Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I just need to know how to do the new gross profit and gross profit percentage please. Answer and explanation would be most appreciated!! !

I just need to know how to do the new gross profit and gross profit percentage please. Answer and explanation would be most appreciated!!

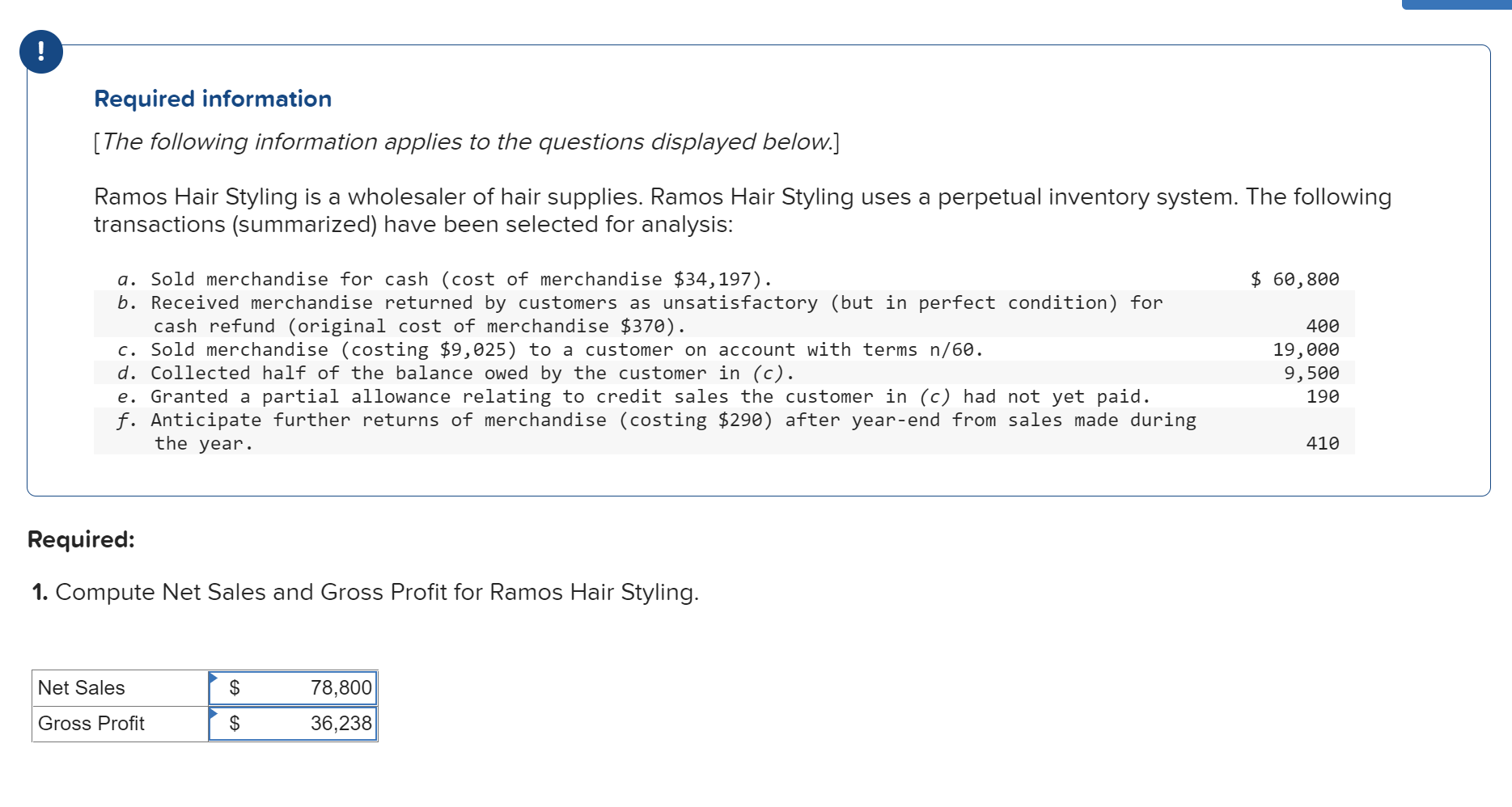

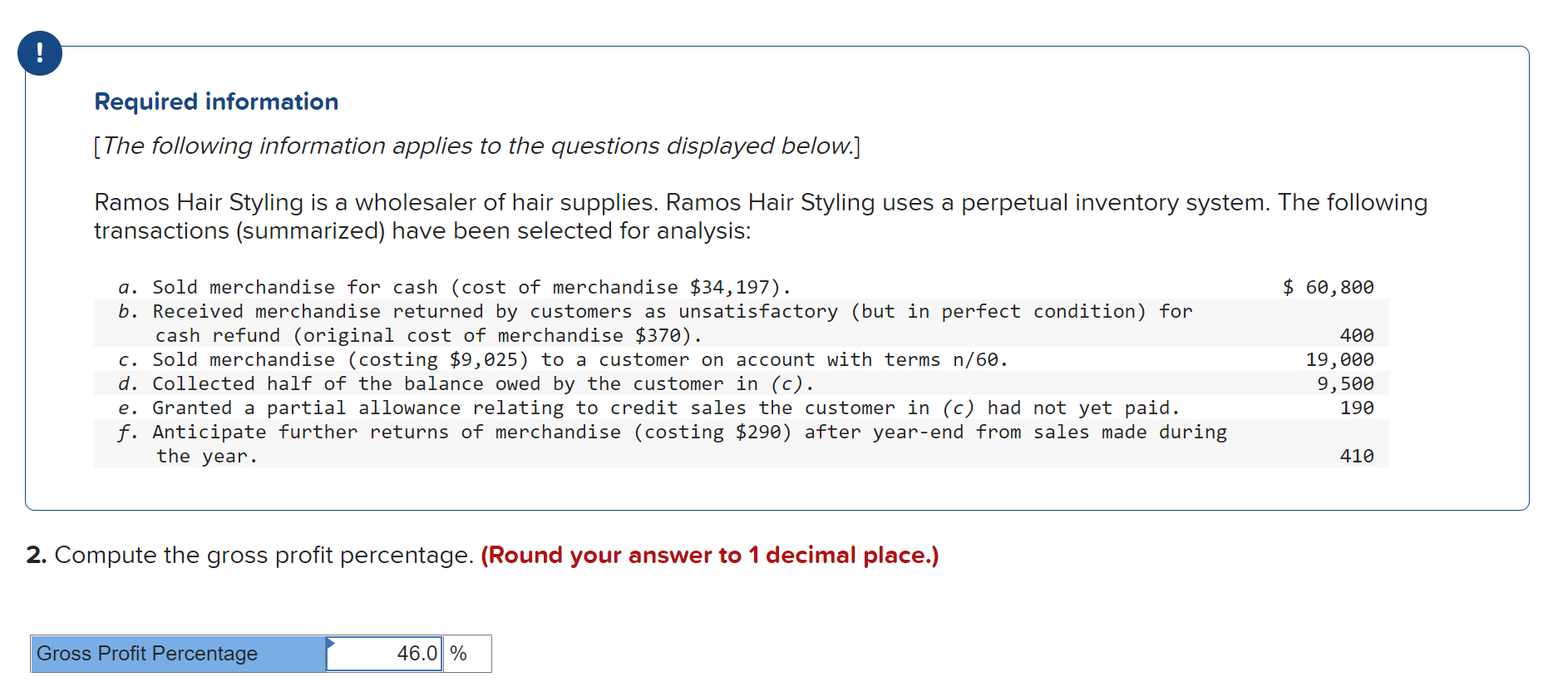

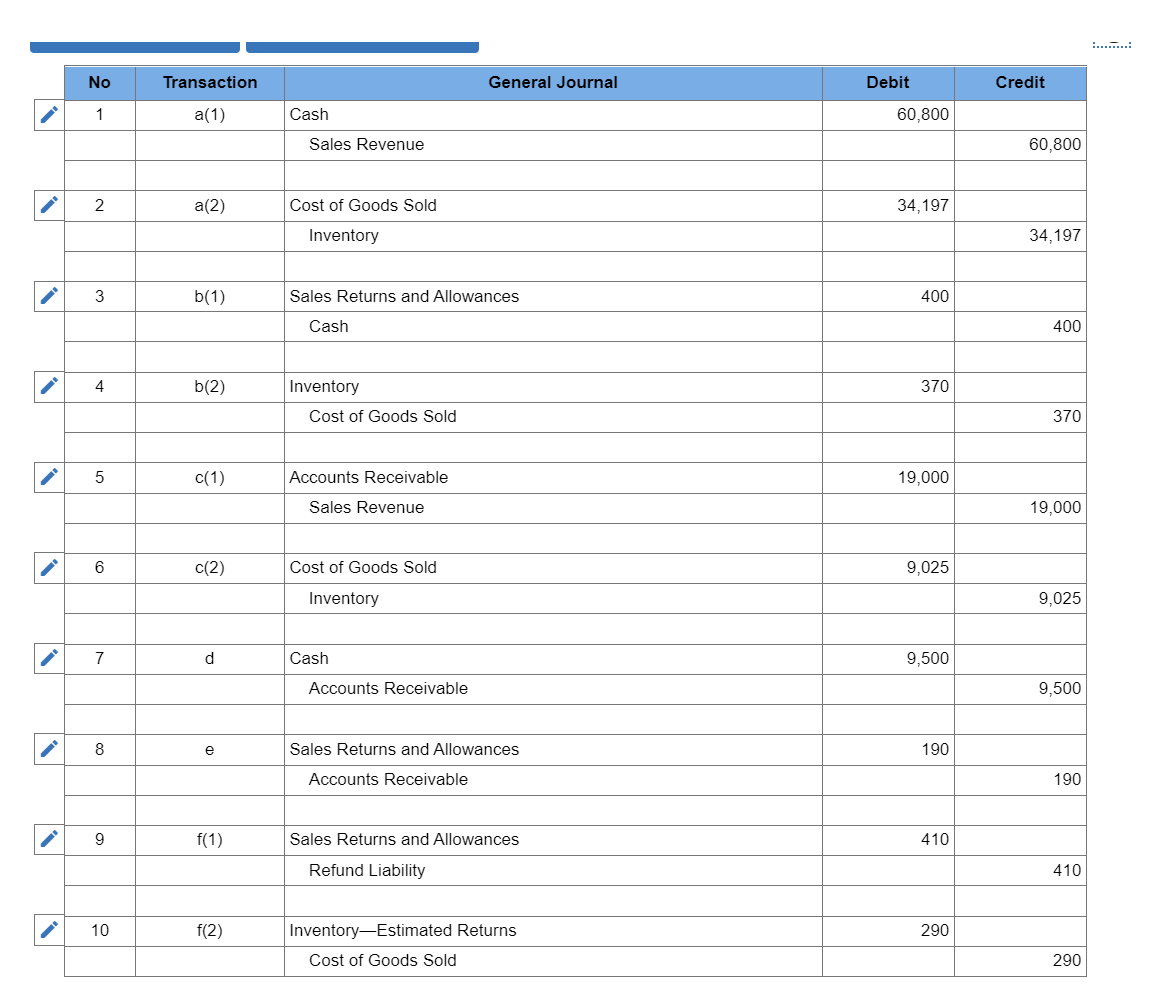

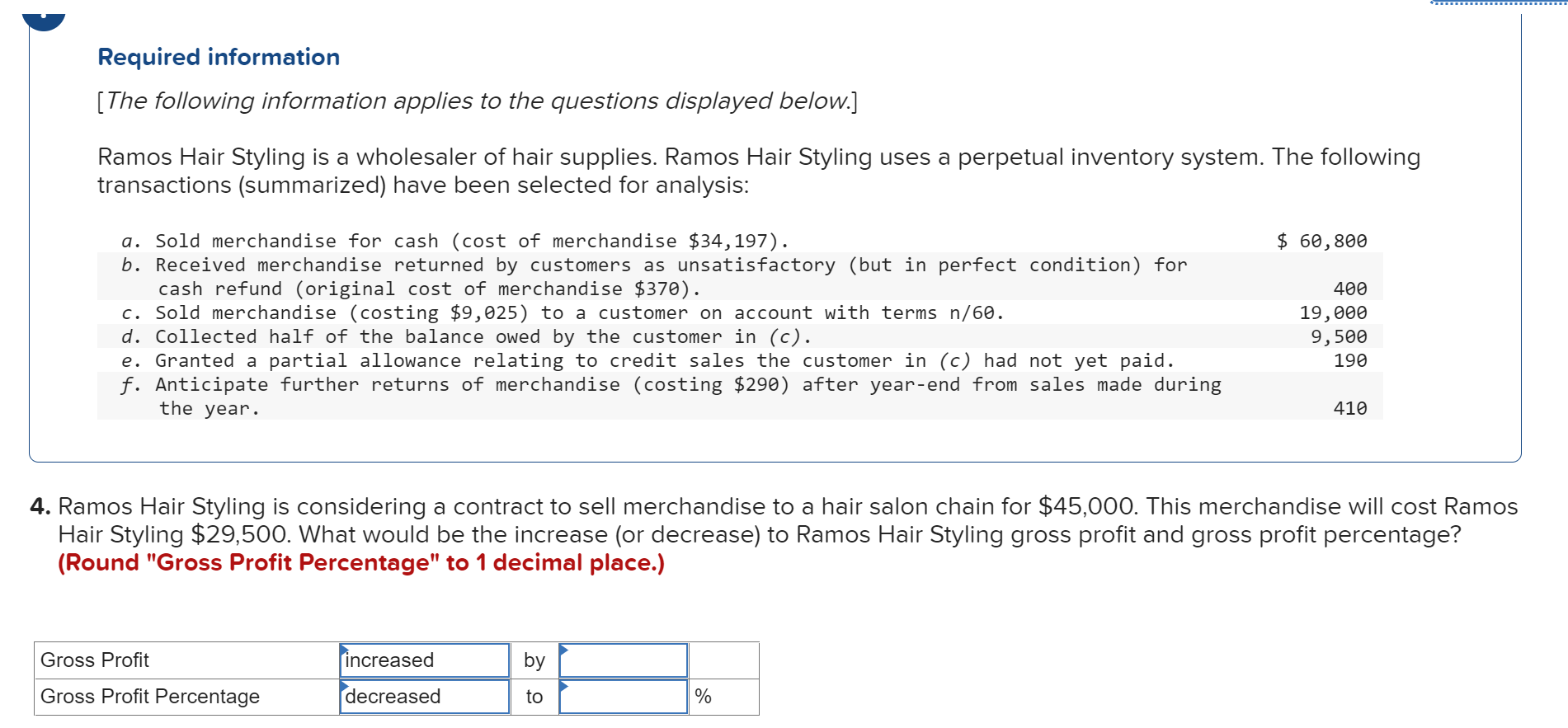

! Required information [The following information applies to the questions displayed below.] Ramos Hair Styling is a wholesaler of hair supplies. Ramos Hair Styling uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: $ 60,800 a. Sold merchandise for cash (cost of merchandise $34, 197). b. Received merchandise returned by customers as unsatisfactory (but in perfect condition) for cash refund (original cost of merchandise $370). c. Sold merchandise (costing $9,025) to a customer on account with terms n/60. d. Collected