i just need to do schedule E and form 4562. no need of finding taxable income

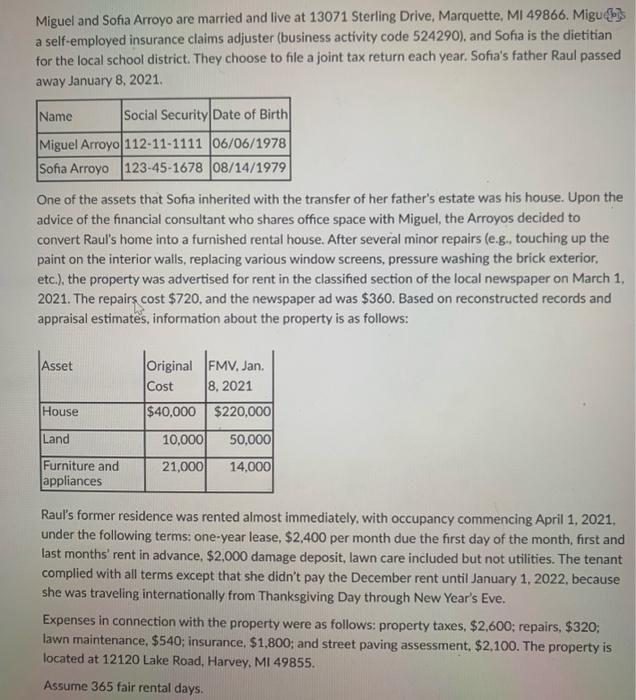

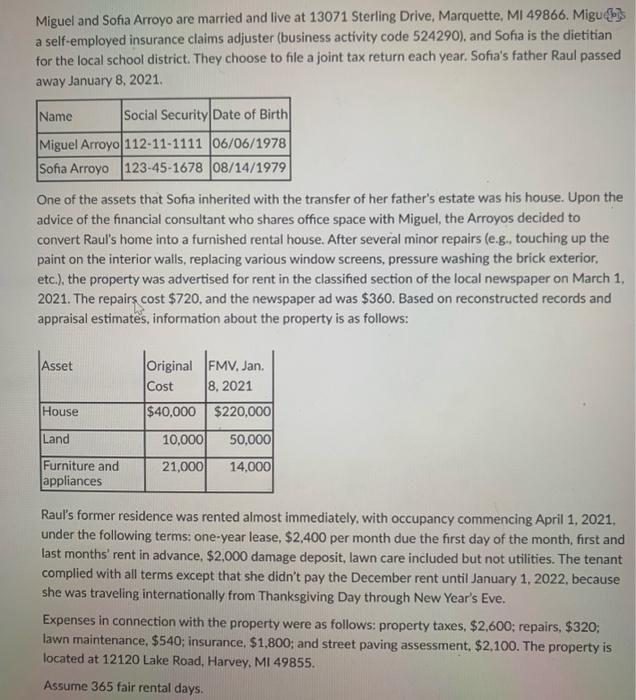

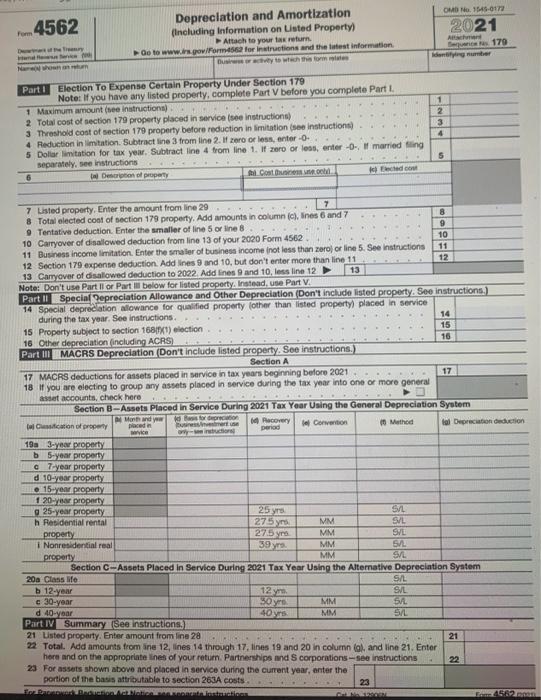

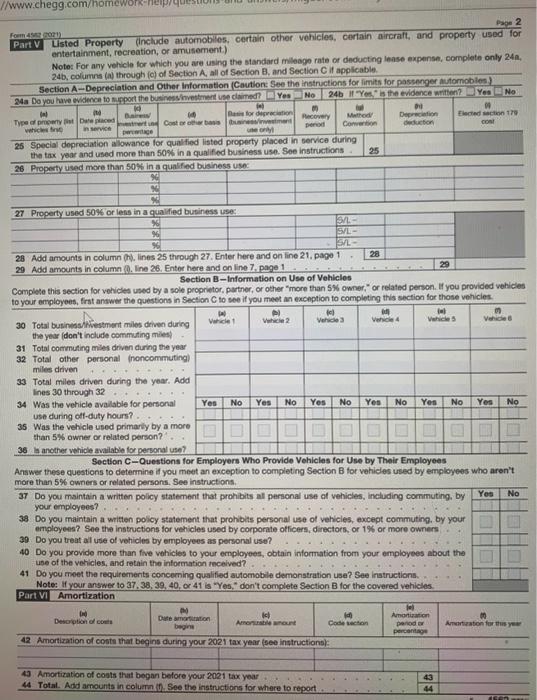

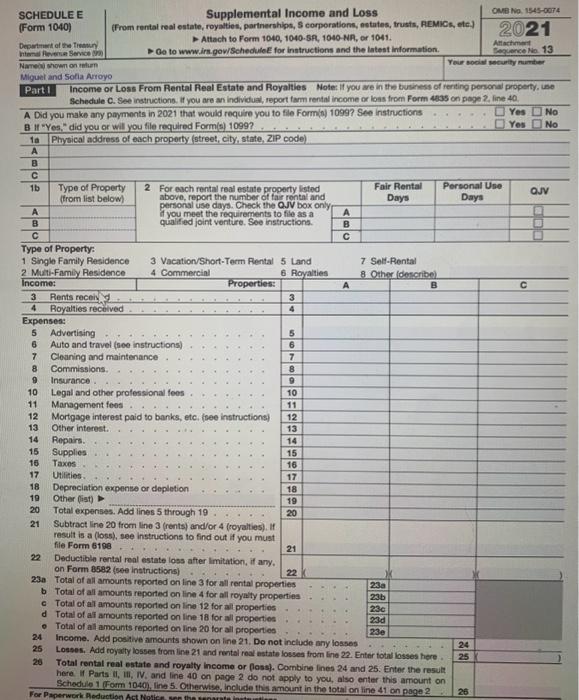

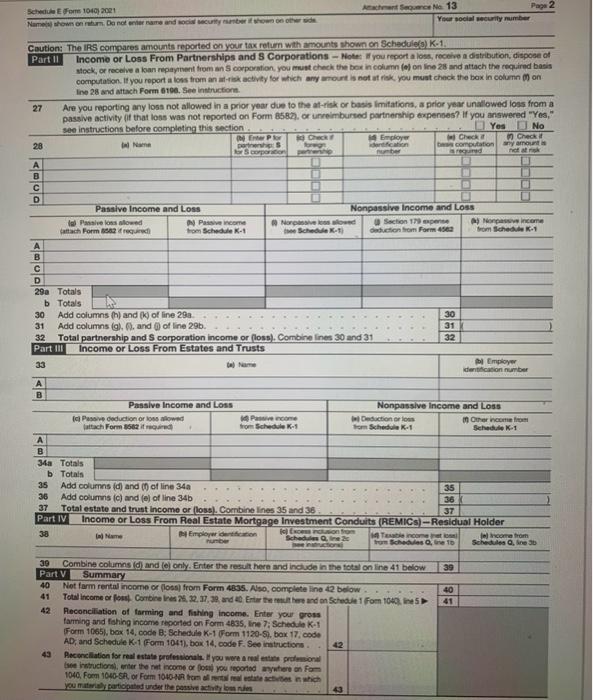

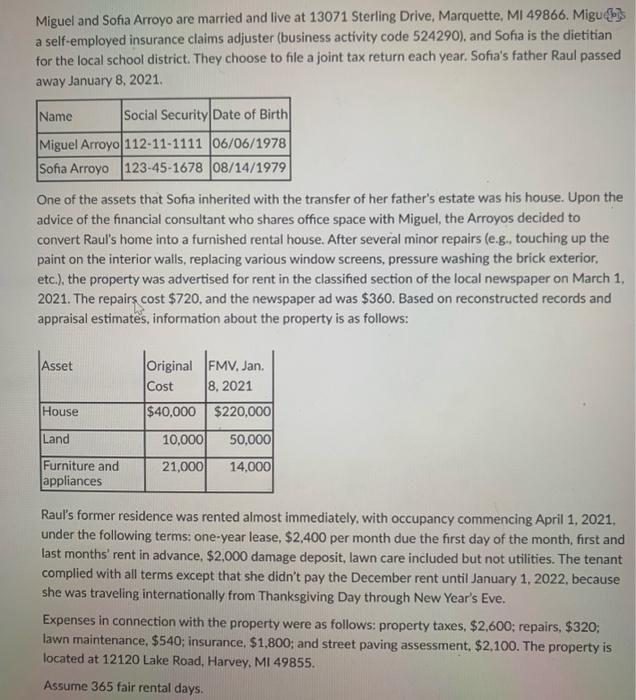

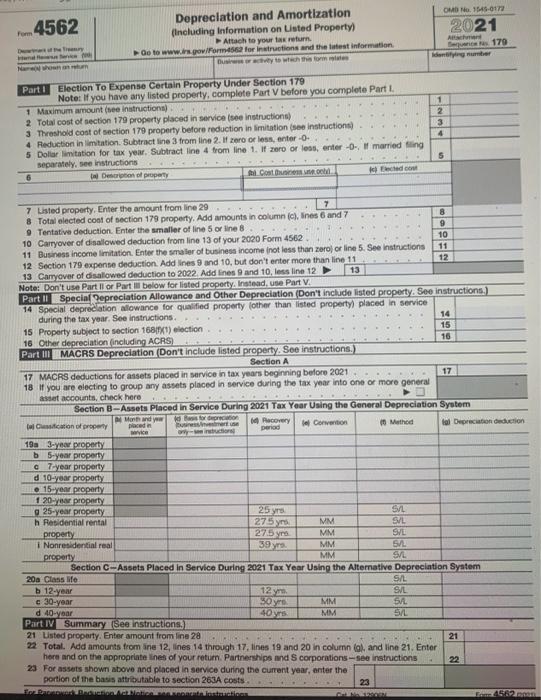

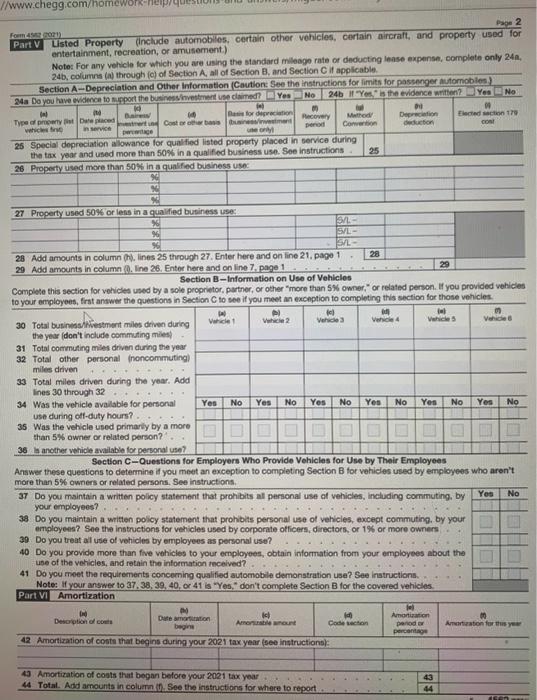

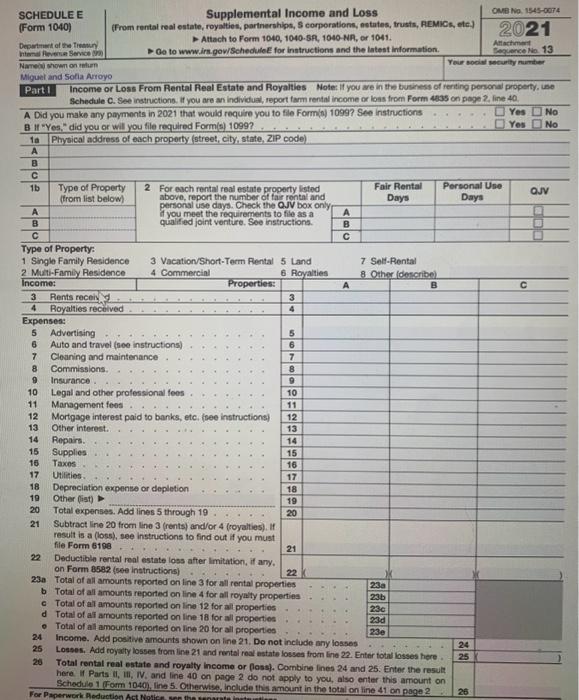

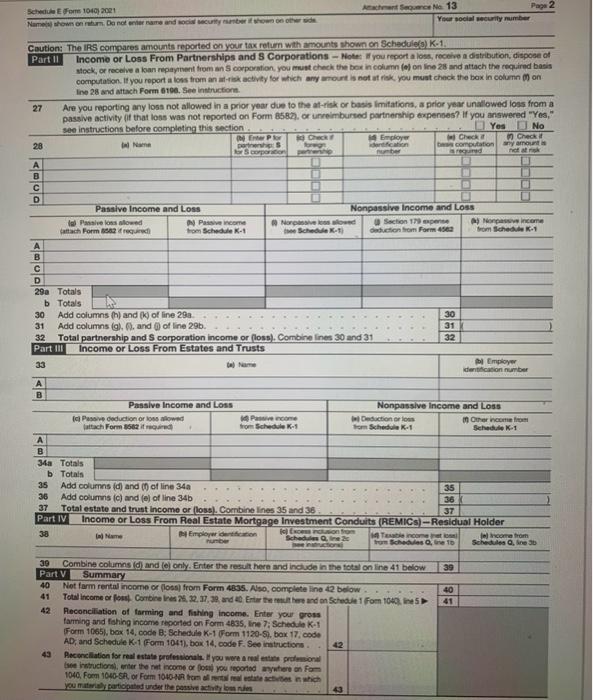

Miguel and Sofia Arroyo are married and live at 13071 Sterling Drive, Marquette, MI 49866. Migugbss a self-employed insurance claims adjuster (business activity code 524290), and Sofia is the dietitian for the local school district. They choose to file a joint tax return each year. Sofia's father Raul passed away January 8, 2021. One of the assets that Sofia inherited with the transfer of her father's estate was his house. Upon the advice of the financial consultant who shares office space with Miguel, the Arroyos decided to convert Raul's home into a furnished rental house. After several minor repairs (e.g., touching up the paint on the interior walls, replacing various window screens, pressure washing the brick exterior. etc.), the property was advertised for rent in the classified section of the local newspaper on March 1 . 2021. The repairs cost $720, and the newspaper ad was $360. Based on reconstructed records and appraisal estimates, information about the property is as follows: Raul's former residence was rented almost immediately, with occupancy commencing April 1, 2021. under the following terms: one-year lease, $2,400 per month due the first day of the month, first and last months' rent in advance, $2,000 damage deposit, lawn care included but not utilities. The tenant complied with all terms except that she didn't pay the December rent until January 1, 2022, because she was traveling internationally from Thanksgiving Day through New Year's Eve. Expenses in connection with the property were as follows: property taxes, $2,600; repairs, $320; lawn maintenance, $540; insurance, $1,800; and street paving assessment, $2,100. The property is located at 12120 Lake Road, Harvey, MI 49855. Assume 365 fair rental days. Part I Election To Expense Certain Property Under Section 179 Note: If you have any listed property, complete Part V before you complete Part 1. 