMM was at 10% interest with level monthly payments based on a 25-year amortization schedule, but with a balloon due at the end of seven years. Similar properties have been selling in the range of $550,000 - $575,000. Typical first mortgage terms are 75%-80% of market value at 11% interest with level monthly payments based on a 25-year amortization schedule. Sellers of PMMs have been receiving discounts based on minimum yield (interest) expectations of 15%. What is the cash equivalent sale price of the sale? 40. Seven years ago, your neighbors, Fred and Mimi, bought their house for $1.2 million. At that time, they financed their purchase with an 80% conventional mortgage at 5.72% payable monthly and a term of 30 years. You have noticed that houses in the area have been increasing in value at 2.6% per year. If Fred and Mimi were to sell their house today, what would be the IRR on their equity investment? a Search Search Highlight Rotate Markup 50.150 37. This problem can be solved in several ways; this is only one way to do so. a. n 23(12) 25 412 PV 100,000 CHS PMT ? $893 FV 0 b. $893 (12) = $10,716 c. Rm = ADS/V. Rm = $10,716 / $100,000 Rm = 0.107160 38. First, solve for the contract requirements. Then find the new present value. FV n 20 (12) i 9 (+12) PV 100,000CHS PMT ? $899.73 0 15 (+12) ? $68,327.24 39. Solve for the cash equivalency of each mortgage separately. a. The cash equivalency of the first mortgage = b. The cash equivalency of the PMM = $417,212.41 71,192.13 Q Search Search Highlight Rotate Markup TVM Practice Problems Homework Page 4 of 4 C. The original down payment- 60,000.00 d. The cash equivalent sale price = $548,404.54 40. Solve for the change in the price of the property and the mortgage separately, the equity will be the difference between them. a. The house value: i PV PMT FV 7 2.6 1,200,000 CHS 0 1,436,193 n b. The mortgage: n PV 960,000 CHS FV 30 (12) 5.72 (+12) PMT ? $5,584.02 0 7 (12) ? 856,167 C. The equity: Originally: $1,200,000 x 0.20 = $240,000 After 7 years: $1,436,193 - 856, 167 = $580,026 PV PMT FV 240,000 CHS 0 580.026 n i ? 7 13.4% The equity IRR is 13.4%