half of the balance owed the customer in (c). e. Granted a partial allowance relating to credit sales the customer in (c) had not yet paid. f. Anticipate further returns of merchandise (costing $290) after year-end from sales made during 400 19,000 9,500 190 the year: 410 Required: 1. Compute Net Sales and Gross Profit for Ramos Hair Styling. Net Sales $ 78,800 36,238 Gross Profit $ ! Required information [The following information applies to the questions displayed below.] Ramos Hair Styling is a wholesaler of hair supplies. Ramos Hair Styling uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: $ 60,800 a. Sold merchandise for cash (cost of merchandise $34, 197). b. Received merchandise returned by customers as unsatisfactory (but in perfect condition) for cash refund (original cost of merchandise $370). c. Sold merchandise (costing $9,025) to a customer on account with terms n/60. d. Collected half of the balance owed by the customer in (c). e. Granted a partial allowance relating to credit sales the customer in (c) had not yet paid. f. Anticipate further returns of merchandise (costing $290) after year-end from sales made during the year: 400 19,000 9,500 190 410 2. Compute the gross profit percentage. (Round your answer to 1 decimal place.) Gross Profit Percentage 46.0 % No Transaction General Journal Debit Credit 1 a(1) Cash 60,800 Sales Revenue 60,800 2 a(2) Cost of Goods Sold 34,197 Inventory 34,197 3 b(1) Sales Returns and Allowances 400 Cash 400 4 b(2) 370 Inventory Cost of Goods Sold 370 c(1) Accounts Receivable 19,000 Sales Revenue 19,000 6 C(2) Cost of Goods Sold 9,025 Inventory 9,025 7 d Cash 9,500 Accounts Receivable 9,500 8 e 190 Sales Returns and Allowances Accounts Receivable 190 9 f(1) Sales Returns and Allowances 410 Refund Liability 410 10 f(2) 290 InventoryEstimated Returns Cost of Goods Sold 290 Required information [The following information applies to the questions displayed below.] Ramos Hair Styling is a wholesaler of hair supplies. Ramos Hair Styling uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: $ 60,800 a. Sold merchandise for cash (cost of merchandise $34,197). b. Received merchandise returned by customers as unsatisfactory (but in perfect condition) for cash refund (original cost of merchandise $370). c. Sold merchandise (costing $9,025) to a customer on account with terms n/60. d. Collected half of the balance owed by the customer in (c). e. Granted a partial allowance relating to credit sales the customer in (c) had not yet paid. f. Anticipate further returns of merchandise (costing $290) after year-end from sales made during 400 19,000 9,500 190 the year: 410 4. Ramos Hair Styling is considering a contract to sell merchandise to a hair salon chain for $45,000. This merchandise will cost Ramos Hair Styling $29,500. What would be the increase (or decrease) to Ramos Hair Styling gross profit and gross profit percentage? (Round "Gross Profit Percentage" to 1 decimal place.) Gross Profit increased by Gross Profit Percentage decreased to %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started