1 Maximum amount (see inatructions) . 2 Totai cost of aection 179 property placed in service (see instructions) 3. Threshold cost of section 170 property betore reduction in Iirnitation (see instructiont) 4 Reduction in limtation. Subtract line 3 from line 2 . If zero or less, enter 0 - 5 Dolar lintation for tax year, Subtract line 4 trom line 1. If zere or less, enter 0-, If married fling separately, see instructions 6 (a) Desuripon d propety. 7 Lsted property. Enter the amount from line 29 8 Total elected coat of section 179 property. Add amounts in column (c), Ines 6 and 7 9. Tentative deduction. Enter the smaller of line 5 or ine 8 . 10 Carryover of disallowed deduction from line 13 of your 2020 Form 4562 . 11 Business income imitation. Enter the smaler of business income inot less than zerol) or line 5. See instructions 12 Section 179 expense decuetion. Add lines 9 and 10, but don't enter more than line 11 13 Carryover of disallowed deduction to 2022. Add ines 9 and 10, less line 12 . \begin{tabular}{|l|} \hline 1 \\ \hline 2 \\ \hline 3 \\ \hline 4 \\ \hline 5 \\ \hline \end{tabular} (c) Erected cont Note: Don't use Part II or Part Eilitow ber listed property, Instead, use Part V. Part II Special Qepreciation Allowance and Other Depreciation (Don't include listed property. See instructions.) 14 Special depreclation alowance for qualified property (other than listed property) placed in service during the tax year, See instructions. 15 Property subject to section 168ip(1) eloction 16 Other depreciation (including ACRS) Part III MACRS Depreciation (Don't include listod property. See instructions.) 17 MACFS deductions for assets placed in sarvice in tax years beginning belore 2021 18 If you are olecting to group any assets placed in service during the tax year into one or more general Section C-Assets Placed in Service During 2021 Tax Year Using the Attemative Depreciation Syatem Part IV Summary (See instructions.) 21 Listed proparty. Enter amount from line 28 22. Total. Add amounts from aline 12, lines 14 through 17 , lines 19 and 20 in column (o), and line 21. Enter here and on the appropriate ines of your return. Partnerships and S corporations - See instructions 23. For assets shown above and placed in service during the current year, anter the perticn of the basis attributable to section 263 A costs. Part V Wated Property (include automobiles, certain other venicies, certain aircraft, and property used for entertainment, recreation, or amusement.) Note: For any vehicle for which you are using the atandard mileoge rate or deducting lense expanse, complete only 24 a, 24b, columns (a) through (c) of Section A, all of Section B, and Section C if applicable. 27 Property used 50% or lens in a qualfied buniness use: 28 Add amounts in column of, lines 25 through 27. Enter here and on line 21, page 1,28 29 Add amounts in column (0. Ine 26 . Enter here and on line 7, page 1 Section B-Information on Use of Vehicles Complete this section for vehicles used by a sole proprimor, partner, or other "more than 5% omner," or related person. If you provided vehicles to your employees, frat answer the questions in Section C to see if you meet an excoption to completing this section for those vehicies. Section C-Questions for Employers Who Provide Vehicles for Use by Their Employees Asswer these questions to determine if you meet an exception to completing Section B for vehicles used by employees who aren't more than 5% owners or related persons. See instructions. 37 Do you maintain a written policy statement that prohibits al personal use of vehicles, including cormmuting, by your employees? 38 Do you maintain a written policy statement that prohibits personal use of vehicies, except commuting, by your employees? See the instructions for vehicles used by corporate otficers, directors, or 1% or more owners 30. Do you treat al use of vehicles by employees as personal use? 40. Do you provide more than five vehicles to your employees, obtain information from your employees about the use of the vehicles, and retain the intormation recelved? 41 Do you moet the requirements concoming qualifed automobile demonstration use? See instructions. Motes If your answer to 37, 38, 39, 40, or 41 is "Yes," don't complete Section B for the covered vehicles. Part VI Amortization 42 Amortization of costs that begins during your 2021 taxyear (see instructions): 43. Amortization of coots that began betore your 2021 tax year 44. Total. Add amounts in colurn in. See the instructions for where to report. SCHEDULE E Supplemental Income and Loss (Form 1040) (From rental real estate, royattios, partinerahips, S corporations, netates, trusts, AEMics, etc) as to wwwirs gow/ScheduleE for intructions and the iatest information. Nameil chiown on thilum Miguet and Sotia Arroyo Part I Income or Loss From Rental Real Estate and Royalties Note il you are in the business of renting penonal property, use Schedule C. See instructions. II you are an individual, report tam rental income or ibas from Form 4355 on pege 2 , ine 40 . A Did you make any paymonts in 2021 that would require you to flie Form(a) 1099 ? See instructions Type of Property: 1. Single Family Residence 3 Vacation/Short-Term Rental 5 Land 7 Sell-Rental 7 Cloaning and maintenance 8 Commissions. 9 Insurance. 10 Legal and other professional feos 11 Management fees. 12 Mortgage interest paid to banks, etc, (teee instructions) 13 Other interest. 14 Repars. 15 Supplies 16 Taxos. 17 Utieies. 18 Deprociation expense or depletion 19 Other (ist) 20 Total expenses. Add lines 5 through 19 21 Subtract line 20 from line 3 (rents) and/or 4 (coyalies). If result is a (loss), see instructions to find out if you must file Form 6188 22 Deductible rental real estate loss after Imitution, if any. on Form B582 (see instructions) 23. Total of all amounts reported on line 3 for all rental properties b. Total of all amounts reponted on line 4 for all royaty properties c Total of al amounts reportied on ine 12 for all propertios d Total of af amounts reported on ine 18 for all properties Setwide E form 1049 2021 Newtront Sequence Ma: 13 Pape 2 Youe social securily mumber Coution: The IfS compares amounts reported on your tax refum wth amounts shown on Schedule(g) K-1. Part II Income or Loss From Partnerships and 5 Corporations - Mote: If you report a loss, recmie a distribution, dispose of stock, or recolve a kan repaynent trom an 5 corporation, you must check the box in colamn (o) on ine 28 and attach the ebquired basis computason. If you report a loss from an atr-tik actvily for which any arrount is not at rick you muat check the box in cotumn in on: Ine 28 and attach Form 616e. See instructiont. 27. Are you reporting any loss not allowed in a prior year due to the at-risk or basis limitations, a prior year unallowed loss from a passive activity (if that loss was not reported on Form 8582, or unreimbursed partnership expenees? If you answered "Yes," \begin{tabular}{l|} \hline 28 \\ \hline A \\ \hline B \\ \hline C \\ \hline D \end{tabular} see instructions before completing this section. 32 Total partnerahip and S corporation income or (loss). Combine ines 30 and 31 Part III Income or Loss From Estates and Trusts 33 te) Nann \begin{tabular}{l|l|} \hline A & B \\ \hline B & P \\ \hline \end{tabular} Miguel and Sofia Arroyo are married and live at 13071 Sterling Drive, Marquette, MI 49866. Migugbss a self-employed insurance claims adjuster (business activity code 524290), and Sofia is the dietitian for the local school district. They choose to file a joint tax return each year. Sofia's father Raul passed away January 8, 2021. One of the assets that Sofia inherited with the transfer of her father's estate was his house. Upon the advice of the financial consultant who shares office space with Miguel, the Arroyos decided to convert Raul's home into a furnished rental house. After several minor repairs (e.g., touching up the paint on the interior walls, replacing various window screens, pressure washing the brick exterior. etc.), the property was advertised for rent in the classified section of the local newspaper on March 1 . 2021. The repairs cost $720, and the newspaper ad was $360. Based on reconstructed records and appraisal estimates, information about the property is as follows: Raul's former residence was rented almost immediately, with occupancy commencing April 1, 2021. under the following terms: one-year lease, $2,400 per month due the first day of the month, first and last months' rent in advance, $2,000 damage deposit, lawn care included but not utilities. The tenant complied with all terms except that she didn't pay the December rent until January 1, 2022, because she was traveling internationally from Thanksgiving Day through New Year's Eve. Expenses in connection with the property were as follows: property taxes, $2,600; repairs, $320; lawn maintenance, $540; insurance, $1,800; and street paving assessment, $2,100. The property is located at 12120 Lake Road, Harvey, MI 49855. Assume 365 fair rental days. Part I Election To Expense Certain Property Under Section 179 Note: If you have any listed property, complete Part V before you complete Part 1. 1 Maximum amount (see inatructions) . 2 Totai cost of aection 179 property placed in service (see instructions) 3. Threshold cost of section 170 property betore reduction in Iirnitation (see instructiont) 4 Reduction in limtation. Subtract line 3 from line 2 . If zero or less, enter 0 - 5 Dolar lintation for tax year, Subtract line 4 trom line 1. If zere or less, enter 0-, If married fling separately, see instructions 6 (a) Desuripon d propety. 7 Lsted property. Enter the amount from line 29 8 Total elected coat of section 179 property. Add amounts in column (c), Ines 6 and 7 9. Tentative deduction. Enter the smaller of line 5 or ine 8 . 10 Carryover of disallowed deduction from line 13 of your 2020 Form 4562 . 11 Business income imitation. Enter the smaler of business income inot less than zerol) or line 5. See instructions 12 Section 179 expense decuetion. Add lines 9 and 10, but don't enter more than line 11 13 Carryover of disallowed deduction to 2022. Add ines 9 and 10, less line 12 . \begin{tabular}{|l|} \hline 1 \\ \hline 2 \\ \hline 3 \\ \hline 4 \\ \hline 5 \\ \hline \end{tabular} (c) Erected cont Note: Don't use Part II or Part Eilitow ber listed property, Instead, use Part V. Part II Special Qepreciation Allowance and Other Depreciation (Don't include listed property. See instructions.) 14 Special depreclation alowance for qualified property (other than listed property) placed in service during the tax year, See instructions. 15 Property subject to section 168ip(1) eloction 16 Other depreciation (including ACRS) Part III MACRS Depreciation (Don't include listod property. See instructions.) 17 MACFS deductions for assets placed in sarvice in tax years beginning belore 2021 18 If you are olecting to group any assets placed in service during the tax year into one or more general Section C-Assets Placed in Service During 2021 Tax Year Using the Attemative Depreciation Syatem Part IV Summary (See instructions.) 21 Listed proparty. Enter amount from line 28 22. Total. Add amounts from aline 12, lines 14 through 17 , lines 19 and 20 in column (o), and line 21. Enter here and on the appropriate ines of your return. Partnerships and S corporations - See instructions 23. For assets shown above and placed in service during the current year, anter the perticn of the basis attributable to section 263 A costs. Part V Wated Property (include automobiles, certain other venicies, certain aircraft, and property used for entertainment, recreation, or amusement.) Note: For any vehicle for which you are using the atandard mileoge rate or deducting lense expanse, complete only 24 a, 24b, columns (a) through (c) of Section A, all of Section B, and Section C if applicable. 27 Property used 50% or lens in a qualfied buniness use: 28 Add amounts in column of, lines 25 through 27. Enter here and on line 21, page 1,28 29 Add amounts in column (0. Ine 26 . Enter here and on line 7, page 1 Section B-Information on Use of Vehicles Complete this section for vehicles used by a sole proprimor, partner, or other "more than 5% omner," or related person. If you provided vehicles to your employees, frat answer the questions in Section C to see if you meet an excoption to completing this section for those vehicies. Section C-Questions for Employers Who Provide Vehicles for Use by Their Employees Asswer these questions to determine if you meet an exception to completing Section B for vehicles used by employees who aren't more than 5% owners or related persons. See instructions. 37 Do you maintain a written policy statement that prohibits al personal use of vehicles, including cormmuting, by your employees? 38 Do you maintain a written policy statement that prohibits personal use of vehicies, except commuting, by your employees? See the instructions for vehicles used by corporate otficers, directors, or 1% or more owners 30. Do you treat al use of vehicles by employees as personal use? 40. Do you provide more than five vehicles to your employees, obtain information from your employees about the use of the vehicles, and retain the intormation recelved? 41 Do you moet the requirements concoming qualifed automobile demonstration use? See instructions. Motes If your answer to 37, 38, 39, 40, or 41 is "Yes," don't complete Section B for the covered vehicles. Part VI Amortization 42 Amortization of costs that begins during your 2021 taxyear (see instructions): 43. Amortization of coots that began betore your 2021 tax year 44. Total. Add amounts in colurn in. See the instructions for where to report. SCHEDULE E Supplemental Income and Loss (Form 1040) (From rental real estate, royattios, partinerahips, S corporations, netates, trusts, AEMics, etc) as to wwwirs gow/ScheduleE for intructions and the iatest information. Nameil chiown on thilum Miguet and Sotia Arroyo Part I Income or Loss From Rental Real Estate and Royalties Note il you are in the business of renting penonal property, use Schedule C. See instructions. II you are an individual, report tam rental income or ibas from Form 4355 on pege 2 , ine 40 . A Did you make any paymonts in 2021 that would require you to flie Form(a) 1099 ? See instructions Type of Property: 1. Single Family Residence 3 Vacation/Short-Term Rental 5 Land 7 Sell-Rental 7 Cloaning and maintenance 8 Commissions. 9 Insurance. 10 Legal and other professional feos 11 Management fees. 12 Mortgage interest paid to banks, etc, (teee instructions) 13 Other interest. 14 Repars. 15 Supplies 16 Taxos. 17 Utieies. 18 Deprociation expense or depletion 19 Other (ist) 20 Total expenses. Add lines 5 through 19 21 Subtract line 20 from line 3 (rents) and/or 4 (coyalies). If result is a (loss), see instructions to find out if you must file Form 6188 22 Deductible rental real estate loss after Imitution, if any. on Form B582 (see instructions) 23. Total of all amounts reported on line 3 for all rental properties b. Total of all amounts reponted on line 4 for all royaty properties c Total of al amounts reportied on ine 12 for all propertios d Total of af amounts reported on ine 18 for all properties Setwide E form 1049 2021 Newtront Sequence Ma: 13 Pape 2 Youe social securily mumber Coution: The IfS compares amounts reported on your tax refum wth amounts shown on Schedule(g) K-1. Part II Income or Loss From Partnerships and 5 Corporations - Mote: If you report a loss, recmie a distribution, dispose of stock, or recolve a kan repaynent trom an 5 corporation, you must check the box in colamn (o) on ine 28 and attach the ebquired basis computason. If you report a loss from an atr-tik actvily for which any arrount is not at rick you muat check the box in cotumn in on: Ine 28 and attach Form 616e. See instructiont. 27. Are you reporting any loss not allowed in a prior year due to the at-risk or basis limitations, a prior year unallowed loss from a passive activity (if that loss was not reported on Form 8582, or unreimbursed partnership expenees? If you answered "Yes," \begin{tabular}{l|} \hline 28 \\ \hline A \\ \hline B \\ \hline C \\ \hline D \end{tabular} see instructions before completing this section. 32 Total partnerahip and S corporation income or (loss). Combine ines 30 and 31 Part III Income or Loss From Estates and Trusts 33 te) Nann \begin{tabular}{l|l|} \hline A & B \\ \hline B & P \\ \hline \end{tabular}